Intraday Market Thoughts Archives

Displaying results for week of Sep 20, 2015The Next Golden Cross

A NEW AND IMPORTANT Golden Cross formation has emerged. Guess what it is !

On Sep 18, we highlighted a Golden Cross formation in the VIX via the crossover of the 55-week moving average above the 100-week moving average for the first time since August 2007. Such formation occurred only in 3 occasions over the last 14 yrs. Now, we've an eerily similar formation -- a Golden Cross formation, also the first since 2007 and also involves the 55-week moving average.

Wanna guess?. Please tweet us your answers to @alaidi and please READ CAREFULLY the CLUES in the box. We will unveil the answer on Monday along with ONLY the correct guesses.

Yellen Correction or Clarification?

Was it a correction or a clarification from Fed Chair Yellen

Upbeat comments on the economy and the potential for a rate hike this year led to a rally in the US dollar. USD had been a laggard on Thursday but her comments sparked a quick rally early in Asis-Pacific trading. Japanese CPI later promises to make it a busy day. 1 of our 2 shorts in Premium Insights in the DAX hit its final 9,400 target from the 10,100 entry. EURUSD, GBPJPY are all in the green, while EURCAD slipped back at a loss.

But first Caterpillar

For those who claim the US should focus only about the US, Caterpillar, the world's biggest mining and construction equipment maker cut its 2015 revenue forecast and announced slashing up to 10,000 jobs due to pluning capex in from the energy sectors.Now Yellen

Yellen took a slightly more hawkish tone than her post-FOMC statement in a speech in Boston Thursday. She said it will likely be appropriate to raise rates this year and that US economic prospects generally appear solid. She added that recent developments should significantly affect the policy path.We noticed one other small change in language as she said a future tightening will be “quite gradual” rather than simply “gradual” which she said before.

The rhetoric suggests Yellen doesn't want markets to abandon an October or December hike. The US dollar climbed 25 to 50 pips across the board on the headlines. The euro was already backing away from the session high of 1.1296 and fell another half-cent to 1.1171 on the speech.

What strikes more than the content of the speech is that Yellen took an opportunity to address rates. In her tenure, she's rarely made waves except during FOMC statements. That she would address monetary policy so soon after the FOMC suggests she felt misinterpreted. That may mean this round of dollar strength lasts through the Friday close.

But what will ultimately decide whether the Fed hikes is economic data. The latest durable goods orders report showed core orders flat in August compared to +0.5% expected. Shipments were also weaker and that led to some modest downward revisions in Q3 GDP estimates.

Another place to watch closely is USD/JPY. The pair has been in a narrowing range for the past month and bounced off the bottom on Thursday. One event that could trigger another move is Japanese CPI numbers due out at 2330 GMT. The national reading for August is expected to show prices up 0.7% y/y excluding food and energy. A low reading could boost USD/JPY on speculation of more BOJ QE.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| National CPI (AUG) (y/y) | |||

| 0.2% | Sep 24 23:30 | ||

| National CPI Ex Food, Energy (AUG) (y/y) | |||

| 0.6% | Sep 24 23:30 | ||

| National CPI Ex-Fresh Food (AUG) (y/y) | |||

| -0.1% | 0.0% | Sep 24 23:30 | |

| Tokyo CPI (SEP) (y/y) | |||

| 0.1% | Sep 24 23:30 | ||

| Tokyo CPI ex Food, Energy (SEP) (y/y) | |||

| 0.4% | Sep 24 23:30 | ||

| Tokyo CPI ex Fresh Food (SEP) (y/y) | |||

| -0.2% | -0.1% | Sep 24 23:30 | |

| Fed's Bullard speech | |||

| Sep 25 13:15 | |||

| Fed's George Speech | |||

| Sep 25 17:25 | |||

| Durable Goods Orders (AUG) | |||

| -2% | -2% | 2% | Sep 24 12:30 |

| Durable Goods Orders ex Transportation (AUG) | |||

| 0.0% | 0.1% | 0.4% | Sep 24 12:30 |

| GDP Annualized (Q2) | |||

| 3.7% | 3.7% | Sep 25 12:30 | |

| GDP Price Index (Q3) | |||

| 2.1% | 2.1% | Sep 25 12:30 | |

Commodity FX Keels, EMs Crack

The Canadian dollar touched a fresh 11-year low and the Brazilian real hit an all-time low on fresh signs of strain in emerging markets. The euro was the top performer on the day while the Australian dollar lagged. The latest Japanese manufacturing PMI is due later.

