Intraday Market Thoughts Archives

Displaying results for week of Dec 27, 2015Three Thoughts as 2015 Winds Down

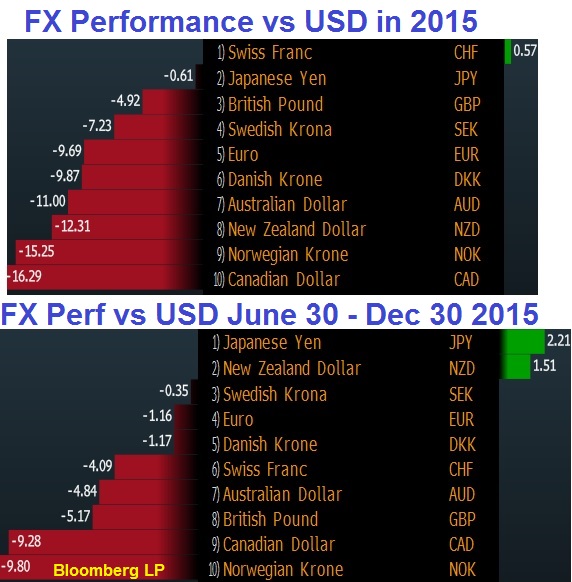

Decent-sized market moves continued again on Wednesday despite fading liquidity. The Swiss franc put underscored its strong performance this year as it was the best performer while the kiwi lagged. The calendar is light in Asia-Pacific trading expect for Australian private sector credit. فيديو العربي التوصيات القائمة و المحتملة

Here are three things to keep in mind as the calendar rolls over:

1) It's the time of year when it's best to be disliked

The most crowded trades at the start of the year tend to be the ones that go the most badly. Median forecasts of currency strategists surveyed by Bloomberg suggest AUD will fall 5% next year and NZD will drop 8%.

2) What a flat year for stocks means

The S&P 500 is virtually flat on the year after a 0.7% decline Wednesday. It closed at 2063 compared to 2058 on Dec 31, 2014. What does a flat year mean? The past seven times the index has finished the year with a up or down by 3% or less, it climbed the following year. In those seven instances, it gained the following year by an average of 17.8%. For a 21-year study of performance in 11 currencies, 7 equity indices and 14 commodities, please see our performance chartbook here.3) Iran is set to turn on the taps

Sanctions on Iran will be lifted on January 5 and they've promised to increase exports by 500K bpd immediately and another 500K bpd in six months. They plan to continue investing in more production in order to maximize sales. A paradigm shift has taken place in the Middle East. Leaders believe the end of oil is in sight and want to sell it all as soon as possible. Oil at $37 is tough but below $30 is when the real pain hits.Looking to Asia-Pacific trading, the final economic data point of the year from Australia is due at 0030 GMT as November private sector credit is due. It's expected to rise 0.6% m/m with housing credit up 9.7% y/y. It's not likely to be a big market mover as trading in 2015 winds down.

China to Open Fiscal Taps

The very first release of 2016, just after midnight GMT will be the Chinese official PMIs. That's a fitting start to what will be a year of laser focus on the economy in the Far East.

A report on Tuesday suggested China may boost government spending and run a deficit at 3% of GDP or more in the year ahead. That would be the loosest policy in a half-century and up from the 2.3% target in 2015.

The shift is being billed as a way maintain strong growth as structural reforms set in. We've recently got a sense of where the latest reforms will hit. Consumers are being hit by tighter lending standards and local governments are being reigned in. The PBOC has loosened policy throughout the year and another cut could come at any time.

The question is: Is it enough? With China, the opacity and size of the economy make evaluations extremely difficult. Chinese markets soured to start the week but they bounced back along with broader equities and commodities. We're cautious about drawing any conclusions from markets at year end.

However the year ahead will have more focus on China than ever. There is no doubt that yuan weakness will be a major story as we continue to hit fresh four year highs.

Commitments of Traders

Speculative net futures trader positions as of the close last Tuesday. Net short denoted by - long by +.

EUR -161K vs -160K prior

JPY -30K vs -26K prior

GBP -27K vs -17K prior

AUD -20K vs -10K prior

CAD -52K vs -51K prior

NZD +0.2K vs +1K prior

It's rare to see anything besides position squaring at this time of year but the dovish comments from Weale triggered a wide-spread rethink on where the Bank of England is heading. Cable continued to slide over the past 24 hours and will finish the year near a 9-month low.Oil and CAD Crumble Again

A number of major themes were in force in 2016 but trading on Monday was perhaps a reminder of what will be the most persistent and telling one – the commodity collapse. The Canadian dollar lagged again on the day as oil fell 3.3%. China is back in focus after government announcements hurt sentiment, sparking a 2.7% decline in the Shanghai Composite on Monday. The Premium Insights closed a GBPNZD short with a 380-pip gain.

China and Iran weighed on commodities to start what will be a quiet week of trading. Iran recommitted to immediately increasing exports by 500K barrels per day when sanctions are lifted next week and another 500K within 6 months.

In China, officials took steps to contain trouble spots in the economy but that will have the knock-on effect of trimming growth. The finance minister said limits will be placed on local government debt. Regulators also targeted online lending, some of which fuelled stock markets last year.

All the talk about the Fed and central banks this year partly drowned out major problems in emerging markets. The marginal demand from the developing world is what fuelled a 15-year run in commodities. The combination of overproduction and falling demand is what popped the bubble. How much each of those factors is responsible is critical in 2016.

Some emerging markets, like Brazil, South Africa and Russia, had terrible years with no quick bounce on the horizon. That threatens a negative feedback loop of softer EM demand hurting commodity prices. The market continues to indicate that Canada will be hit hard by soft commodities but the Bank of Canada believes non-commodity exports will help to fill the gap. We're skeptical.

Three Things to Watch in January Seasonals

The year is winding down and we are continuing to focus on the incoming economic data but it's certainly not too soon to look forward to January and some strong seasonal skews. In 2015, the top performer was the Swiss franc after the SNB floor collapsed but it was almost surpassed by the US dollar. The commodity bloc, led by CAD, lagged. In the upcoming Asia-Pacific session, Japanese industrial production and retail sales are due. Ashraf's analytics team has devised an interactive peformance database for equity indices, commodities and currencies from 1993 to 2015, illustrating several intermarket relationships, including the January Effect in FX (see below).

Seasonals are certainly not the only basis for a trade and they can be skewed by one-off events or coincidences in timing of central bank moves. Overall, they're one small tool in the toolbox and are something to keep in mind every time the calendar turns.

For January, the first strong seasonal is gold. It fell more than 9% in 2015 but it started last year with a 10% rally. That may have been partly due to a strong seasonal bias. January is the best month for gold with an average gain of more than 4% over the past decade.

Another one to watch is sterling. January is the worst month for cable over the past 30 years and with a hawk like Weale backing away from a rate hike, there is certainly reason for concern. The weakness may have come early this year with no BOE rate hikes fully priced into the rates market in the year ahead.

The underlying seasonal theme in FX markets in January is US dollar strength. It's the strongest month for the Dollar Index over the past 30 years. The bull market in the dollar is already well-entrenched and foreign asset managers or those frightened about emerging markets in 2016 may cycle into USD early in the year.

For the immediate term, the focus is on incoming Japanese economic data with retail sales and industrial production due at 2350 GMT. November IP is expected to slide 0.5% m/m but rise 1.6% y/y. The soft yen has been a disappointment on the economic growth and inflation fronts and what Abe does next is a major theme of 2016. At the same time, the retail sales report is expected to show a 1.4% m/m decline in November. Don't expect a big JPY reaction to the data.