Intraday Market Thoughts Archives

Displaying results for week of Jan 24, 2016Implicit BoJ Depreciation Means more Explicit PBOC Devaluation

The BoJ's decision to cut the interest rate on current account balances to -0.10% highlights the beginning of the end of Japan's asset purchase program due to insufficient bonds held by banks, pension funds and insurance companies.

The fact that the BoJ voted 5-4 in favour of negative rates and 8-1 to keep monthly assets purchases unchanged exposes the controversial nature of the decision to re-enter negative rates and infeasibility of adding fresh QE.

At the current pace of asset purchases (which include Japanese Government Bonds and even equity ETFs), by end of 2017, the BoJ's holdings of JGBs would have risen from yen 200 trn to yen 500 trn, which means the BoJ would have to buy yen 30-40 trln from existing holders to hit its yen 80 trn per year goal in bond buying. It won't happen.

But where will it find the extra bonds when current holders of JGBs (insurance companies and pensions funds) will simply not sell?

Insurers need JGBs for asset-liability balancing, while pension funds such as the Japanese Pension Investment Fund have disposed of enough JGBs as part of their bonds-to-equities rebalancing.

Slashing rates to negative is aimed at encouraging banks to lend, rather than keep their funds at negative rates. If the BoJ means what it says and deepens the path to negative rates, it would risk endangering the financial system by as it exasperating the asymmetry between investing in equities and insufficient bank lending, while retail deposit rates will fall further.

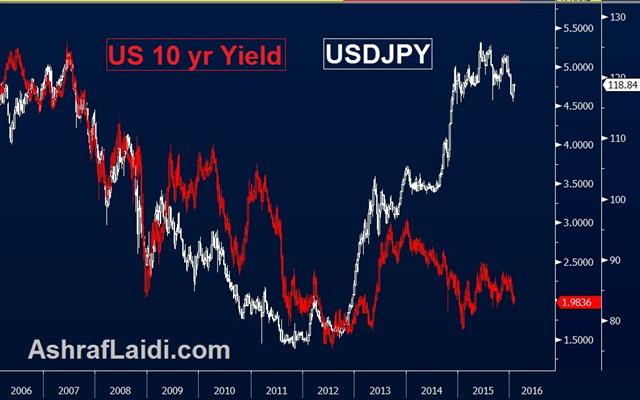

Market-Friendly Yen Devaluation means more Unfriendly Yuan Devaluation

The yen's violent ascent of the past 5 weeks was instrumental in the BoJ's decision, but will also reduce the likelihood of Tokyo adopting structural measures and may even postpone the next tax hike. The BoJ said it is ready to slash rates further, a decision, which reflects total desperation from the central bank as all other methods have failed.

As Japan continues to devalue its currency via negative interest rates, China may well be able to continue weakening its currency, especially as JPY makes up for 15% of the CNY's index under the China Foreign Exchange System. The negative market implications from further CNY devaluation versus the positive implications of JPY devaluation force an asymmetric reaction to these events.

China will have no choice but to further devalue its currency as CNYJPY rose 75% from 2011 to 2015 and fell by only 12% since June. Further devaluation is inevitable and its impact on global markets will be negative, including the rising yen.

A new JPY trade has been issued in our Premium Insights, with supporting charts & analysis.

Enduring Disappointment, BoJ Next

A wild day in oil overshadowed a terrible durable goods orders report Thursday, but it shouldn't have. Volatility was high as the pound led the way while the yen lagged. The Bank of Japan decision is up next. An adjustment has been issued to the Premium EURJPY, justified by 3 charts and fund/flow note. Ashraf is warning that hey may issue a JPY trade before the BoJ decision. Subscribers are recommended to register their in the Alerts service to receive Premium alerts to their mobile/emai in here.

The past two days have delivered a different kind of market than the earlier part of January. Oil was a major driver then but the inability of risk trades to stage a meaningful rebound alongside crude is a worrisome sign.

Even more worrisome is the economic data. The durable goods orders report was one of the worst in years. Overall orders fell 5.1% compared to 0.6%. Core orders were at -4.3% compared to -0.3% exp. The bad news was compounded by downward revisions and weak shipments – something that will weigh on Friday's GDP report.

It's been a nightmare start to the for markets but now US economic data is beginning to turn. Earlier in the month December retail sales were soft as well.

Another concern is the continuing volatility. The market was bounced around on a series of OPEC headlines and sentiment-driven swings Thursday. That kind of instability is what sends long-term investors to the sidelines and causes bear markets.

The BOJ decision is a major event in the hours ahead. It has no scheduled time but is usually out between 0230 and 0330 GMT. The rule of thumb is that the longer it takes, the more likely the BOJ is to offer more stimulus. Kuroda hosts a press conference at 0630 GMT.

Four of 41 economists polled by Bloomberg expect the BOJ to raise the target for the rise in the monetary base to 100 trillion yen from 80 trillion. That may slightly understate market expectations. The tricky thing with Kuroda is that he likes to catch markets off guard. He spent the week in Davos playing down expectations but he did the same thing the last time he delivered QE.

