Intraday Market Thoughts Archives

Displaying results for week of Oct 25, 2015US GDP Soft, but BoJ is the Focus

The US dollar wobbled on a slightly soft GDP but expectations for December Fed hikes continued to rise. The euro was the top performer in a rebound from Wednesday's losses while the Australian dollar lagged. The BOJ decision is next.The Premium AUDUSD trade has been filled and is now in progress along with 7 other Premium trades.

US GDP rose at a 1.5% pace in Q3 as strong consumer spending and trade masked a fall in inventories. The report puts the US on a 2% growth pace this year after a 0.6% rise in Q1 and 3.9% in Q2. The Fed believes growth is set to accelerate, but if the economy can only muster 2% with rates at zero, how could growth improve with rates 100-200 basis points higher (as predicted by the dot plot) and the dollar surging.

According to MNI sources the dollar is already a concern from some US policymakers. They reported that the US asked the ECB to refrain from talking down the euro.

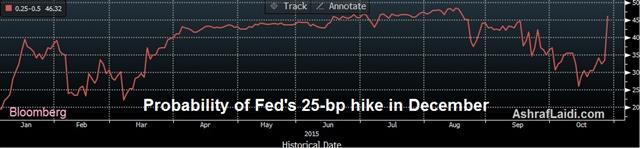

But it's the potential for action rather than talk that's weighing on the euro. The implied probability of a Dec Fed move is now 50% compared to 34% before the FOMC. The chance of ECB easing in December can't be measured by derivatives but it's at least 70% but it may have ticked slightly lower after German CPI numbers.

The general theme on the day was US dollar weakness as it retraced a portion of the Fed moves. The retracement may be short-lived because bond market hasn't stopped selling off. US 30 year yields rose 8 bps on the day and US 2s moved another 2 bps higher.

The focus now is on the Bank of Japan, which will render a decision at sometime around 0300 GMT. The rule of thumb is that the longer they wait, the higher the probability of action. The average release time of BoJ decisios has been around 12:22 pm in Tokyo 0322 GMT).

Before the decision the BOJ will get a final look at employment and CPI inflation with those reports due at 2330 GMT.

Nearly half of economists polled by Bloomberg expect the BOJ to announce fresh measures but the probability is lower than 50%. A number of local media reports say officials will push back the target date for hitting 2% inflation to H2 2016 from the current H1 forecast. Rather than triggering additional easing, they may continue with current policy and blame lower inflation on commodities.

The immediate result will be yen buying.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Annualized (Q3) [P] | |||

| 1.5% | 1.6% | 3.9% | Oct 29 12:30 |

| GDP Price Index (Q3) [P] | |||

| 1.2% | 1.5% | 2.1% | Oct 29 12:30 |

| Eurozone CPI (OCT) (y/y) [P] | |||

| 0.0% | -0.1% | Oct 30 10:00 | |

| Eurozone CPI - Core (OCT) (y/y) [P] | |||

| 0.9% | Oct 30 10:00 | ||

| Germany CPI (OCT) (m/m) [P] | |||

| 0.0% | -0.1% | -0.2% | Oct 29 13:00 |

| Germany Harmonised Index of Consumer Prices (OCT) (m/m) [P] | |||

| 0.0% | -0.1% | -0.3% | Oct 29 13:00 |

| Germany CPI (OCT) (y/y) [P] | |||

| 0.3% | 0.2% | 0.0% | Oct 29 13:00 |

| Germany Harmonised Index of Consumer Prices (OCT) (y/y) [P] | |||

| 0.2% | 0.1% | -0.2% | Oct 29 13:00 |

| Eurozone Unemployment Rate (SEP) | |||

| 11% | 11% | Oct 30 10:00 | |

Fed's Dangerous Game of Chicken

The Fed wanted to send a message to the market on Wednesday that a hike this year is a strong possibility. It's a dangerous game because the talk creates a de-facto tightening that will add to the current headwinds, forcing the central bank into another retreat. The US dollar surged on the FOMC statement in a volatile market day, which was followed by dovish talk from the RBNZ. Ashraf's Premium Insights modified the parameters of the existing EURUSD trade, while introducing the latest stress points in EURUSD and USDX charts. A new AUDUSD trade was added and both of the English and Arabic Premium videos posted here.

The Fed specifically highlighted the 'next' meeting as an opportunity to decide on rate hikes and removed a paragraph fretting about global headwinds. The result was a much more hawkish statement that the market was expecting.The dollar climbed 70 to 170 pips across the board. The dichotomy of the Fed hiking in and ECB easing in December dealt another blow to EUR/USD, tumbling to as low as $1.0897 from $1.1070.

