Intraday Market Thoughts Archives

Displaying results for week of May 25, 2014Bitcoin +36% in May, Gold at $1245

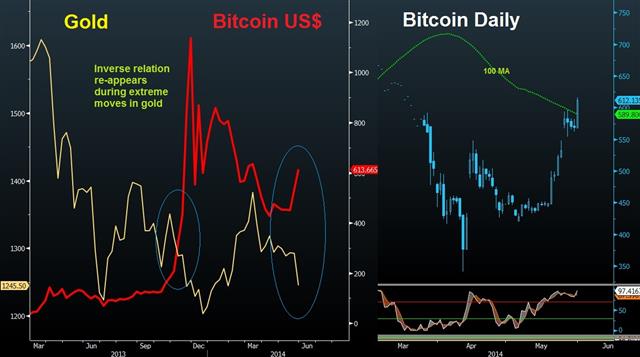

Bitcoin regains its 100-day moving average closing above $600, +36% in May and 80% from its April lows. The inverse relation between gold and Bitcoin during phases of rapid selling in the yellow metal continues. Many hard currency loyalists who sought refuge into the safety of gold out of protest against central banks' erosion of currency value are now fleeing to Bitcoin. This time last year, gold was licking wounds from the biggest decline in over a quarter of century. Full chart & analysis.

Negative Growth? No Problem. Onto Japan Data

The market was nonchalant about a disappointing revision to Q1 US GDP. The antipodean trade broke out as AUD led the way and NZD lagged. Up next is a big day for Japanese data with CPI, employment and industrial production.

The Q1 GDP report was the worst since 2011 as the economy contracted 1.0%, worse than the 0.5% expected. You wouldn't know it from the market reaction as the S&P 500 rallied 0.5% to a fresh record and the US dollar hardly wavered.

Part of the reason is that an inventory drawdown and trade was the major drag and much of that will be reversed in the current quarter. Other data was also solid with initial jobless claims slipping to 300K compared to 318K expected.

The most notable market move was AUD/NZD as it broke above the Feb and April highs to the best levels this year. Outside of FX, the Treasury market showed signs of a turnaround; after falling to 2.40% the 10-year yield closed higher on the day at 2.46%.

Looking ahead, Fridays are typically slow in the Asia-Pacific region but not this one. It begins at 2330 GMT with Japanese April CPI which is expected at 3.4% y/y because of the consumption tax hike. Look for about 1.5% when that is stripped out.

At the same time the unemployment rate is expected to remain steady at 3.6%.

Twenty minutes later April industrial production is expected down 2.0% m/m in April.

There is also a sprinkling of lower tier data from Australia and New Zealand, Japanese housing starts and a speech from Fed hawk George.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Price Index (q/q) [P] | |||

