Intraday Market Thoughts Archives

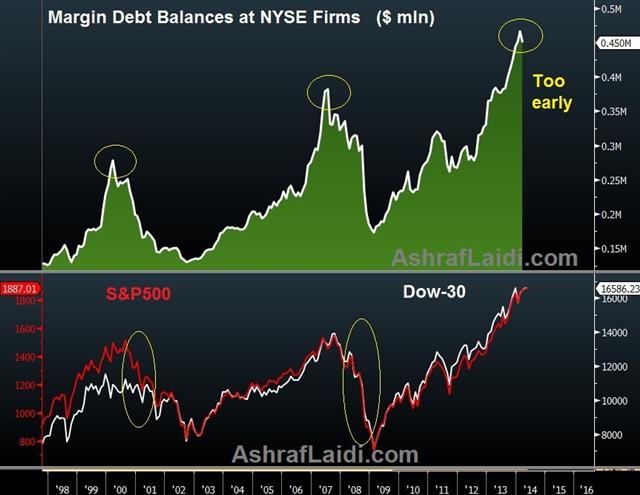

Displaying results for week of Apr 27, 2014First Drop in Margin Debt in 8 Months

The first monthly decline in margin debt by NYSE-member firms in 8 months is drawing notice due to the tight relationship between margin debt and stock market performance. The peak in margin debt seen in March 2000 coincided with the high in the S&P500 dotcom bubble, but in 2007, the peak in margin debt occurred in July, three months prior to the pre-crisis record highs in equities. Full charts & analysis

A Season(al) to Remember

The calendar rolled over on Thursday and there are some seasonals to keep in mind. Trading was sapped by the May Day holiday and changes were less than 20 pips but NZD led while AUD lagged. With traders returning on Friday the moves could pick up with Aussie housing data and Japanese jobs on the calendar.

The market took little from the full slate of economic data. Initial jobless claims were weak but Easter probably skewed the numbers. The ISM manufacturing index was a touch strong but it was priced in after the Chicago PMI.

The surprise market mover was March construction spending at 0.2% compared to 0.5% along with a downward revision to the prior. The dollar slid afterwards and several firms lowered Q1 GDP forecasts into negative territory.

There are signs of a pickup as March consumer spending was a strong point of the PCE report but there's no evidence of the quick rebound many envisioned a month ago. One place US dollar strength could come from is seasonals. May is the best month of the year for the dollar index over the past 10 years and second best over the past decade. Another trend to watch is for commodity currency weakness. May is one of the weaker months for AUD, CAD and NZD but the past four years have been especially poor with AUD averaging a 6.4% decline in that period.

The final seasonal trend to watch is euro weakness. Ultimately fundamentals trump everything else but May is by far the weakest month for the euro and hints at a rate cut from Draghi would certainly help the case.

The calendar is steady in Asia ahead of non-farm payrolls but three events are notable. First is the 2350 GMT release of the March Japan jobs report, there's always the chance of a surprise after the tax hike but the consensus is for no change in the 3.6% unemployment rate.

At 0100 GMT, it's HIA Australian home sales. The industry is under some scrutiny for overvaluation. Thirty minutes later the Australian Q1 PPI report is due and expected to show prices 2.2% higher y/y.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ISM Manufacturing Employment | |||