In the hours leading up to the decision, the US dollar had slowly been losing ground. The late trades on the wrong side of the market likely added to the large moves and pushed them further than they might have gone, at least in the immediate term.

The Fed is more eager to hike rates than it needs to be, especially with headwinds coming from the US dollar and emerging markets. Yellen is showing that she's willing to sacrifice some growth to boost rates. That's a mistake in a low inflation environment.

But the Fed has threatened to hike before and then blinked. We will be looking for signs of how serious the Fed is this time.

Another story Wednesday was a nearly 7% rebound in oil prices. Crude had fallen in 6 of 7 days and fractionally tighter-than-expected inventories added to a violent squeeze. It spilled over into CAD trading and broad gains for the loonie.

The final piece of news on the day was the RBNZ decision. The main guidance – “some further reduction in the OCR seems likely” – was unchanged. Wheeler attempted to cap any NZD gains by saying a higher NZD would require a lower rate path but the market was looking for a more dovish slant and NZD/USD gained a half-cent after the announcement.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Lockhart speech | |||

| Oct 29 13:10 | |||

Safety in Demand as Fed Looms

A series of central bank decisions in the days ahead led to a bid for safe assets Tuesday. The Japanese yen was the top performer while the Canadian dollar lagged. A busy session is coming up with Japanese retail sales and business confidence along with Australian CPI. Ashraf's Premium Insights issued a new EURUSD trade with 6 reasons for the trade backed by 2 charts, while the 2nd USDJPY short was filled and in progress. The English Premium Video Analysis will be available late Wednesday morning.

JPY & USD strength dominated the day. The dollar showed some impressive resilience despite a soft durable goods orders report. The all-important non-defense capital goods orders ex-air component fell 0.3% compared to a flat reading expected. It was compounded by a drop in the prior reading to -1.6% from -0.8%. Shipments were also soft.

USD/JPY touched a session low of 120.14 after the report but bids ahead of the big figure sparked an immediate bounce to 120.45 and the pair moved sideways for the rest of the day.

The lasting theme in New York trading was selling in the commodity currencies. The loonie was under particular pressure as WTI crude fell below $43.00. Even as oil prices rebounded to $43.41 late in the day, USD/CAD remained a full cent above opening levels.

AUD/USD was similarly under pressure in a slide down to 0.7175 from 0.7250.

Other US data was mixed. The Richmond Fed was at -1 compared to -3 expected. Consumer confidence was at 97.6 vs 103.0 expected and the Markit services PMI was 54.4 vs 55.1 expected.

The day ahead is a big one with FOMC decision followed by the RBNZ. The BoJ is on Friday and expectations for easing are elevated because it's almost exactly a year since the surprise QE expansion in 2014. Nikkei reported today the BOJ will push back its estimate for hitting 2% inflation and that could be a greenlight for more easing but they could also blame it on external factors. At the moment, 16 of 36 economists surveyed by Bloomberg expect more easing.

The BOJ will get some final pieces of data with Sept retail sales due at 2350 GMT. The consensus is +1.1% m/m after a flat reading in Aug. At 0500 GMT Japanese small business confidence is forecast to rise to 49.2 from 49.0.

The other major data point is Australian CPI, which is expected to rise 2.4% in Q3 in the trimmed mean, which is the core measure. It would take a 2-3 tick miss to spark serious talk about RBA easing next week.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Durables Ex Transportation (SEP) | |||

| -0.4% | 0.0% | -0.9% | Oct 27 12:30 |

| Markit US Composite PMI (OCT) [P] | |||

| 54.5 | 55 | Oct 27 13:45 | |

| Cap Goods Orders Nondef Ex Air (SEP) | |||

| -0.3% | 0.2% | -1.6% | Oct 27 12:30 |

| Cap Goods Ship Nondef Ex Air (SEP) | |||

| 0.5% | 0.4% | -0.8% | Oct 27 12:30 |

| CB Consumer Confidence (OCT) | |||

| 97.6 | 102.9 | 103.0 | Oct 27 14:00 |

| Richmond Fed Manufacturing Index (OCT) | |||

| -1 | -3 | -5 | Oct 27 14:00 |

Home Sales Hurt US, China Indus Profits Next

The US dollar stumbled on Monday in a modest retracement from last week's gains driven by soft home sales. The Swiss franc was the worst performer on the day while the antipodeans led. Chinese industrial profits are due later. Ashraf's Premium Insights issued a new trade on EURUSD with 2 charts and 6 reasons behind the decision ahead of Wednesday's Fed decision.

