Intraday Market Thoughts Archives

Displaying results for week of Aug 28, 2016Where's my Work Week?

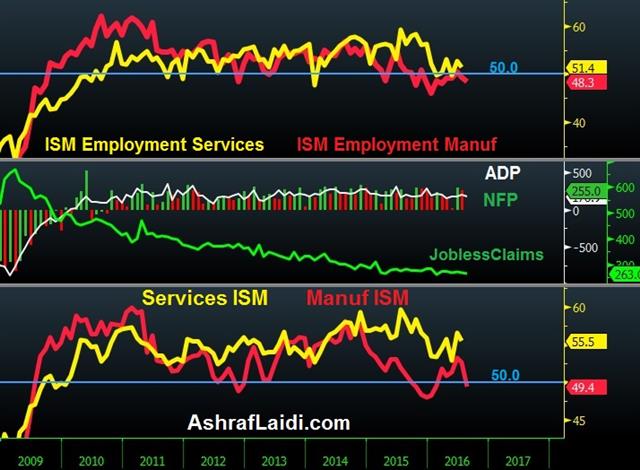

If the broad contraction in Aug manufacturing ISM were not enough to raise doubts among those who think the US economy needs a rate hike, then today's release of Aug US jobs report will do the job. The 151K rise in NFP is a steady figure, but marks a clear decline under the 3-month and 6-month moving averages. The same goes for services and manufacturing sector jobs.

The broad slowdown in August labour market metrics may be a result of slower summer hiring, but are jobs truly strong enough for rates to be raised at a time when inflation remains not only below target but trending lower as shown in these charts.

And even if we kept the analysis inside the labour market, slower wage growth remains the highlight of Yellen's jobs dashboard. Average hourly earnings growth slowed to 2.4% y/y from 2.7% and 2.6% in Jul and Jun respectively, while average work week fell to a 2 ½ year low of 34.3 hours. This last point will be a crucial element in determining earnings, consumption and overall GDP.

Finally, the above chart suggests that full employment may already have been reached, as jobless claims and the unemployment rate exhibit tendencies of a bottoming pattern (red boxes) at a time when total and services payrolls are in topping pattern. Linking the historical bottoming patterns in unemployment and jobless claims with the Fed Funds rate (blue graph), it suggests that rates should be at the end of their holding pattern before the next rate cut.

Instead, the Fed has convinced markets there is a 30% chance of a rate hike this month, like it convinced many experts in January that it would raise rates four times this year. The challenge, however, is not to write a piece blog expressing your agreement or disagreement with the Fed/markets' view, but to turn your view into a tradable and profitable idea, which rises across the noise. We currently have 9 Premium trades; 2 in metals, 2 in indices and 5 in FX. The trades await a notable market/liquidity adjustment upon ECB president Draghi's return to action next Thursday.

What’s the NFP Minimum?

Nonfarm payrolls is the marquee event on the calendar in the day ahead, we look at the key metrics and scenarios. The pound sterling was the top performer while the US dollar lagged. The Asia-Pacific week ends with Japanese August consumer confidence. Ashraf's 2nd Premium of the week has just been posted, focusing on the emerging links between high yield & indices and the preferred trades based on falling oil.

The Fed's Mester made an interesting comment about the jobs picture on Thursday, saying that the economy only needs 75K to 150K new jobs per month to keep unemployment steady.

That leaves for an interesting mismatch with the consensus estimate of 180K jobs on Friday. To be sure, the Fed has long warned that a decline in unemployment would lower jobs gains but it's unclear how the market would react.

By the same token, it's fair to ask how the Fed will react. For years, Fed speakers have highlighted that they smooth out economic data and don't focus on single numbers but when the May jobs report was dismal, the Fed scrambled to the sidelines.

So we're left with the question of what's needed to keep a realistic belief in a Fed hike on Sept 21. Despite what Mester said, it's probably at least 160K. Even then, virtually every other economic data point from now until Sept 21 would need to be strong.

In addition, revisions would need to be net positive with a favorable unemployment rate/participation rate and something that matches the +0.2% consensus on average hourly earnings.

If that's met, the dollar is likely to recuperate post-ISM losses but it may still leave dollar bulls uneasy about pushing further. However if the numbers are disappointing, the ISM jitteriness Thursday demonstrates that the crowded dollar long trade might get a more serious chill.

Before non-farm payrolls, at 0500 GMT, the August Japanese consumer confidence index is the lone notable economic release on the Asia-Pac calendar. The consensus estimate is 41.8 compared to 41.3 prior but it's not likely to be a yen mover.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Confidence | |||

| 41.6 | 41.3 | Sep 02 5:00 | |

Broad ISM Contraction & Skittish Markets

Confidence in the idea of a Fed hike took a hard hit on the disappointing ISM manufacturing index, which showed a contraction in the headline, new orders and employment components. The dollar was near session highs before the data but fell around 80 pips across the board after the release. Construction spending data also puts a kink in GDP. In the Oremium trades, AUDNZD was stopped out and a new JPY trade had been issued prior to the ISM. A second Premium video will be posted this evening ahead of NFP.

