Intraday Market Thoughts Archives

Displaying results for week of Oct 22, 2017Euro Crumbles, Dollar Soars

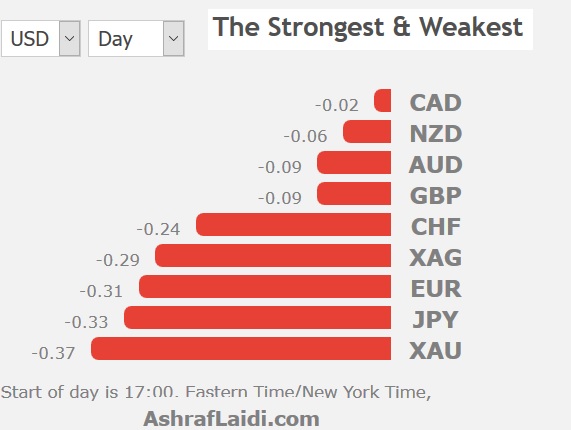

Draghi gave himself the flexibility to keep QE going beyond Sept 2018 and the market sent EUR/USD to the lowest since July. The US dollar was the top performer Thursday while the euro lagged. Japanese CPI is due up next. One EURUSD Premium trade was closed at gain, while a new one was opened, currently at a loss.

We warned ahead of the ECB decision that Draghi would want to preserve the option of continuing QE beyond September. “The market could interpret the flexibility as dovish and send the euro lower,” we wrote. “In addition, the large net-long EUR position could be waiting to 'sell the fact' on a taper announcement.” That's what happened as EUR/USD broke the October and August lows to break the neckline of a well-defined head-and-shoulders pattern. But taking a step back, the magnitude of EUR declines could be seen as overdone. Said differently, the reaction emerged as if the ECB announced an increase in QE size and duration.

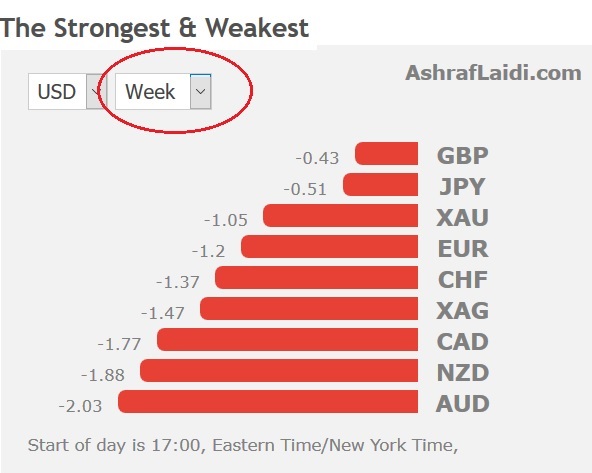

It would be wrong to give all the blame to the euro as the US dollar was broadly stronger and finished at the highs of the day. Commodity currencies weakened substantially and cable reversed virtually all of Wednesday's climb.

Pefect USD Storm?

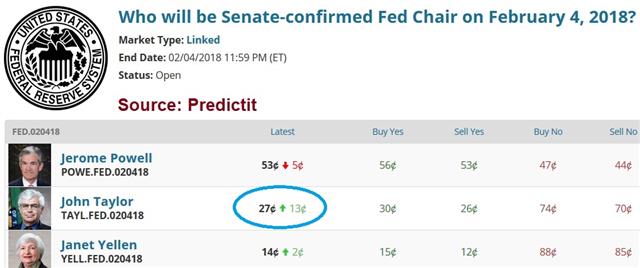

A driver of USD strength is the bond market as 10-year yields consolidate above 2.40%. A soft 7-year auction added to the bond move, along with the House passing a budget motion that brings a tax cut closer. A report from Politico also said Yellen is out of the running for the Fed chair and that it's now between Taylor and Powell.

The yen will be in focus in the hours ahead with September CPI numbers due at 2330 GMT. The consensus is for a 0.7% y/y rise on the headline and +0.2% y/y on ex-fresh food and energy. Abe is rumored to have asked for a extra budget as he restarts efforts to get the economy moving and inflation higher.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| National Core CPI (y/y) | |||

| 0.7% | 0.7% | Oct 26 23:30 | |

The Bank-of-Can’t Decide

The Bank of Canada put a screeching halt to interest rate hikes Wednesday after two quick hikes in succession. The Canadian dollar was the top performer on the day while the pound surged to lead the way. The ECB decision is up next. The Premium video outlining the trades strategy ahead of the ECB is found below.