Emerging market and commodity worries continued to ramp up on Wednesday. The Canadian dollar initially rose on a bullish US oil inventory report but crude quickly reversed to fall 3.5% and pulled down the loonie with it. It was compounded by a flat reading on Canadian retail sales ex-autos, compared to a 0.5% rise expected. Late in the day, USD/CAD rose narrowly above the August high of 1.3353 in the fifth day of gains.

The Australian dollar and pound sterling are also working on four day losing streams but perhaps the worst streak of all is the Brazilian real. It's declined in 11 of the past 12 weeks and has been halved in the past year. Talk of impeaching President Rousseff continues and bonds of semi-state-oil company Petrobras are trading at severely distressed levels.

Brazil is often seen as a forerunner for emerging markets but they're far from the lone weak spot. South Africa's central bank slashed growth forecasts for 2015-2017 Wednesday and warned of FX weakness. Yesterday's China PMI raised fresh concerns about growth there and President Xi Jinping offered comments to reassure on growth during a trip to Washington.

One standout on the day was the euro as it rebounded after three days of losses. Soft global growth has sparked talk of more ECB QE but a speech from Draghi was very similar to his September ECB statement. He said the ECB could change the size, composition and duration of its balance sheet as needed but offered no more.

Looking ahead, a few Asia-Pacific events are on our radar. Up first, it's New Zealand trade balance at 2245 GMT. Exports are expected at $3.6B. Next is the Japan Nikkei prelim PMI for September. The BOJ hasn't yet opened the door to further easing but economic data is in sharp focus. The index is expected to slip to 51.2 from 51.7. Finally, at 0530 GMT, the RBA's Heath speaks in Perth.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Nomura/ JMMA PMI Manufacturing (SEP) [P] | |||

| 51.7 | Sep 24 1:35 | ||

| Markit US Manufacturing PMI (SEP) [P] | |||

| 53.0 | 52.8 | 53.0 | Sep 23 13:45 |

| PMI | |||

| 47.0 | 47.6 | 47.3 | Sep 23 1:45 |

| Eurozone Markit PMI Composite (SEP) [P] | |||

| 53.9 | 54.1 | 54.3 | Sep 23 8:00 |

| Eurozone Markit PMI Manufacturing (SEP) [P] | |||

| 52.0 | 52.0 | 52.3 | Sep 23 8:00 |

| Eurozone Markit Services PMI (SEP) [P] | |||

| 54.0 | 54.2 | 54.4 | Sep 23 8:00 |

| Retail Sales (AUG) (m/m) | |||

| 0.5% | 0.5% | 0.4% | Sep 23 12:30 |

| Retail Sales ex Autos (AUG) (m/m) | |||

| 0.0% | 0.4% | 0.5% | Sep 23 12:30 |

| Fed's Yellen Speech | |||

| Sep 24 21:00 | |||

| Trade Balance (AUG) (m/m) | |||

| $-850M | $-649M | Sep 23 22:45 | |

| Trade Balance (AUG) (y/y) | |||

| $-3.07B | $-2.69B | Sep 23 22:45 | |

| Exports (AUG) | |||

| $3.67B | $4.20B | Sep 23 22:45 | |

عودة البيع في البورصات

Ashraf on BNN

عودة البيع في البورصات

EUR, GBP Near Support, China PMI Next

Sentiment continued to deteriorate Tuesday and the euro and pound were the chief victims as global growth concerns mount. The yen was the best performer while sterling lagged. Up next it's the Caixin China PMI. A new video has been issued for Premium subscribers about the existing and upcoming trades as well as a new note & charts on EURUSD. GBPJPY and DAX trades deepen in the profut, EURUSD and EURCAD are in the red, while USDJPY is flat.

It's a tough market for headline-driven traders at the moment as sentiment and momentum are the prime drivers. The lone bit of economic news in US trading was the Richmond Fed as it slipped to -5 compared to +2 expected. The Philly and Empire surveys also missed expectations in a sign that US dollar strength is crimping manufacturing.

The dollar was strong once again on Tuesday, in particular against the euro and pound. EUR/USD and GBP/USD both fell for the third consecutive day. Both now rest just above last week's lows in what will be an important technical challenge.

We are keeping a very close eye on the bond market. US 10-year yields hit a two-week low of 2.11% Tuesday and German 10s fell to a three-week low. The synchronous falls in global yields highlight global growth concerns.

Looking ahead, focus on China as one of the rare private economic indicators is released. The Caixin PMI (former HSBC PMI) is due at 0145 GMT and expected to improve slightly to 47.5 from 47.3. After spending most of the past year near 49-50, the previous two readings deteriorated sharply.

A fresh low, even a modest one, may set off another round of China-driven worries. Along with the reading, watch the reaction in Shanghai stocks and the Australian dollar. The Aussie had posted a two-week bounce but it's faded badly in the past three days.

