Intraday Market Thoughts Archives

Displaying results for week of Dec 20, 2020VIX, USDX & Yields

It will be important to watch those fixing times for the remainder of the year. Christmas Eve, Christmas, New Years Eve and New Years all fall on weekdays this year so that leaves only four proper business days in the year, including today. Importantly, Monday, Dec 28 is the final day of the year for tax loss selling so we could see extra flows and volatility around that date.

Stock and bond markets in most markets will close early on Thursday for the Christmas holidays.

Mixed in with that will be ongoing Brexit talks. The more-transmissible strain of covid also bears watching with the UK reporting a record number of new cases on Tuesday.

Economic data also continues to surprise. US consumer confidence from the Conference Board was at 88.6 in December, which badly missed the 97.0 consensus. The market largely shrugged it off because US stimulus (which passed Tuesday) will give a jolt to consumer spending.

Onto Plan B.1.1.7

There are far more questions than answers about the new covid varient but top virologists are now more confident that it's more transmissible by 40-70%. It explains why UK cases have continued to surge despite the latest lockdowns and it's likely already spreading in many other countries.

The Spanish variant earlier in the year was first thought to be a similar problem but it turned out to be a result of luck and circumstance. It's now clear that the quick spread of that virus was a result of many people traveling to Spain along with some super-spreader events.

What's different this time is that this strain has 17 mutations compared to its most-recent ancestor. Scientists believe it incubated in a single, immunodeficient patient in a long-term battle with covid.

Secondly, this strain is competing with other ones in the UK, where there have been a high number of cases -- and it's winning. On Nov 18, a total of 28% of London cases were this variant. That had risen to 62% by Dec 9.

On the economic side, it means that more countries will need to go into March-style lockdowns and that schools may close again. It risks a deeper contraction in Q1 GDP and a slower recovery, especially in emerging markets where vaccines are many months away.

What it's not likely to change is the vaccine. US officials Monday said 50m Americans could receive a first dose of the vaccine by the end of January. Other countries are also moving forward vaccine timelines. Given the strength of the bounce in risk assets Monday, the message is that so long as the vaccine is on schedule, the recovery trade is on.

That said, we will be keeping a close eye on UK cases in the coming days along with South Africa, where another variant may also be more transmissible.

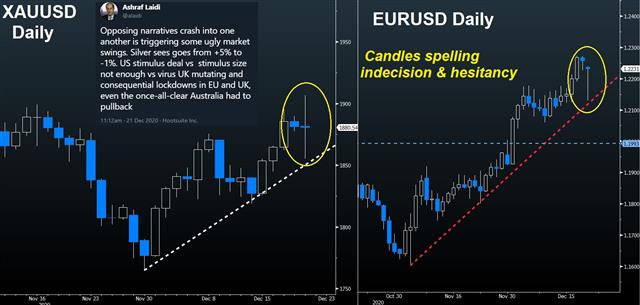

Ashraf is closely watching the Gold/Silver ratio and whether it retests the 75 level of previous support-now-turned-resistance. Thus, any rebound from, 73 to 75 will mean fresh selling in XAUUSD (to 1863/4) and XAGUSD (towards 24.80s) until we hit the 75 ceiling in the Mint Ratio.استغلال ظاهرة السانتا رالي

ما هي ظاهرة الـ "سانتا رالي" التي ظهرت خلال آخر ١٥ سنة؟ وكيف بإمكاننا انتهاز استثناءات هذه الظاهرة على مؤشري الداكس والداو جونز؟ كل التفاصيل في الفيديو الكامل

Clashing Narratives

The horror film-like qualities of 2020 continued on the weekend as concern about a more-easily transmissible strain of covid-19 circulating in the UK led to some drastic actions.

A surge of cases and the new strain led to London and the southeast of England going into a Tier 4 lockdown, meaning that all non-essential shots including hairdressers and leisure most close. A new stay-at-home message was also introduced, urging people to work from home and mixing households is banned. Overnight travel of any kind is banned.

The Telegraph reports that that Tier 4 restrictions in the UK could last four months.

A multitude of countries have now banned all travel to the UK but there were confirmed cases of the new variant in continental Europe two weeks ago; raising the possibility that this winter will be even worse than feared.

The Brexit front also did no favours to sterling. Talks will continue but there was no breakthrough and time is running short. Fishing remains the main snag.