Intraday Market Thoughts Archives

Displaying results for week of Oct 25, 2020Election Scenario #1: Blue Wave

This scenario would give Democrats the most power, similar to Obama's first two years (Obamacare) and Trump's first two years (corporate tax cut). Given deep partisan divisions, it's a rare opportunity to be able to deliver on political promises.

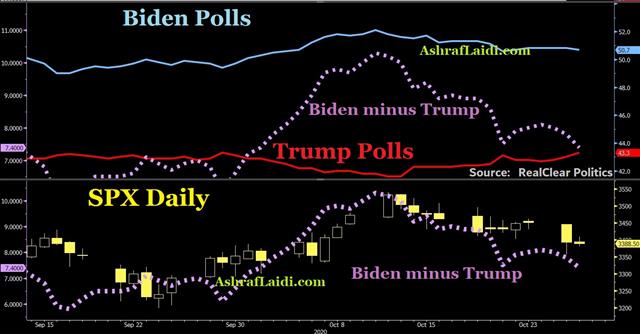

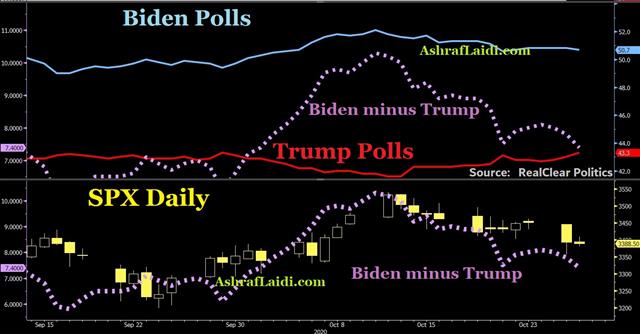

In this election, it's also the most-likely scenario as measure by polls and betting markets. That said, it's a narrow probability, in the Senate in particular where Democrats will need to flip four seats to take control. Given that and the high uncertainty around the election, this outcome is not priced in.

For risk assets, this is the most-bullish scenario. It would mean a large stimulus package as soon as Biden takes office in January and would likely include further high spending and high deficits, particularly on green initiatives and infrastructure.

In FX, the US dollar would generally weaken and emerging market currencies would benefit, particularly the Mexican peso. On the other border, CAD may see some initial softness on worries about pipelines and anti-oil messages but expect that to be quickly overwhelmed by enthusiasm about growth.

With the dollar weakness and the promise of deep deficit spending, precious metals are the clear winners in the commodity market.

How strongly Biden can deliver on his promises may depend on how strong the wave is. A one-seat majority in the Senate would leave every initiative at the mercy of a single vote. A larger wave would raise the odds of more-aggressive measures and that could temper the market's enthusiasm. In particular, Biden has promised to reverse Trump's corporate tax cut along with raising taxes on incomes above $400,000 and/or on capital gains. On corporate taxes, Democratic House leader Pelosi hinted Thursday that might be a tough sell for her. Meanwhile, taxing higher incomes is unlikely to hurt the market but fears of a capital gains hike could cause selling – especially among high-flying tech stocks – before year end.Faith of Flight

The market has shown a remarkable ability to look beyond the pandemic to a future of low interest rates and high fiscal spending. There has also been a clear confidence in a Biden win with a high probability of a blue wave.

However a fresh surge in cases along with ever-present fears of a contested election finally pushed the market beyond the tipping point. It's a sign that fear of the weeks and months ahead has conquered faith in what is coming beyond.

We have been warning for weeks that the risks of the coming months weren't worth the rewards, especially with equities already at elevated levels. The chance of some last-minute election fears was always uncomfortably high.

At the same time, there is a case for wading into risk before long. The kinds of virus curbs the EU is doing have proven they can work. While Q4 is now looking like a flat quarter or worse, harsher measures improve the outlook for Q1 and beyond. In the US, the polls in the midterms were right and given that pollsters have likely overcompensated for the 2016 Trump surprise, there's a much better chance of a blue wave than is priced in.

In the shorter term, the focus will be on the wave of news and events scheduled Thursday. The consensus thinking on the ECB is that they will wait until December to act but the new curbs in Germany and France dramatically increase the odds of a surprise, or for Lagarde to pre-announce December action. In the US, the main headline will be a record quarter of GDP growth at +30% q/q annualized but the weekly initial jobless claims report will tell us more about the current state of the economy.

Late in the day there will also be earnings from Apple, Amazon, Facebook and Alphabet. So far this earnings season it has been tough for companies to make any headway, even on big earnings beats.Lockdown Linguistics

There is no consensus definition for what a pandemic 'lockdown' means. It's used to range from everything to harshly-enforced home quarantines in China to the closures of bars. As cases mount, there's a fear of a new lockdown as if it's a binary event when in reality is a series of potential steps that governments could take.

The likelihood of true nationwide lockdowns was saw in March is remote. Even parks were closed in many countries and that's something that proved unnecessary.

The real question is how a resurgence in virus cases will impact economies. It's how much economic growth will be curbed by efforts to curb the virus, whether those are government mandated or behavioral.

Framing it as lockdown vs no lockdown is a mistake. What we should be considering is how much a continued spike through flu season will affect consumer behaviour. Part of the reason we don't hear much commentary about that is because it's so difficult to estimate. Returning to a lockdown would mirror what happened in March; economists now have a model for that.

What we don't have any idea on is how consumers will react to a long, dangerous and depressing winter. Will banks and governments continue their generosity? Will business owners continue to battle or close their doors?

There is no model to fall back on and almost every turn so far in the pandemic has been unexpected. Caution is warranted.

Ashraf's Webinar Today for MoneyShow

Dawn of the Dark Winter

The euro strength of the past week remains a puzzle. Some of that is a better tone on Brexit but the resurgence in the coronavirus no doubt dims in the economic outlook for Q4 and Q1 2021. No doubt positioning ahead of the US election is playing into it.

The growth in virus numbers in Europe is daunting. In Italy cases hit a record 21,273 on Sunday. A week earlier, they were at 10,009; a week before that at 5372; and a week before that at 2499. The nearly 100% w/w growth rate is terrifying and the government responded with a partial lockdown that will limit hours for restaurants while closing entertainment and gyms.

A similar dynamic is unfolding elsewhere. In Spain a national curfew from 6 am to 11 pm was imposed and a tighter lockdown is rumored in France.

In the US, cases have spiked to a record 82K cases and there are rising cases in the middle east and the largest outbreak in China in months.

The market may be preoccupied with the US election at the moment and not appreciating the possibility of much slower growth in the next five months. We may be nearing a tipping point where it can't be ignored. Some countries have shown resilience to the virus and there's no chance that lockdowns are as broad as in March but combined with waning stimulus money there's a big risk that consumers retrench in what Biden warned will be a 'dark winter'.

Oil may be particularly vulnerable a slowdown in activity, especially with Libya set to add roughly 800kbpd in Oct/Nov.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +166K vs +168K prior GBP -2K vs -10K prior JPY +14K vs +20K prior CHF +14K vs +12K prior CAD -19K vs -14K prior AUD +7K vs +4K prior NZD +6K vs +6K prior

Sterling shorts were fortunate (or smart) to square up ahead of last Wedneday's announcement of a restart of negotiations. However the lack of follow-through in GBP afterwards highlights the uneasiness of the market.Ashraf's English XTB Webinar Wednesday