Other news to watch includes the Fed's Lockhart at 2230 GMT and Australian skilled vacancies at 0100 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (SEP) [P] | |||

| 53 | Sep 23 13:45 | ||

| PMI (SEP) [P] | |||

| 47.5 | 47.3 | Sep 23 1:45 | |

| Eurozone Markit Services PMI (SEP) [P] | |||

| 54.2 | 54.4 | Sep 23 8:00 | |

| Eurozone Markit PMI Composite (SEP) [P] | |||

| 54.1 | 54.3 | Sep 23 8:00 | |

| Eurozone Markit PMI Manufacturing (SEP) [P] | |||

| 52.0 | 52.3 | Sep 23 8:00 | |

| Germany Markit PMI Composite (SEP) [P] | |||

| 54.7 | 55.0 | Sep 23 7:30 | |

| Germany Markit PMI Manufacturing (SEP) [P] | |||

| 52.8 | 53.3 | Sep 23 7:30 | |

| Germany Markit Services PMI (SEP) [P] | |||

| 54.9 | Sep 23 7:30 | ||

| Richmond Fed Manufacturing Index (SEP) | |||

| -5 | 2 | 0 | Sep 22 14:00 |

NYSE Margin Debt Raise Key Questions

It's happening again. The amount of margin debt balances at New York Stock Exchange member firms fell to $473,412 billion in August, down 2.9%. It is the 2nd consecutive monthly decline and the first back-to-back monthly drop since December-January.

The importance of these figures is highlighted by the historical relationship between peaks in margin debt, and tops in the stock market, typically measured by the S&P500.

Margin calls & forced selling

As markets enter the early stages of a rally, smart money (hedge funds, index funds) usually leads the ascent until it is joined by retail players to trigger the next buying wave. As the rally sustains itself to higher levels, existing and new payers add on to positons with varying use of leverage (buying on margin). Once markets peak out and/or start to pull back, buyers on margin are obliged to close or pare long positions as margin calls creep in. Clients' losses at member firms escalate especially as soaring volatility triggers the cascading of stops, prompting further market downside.The high correlation between margin debt and equities reflects the increasing use of debt in purchasing stocks by institutional and retail investors, shedding important light on the circular loop between price performance and the use of margin debt.

1-3 month lags

July 1998 – The stock market top of July 1998 coincided with the peak in margin debt before the decline was propagated by the EM fallout & LTCM collapse.March 2000 -- The peak in margin debt of March 2000 coincided with the market high in the S&P500 right before the burst of the dotcom bubble, which was intensified by a new generation of margined trading, made easy by online trading.

July 2007 -- The peak in margin debt of July 2007 occurred three months prior to the pre-crisis top in the market.

The 1-month lag has reappeared as the latest margin debt figures show leverage has fallen 7% from its April peak -- one month prior to the record high in the S&P500 and the Dow.

Margin buying & forced selling

The escalation and subsequent decline in margin debt highlights the risks of speculative stock buying at a time when equities are increasingly vulnerable to contracting earnings growth, slowing global trade, deepening China macro retreat, plunging commodities, falling capex and +$1.5 trillion in cancelled oil projects. The other risk to equities is the back-up of bond yields in an increasingly thin global bond market.This will not help stock valuations, especially as chest-thumping reminders from Fed hawks fuel the risk of higher yields. And the last thing that's needed is a bout of forced redemptions from hedge funds and margin calls by retail investors.

How I used margin debt in January 2008 and October 2008 to forecast further damage in equities

Margin debt can best be utilized for continuation patterns during selloffs rather than timing of turning points. On January 2008, margin balance helped me make the case for an additional 25% decline after equities had already fallen by 14% from their peak.

Then in October 2008, as stocks had plunged 25% from their 2007 peak, we remained negative on stocks to the extent of predicting further Fed easing against the prevailing market consensus, which leaned towards US rates reaching a bottom at 2.0%.

مقابلتي مع لارا حبيب على قناة العربية

Fed Lays out Rules of Engagement..again

Comments from the Fed show three things need to happen before they will raise rates, we take a closer look. The US dollar was the top performer to start the week while the euro and kiwi lagged. The Asia-Pacific calendar later is thin.

Comments from four Fed speakers – Williams, Lacker, Lockhart and Bullard – along with Yellen's press conference paint a comprehensive picture of what kept them on the sidelines in September and offers clues about what comes next.