A steep stumbled in September US new home sales was the top news in New York trade. They fell to 468K compared to 550K expected. The US dollar fell 20 pips against the yen to a session low of 120.58 on the headlines but the pair eventually recovered back to 121.05.

The drop was driven by a 62% decline in sales in the northeast, possibly due to tax changes. Other regions fell 11% the data may be another element that gives the Fed pause. Durable goods orders on Tuesday is a final indicator before the FOMC.

Early in Asia-Pacific trading, the New Zealand dollar dipped trade figures. Exports fell to 3.69B compared to 3.90B expected. Imports rose to 4.91B compared to 4.77B expected. As a result, the monthly trade deficit in Sept was 1.2B versus 0.825m expected. NZD/USD immediate fell 20 pips on the headlines but quickly recovered. The RBNZ decision is tomorrow.

The overall theme in the market is consolidation ahead of the central bank decisions this week. That's likely to continue on Tuesday.

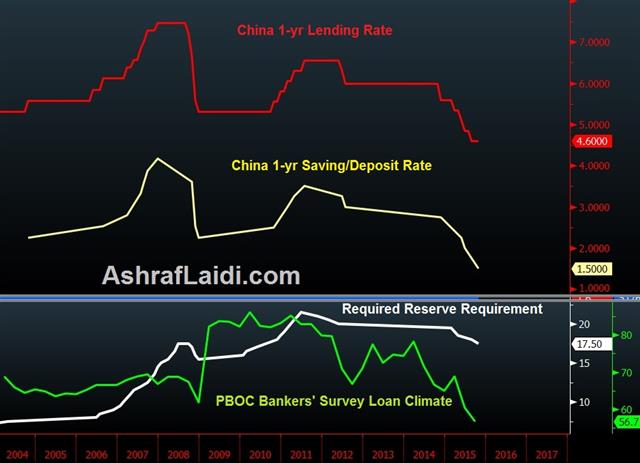

USDJPY pulled lower after Japan Sep producer prices came in within expectations at 0.6% y/y following 0.8% in Aug. Chinese industrial profits are due at 0130 GMT after an 8.8% y/y decline in August. We continue to keep close watch on the Shanghai Composite. It rose just 0.5% on Monday despite the rate cut.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| New Home Sales (SEP) | |||

| 468K | 549K | 529K | Oct 26 14:00 |

| New Home Sales (SEP) (m/m) | |||

| -11.5% | -0.6% | 5.2% | Oct 26 14:00 |

| Durable Goods Orders (SEP) | |||

| -1.1% | -2.3% | Oct 27 12:30 | |

| Durable Goods Orders ex Transportation (SEP) | |||

| 0% | 0% | Oct 27 12:30 | |

| Exports (New Zealand dollars) (SEP) | |||

| 3.69B | 3.90B | 3.71B | Oct 26 21:45 |

| Imports (New Zealand dollars) (SEP) | |||

| 4.91B | 4.78B | 4.79B | Oct 26 21:45 |

The China Conundrum

All signs point to a larger slowdown in China but is it wise to fight the central bank? Markets opened for the new week with the euro below 1.10 as the selling continues. The Asia-Pacific calendar is light to start the week but it will be the first opportunity for Chinese stocks to react to the rate cut.

The final two pieces of economic data before China cut rates were stronger-than-expected GDP and housing numbers. Yet in a departure from the usual practice of rate moves on the weekend; the PBOC cut rates on Friday, sending global stocks soaring.

The first conundrum is that if Chinese growth was as strong as touted, a rate cut wouldn't be necessary; especially as it comes less than two months after the previous cut.

Another worrisome sign we dug up on the weekend was the earnings report from Whirlpool. The appliance manufacturing giant is a good barometer of consumer health because it's rare for people to buy new fridges and stoves unless they're feeling good about their financial health.

The company's shares were hammered 11% on Friday as executives fretted about FX costs, flat US demand and weak emerging markets – especially Brazil. But they also noted that Chinese demand was down 4% y/y. That's another reason to believe the economy isn't growing near 7% with consumers picking up the slack.

So what's a trader to do? It's tough to fight any central bank. What contributed to the mini-panic in August wasn't that China cut rates and devalued. It's that it was read to be a signal of larger problems in the economy.

There are signs that growth is soft but unless markets begin to fret about China again; it's very tough to fight.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -63K vs -81K prior

JPY -4K vs -14K prior

GBP +7.5K vs -8K prior

AUD -38K vs -34K prior

CAD -27K vs -34K prior

It looks like some euro shorts gave up just before the tide turned. The data is from before the ECB decision and it shows how low expectations were. There's a broader trend of USD selling early last week and that obviously reversed later in the week.