Intraday Market Thoughts Archives

Displaying results for week of Aug 23, 2020A Change in the Game but Not a Game-Changer

It's likely that the simple explanation of the FOMC paradigm shift on Thursday is the correct one: It means that rates will stay lower for longer. Yields rose, equities where higher and AUD/JPY was the best performer in a classic risk trade. Yen turned later on Abe's resignation. That points to a return of the pre-pandemic risk trade and additional news on virus treatments and testing is a tailwind.

In the longer-term, it raises a series of risks and more questions about the wisdom of owning sub-1% bonds with a Fed target now above 2%. That could spark a negative feedback loop but it's too early to declare the 6 bps rise in 10-year yields as a genuine breakout. It's a spot to watch in September.

In FX, the series of doji stars in EUR/USD, GBP/USD and other crosses speak to the indecision in the overall market. Ultimately, economic strength will matter and with that we will continue to watch the data. On Thursday, US initial jobless claims were once again above 1m. On Friday, the US July PCE report is expected to show a 1.5% rise in personal consumption. Watch inflationary numbers too for a sign of surprise. Anything on the upside could spark a bigger move in yields and USD/JPY.Will Powell go Deep?

The major refining area stretching from Beamont, TX to Lake Charles, LA was hammered by Laura early on Thursday. The storm made landfall with higher windspeeds than either Katrina or Harvey – the two most-costly storms in US history. It's far too early to evaluate this storm and it's hitting a less-populated area but it went through the heart of US offshore production and at least 10 refineries are in its path.

The day ahead though belongs to Powell. Expect him to recommit to doing everything in the Fed's power to cushion the pandemic blow. Anything less than that would sour the market. At the same time, you have to wonder if the Fed is considering the potential consequences of what looks to be a massive leveraging in the financial system. Retail margin costs are as low as 0.75% and those rates almost beg mom-and-pop investors to lever up.

The topic of Powell's speech at 1310 GMT is the Fed's framework review and the big question is whether he will support a shift to average inflation targeting; meaning prices would be allowed to run hotter than usual after periods of undershooting. That would add more fuel to the risk fire and it could reinvigorate precious metals.

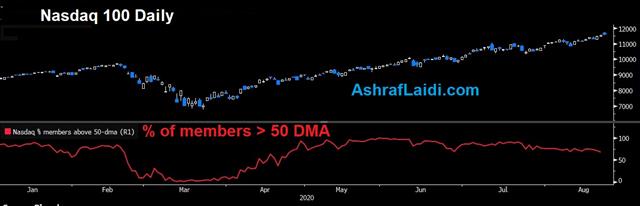

The larger risks may be on the downside though if he offers less than expected. The latest equity market moves show signs of classic euphoria with (for example) Netflix jumping nearly 10% Wednesday on no news.Oil in the Eye of the Hurricane

The winds of Hurricane Laura continue to strengthen as it crosses the warm waters of the gulf of Mexico and along with it, oil is strengthening. That led to the highest close in WTI on Tuesday since the pandemic and also left Brent just shy of the 200-dma. Laura is gaining in strength and appraoching to be a "catastrophic" Category 4 storm. More than half a million people were ordered to evacuate in Texas and Louisiana.

Most offshore production is shut down and the storm is headed right for the heart of US refining country in Beaumont, Texas.

The problem for oil bulls is that a storm does nothing to change the overall fundamental picture. There's still 10m barrels of spare OPEC capacity and the latest mobility numbers in Europe are turning lower as the pandemic picks up.

With that, it's dangerous to see a short-term storm-inspired breakout as a the underpinning of a larger rally. At the same time, commodities everywhere have been strong as the US dollar slides and economies recover.

At times, the Canadian dollar has acted as a good leading indicator for oil and it's back to pre-pandemic levels. This is already the most-hated rally in history, why not add an oil chapter?

In terms of the broader risk trade, a big miss in August US consumer confidence did nothing to dent market confidence, especially ahead of Powell's speech on Thursday due 9:10 Eastern time (14:10 London, 17:10 Dubai).

Down the Jackson Hole

The Jackson Hole symposium will be held virtually this year but it will be no less of an event for market participants. Powell's topic will be the Fed's long-run framework and specifically, shifting towards average inflation targeting.

Currently, the Fed aims to hit 2% inflation and if it undershoots, it tries again. A new regime could see the central bank overshoot to make up for lost ground.

The hope is that it will act as a natural stabilizer that signals easier policy for longer, without all the complications of forward guidance.

It's fraught with pitfalls. At the heart of the Fed's thinking is that it believes it can control inflation if/when it returns. It's as simple as raising rates and at the moment, the Fed doesn't see the risks of rising prices.

Yet officials don't need to look any further that US housing for an inflationary jump that few saw coming.

“The housing market is past the recovery phase and is now in a booming stage,” said Lawrence Yun, the chief economist of the US National Association of Realtors on Friday after a record jump in existing home sales.

The Fed is right that it has the tools but the Fed has always had the tools to curb inflation and it's arrived many times. Why? Political risks is a big one. It's simply hard to raise rates and demand that all borrowers pay more. With Wall Street firmly in control of the Fed and increasing politicization at the Fed (and everywhere else), we would argue that long-term risks are higher than they've been in a generation.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +197K vs +200K prior

GBP +7K vs -3K prior

JPY +21K vs +27K prior

CHF +15K vs +17K prior

CAD -34K vs -30K prior

AUD -3K vs -1K prior

NZD +4K vs 0K prior

The recent rally in the pound appears to have caught the speculative market by surprise and that leaves plenty of fuel for the fire. Expect a slow burn with the never-ending Brexit saga as a constant headwind.