1. Volatility

The August mini-panic rattled the Fed and they're not quite sure what it means. They've detected stress in financial conditions abroad and domestically but they're not sure if it's a blip or a tremor before an earthquake. Lockhart highlighted how the Fed felt comfortable waiting because inflation is still benign.2. Market Certainty

Officials admitted that it wasn't favorable to have markets so uncertain heading into liftoff. We've argued before that virtually pre-committing to a rate hike is a better option that leaving half the market surprised. Fed credibility isn't at risk and offering a very strong hint about a move before it comes will smooth the market reaction.3. Inflation

The argument for hiking now assumes that a tighter labor market will produce inflation. In theory, that's true but the Fed isn't sufficiently confident to take action. They want to see genuine signs of rising prices before they vote to hike.Add it up and it makes it difficult to envision a hike this year. Even if there was a string of spectacular data domestically and abroad, the six weeks before October decision don't leave enough time to warn markets or for more than 1 better data point on inflation. December is still realistically on the table but in all likelihood the data will remain mixed. There's also the case against hiking just before year end. The Fed's Lockhart said that's not a large factor but it could tip the scales.

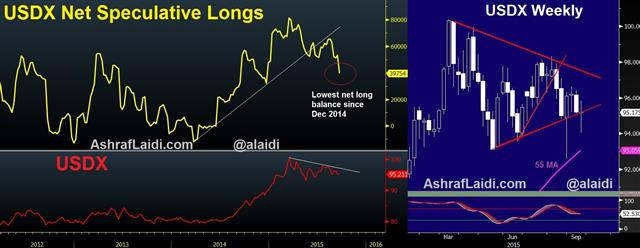

USDX net Longs Lowest for the Year

Net speculative longs in USD Index contracts traded at the New York Board of Trade reached their lowest level for the year in the week ending on Tuesday at 39,754 contracts. The information was provided before Thursday's FOMC-driven selloff of the greenback. But the late Friday pullback in EURUSD means that the weekly chart on USDX ended unchanged, right on the 4-month trend support.

Criticism of the USD index revolves around the non-representational nature of the index, which is 58% occupied by the euro, 14% by the yen, 12% by the pound and 9% by the Canadian dollar. The Swedish krona and Swiss franc make up the rest around 4% each.

Broader USD Index

A broader measure of the US dollar is the 25-currency Broad USD index, prepared by the St Louis Fed, which is currently near 11-year highs. The index includes several emerging market nations, hence the relative strength. Considering the Federal Reserve widely cites its broad index, as did Yellen at Thursday's press conference, this implies further cautiousness from the US central bank ahead. The Fed decision was a wake-up call to those who have rejected the idea of globally-sensitive policy making by the US central bank.Relevance of USDX

The relevance of the USD index is highlighted by its near inverse relation with EURUSD, a pair that occupies about 23% of the daily turnover in the spot FX market. Having EUR/USDX equivalents during trading helps pin-point inflection points in currencies, especially as the index is largely traded by hedge funds. Identifying coincident confluences in moving averages and trendlines is part of the puzzle.Now that the Fed is out of the way for at least 4 weeks, attention returns to ECB policymakers for actionable rhetoric before reverting to the usual US data watch. A retest of 91.20 is anticipated before a new direction is sought.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Lockhart speech | |||

| Sep 21 17:00 | |||

Syriza Wins

Syriza held onto power in an election that served as a referendum on the latest bailout deal. Early week trading pushed the Australian dollar slightly higher while the euro trails.

Syriza cruised to a win in Greek elections, holding about a 5 point lead despite polls showing them neck-and-neck with New Democracy. The vote got plenty of attention but we struggle to see how it could have an impact. Policy is dictated from Germany and any Greek government has little room to negotiate.

One takeaway is that a leftist party was able to hold power. Politics in the UK, Australia and Canada have all shown signs of swinging that way while anti-establishment candidates are gaining momentum in the US. It' something we're watching but it will take years for these trends to show up in policy.

The modest euro weakness in early trading may be more a result of ratings agencies then elections. Moody's downgraded France late on Friday by one notch. Ten-year borrowing costs are just over 1% for France so the fallout will be minimal.

Elsewhere, Portugal was upgraded by S&P to BB+

In other weekend news, SF Fed President Williams said wage growth is expected to pick up and help guide inflation towards target but he didn't offer any hints on the timing of rate hikes.

The Fed's Bullard said he argued in favor of hiking rates in the FOMC. The Minutes of the meeting will reveal more. He will have a vote in 2016

CFTC Commitments of Traders

Net speculative positions as of the close on Tuesday (-/+ denotes net short/long vs USD).

EUR -84K vs -82K prior GBP -4K vs -18K prior JPY -27K vs -7K prior CAD -47K vs -49K prior AUD -41K vs -47K prior CHF +4K vs -7K prior NZD -2K vs -11K prior