| 54.7 | 52.8 | 51.1 | May 01 14:00 |

| ISM Manufacturing Prices | |||

| 56.5 | 59.1 | 59.0 | May 01 14:00 |

| ISM Manufacturing PMI (APR) | |||

| 54.9 | 54.3 | 53.7 | May 01 14:00 |

| Eurozone Markit PMI Manufacturing (APR) | |||

| 53.3 | 53.0 | May 02 8:00 | |

| Construction Spending (m/m) | |||

| 0.2% | 0.5% | -0.2% | May 01 14:00 |

| Nonfarm Payrolls (APR) | |||

| 210K | 192K | May 02 12:30 | |

| Unemployment Rate (APR) | |||

| 6.6% | 6.7% | May 02 12:30 | |

| Producer Price Index (Q1) (q/q) | |||

| 0.5% | 0.2% | May 02 1:30 | |

| Producer Price Index (Q1) (y/y) | |||

| 2.1% | 1.9% | May 02 1:30 | |

| AIG Performance of Manufacturing | |||

| 44.8 | 47.9 | Apr 30 23:30 | |

| Challenger Job Cuts | |||

| 40.3K | 34.4K | May 01 11:30 | |

| Challenger Job Cuts (y/y) | |||

| 5.7% | -30.2% | May 01 11:30 | |

| Initial Jobless Claims | |||

| 344K | 319K | 330K | May 01 12:30 |

| Jobless Claims 4-Week Avg. | |||

| 320.00K | 317.00K | May 01 12:30 | |

| Continuing Jobless Claims | |||

| 2,771K | 2,708K | 2,674K | May 01 12:30 |

| Unemployment Rate (MAR) | |||

| 3.6% | 3.6% | May 01 23:30 | |

| Eurozone Unemployment Rate (MAR) | |||

| 11.9% | 11.9% | May 02 9:00 | |

Ashraf's Webinar Tonight

Ashraf's Webinar with Fari Hamzei And George Cavaligos starts at 16:00 ET, 20:00 GMT, 21:00 London time , covering Friday's release of the US jobs report. Ashraf will go through the existing and past Premium trade calls EURUSD, USDJPY, GBPUSD, USDCAD, AUDNZD and gold. Registration link

Fed Tapers, GDP Slumps, Sterling Jumps

April was supposed to be the month where questions about the weather were put to bed, instead the US economy was worse than expected and for reasons that could persist. First quarter GDP sank the US dollar despite Fed reassurances. The economic announcements continue in China with the official PMI on tap.

Wednesday was jammed full of news and events but the Q1 GDP report stole the show with meagre growth at just 0.1% compared to 1.2% expected. For many, weather excuses are growing thin as the weakness was driven by soft exports and business investment, two categories that shouldn't be sensitive. Meanwhile, one area of strength came from the snowed-in consumer.

Still, there are signs of a thaw. The ADP jobs report rose 220K versus 210K expected and the Chicago PMI jumped to 63.0, beating the 57.0 consensus.

After the GDP report traders began to worry the Fed would hint at a weakened economic outlook and the US dollar sold off. The main winner on that trade was the pound as it rose to 5-year high of 1.6901. USD/JPY also sunk a half cent but couldn't break 102.00.

But the Fed didn't budge and the statement was more upbeat than most analysts expected. The Fed noted a recent pickup in economic activity but overall changes in the commentary were entirely minor.

Don't discount the effect of month-end/month-beginning flows as the calendar turns. In April, the pound was the top performer while the kiwi and US dollar lagged.

May is often a volatile month and it begins with the China PMI at 0100 GMT. It's expected to edge higher to 50.5 from 50.3 and a miss could put the Aussie back on its heels.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Price Index (q/q) [P] | |||

| 1.3% | 1.6% | 1.6% | Apr 30 12:30 |

| Markit Manufacturing PMI (APR) | |||

| 55.3 | 55.5 | May 01 13:45 | |

| ISM Manufacturing PMI (APR) | |||

| 54.3 | 53.7 | May 01 14:00 | |

| PMI (APR) | |||

| 50.5 | 50.3 | May 01 1:00 | |

| ADP Employment Change (APR) | |||

| 220K | 210K | 209K | Apr 30 12:15 |

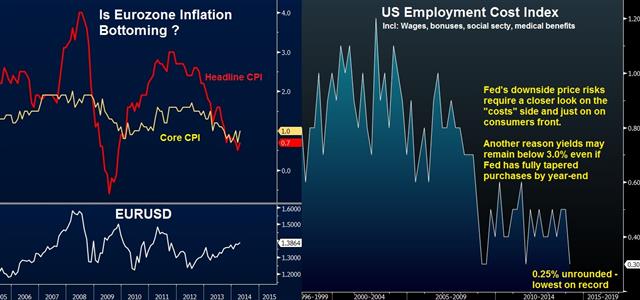

Slumping US GDP & Stabilizing Ezone CPI

Today's Eurozone inflation figures give more time for the ECB to monitor the effect of the longer-term price trend before resorting to further policy action, while the US Q1 GDP & ECI underline the disinflationary obstacles to hawkish interpretations that tapering could transition into tightening by end of Q1 2015. Full charts & analysis.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Price Index (q/q) [P] | |||

