Intraday Market Thoughts Archives

Displaying results for week of Nov 20, 2016USD/JPY Train Keeps Rolling

Not even a US holiday could halt the momentum of the US dollar against the yen. The pair has now risen in 12 of the past 15 days and Japanese CPI is due later. The Australian dollar was the top performer on the day despite dismal construction numbers. 8 Premium trades remain in progress; 3 of which in FX, 4 in equity indices and 1 in commodities.

The temptation ahead of any holiday is always to assume that profit taking and position squaring will lead to a retracement. The reality is usually the opposite as the flows that drove the move continue to work in a less-liquid market.

USD/JPY rose another 80 pips on Thursday with US traders out for Thanksgiving. The bulk of the move came in Asia as 113.00 broke in flurry that topped out at 113.53. What might have been even more impressive was that the move retraced early in Europe but the bidders returned throughout the rest of London and New York trade to finish at 113.25.

Every trend ends and a retracement will come but we look first for some kind of blow-off squeezed-out top or technical levels. The rally Thursday took out the 50.0% retracement of the June 2015 to June 2016 decline and that targets the 61.8% level at 115.61. That's also close to the 2015 and early 2016 lows.

On a risk/reward basis, it's late in the day to be buying USD/JPY but there is also no signal to sell yet. As we wrote about yesterday, we continue to watch for a shift in risk sentiment led by China and the weakening yuan. Alternatively, a Trump misstep or signs of a trade way would be damaging.

For the day ahead, the US remains on a de facto holiday but there is advance trade goods balance data due out that often moves the US dollar.

Elsewhere, yesterday's number on Australian construction work raised serious questions about Q3 growth. Economists have trimmed 0.5-0.7 percentage points from forecasts and that may take the quarter into negative territory.

Today's Asia-Pacific highlight is at 2330 GMT when Japan releases October CPI numbers. The consensus is for a 0.1% y/y rise in CPI ex food and energy. That's still a long ways from the BOJ's target and adding a slight slope to the yield curve isn't going to be the trick to get back to 2% growth.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Tokyo Core CPI (y/y) | |||

| -0.4% | -0.4% | Nov 24 23:30 | |

| BoJ Core CPI (y/y) | |||

| 0.3% | 0.2% | Nov 25 5:00 | |

“What if I’m wrong?”

There are no extra points for stubbornly holding a view so it always pays to be skeptical and question any assumptions we have about why market moves are taking place. The long gold in the Premium Insights was stopped out, raising questions as to the next key support.

(فيديو للمشتركين فقط) صاعقة الدولار تزعزع المعادن

There is no doubt that the implications to the US Elections is a key driver in the latest market moves. One-directional moves in virtually all global assets since the vote is evidence and the idea that Republicans will increase spending, cut taxes and trim regulation is compelling.

But it might not be the whole story. Even if all those things take place, there is no sure thing. Beyond that, everything they plan to try has been done in Japan for a generation without creating the kind of inflation that would justify the 65-bps rise in 10-year yields since election night.

In the broader view, the appetite for safety has collapsed despite the chance that global trade deals will be torn up. On Wednesday it was gold that came crashing $30 lower as it broke the May lows.

The alternative is that someone else is selling bonds. Aside from Mexico, the nation with the most to lose after the US election is China and they are also the second-largest holder of Treasuries. If not for the election, the market would be transfixed on the recent fall in the yuan. On Wednesday, the drop was the largest since the Brexit vote and the cumulative decline since the start of October is 4.2%.

Recent spells of aggressive yuan weakness have coincided with stock market drops. So the question here isn't “what if I'm wrong?” In this case it's “what if everyone is wrong?” Normally, that's an incredulous question but in light of how wrong the consensus was on the market reaction to Trump's election, it's a question worth pondering. We'll take a closer look in the days ahead with markets likely to stay quiet due to the US holiday.

Recording of Ashraf's Webinar

Ashraf's webinar last night touched on seasonalities in oil, EURUSD, AUDUSD and revealed his insights on the major FX pairs and global indices. Full video.

Optimism Abounds, USD Chops

The drumbeat of optimism for a Republican-led US economy continued Tuesday. The Australian dollar was the top performer while the pound lagged. Aussie skilled vacancies and construction data are due next. The latest Premium video focuses on Gold/Silver dynamics and the USD, with additional focus on SPX, DAX ad FTSE.

Every day, another firm or analyst upgrades his US economic expectations and boosts forecasts for the dollar and stocks. The S&P 500 hit a record for a second day and the US dollar was mostly higher.

Economic data helped USD as existing home sales were at a 5.60m pace compared to 5.44m expected and the Richmond Fed improved to +4 from a flat reading expected. At the moment though, economic data is largely ignored as the market fantasizes about a Trump-led future of lower taxes, less regulation, higher rates and endless stimulus.

At some point there will be a reality check but the momentum right now is clear on the dollar's side. Dips are shallow, bad data is cast aside and seen as something from the past while good news strengthens the market's newfound conviction.

It's a short week in US trading as Thanksgiving brings a de facto four-day weekend starting Thursday. That might put the brakes on the dollar's run but a meaningful retracement is doubtful.

OPEC remains in focus and conflicting reports from unnamed sources have emerged with some saying a deal is virtually done to cap output for six months and others saying serious hurdles with Iran and Iraq remain. USD/CAD touched a two-week low Tuesday but quickly bounced back.

