Intraday Market Thoughts Archives

Displaying results for week of Feb 02, 2014Tapering Unweathered by NFP

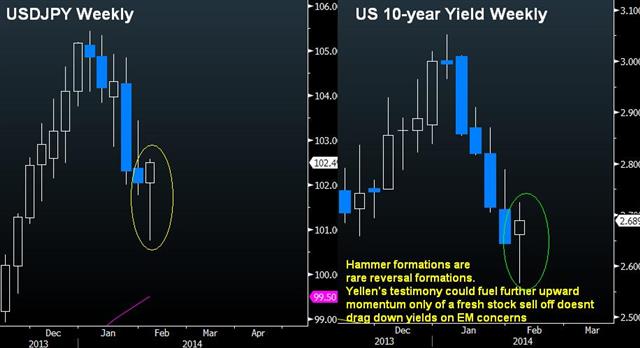

Weather was no factor. The 113K in Jan NFP and lowest unemp rate since Oct 2008 will not dissuade Fed ChairYellen from making a hawkish testimony at her Congressional appearance next week, supporting the case for further tapering in monthly asset purchases. This explains the hammer formation in Weekly USDJPY and 10 yr yields. Full Charts & Analysis

Recording of Last Night's Webinar

Here is the link to the recording of last night's webinar by Ashraf Laidi, George Cavaligos and Fari Hamzei. Recording Link

Payrolls Optimism Building, ECB Watching

Draghi lit a fire under the euro but risk trades also caught fire on optimism about Friday's non-farm payrolls report. The Australian dollar was the best performer on the day after upbeat retail sales while the yen lagged. The China services PMI and RBA quarterly report are out later. Existing Premium trades include EURUSD, GBPUSD, USDCAD, AUDJPY and gold. Charts & trades are seen in the latest Premium Insights.

Draghi left the focus on data in a press conference that had something for everyone. He was surprisingly confident in the path of inflation and growth but also said the ECB was waiting for more information before acting. That puts the focus squarely on incoming data and will mean EUR/USD hangs on every release in the month ahead.

The broader story was the boost in yen crosses and stock markets as optimism returned. Everywhere we looked, there were upbeat prognostications on Friday's non-farm payrolls report. Much of that is built on solid ADP and ISM non-manufacturing data with the remainder on a recovery from weather effects.

With the moves, it's likely the market is expecting NFP near 200K rather than the 180K consensus and another decline in unemployment is also possible. The main bullish thesis is on higher revisions to the extremely soft December print.

Emerging market concern has died rapidly died down. On Thursday the lira was the top performer, gaining 1.3% with other beat up currencies like BRL, ZAR and RUB not far behind. On the year, the lira has trimmed its loses to just 2.8%.

One of the reasons EM has been able to recover is the lack of any negative news out of China this week because of holidays but that could change with the services PMI at 0145 GMT. This indicator is generally ignored but with nerves frayed, a decline from the 50.9 reading in Dec could have an outsized effect.

The other release on the schedule to watch is at 0030 GMT when the RBA presents its quarterly statement on monetary policy. Look for comments on the Australian dollar. Currency commentary was absent from the statement and there is chatter they could endorse AUD near the current levels. That will mark a change since officials have been repeatedly talking AUD down and the market could buy AUD/USD in response.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Nonfarm Payrolls (JAN) | |||

| 185K | 74K | Feb 07 13:30 | |

| Retail Sales (DEC) (m/m) | |||

| 0.5% | 0.4% | 0.7% | Feb 06 0:30 |

| PMI (JAN) | |||

| 50.9 | Feb 07 1:45 | ||

| Retail PMI | |||

| 50.5 | 47.7 | Feb 06 9:10 | |

| Unemployment Rate (JAN) | |||

| 6.7% | 6.7% | Feb 07 13:30 | |

Euro Lifted by Draghi, Faces Yellen

Another ECB press conference sends the euro higher as European Central Bank president Draghi did not share markets' concerns with prolonged declines in inflation. Not only Draghi touted the benefits of low inflation on real incomes, but also explained falling prices to be largely a result of weak energy prices and concentrated in bailout countries. How will the euro face Yellen's testimony next week? More

Stuck in the Mushy Middle

The market was looking for a signal one way or the other on the US economy but ADP and ISM data didn't send a strong signal. The overall changes on the day were small with JPY leading and AUD lagging. Australian retail sales and trade balance are up next on the calendar.