| 1.3% | 1.6% | 1.6% | Apr 30 12:30 |

| Eurozone Spanish GDP (1Q) (q/q) [P] | |||

| 0.4% | 0.4% | 0.2% | Apr 30 7:00 |

| Eurozone Spanish GDP (1Q) (y/y) [P] | |||

| 0.6% | 0.5% | -0.2% | Apr 30 7:00 |

| Eurozone CPI Estimate (APR) (y/y) | |||

| 0.7% | 0.8% | 0.5% | Apr 30 9:00 |

| Eurozone CPI - Core (APR) (y/y) [P] | |||

| 1.0% | 1.0% | 0.7% | Apr 30 9:00 |

Eurozone CPI and BOJ Forecasts Next

A soft German inflation reading added to ECB rate cut speculation and weighed on the euro Tuesday. The Canadian dollar was the top performer while the Swiss franc lagged. The highlight of the hours ahead is the update to BOJ inflation forecasts.

It's all about inflation (or the lack thereof) as German HICP numbers made a mockery or the ECB claim that “there is no risk of deflation”. Prices fell 0.3% in the month compared to a 0.1% decline expected, knocking the euro a half-cent lower.

The first estimate on Eurozone inflation is due on Wednesday and the market will now be priced for something below the 0.8% y/y expected.

The yen will be the focus of the hours ahead with the Bank of Japan releasing updated inflation forecasts between 0330 GMT and 0530 GMT. A cut in the projections would be the first step toward fresh easing but the risks are two sided.

There is some chatter the BOJ could actually hike 2014 projections but that's a low probability after soft Tokyo CPI numbers last week. The main focus will be forecasts for 2015 and 2016, the current 2015 estimate is 1.9% and there is no forecast for 2016. If it's less than 1.9%, that raises the possibility of a hike and will push USD/JPY higher.

Those data points are only part of the picture in the day ahead with the ADP employment report and FOMC also on the docket. Tread carefully and keep a close eye on the news.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Germany CPI (m/m) [P] | |||

| -0.2% | -0.1% | 0.3% | Apr 29 12:00 |

| Germany CPI (y/y) [P] | |||

| 1.3% | 1.4% | 1.0% | Apr 29 12:00 |

| ADP Employment Change (APR) | |||

| 210K | 191K | Apr 30 12:15 | |

| Eurozone Spanish Unemployment Rate | |||

| 25.9% | 25.6% | 25.7% | Apr 29 7:00 |

EONIA Could Corner ECB

The key eurozone overnight lending metric continues to disconnect from the ECB benchmark in a move that raises the odds of a rate cut. The Swiss franc was the top performer on Monday while the yen lagged. The upcoming Asia-Pacific session is light but German CPI is up later. A new set of Premium Insights starts on Tuesday.

The conventional thinking in markets was that a 1.40 euro could push the ECB to take action but a squeeze in the short-term debt markets could be the catalyst.

EONIA borrowing rates rose 6 basis points to 0.40% on Monday – the highest since 2011 excluding month and quarter-end spikes. The ECB also reported that excess liquidity at eurozone banks had fallen below €100 billion for the first time since late 2011.The moves are likely related to window dressing for eurozone stress tests but could be due to Russian funds shuffling or something more sinister in the European banking system. In any case, the move will have caught Draghi's attention.The market struggled to interpret housing data and Russian sanctions on Monday. Sentiment wavered between yen buying and selling as stocks switched directions.

The initial reaction move was to cheer US pending home sales as they rose 3.4% compared to a 0.7% expected. Relief that sanctions against Russia weren't stronger also boosted sentiment. Still, it was the first climb in home sales in 9 months and the Ukraine saga is far from over.

USD/JPY jumped to 102.62 on the initial move but later slid back to 102.32. Stocks were especially volatile as the wild ride in the Nasdaq continued but the spillover to FX was minimal.

A large rumored pharma M&A deal helped boost cable by more than a half cent in European trading but a strong US dollar bid in New York trading unwound most of the move.