The signal from the ISM manufacturing index may be that economic data will need to run a nearly perfect gauntlet between now and Sept 21 for the Fed to hike. Markets will also have to cooperate. Right now, odds of a 25-bp hike in Sept have fallen to 30% from 42% last week.

Manufacturing data has been routinely ignored over the past two years but a dip in ISM manufacturing to 49.4 from 52.0 (and 52.6 expected) sent dollar bulls scrambling. USD/JPY was at 104.00 prior to the release and quickly fell to 103.19 afterwards.

At the moment, the market is hyper-focused on non-farm payrolls but it's only part of the puzzle before the FOMC decision. What the ISM manufacturing reaction might be saying is that if retail sales, CPI, durable goods orders, services PMI or trade miss estimates, the Fed may wait.

The construction spending numbers also leave the Fed with a bit of a headache. The good news was that June spending was revised to +0.9% from -0.6% and that should lead to a positive revision to Q2 GDP. The bad news is that July spending was flat and that will restrain Q3 growth.

Other numbers showed initial jobless claims at 263K vs 265K expected; and non-farm productivity for Q2 was revised to -0.6% from -0.5%. That's the third consecutive quarter of contractions in productivity. That fall may give the Fed pause when it sees rising wages elsewhere.

The other story early was the resilience of the UK economy. The Markit manufacturing PMI jumped to 53.3 from 48.3. The economy is showing excellent resilience to the Brexit vote and that's given cable a more than 150 pip boost.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| PMI Manufacturing | |||

| 53.3 | 49.1 | 48.3 | Sep 01 8:30 |

| Construction PMI | |||

| 46.6 | 45.9 | Sep 02 8:30 | |

| AIG Performance of Manufacturing | |||

| 46.9 | 56.4 | Aug 31 23:30 | |

Buckle Up, Doldrums are Done

The Summer doldrums end on Wednesday with a slate of FOMC speakers and key data; we look at the themes. The US dollar was the top performer while the yen lagged. Japanese industrial production and Australian private credit are up next. A new JPY trade was issued ahead of this week's busy US data schedule. The latest Premium video focuses on gold, silver, USDX, EURUSD and the Fed.

The theme heading into September is central banking. Japan is preparing some kind of easing package (again), the Fed might hike and the ECB has been eerily quiet. With a stacked calendar coming up, trading will be more about reacting and analyzing than speculating.

As we head into the month, Fed fund futures price the chance of a hike at 32%. That's down 10 points from the frothy 42% on Monday, despite strong data. Consumer confidence rose to a 10-month high of 101.1 compared to 97.0 expected and that helped lift the dollar for the third day.

One headline that didn't get enough attention was German HICP. The flash reading for August was -0.1% compared to a +0.1% consensus. The market has given Draghi & Co a vacation this month but the pressure will ramp up soon to do more. Due tomrrow is flash Eurozone Aug CPI.

Japan is also getting a break as dollar strength helped to push USD/JPY to the highest since July 28. The market isn't entirely sure what the BoJ may roll out but look for some leaks in the weeks ahead.

Finally, the drama in oil can't be underestimated. Iran revealed it plans to add nearly another 1 million bpd of production Tuesday and that pushed down prices. The Fed puts plenty of focus on the data but a $5 decline in the price of oil before the Fed decision would be another reason to wait.

Looking at what's in the near-term calendar, Japanese July preliminary industrial production is due at 2350 and expected up 0.8% after a 2.3% rise in July. However that will still leave it down 3.0% y/y. In the same way that Japan was a monetary policy experiment, the world will be closely watching fiscal infrastructure spending in the year ahead to see if it can spur growth and private investment.

The other release to watch is at 0130 GMT when Australian private sector credit is due. The consensus is for a 6.1% y/y rise. That's the kind of number that gives a dovish RBA pause.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Assist Gov Debelle Speaks | |||

| Aug 31 1:00 | |||

| Industrial Production (m/m) [P] | |||

| 0.7% | 2.3% | Aug 30 23:50 | |

| Eurozone CPI Flash Estimate (y/y) | |||

| 0.3% | 0.2% | Aug 31 9:00 | |

| Private Sector Credit (m/m) | |||

| 0.4% | 0.2% | Aug 31 1:30 | |

| CB Consumer Confidence | |||

| 101.1 | 97.2 | 96.7 | Aug 30 14:00 |

Inflated Expectations

The Fed's preferred inflation measure didn't add any urgency to the rate hike debate on Tuesday but it helped to crystalize the debate. The dollar finished the day as the top performer on continued momentum from Jackson Hole while the pound lagged. Key data on Australian housing and Japanese consumers is due next. Friday's UK jobs report will be the week's main event, but Wednesday's Eurozone flash Aug CPI should be a key determinant of medium term EURUSD moves. Gold will be the focus of this week's Premium video ahead of NFP.