Asia-Pacific trading features a focus on Australia. Up first is the October report on skilled vacancies at 0000 GMT. The report that's more likely to move the markets comes 30 minutes later when the Q3 construction work data is out. The consensus is for a 1.6% decline.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| New Home Sales | |||

| 591K | 593K | Nov 23 15:00 | |

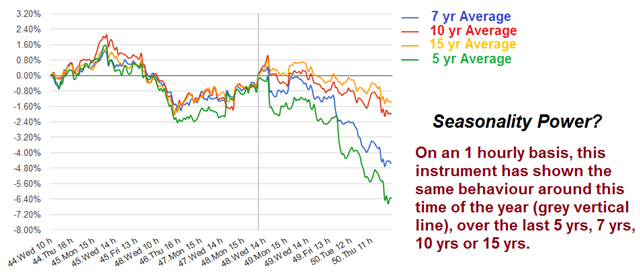

Tonight: Seasonality Power

I will explore several dynamics in tonight's webinar, one of which is the peculiar behaviour highlighted in the chart below. This instrument has begun topping (and later declining) around the same time of the year (grey vertical line) over the last five, seven ten and fifteen years. I will identify this instrument and many more tonight at 10 pm London/GMT. Regsiter here.

Dollar Dented, Stocks at New Highs

A long-anticipated US dollar pullback materialized on Monday, sort of. The pound was the top performer while the US dollar lagged. An earthquake near Fukushima sent the yen higher in early Asian trading. Will EURUSD break below 1.05? Is the USD up leg just starting? Will gold break below 1100? All of this and more will be tackled in Tuesday evening's webinar.

The retracement often says more about the trend than the initial move. On Monday, a pullback finally hit the dollar rally but it quickly floundered in a sign of the extraordinary demand for dollars.

The bid was assisted by a fresh record high in the S&P 500 and a close near the best levels of the day. The combination of a united Congress and Fed on the verge of hiking is proving to be an unstoppable force.

Only two currencies were able to make dents in the dollar; GBP and CAD. The pound rose 150 pips to a six-day high. There weren't any Brexit headlines to drive it. Instead, selling in EUR/GBP and buying in GBP/JPY at technical levels helped out the move.

The Canadian dollar got a helping hand from OPEC as ministers were upbeat following the first of two days of technical meetings in Vienna ahead of the Nov 30 production decision. WTI rose nearly 4%.

Otherwise, the euro climbed 40 pips but through the lens of the recent 600 pip decline, that's virtually nothing.

USD/JPY finished close to unchanged at 111.00 after it tested 110.50. The pair has risen 1000 pips since the election-night low and is showing no signs of stopping. Another brief 50 pip dip hit the pair early in the Tokyo morning after reports of a 7.3 magnitude earthquake. A tsunami warning was issued for Fukushima and that sent a shudder through markets but the 3 meter waves are faint compared to the 13-15m waves in the 2011 disaster.

We also note that Japanese PM Abe met with Trump on Friday. The meeting went long in what's usually a sign of a positive exchange and Abe said he found Trump to be trustworthy. A trade war is less likely by the day and rumored cabinet picks including Mitt Romney set up an administration with a distinctly establishment flavour.

The Asia-Pacific calendar is light today. Events to watch include Japanese department store sales at 0530 GMT and the RBNZ's Bascand at 0630 GMT.

أشرف العايدي على قناة العربية

أحداث السوق الأكثر أهمية هذا الأسبوع

يفتح الأسبوع بخطابات من نائب رئيس الاحتياطي الفدرالي فيشر و رئيس المركزي الأوروبي دراغي يوم الاثنين ثم عدة بيانات مبيعات المنازل في الولايات المتحدة. سوف يكون الأربعاء أهم يوم الأسبوع مع الانتاج الإجمالي البريطاني، إعلان الميزانية الحكومية البريطانية و شهادة لقاء الاحتياطي. لمعرفة اليوم والتوقيت لكل هذه الأحداث و اكثر، الرجاء مشاهدة الرابط/الفيديو

4 Spots to Watch in China-US Relationship

We look at the different ways China and the United States are poised to drift apart in the four years ahead. CAD was the best performer last week while AUD lagged. CFTC data showed traders squaring up and cutting exposure. A new GBP Premium trade was issued on Friday, which will be discussed in Tuesday evening's open webinar.

The relationship between two largest and most-power economies may define Trump's Presidency and will be an omnipresent risk. Here are the potential fault lines.

1) Free Trade

The APEC summit in Peru wrapped up on Sunday and China is clearly pursuing more trade deals and every country appears to want to move forward with a TPP that may exclude the US.At the moment, it's clear that the US won't sign the TPP but what could happen is that a few largely-cosmetic clauses are re-worked and the deal is re-named so Trump gets to claim a victory, albeit a hollow one. This could be the strongest indication he isn't truly setting out to restructure US trade policy.

2) Economic Allies

Asian power appears to be gearing up for a future where the US pulls away from trade. Abe and Xi met on Sunday and Japan's leader said he wanted comprehensively closer ties with China and Xi was said to be impressed by the overture.China may also build closer ties with Russia, Middle Eastern countries and Canada as it attempts to encroach on the US sphere of influence.

3) Currencies

Trump probably won't name China as a currency manipulator but record lows in the yuan are sure to be a sore spot and the rhetoric from Trump's side will probably be the first indication of how friendly he intends to be with Beijing.4) Bonds

China is the second-largest holder of Treasuries after Japan but at the moment someone is clearly selling. Perhaps it's one of the Asian powers? We won't find out for months but Treasury-holdings data in the months ahead is must-watch economic news.Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -119K vs -129K prior JPY +21K vs +32K prior GBP -80K vs -90K prior CHF -22K vs -23K prior AUD +42K vs +41K prior CAD -18K vs -21K prior NZD +2K vs +2K prior

The euro shorts have been paid off since the US election and they've used the drop to lighten up, but only marginally. Overall, the theme was to pare back exposure but not in a big way. We're a bit surprised that yen longs have pared even with bond yields moving up. That's a correlation that can't last.