| 1.3% | 1.3% | 1.3% | May 29 12:30 |

| National CPI (APR) (y/y) | |||

| 1.6% | May 29 23:30 | ||

| National CPI Ex Food, Energy (APR) (y/y) | |||

| 0.7% | May 29 23:30 | ||

| National CPI Ex-Fresh Food (APR) (y/y) | |||

| 3.1% | 1.3% | May 29 23:30 | |

| Tokyo CPI (APR) (y/y) | |||

| 2.9% | May 29 23:30 | ||

| Tokyo CPI ex Food, Energy (APR) (y/y) | |||

| 2% | May 29 23:30 | ||

| Tokyo CPI ex Fresh Food (APR) (y/y) | |||

| 2.9% | 2.7% | May 29 23:30 | |

| Industrial Production (APR) (m/m) [P] | |||

| -2.0% | 3.8% | May 29 23:50 | |

| Industrial Production (APR) (y/y) [P] | |||

| 7.4% | May 29 23:50 | ||

| Housing Starts (APR) | |||

| 895M | May 30 5:00 | ||

| Housing Starts (APR) (y/y) | |||

| -8.4% | -2.9% | May 30 5:00 | |

| Fed's George Speech | |||

| May 30 1:30 | |||

| Fed's Lacker speech | |||

| May 30 18:00 | |||

| FOMC's Williams speech | |||

| May 30 21:00 | |||

| Philadelphia Fed's Plosser speech | |||

| May 30 21:00 | |||

| Continuing Jobless Claims | |||

| 2,631K | 2,650K | 2,648K | May 29 12:30 |

| Initial Jobless Claims | |||

| 300K | 318K | 327K | May 29 12:30 |

| Jobless Claims 4-Week Avg. | |||

| 311.50K | 322.75K | May 29 12:30 | |

| Unemployment Rate (APR) | |||

| 3.6% | 3.6% | May 29 23:30 | |

GDP: Gold’s Disinflation Plunge

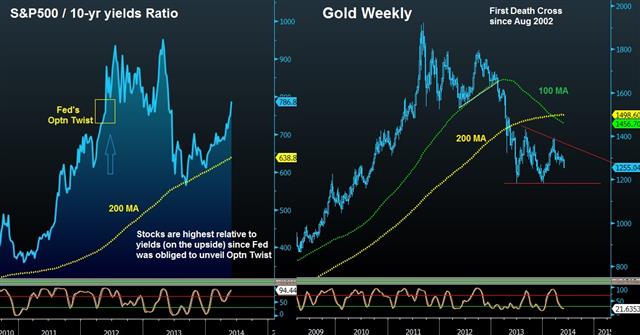

The bigger than expected downward revision in US Q2 GDP to -1.0% from an initial reading of +0.1% mainly resulted from an inventory drawdown of 1.62% (three times as original expected), lower private investments and more negative contribution from net trade. The good news is that personal consumption was revised to 3.1% from 3.0%. The absence of inflation combined with the onset of imported disinflation from the Eurozone and China's weakening currencies lends credence to the selloff in gold. The metal's shine is further eroded when new record highs in US & European stocks operate in a low-inflation environment. Full charts & analysis

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Price Index (q/q) [P] | |||

| 1.3% | 1.3% | 1.3% | May 29 12:30 |

| PCE Prices (Q1) (q/q) | |||

| 1.4% | 1.4% | 1.4% | May 29 12:30 |

| Core PCE (Q1) (q/q) | |||

| 1.2% | 1.3% | 1.3% | May 29 12:30 |

| Core PCE - Price Index (APR) (m/m) | |||

| 0.2% | May 30 12:30 | ||

| PCE - Price Index (APR) (m/m) | |||

| 0.2% | May 30 12:30 | ||

| Core PCE - Price Index (APR) (y/y) | |||

| 1.2% | May 30 12:30 | ||

| PCE - Price Index (APR) (y/y) | |||

| 1.1% | May 30 12:30 | ||

The 200-Day Dance

Some days are about news but Wednesday was about price action. JPY was the best performer Wednesday while NZD lagged but tests of technical levels were the story. Japanese retail sales are on the schedule next.

News flow was nearly non-existent. The only headlines that trickled out showed French jobseekers rising to a record in a worse-than-expected reading along with a better tone from Ukraine, but only marginally.

The market moves stemmed from bonds where US 10-year yield sank 8 basis points to 2.43%, knocking out the October lows from when the Fed held off on the taper.

You would expect that kind of move to spark some broad US dollar weakness but other than 30 pip hiccup in USD/JPY down to 101.64 that was mostly erased, the broader market didn't follow any particular correlations, when correlations break down markets can get very volatile.

Some levels that were tested:

- EUR/JPY touched the 200dma after successfully bouncing from it last week.

- USD/CHF briefly rose above the 200dma for the first time in 9 months

- EUR/USD finally closed definitively below the 200dma

- Cable broke the 55dma and the May low

Japanese economic data is in focus in the hours ahead especially the retail trade report at 2350 GMT. This is the first direct look at the consumption tax hike and it's expected to curb sales by 11.7% m/m in April and 3.3% y/y. A better number could make the BOJ reluctant to add to easing and weigh on yen crosses.

The other number to watch comes at 0130 GMT with Australia Q1 private capital expenditures. It's always tough to get a reading on Australian investment and even though this is a laggy number, it's one to watch. The consensus is for a 1.9% decline.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Trade s.a (APR) (m/m) | |||