One reason the BoJ is unlikely to act is that the weak yen hasn't delivered the stimulus officials expected. Exports were down 8% y/y in this week's trade report and retail sales fell 1.1% y/y. Shortly before the BOJ decision, CPI numbers are due out and is expected to rise just 0.2%. Another reason for no action is what Ashraf has explained in detail for Premium subscribers, namely, the lack of sufficient JGB inventories to meet an increase in QE.

Press murmurs suggested the BOJ will push back its target for hitting 2% inflation but that doesn't mean more stimulus is coming. Kuroda will simply blame it on lower commodity prices. If he doesn't hike, don't expect dovish comments because he likely wants to maintain an element of surprise if the BOJ decides to cut again.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Durable Goods Orders (m/m) | |||

| -1.2% | -0.1% | 0.0% | Jan 28 13:30 |

| GDP Annualized (Q4) [P] | |||

| 0.8% | 2.0% | Jan 29 13:30 | |

| GDP Price Index (Q4) [P] | |||

| 0.8% | 1.3% | Jan 29 13:30 | |

| National CPI (DEC) (y/y) | |||

| 0.2% | 0.3% | Jan 28 23:30 | |

| National CPI Ex Food, Energy (DEC) (y/y) | |||

| 0.8% | 0.9% | Jan 28 23:30 | |

| National CPI Ex-Fresh Food (DEC) (y/y) | |||

| 0.1% | 0.1% | 0.1% | Jan 28 23:30 |

| Tokyo CPI (JAN) (y/y) | |||

| -0.3% | 0.0% | Jan 28 23:30 | |

| Tokyo CPI ex Food, Energy (JAN) (y/y) | |||

| 0.4% | 0.7% | Jan 28 23:30 | |

| Tokyo CPI ex Fresh Food (JAN) (y/y) | |||

| -0.1% | 0.6% | Jan 28 23:30 | |

What Markets Say is more Important than what Fed Says

The Fed offered several dovish hints in the FOMC statement revealed Wednesday but it wasn't enough to satisfy markets. The Australian dollar was the top performer while the kiwi lagged. The NZD softness came after the RBNZ hinted at more cuts. A new Premium trade has been issued after the Fed statemeny, ahead of Thursday's UK Q4 GDP release, with charts and tech/flow rationale.

The Fed delivered a dovish FOMC statement. Realistically, it was the biggest nod they could give markets without completely backtracking on the long-held hawkish bias. The Fed was incorrect to hike rates in December but this is a signal that they won't repeat the same mistake, unless markets cooperate.

Omissions & Edits

The Fed removed a line about growth expanding at a 'moderate pace', warned that breakevens were falling further and explicitly said they were closely monitoring global economic and financial developments. More important was what they left out. The line on risks being balanced was removed and a reference to being 'reasonably confident' about inflation returning to 2% was cut.That final point is particularly telling because getting to a 'reasonably confident' point was a struggle for the Fed. Removing it was a clear indication the Fed doesn't plan to hike in March.

What's more telling today was how markets reacted. We often say that how markets react to news is more important than the news itself. This was good news and markets still didn't like it.

Analysts often like to fit the news to the market moves and some are even calling this a less-dovish-than-expected statement. It wasn't. This should have been good news for risk trades. Instead they faltered and that argues for more trouble ahead. It may only be a late day blip and real money could spark a reversal tomorrow and that's something we will watch closely.

The other divergence we continue to monitor is oil. Crude rose 2.3% Wednesday and yet stocks declined more than 1%. For the past month, the positive correlation has been very tight and we expect that to continue as junk bond market fears remain.

The other central bank in the headlines was the RBNZ as rates were held unchanged at 2.50%, as expected following the December cut. RBNZ's Wheeler also underscored global markets and economies as areas for concern. The statement added the line that 'further policy easing may be required over the coming year,' along with some anti-NZD jawboning.

The focus now shifts to Japan and retail sales. The recent trade data underscored that FX weakness has not been the cure-all for economic woes that Abe envisioned. That's a lesson Japanese officials may be learning as they allow the yen to strengthen. The health of the consumer is today's concern with December retail sales due at 2350 GMT. The consensus is for a 1.0% m/m gain.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (Q4) (q/q) [P] | |||

| 0.5% | 0.4% | Jan 28 9:30 | |

| GDP (Q4) (y/y) [P] | |||

| 1.9% | 2.1% | Jan 28 9:30 | |

Ahead of the FOMC

Markets are sending negative signals about the global economy but economic data isn't, at least not yet. The Fed is inclined to focus on data confirming its bias toward higher growth and inflation in 2016 so the risks are skewed toward disappointment. Markets were upbeat Tuesday and that will take a bit of pressure of the Fed. The latest Premium Video is up, tited "How High is the Rebound? Yen, Stocks & the Rest" assesses the technicals and fundamentals of the bounce in indices and dissects the latest similarities and differences from 2007-2008. The existing Premium trades are also revisited, with a preview to the Fed, RBNZ and key GDP reports.