The January ADP employment report showed 175K new jobs compared to 185K expected. December figures were revised slightly lower while the November data was boosted by 50K. It was the softest ADP number since August and it briefly sent USD/JPY to a retest of Tuesday's lows.

Still the data wasn't bad enough to leave a lasting mark. Instead, traders waited for the ISM non-manufacturing survey. The 54.0 reading was slightly better than 53.7 expected and both the employment and new orders numbers climbed.

Overall, the trend in the ADP and ISM non-manufacturing numbers don't point to any kind of swift drop in the economy so those worries will probably ebb. The final verdict will come after non-farm payrolls and a good number with solid revisions could send USD/JPY higher.

AUD/USD traded in a narrow range but it continues to show some positive signs. There was virtually no retracement from Tuesday's post-RBA gains despite the choppy sentiment in markets. The next hurdle is the 100-day moving average, which has so far limited gains.

China re-opens after three days of holidays and that could make waves in Australian dollar trading but economic data is the main threat. Trade balance and retail sales are due at 0030 GMT. A trade deficit of $200m is expected and sales are expected to rise 0.5%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change (JAN) | |||

| 175K | 180K | 227K | Feb 05 13:15 |

| Retail Sales (DEC) (m/m) | |||

| 0.4% | 0.7% | Feb 06 0:30 | |

| Trade Balance (DEC) | |||

| $-36.00B | $-34.25B | Feb 06 13:30 | |

| ISM Non-Manufacturing Prices | |||

| 57.1 | 54.5 | 54.7 | Feb 05 15:00 |

| ISM Non-Manufacturing Employment | |||

| 56.4 | 55.8 | Feb 05 15:00 | |

| ISM Non-Manufacturing New Orders | |||

| 50.9 | 49.4 | Feb 05 15:00 | |

Bright Spots in The South Pacific

Risk trades bounced but only modestly after the rout on Monday. The Australian dollar caught an extra boost from the RBA and was the best performer while the yen lagged. The New Zealand dollar was able to keep pace with its Aussie rival after a late boost from jobs numbers.

The New Zealand jobs report was in-line with estimates as the unemployment rate remained at 6.0% but that didn't tell the whole story. The participation rate surprisingly rose 0.3 percentage points; no change would have knocked unemployment to 5.7%.

Even before the data, the ability of the kiwi to rally so much on a small bounce in risk sentiment was a positive sign.

Otherwise markets were subdued ahead of the ADP and ISM reports due on Wednesday followed by the ECB and NFP. The yen crosses pared a portion of Monday's losses but generally not enough to make traders rethink positions.

US Dec factory orders fell 1.5% which was slightly better than expected but near-target after negative revisions. Comments from Evans and Lacker emphasized the high bar for any changes to the Fed's $10 billion pace of tapering.

The theme in 2014 so far has been data-driven momentum. Good headlines like we saw from the RBA have led to lasting gains while negative news like the ISM manufacturing data has led to extended declines. That emphasizes keeping and eye on the news and riding the momentum.

China remains closed for a third day for holidays and the Asia-Pacific calendar is light.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change (JAN) | |||

| 180K | 238K | Feb 05 13:15 | |

| Factory Orders (m/m) | |||

| -1.5% | -1.7% | 1.5% | Feb 04 15:00 |

| Factory orders ex transportation (m/m) | |||

| 0.2% | 0.3% | Feb 04 15:00 | |

| Unemployment Rate | |||

| 6.0% | 6.0% | 6.2% | Feb 04 21:45 |

| Employment Change (q/q) | |||

| 1.1% | 0.6% | 1.2% | Feb 04 21:45 |

Whether It’s The Weather

A month ago the sun was shining on the US economy and sunny economists were predicting the economy would heat up in 2014. A month later and what started out as some weather concerns has turned into a blizzard of worries. Stocks had their worst day since June on Monday and GBP/JPY fell more than 300 pips.