| 6.3% | May 28 23:50 | ||

| Retail Trade (APR) (y/y) | |||

| -3.3% | 11.0% | May 28 23:50 | |

| Private Capital Expenditure (Q1) | |||

| -1.4% | -5.2% | May 29 1:30 | |

Yen-Yield Unwinding & Kiwi Carnage

Yields and stocks continue their divergence at the expense of the higher yieldimng currencies, specifically NZD, which is the biggest underperformer of the last 2 days. The notion that Sunday's European parliamentary elections boosted Eurosceptic parties in France and the US is weighing on the euro on the argument that the ECB will have to do most of the work in the way of reforms is not shared by Fitch. The credit rating agency said in a note today the EU elections from Italy, Spain and Greece and Portugal were largely pro-Euro and that fiscal and economic reforms are on track. Italy's centre left PD victory over populist and centre right parties is an outright vote for maintaining the current reform agenda on track. The victory of Spain's centre right PP implies no change as the party has been in power since 2011, vocally calling for fiscal tightening and creation of bad bank. Questions may arise in Portugal & Greece, where the pro-reform incumbents, but Fitch sees there has “not been a large electoral backlash against fiscal and economic reform”. In this week's Premium Insights, we affirmed our EURAUD and AUDUSD trades by issuing 3 new charts. We hold fire on EURUSD, while seeing USDJPY short of May 15 reentering the green. Our May 13 NZDUSD short hit its final 0.8500 target from the 0.8640 entry, while gold has been stopped out. GBPUSD trades remain in progress. All details are in the Premium Insights.

Gold Breaks, Euro Sticks

Gold prices tumbled Tuesday as a wedge formation broke while the euro continues to hang around the 200-day moving average. The Australian dollar was the top performer while the Swiss franc lagged. Comments from Kuroda are the highlight of the upcoming session.

The US calendar was filled with economic data but it was price moves that stole the show. Gold fell $27 to $1266 as it cut through the April and May lows and hit a three-month high. The move was initially sustained by mild US dollar strength but even as the dollar retraced, gold remained near the lows.

No particular headline sparked the gold move but hope for stability in the Ukraine and a fresh record high in the S&P 500 contributed. The safe-haven demand for gold is crippled by large positions remain so a slide to $1200 or below in the near term can't be ruled out. This also explains the rlaly in USDCHF.

Better economic data would certainly help and there was some good news Tuesday in the durable goods orders report. Core orders fell 1.2% compared to 0.3% but the story was a two percentage point revision higher in the March report. Strong orders in at the end of Q1 will fuel economic optimism. The consumer confidence data was also solid while the Markit services PMI rose to 58.4 compared to 54.5 expected.

Most talk in markets continues to revolve around what the ECB will do next Thursday. Rate cuts are seen as a sure thing and now talk of a very long term refinancing operation is becoming more main stream. The euro tried the downside, hitting 1.3612 but later rebounded to a close at 1.3635; once again sticking close to the 200dma.

The next focus is BOJ leader Kuroda at 0000 GMT. He's been vocal lately and began jawboning last week. His initial comments failed to spook markets so he could choose to sound more aggressive today. A sprinkling of Australian and New Zealand indicators are also on the calendar but nothing likely to move markets.

Elections in Focus, EUR Shorts Climb

The results of Ukrainian and European elections of Sunday will be the focus of the early week. Russian president Putin has repeatedly stated Russia will not intervene in Ukraine's elections, but reports of disruptions in polling centers by Russian separatist groups are on the rise. The news will be hitting a dicey market with the US and UK closed for holidays on Monday. New Zealand trade balance is the only item on the economic calendar.

Volatile news in a thin market is a recipe for whipsaws so play it safe out there on Monday. Look for hints from Russia, the west and separatists after the election. In Europe, protest votes are largely priced in and will be more of a longer-term story than Monday's trade.

The early event on the calendar is at 2245 GMT when New Zealand releases April trade balance. A $634m surplus is expected but the key to watch is exports. The consensus is $4.64B and anything less could show how the strong NZD is weighing on the economy. If they happen to be strong, NZD could jump as worries are dismissed.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -9K vs -2K prior JPY -54K vs -65K prior GBP +33K vs +32K prior AUD +19K vs +17K prior CAD -27K vs -26K prior CHF +5K vs +7K prior NZD +18K vs +19K priorOver the past few years speculators have been burned so many times betting against the euro but ahead of the June 5 ECB decision, they're taking another shot. Friday's break of the 200dma adds some conviction but the inability to continue lower afterwards raises some questions. The momentum early in the week will be key. Last week's resilience of yen shorts surprised us but the bounce from 100.85 to 102.00 justifies some of the optimism. The Nikkei is also showing signs of a bottom. Net yen shorts have been halved from their peak so there might be room for specs to push USD/JPY higher.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance (APR) (m/m) | |||

| $667B | $920M | May 25 22:45 | |

| Trade Balance (APR) (y/y) | |||

| $1.3B | $0.8B | May 25 22:45 | |

| Exports (APR) | |||

| $4.64B | $5.08B | May 25 22:45 | |