Wednesday's FOMC decision only includes a statement, no press conference or forecasts. That limits the Fed's playbook to changing its guidance. Even then, the chance of a deviation from expecting “gradual” hikes is a longshot because the Fed has invested credibility in its optimistic outlook and a rough month in markets probably isn't enough to change that.

A token nod to markets or global financial markets in the statement would send a small message that the Fed is aware, worried and watching. That could be accompanied by a nod to downside inflation risks from oil. The combination would make a March hike extremely unlikely without completely taking it off the table (something the Fed doesn't want to do).

The risk is that markets kick and scream because the FOMC doesn't do enough. In that case, look for the commodity currencies to suffer further.

The economy continues to send mixed messages. US consumer confidence improved to 98.1 from 96.5 expected in January while the Markit flash services PMI was at 53.7 vs 54.0 expected. The Richmond Fed was square-on expectations at +2.

A separate spot to watch is gold. It broke out to a three-month high on Tuesday despite positive risk sentiment. The next two weeks will tell us a great deal about the gold market.

First is the Fed. Gold bulls would prefer a dovish outlook but we're more interested to see how it behaves if the Fed is less-dovish. If it could rally anyway, that would be powerful signal.

The other event to watch will be Chinese New Year. January is the strongest seasonal month for gold and that was true once again this year. Buying ahead of the Chinese holidays may have been the driving factor. If it sags as February begins and Chinese celebrations start, then it the bulls might quickly head to the exits.

The Australian dollar is a little firmer after trimmed mean (core) CPI rose 0.6% q/q vs exp 0.5% q/q. The RBNZ decision is also tomorrow, shortly after the Fed.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Monetary Policy Statement and press conference | |||

| Jan 27 19:30 | |||

| Flash Services PMI | |||

| 53.7 | 53.9 | 54.3 | Jan 26 14:45 |

| CB Consumer Confidence (JAN) | |||

| 98.1 | 96.8 | 96.3 | Jan 26 15:00 |

The Downgrade Headwinds Are Blowing

A crisis usually starts in a pocket of the economy and then moves to the financial sector. The commodity bust was back in focus after a fresh fall in oil Monday. The euro was the top performer while CAD lagged. Australian markets are closed for holiday today. A new Premium trade in an index was issued today, backed by 2 charts and analysis.

فيديو العربي-- - كيف نتداول ارتداد البورصات؟ - لا يوجد ارتداد/هبوط نظيف.

We wrote about escalators and elevators yesterday and it was the trend of risk aversion that reasserted itself Monday. It looked to be a quiet day with New York cleaning up from a blizzard but as the day wore on, oil began to slide and then risk trades joined in. The S&P 500 fell 30 points to nearly wipe out Friday's rally.

One of the headlines that weighed was a Fitch downgrade of oil-services company Weatherford International. The company has $7.5 billion in debt, which is a long way from the $57B of an oil giant like BP but underscores a few points.

One is the uncertainty about how that debt will be rolled over and at what rates. High yield bounced late last week but lower-rated oil companies are paying upwards of 17% to borrow. Along with lower oil prices, it's a death-spiral-inducing combination.

The natural reaction of markets is to get away from anyone who might be exposed. The memory of subprime and the hidden risks is probably making markets overreact to the financial risks but the global economic risks of oil are much higher, with a number of countries in dire straits because of budget shortfalls.

The headwinds come from the steady stream of downgrades that are inevitable. Ratings agencies are always reactive and late but it's impossible to sustain a recovery until the headline risk is gone. It's reminiscent of the Eurozone crisis when no one wanted to buy the euro because of the ever-present risk of another sovereign downgrade.

Escalators and Elevators

The elevator/escalator analogy is apt because it argues that it's a normal correction and that the underlying trends remain in force. We may not get clearer answers early in the week because the US East coast was hit with a heavy weekend blizzard.

Early-week moves in the forex market have been light. The only notable change is a 20-pip gain in USD/CAD after a sharp slide late last week. The loonie was the best performer last week while the yen lagged.

The weekend didn't feature much in the way of market-moving news. The PBOC was quiet but note that new RRR rules to into effect for offshore branches of onshore banks today and that could sap liquidity from the CNH market or trigger a short squeeze.

Kuroda made headlines in Davos as he continued to play down economic worries. Bloomberg cited unnamed BOJ officials who said the inflation target may be pushed back again and that central bankers are disappointed with low wage demands from Japanese labor unions. The BOJ probably only has one more shot at QE and there have been no hints this week but Kuroda likes to surprise so the Friday decision will be a focus all week.

First, December trade balance data is due at 2350 GMT. The consensus is for a 7.0% fall in exports and a 16.4% decline in imports. The weak yen doesn't appear to be having the intended effect.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -137K vs -146K prior

JPY +38K vs +25K prior

GBP -39K vs -31K prior

AUD -36K vs -12K prior

CAD -66K vs -59K prior

NZD -3K vs +2K prior

Yen longs continue to make fresh highs since 2012. The Bank of Japan meeting is this week and that may spook out some of the weaker hands. The snap-back rallies in cable, CAD and AUD could leave plenty of specs off side.