Overall, the see-saw in market continued but the start of a wave of data and announcements will surely shake up the market. The first is German CPI early in Europe. It's a unique release with regional numbers trickling out first followed by the national reading. With the market so sensitive to Eurozone CPI, watch for a euro move on every regional data point.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Pending Home Sales (MAR) (m/m) | |||

| 3.4% | -0.5% | Apr 28 14:00 | |

| Pending Home Sales (MAR) (y/y) | |||

| -7.9% | -10.5% | Apr 28 14:00 | |

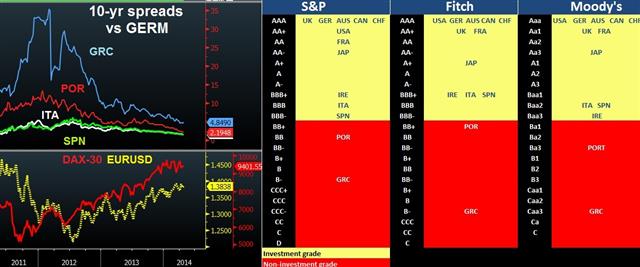

Spain's Upgrade, Plunging Spreads & Firming Euro

Fitch upgraded its rating on Spain's sovereign credit by one notch to BBB+ joins the rank of Italy and Ireland and emerges 2 months following Moody's upgrade of Spain to Baa2, but remains comparably lower than that by Fitch. Standard & Poor's maintains its BBB- rating on Spain, which is not only the lowest for Spain among the three major agencies, but also the lowest within in the investment grade category. Full charts & analysis here.

Big Week Starts with Japan Retail Sales

The FX market was filled with groans last week over the lackluster volatility but the week ahead promises to be busier. Japanese retail sales are up first. Last week, the yen was the top performer while the loonie lagged.

A few of the questions that will be answered this week:

Will the ECB cut rates? (Eurozone inflation Wed) Will the BOJ edge toward easing? (Inflation forecast due Wed) How worries is the Fed about low inflation (FOMC on Wed) How did the US economy respond in Spring? (ADP, NFP, ISM manufacturing, PCE, vehicle sales)

First, at 2350 GMT we find out how much of a race it was to the Japanese shopping centres in March ahead of the consumption tax hike. An 11% jump in sales is expected as shoppers attempted to beat the hike. A miss is likely to be seen as an outlier that doesn't change the underlying dynamics of the economy.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR +26 vs +28K prior JPY -67K vs -69K prior GBP +48K vs +51K prior AUD +16K vs +8K prior CAD -35K vs -35K prior CHF +14K vs +14K prior NZD +20K vs +20K prior

The Australian dollar longs are rusing in. Over the past 4 weeks AUD/USD is virtually unchanged but the net in this report has shifted from -20K to +16K. That means all those fresh buyers are very close to underwater.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Trade s.a (MAR) (m/m) | |||

| 0.3% | Apr 27 23:50 | ||

| Retail Trade (MAR) (y/y) | |||

| 11.0% | 3.6% | Apr 27 23:50 | |

Big Week Starts with Japan Retail Sales

The FX market was filled with groans last week over the lackluster volatility but the week ahead promises to be busier. Japanese retail sales are up first. Last week, the yen was the top performer while the loonie lagged.

A few of the questions that will be answered this week:

Will the ECB cut rates? (Eurozone inflation Wed) Will the BOJ edge toward easing? (Inflation forecast due Wed) How worries is the Fed about low inflation (FOMC on Wed) How did the US economy respond in Spring? (ADP, NFP, ISM manufacturing, PCE, vehicle sales)

First, at 2350 GMT we find out how much of a race it was to the Japanese shopping centres in March ahead of the consumption tax hike. An 11% jump in sales is expected as shoppers attempted to beat the hike. A miss is likely to be seen as an outlier that doesn't change the underlying dynamics of the economy.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR +26 vs +28K prior JPY -67K vs -69K prior GBP +48K vs +51K prior AUD +16K vs +8K prior CAD -35K vs -35K prior CHF +14K vs +14K prior NZD +20K vs +20K prior

The Australian dollar longs are rushing in. Over the past 4 weeks AUD/USD is virtually unchanged but the net in this report has shifted from -20K to +16K. That means all those fresh buyers are very close to underwater.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Trade s.a (MAR) (m/m) | |||

| 0.3% | Apr 27 23:50 | ||

| Retail Trade (MAR) (y/y) | |||

| 11.0% | 3.6% | Apr 27 23:50 | |