(فيديو البنك المركزي الأوروبي للمشتركين فقط) إدارة صفقات اليورو مع دراغي

It has been a bizarre year for the Bank of Canada, who is quickly earning a reputation for doing the right thing… only after all the other options are exhausted. Through most of the first half of the year, the BOC was stubbornly dovish, hinting at rate hikes and keep rates low despite months of very strong economic data. Then, days before the July decision, deputy governor Wilkins dropped a hint about a hike.

Despite a weak CPI report afterwards, the BOC surprised markets with a hike. The Bank then hit the mute button and didn't have a single statement or interview until the September meeting when they caught markets largely by surprise with another hike.

Back-to-back hikes are unheard of in the post-crisis era and the message from those actions was that policymakers were worried about inflation. Poloz tried to emphasize data dependence and that cooled expectations for a hike Wednesday but still left the markets expecting something hawkish.

Instead, the BOC delivered a dovish hike saying the Governing Council will be “cautious in making future adjustments”. They cited NAFTA, mortgage rules changes and the Canadian dollar as reasons. None of that will be cleared up by year-end so a 50/50 chance of Dec hike is closer to zero and that's why USD/CAD jumped above 1.28.

At the same time GBP/CAD jumped more than 300 pips as it was also fueled by strong UK GDP numbers and the expectation that Carney will hike UK rates next week. Technically, that pair exploded above the Aug/Sept highs to a test of 1.70. It will likely rise to 1.75 if Carney delivers a hike with a hint of hawkishness.

Before that, the ECB is on deck. Expectations are centered around a taper to 30 billion euros per month of QE from 60 billion starting in December. Many market watchers are also talking about an extension in buying until September but it's highly unlikely that the ECB gives that much clarity. Draghi loves to add a measure of uncertainty and flexibility. Locking himself in with a timeline would be out of character.

The market could interpret the flexibility as dovish and send the euro lower. In addition, the large net-long EUR position could be waiting to 'sell the fact' on a taper announcement. A 3rd euro trade in the Premium Insights will be added ahead of the ECB.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Minimum Bid Rate | |||

| 0.00% | 0.00% | Oct 26 11:45 | |

| Prelim GDP (q/q) [P] | |||

| 0.4% | 0.3% | 0.3% | Oct 25 8:30 |

Does it Matter who's the new Fed Chair?

President Trump will likely announce his pick for a new Fed chairman before his trip to Asia next week. This means an announcement for the Chair and vice chair at the Fed is imminent by end of this week. Full analysis.

BOC to Back Off, Big Day Ahead

The 2nd half of the week is underway, featuring non-stop news including Wednesday's Bank of Canada decision. On Tuesday, the euro was the top performer while the New Zealand dollar lagged as the swoon continued. Bad news on the tax reform plan and chatter of a Taylor nomination (see standing in image below) confounded USD traders. Australian CPI, UK GDP and the BOC decision are up next.

USD/CAD touched the highest since mid-August on Tuesday in a sign that the market is less-worried about a hawkish Bank of Canada. USD/CAD broke the 100-day moving average and neared 1.27 as the +200 pip gain since Friday's soft retail sales reported extended.

That data point is a big reason why few expect another hike from Poloz. However the market is pricing in a 18% chance of higher rates because of the central bank's unpredictable recent history. If the BOC decides to remain on the sidelines, signals about the December meeting and beyond will be closely watched. The market is pricing in a 46% chance of a hike on Dec 6 and that rises to 72% for the January meeting. If the BOC moves to a clear neutral stance, expect a sharp rally in USD/CAD.

The other side of that trade is also dangerous. US 10-year yields broke above 2.40% Tuesday in a move that Bill Gross said could signal the end of the generational bond bull market. That helped to push USD/JPY briefly above 114.00.

At the same time, politics remains a dominant theme. USD fell on talk that Trump's tax cut plan doesn't have enough votes in the Senate. Competing with that was a report that John Taylor won an informal Senate Republican poll to be the next Fed Chair.