For sure, poor US weather in December and January contributed to some weakness in economic data but the market no longer believes that's the full story. Not after the January ISM non-manufacturing survey plunged to 51.3 compared to 56.0 expected.

Technically, it caused a meltdown with USD/JPY smashing through 102, then through 101 to as low as 100.78. EUR/JPY took out the 61.8% retracement of the Nov-Dec rally and cable swan dove to the 100-day moving average.

More levels were broken than we can mention but the major ones that screamed risk-off were the fall below the 200-day moving average in US 30-year bonds and the breakdown below the Dec and Nov lows in the S&P 500.

To keep things in perspective, these moves are squeezing crowded, leveraged trades so they're probably exaggerated but the technicals are concerning. The next wave of data this week including ADP, the ISM-non manufacturing survey and non-farm payrolls will be extremely important.

We get a sense of how central bankers are feeling right away with the RBA decision due at 0330 GMT. Stevens has a nearly neutral outlook but the high quarterly inflation data is expected to prompt some kind of warning on inflation. The risk as that the RBA looks past the current inflation, says prices are contained and continues to re-iterate that AUD is overvalued. That's the formula for 0.8500 or lower in AUD/USD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ISM Manufacturing Employment | |||

| 52.3 | 55.8 | 56.9 | Feb 03 15:00 |

| ISM Manufacturing Prices | |||

| 60.5 | 54.0 | 53.5 | Feb 03 15:00 |

Yen, Yields, Shares Trifecta Threatens Yellen Autopilot

The trifecta of declines in bond yields, US equities and USDJPY (rising yen) following today's dismal US data is a rare but classic reflection that existing concerns of emerging markets contagion may be compounded by worries over slowing growth in the US. An extension of this negative trifecta would deal a serious blow to the notion that Fed tapering remains on auto-pilot. More detailed charts & analysis

China PMI Solid, EUR/USD Below 1.350

EUR/USD fell below 1.35 for the first time since November on Friday in a move that cracked technical support. Last week, the yen was the top performer while the New Zealand dollar lagged but in early trading those trends have flipped. China's non-manufacturing PMI from HSBC is due out later.

Traders are wary of betting against a euro fall because of repeated whipsaws in the past few months but with the break of 1.35 along with soft inflation the table is set for shorts. The key will be Thursday's ECB decision but it's sure to be a close call.

On the weekend, China's official manufacturing PMI was in-line with the consensus at 50.5. The market doesn't trust the government as much as private survey from HSBC but it might be enough to ease nerves.

The less-important non-manufacturing PMI from HSBC for China is due out at 0100 GMT. There is no consensus and the prior reading was 54.6. Early in Asian trading, the Australian economy grabbed headlines for the wrong reasons once again as the AiG manufacturing index fell to 46.7 from 47.6. It's one of the final data points ahead of tomorrow's RBA decision.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR +14 vs -4K prior JPY -86K vs -115K prior GBP +22K vs +8K prior AUD -66K vs -65K prior CAD -63K vs -70K prior CHF -1K vs -2K prior

Specs switched to long euros at the worst possible time as EUR/USD finally broke down last week. A trend over the past year has been the resilience of yen shorts when risk aversion increased but the swift change this week suggests heightened jitters this time.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (JAN) | |||

| Feb 03 13:58 | |||

| ISM Manufacturing PMI (JAN) | |||

| 56 | 57 | Feb 03 15:00 | |

| PMI (JAN) | |||

| 54.6 | Feb 03 1:00 | ||

| Markit PMI Manufacturing (JAN) | |||

| 53.9 | 52.7 | Feb 03 8:58 | |