Intraday Market Thoughts Archives

Displaying results for week of Aug 22, 2021Cardano & Gold Video فيديو عن كاردانو والذهب

Updating gold after Powell's speech & latest on Cardano تحديث الذهب بعد خطاب باول و FULL VIDEO آخر تحليل لكاردانو

Powell Possibilities

One thing is certian: Powell's address will not be a game-changer. This speech is wildly overhyped because nothing else is happening and because the market has aggrandized the Bernanke-era taper tantrum.

None of the underlying fundamentals of the market are going to change on Friday no matter what Powell says so there's a good argument to fade any big move.

That said, here is what to watch out for.

1) Acknowledging delta will slow the recovery

At the July 28 FOMC press conference, Powell brushed aside delta, saying it wasn't likely to affect the recovery. By simply acknowledging that it will be a drag on Q3 (some banks have cut Q3 GDP estimates by 4 percentage points), it's a dovish shift.

2) The caveat could be that lost growth will materialize later

Delta may simply push the Q3 recovery trade back by a quarter. On its own, that wouldn't worry the Fed. If Powell strongly emphasizes that line of thinking, then it will be seen as a hawkish speech. The caveat to the caveat is that if he points out that delta and other variants add uncertainty, then it may balance out.3) Inflation and bottlenecks

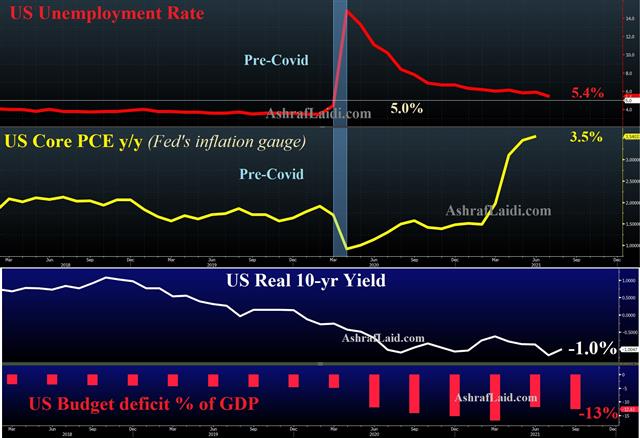

The message at the July 28 FOMC and since then has been that bottlenecks and transitory inflation will be more persistent than previously thought. This theme is no longer at the top of markets' minds, but if Powell highlights it again, then it will be another hawkish note. At the same time, his personal view remains that price pressures are transitory--something he will likely emphasize today away from the FOMC podium.Finally, Powell's overall tone will be important. If he converys a message that Fed will support the recovery and is in no rush to tighten policy, then it could outweigh everything else. At the same time, Powell isn't going to tip his hand on the Sept FOMC yet. There's plenty of data to come and he likely intends to take his time sorting through delta, inflation and the jobs picture. All that argues for focusing on continued improvements in the virus situation in most of the world.

Kabul Fills Jackson Hole

Markets were settled into a bit of a lull ahead of Powell's Jackson Hole speech. The main themes of equity strength and yen weakness continued Wednesday but with less urgency. A larger change was in the sovereign bond market where yields rose the most in weeks in the US and Germany.

There's no clear catalyst but we're reminded of the June/early-July drop in Treasury yields that left everyone scratching their heads. It later turned out that the bond market was dialed into what was coming with delta.

Is there a new signal brewing? It's far too early to say. US 10-year yields rose 4 basis points to 1.34%, which is only back to August 13 levels and far from 1.60% pre-delta.

The obvious catalyst for higher rates is the better sentiment on delta, but it could also be jitters about Powell hinting at a taper, genuine fears about inflation or economic optimism and rotation into equities.

Technically, there's reason to expect the move to extend. The double bottom at 1.12% in July/August hasn't been tested with lows near 1.23% last week despite the jitters. A climb above the August high of 1.38% would add to the case for higher rates and, by extension, higher USD/JPY. Nonetheless, US 10 yr yields must first cross above the 55-DMA of 1.34%.

In Asia-Pacific trading there was another hint from the Bank of Korea, who became the first developed market central bank in the pandemic era to hike rates, lifting them 25 bps to 0.75%. Economists were split on the move ahead of time but rising consumer debt, a hot housing market and elevated consumer prices caused them to pull the trigger. Officials had been signaling a rate hike since May but that was delayed by a July lockdown.

Could that be a hint about what's coming from the Fed?مجموعة الواتساب الخاصة

تفضل الى الفيديو الإرشادي لتكوين إسم مستخدم لأكتمال عملية الإشتراك

BEWARE حذاري

If you are approached by anyone using my profile photo, it is 100% NOT me

حذاري من الحسابات المزيفة على والوسائل الاجتماعية التي تحمل صورتي البروفايل. لن أقترب أبدًا أي شخص

وأطلب منهم فلوس او اقترح لهم خدماتي...أبدآ ابدآ

Reopening Trade Takes Hold

We highlighted a potential peak in US cases and shift in Fed tone early on Monday, a theme the market has run with to start the week. Commodity currencies led the way again on Tuesday and US equities hit another record high. Importantly, within the US equity space there was a decided reopening bent with casinos and hotels as the top gainers, while consumer staples and Pfizer lagged.

For now, the trade is all about positioning for a crest in covid cases and repositioning for the reopening. It's an opportunity bulls don't want to miss.

Given the strength of some of the reversals, the momentum in this trade could last for some time, especially if Powell stays dovish. Beyond that, the market may focus on the demand picture. There were some warning signs in a soft Richmond Fed Tuesday at +9 vs +25 prior but new home sales were slightly stronger.

US Covid Cases Hit Peak?

It's now abundantly clear that this wave of covid cases will have a detrimental effect on the US economy, particularly with supplementary employment benefits set to expire in two weeks. A sign of the shifting sands at the Fed came on Friday as Dallas Fed President Kaplan – who was one of the first to call for a September taper – said delta is limiting production and slowing a return to the office. He highlighted the negative trend and said he may have to adjust his view by the time the Sept FOMC rolls around.

His comments helped to turn sentiment in equities but there's also growing evidence that the US is near a peak in infections. The seven-day average of cases today is 151K, up from 129K a week ago. That's a slowdown in the rise. Moreover, Florida cases are now down week-over-week (with the caveat that data from that state is messy). Importantly, Trump urged supporters to get vaccinated on the weekend and the US boosted its vaccination pace to 1 million for three straight days, with about half of those receiving a first dose.

The price action in global FX last week certainly highlighted fears about covid, delta and whatever variant comes next. On Friday, however, there were signs of a reversal in equities and hard-hit CAD. US Treasuries are also showing no sign of fresh fears.

For Monday's trade, the data points to watch will be the Markit August US PMIs. They're solid forward-looking indicators and may offer clues on how businesses are handling the virus impacts.