Aside from the BOC and Fed, look for big moves in the Australian and UK currencies. At 0030 GMT, the Q3 Australian CPI report is due and expected to show a 0.8% q/q rise. The trimmed mean is forecast at +0.5% q/q and a miss there will be a market driver.

At 0830 GMT, pound traders will be locked into the first look at UK Q3 GDP. The consensus is for a +0.3% reading and a miss in either direction will have major implications for GBP.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.8% | 0.2% | Oct 25 0:30 | |

| Prelim GDP (q/q) [P] | |||

| 0.3% | 0.3% | Oct 25 8:30 | |

من سيترأس الاحتياطي الفيدرالي؟

من هم المرشحون الرئيسيون وآثارهم على الأسواق التحليل الكامل

Ranges on Lockdown Ahead of 3 Events

A trio of pairs are waiting near key levels in anticipation of big news this week. The yen was the top performer Monday while the euro lagged. In mid-day EU trading, the euro is the best performer and the NZD at the opposite end. We trun to today's PMI figures from the US after a series of neutral to better than expected PMI reports from the Eurozone. A Premium trade that has long been awaited was finally opened yesterday, bringing the number of open trades to 6.

The election excitement in USD/JPY faded Monday and the opening gap closed. The pair touched as high as 114.10 but sagged back to 113.43 late in the day as risk aversion picked up. The reversal highlights resistance near 114.50. In the bigger picture it highlights a market that's waiting for clarity on the Fed choice before making a move. For confirmation, watch 2.40% in 10-year yields, which is a level we are hearing about frequently.

Elsewhere, it's a similar story. The euro remains stuck in the 1.17 to 1.19 range as the hours tick towards Thursday's ECB decision. As we highlighted earlier, the market is holding a large net-long euro position that's vulnerable to a dovish surprise. Expectations for ECB tapering range from € 20 bn to € 40 bn, with an extension in the program ranging from 6 to 12 months.

A position that's most uneasy may be CAD because of Poloz's recent unpredictability. USD/CAD touched 1.2660 Monday but couldn't break the Aug 31 high or the 100-day moving average. The market is divided on whether or not the Bank of Canada will hike again this year and the pair could easily swing 5 cents in either direction once there is more clarity. Wednesday's outlook announcement from the BoC will be key.

Expect the market to tip-toe until some of those questions are answered.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Flash Manufacturing PMI | |||

| 53.3 | 53.1 | Oct 24 13:45 | |

| Eurozone Flash PMI Manufacturing | |||

| 58.6 | 57.9 | 58.1 | Oct 24 8:00 |

Abe Wins, Yen Weakens

Shinzo Abe cemented himself as one of the great modern Japanese leaders with another election win on Sunday. USD/JPY climbed half a yen past the 114 level at the Asia open before retreating. CFTC positioning continues to show stretched EUR and CAD longs. A busy week ahead with the ECB decision on tapering, Catalunia meeting on Spanish direct rule, Senate vote in Madrid and US GDP figures. The JPY trade was stopped out, while 1 of the EUR trades deepened in the green.

Japanese politics is notoriously fickle but Abe has held power for nearly 5 years and won a new mandate in what looks to be a landslide Sunday. The results sent USD/JPY to the highest since July. Like Trump, one of his next missions will be appoint a new central bank leader. He could reappoint Kuroda or look to someone but either way, he will pursue a strategy to weaken the currency.

Another currency that's suffering is the Canadian dollar. On Friday, retail sales fell 0.3% compared to a +0.5% reading expected. It wasn't due to special factors; even stripping out autos, gasoline or other skews showed a poor number.

USD/CAD climbed 140 pips on Friday to break above the October double top. The market is divided on whether Poloz will hike again before year end, but the economic data is beginning to make a strong case for the sidelines.The Bank of Canada decides on rates on Wednesday. Technically, the August 30 high of 1.2663 will be a key level to watch in the day ahead.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - and long by +.EUR +90K vs +98K prior GBP +5K vs +15K prior JPY -101K vs -101K prior CHF –5K vs -4.3K prior CAD +75K vs +76K prior AUD +62K vs +69K prior NZD +7K vs +6K prior

The moves were minor for the second week. What's interesting is that some specs – particularly CAD and EUR longs – are beginning to look vulnerable. There are some heavy bets riding on the ECB and BOC.