Intraday Market Thoughts Archives

Displaying results for week of Nov 29, 2020Oil Shrugs Off OPEC, USD Hardens Fall

Thursday was all about deal-making with OPEC, Brexit and US stimulus all in play. The market continues to lean towards a Brexit deal but hopes are now pinned on weekend talks, which will make for an interesting Friday trade. US stimulus talks continue to move in a positive direction but we're not at the final stages yet.

It was OPEC+ that made its move on Thursday and it wasn't the 3 month extension the market had expected. Instead, OPEC opted for a plan to raise production 500k bpd each month starting in January. We would have expected some crude selling on that but after a small blip, WTI crude found a base and the rallied back above $45.50. Brent also finished more than 1% higher.

The adage that applies here is: When a market can't fall on bad news, it can't fall at all. Holding well-above the recent range in crude through the OPEC news is a good sign for the bulls. OPEC still has 7.2mbpd of spare capacity so that will certainly keep oil from running higher but the surplus in inventories will slowly be run off in the months ahead and at some point in 2021, demand will be strong.

That was reflected in the Canadian dollar Thursday as USD/CAD fell to the lowest since 2018. The break of 1.30 clears out a key support level and highlights the case for a further decline on heavy Canadian fiscal spending and its commodity riches.

The EUR/USD breakout resumed on Thursday as it climbed above 1.21 and it was joined by the Australian dollar in a climb above the September high of 0.7411 to the best levels since 2018.

The dollar is behaving like a classic bear market, as intermittent retracements are met with renewed selling. The trigger on Wednesday was more positive talk on US stimulus. It's tough to know if differences can be bridged but Democratic leaders said they could work with the bipartisan group's proposal and McConnell said Democrats were acting in good faith.

In the shorter-term though, the trade will evolve around Friday's US and Canadian jobs reports. Non-farm payrolls estimates have come down and sit at 478K. Homebase hiring numbers point to the risk of a downside surprise but markets have been able to ignore any bad economic data for months. On the flipside, a positive surprise may be welcomed, leaving a positive skew.Dollar Defence Cracks

EUR/USD made a textbook break of the September high on Tuesday as the dollar continues to take on water. After running into sellers at 1.20 a day earlier, the pair broke through in a big way and continued above 1.2100. If the pair closes Wednesday above 1.2080/85, then the next target stands at 1.2160, followed by key resistance at 1.2195.

Cable jumped by more than a full cent on Tuesday on reports that Brexit negotiations are entering 'the tunnel' -- meaning that Barnier and small teams will go into intensive talks and avoid leaks--But the pair gave up all of those gains today on news of lingering disagreements on the topic of fisheries.

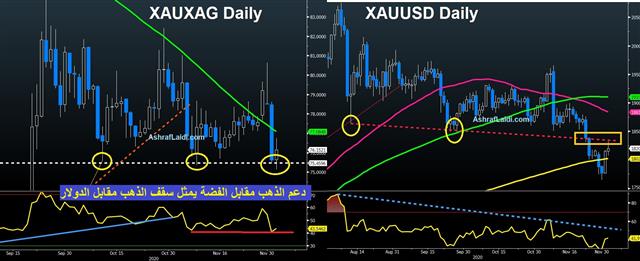

Gold and Silver added to their gains, with Ashraf pointing out in the above charts that the 75.00 support in the Gold/Silver ratio represents the equivalent resistance in XAUUSD, shown at 1838/40

More broadly, the US dollar looks soft on numerous fronts, including the commodity currencies and emerging market currencies. Even gold rebounded on Tuesday.

The trigger was a bipartisan group in the senate coming together on a stimulus deal. It led to a jump in risk appetite but the biggest move might have been in 30-year Treasury bonds, which rose 10 bps to 1.66%. We're not in danger of a serious breakout on that front until 1.75% but market participants will be watching closely for follow-through.

Along with higher yields, breakevens are also rising with the 10-year measure hitting 1.85%, which is the highest since May 2019. It symbolizes rising market expectations of inflation and it was underscored by the Fed's Evans reiterating no rate hikes in his forecast through 2023. Expect further USD weakness to persist if these break-even rates show no retreat any time soon.

In testimony Powell also remained dovish but it was notable that neither he nor Fed dove Daly offered any hints of December action. It's safe to say that the Fed isn't going to make a move of a duration extension this month.

فيديو عن مؤشر الداكس

ما الذي يُميّز مؤشر الداكس فنيّاً عن الداوجونز و الناسداك؟ وهل تعتبر هذه الميزة فرصة لشراء المؤشر الألماني أم بيعه؟ التفاصيل في هذا الفيديو

A November to Remember

The monthly equity numbers for November are staggering. It started with a huge bid for option protection into the US election that quickly unwound at the start of the month and was followed by a trio of positive data releases on upcoming vaccines. The result was a monthly gain in global equities that stretched from 11% (S&P 500) to 27% (Spain's IBEX 35).

This was clearly the month the market began to look beyond the pandemic and the momentum continued late into the month as the safe haven bid for gold evaporates. It slumped late in the month and that continued with a decline to $1781 on Monday. What's troubling for gold bulls is that all the declines are coming as the US dollar slumps, something that's mechanically bullish for all commodities.

Who'd have known that energy and financials would be the month's best performing sectors, gaining 29% and 17% respectively, with Tech up 11% and healthcare +7%.

The US dollar was the worst performing major in November while the kiwi led the way, up 6.5%. In emerging markets it was the beaten-down BRL leading the way with a 7.6% gain.

It all begs the question: Can this keep on going?

There's no fundamental answer. The pandemic clearly continues to rage but the market stopped caring about the headlines altogether in November. Fresh restrictions in Europe and elsewhere barely led to a flinch in markets. It's tough to see that changing.At the same time, the defining characteristic of the recovery is how it's consistently outpaced economist expectations. Though the pace of improvement is slowing, the data continued to impress to start the new week as Japanese industrial production and the official China PMIs outpaced the consensus.

We concluded long ago that we're in a post-pandemic market but how far it runs is more a function of sentiment than economic status. Yet, there is no sign that easy money from central banks and governments are drying up. There are still a number of markets playing catch-up, particularly emerging markets. That's going to draw capital out of US dollars and other safe havens and into beaten down currencies, especially those with commodity exposure.

Be cautious of swings at month end then into December. Given the magnitude of these equity moves, the flows will be overwhelming in many assets.

The moves anticipated in Friday's Premium video seem to be underway today. Let's see how far they'll extend.