The PCE report showed that US inflation rose 0.8% year-over-year in July. That low number matched expectations and underscored the needlessness of hiking rates in September.

The low inflation number isn't an artifact of slow commodity inflation a year ago either. In month-over-month terms, inflation was flat and has average just a 0.1% m/m rise over the past three and six-month periods.

Core inflation is a touch hotter at 1.6% y/y but slowed from 1.7% and aside from fanciful hopes that a 'tight' labor market will lead to wage gains, there isn't any evidence of a brewing jump in prices.

The bond market may be signalling some apprehension about the hawkish rate talk. On Monday, yields moved lower across the curve including 7 bps lower in 10s. Stock markets also showed some diminished fears with the S&P 500 wiping out the Thurs/Friday decline.

The dollar was a different story as the momentum higher continued, albeit at a slower pace. Late in the day, USD began to take the hint from bonds and pared some of the gains. With a trio of Fed doves coming up on Wednesday in Evans, Rosengren and Kocherlakota, the retracement theme might continue.

On the data front, housing in Australia and Japan are in focus. There are some preliminary signs of a slowdown in Australian home construction; dwelling approvals fell 2.9% in June after a 5.4% decline in May. The outlook isn't any better for the July data at 0130 GMT.

The main focus is on Japan as BOJ speculation mounts. It would take an extraordinary turn in the numbers to derail Kuroda's plan of action but a series of weak data points could add some pressure. At 2330 GMT numbers are due out on jobs, household spending and retail sales.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Overall Household Spending (y/y) | |||

| -1.3% | -2.2% | Aug 29 23:30 | |

| Retail Sales (y/y) | |||

| -0.9% | -1.3% | Aug 29 23:50 | |

Fed Playing with Fire, PCE next

The Fed stoked the rate hike fires at Jackson Hole while Kuroda hinted the BOJ had easing ammunition. The US dollar was the top performer last week while the Swiss franc lagged. CFTC positioning data showed euro shorts falling out of fashion. Monday is a holiday in the UK, but the all important core PCE price index from the US is due at 12:30 PM GMT, 13:30 BST. So far today. GBP is the weakest currency, followed by the JPY and the NZD is the strongest.

The implied probability of a Fed hike on September 26 rose to 42% at the start of the week from 22% on Aug 19. That's primarily after Yellen said the case for hiking on that date “had strengthened” and hawkish comments from other Fed members.

The universal caveat remains data dependence and an insistence that upcoming numbers continue to improve. Ultimately, it's tough to believe the Fed won't back down or disappoint. It's even surprising that they're willing to flirt with a hike once again after getting burned so many times before. Revisions to Q2 GDP showed growth was at a pace of just under 1% for the first half of the year and the Fed is increasingly a political punching bag with the election 10 weeks away.

Otherwise at Jackson Hole it was Kuroda who stole headlines saying there is “ample space” for more asset buying, an expansion in the monetary base and negative rates.

In early trading, the market reaction has been mild USD/JPY buying but that may also be a reflection of the economic calendar. London is close to start the week and the Asia-Pacific calendar is very light.

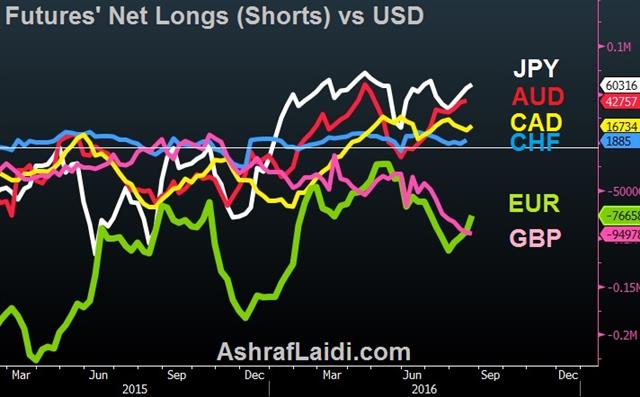

CFTC Commitments of Traders

Forex speculative futures positioning. + denotes net long; - denotes net short.EUR -77K vs -93K prior GBP -95K vs -94K prior JPY +60K vs +56K prior CHF +1.8K vs +1.5K prior CAD +17K vs +12K prior AUD +43K vs +41K prior NZD -0.9K vs -0.7K prior