Intraday Market Thoughts Archives

Displaying results for week of Apr 29, 2018Recording of Yesterday's Webinar

I don't usually send out the recording of my webinars, but I'm making an exception for last night's webinar for Swissquote, which covered some of my trading ideas and the technical/fundamental rationale behind them. Full recording.

Cable at 200-dma, NFP Next

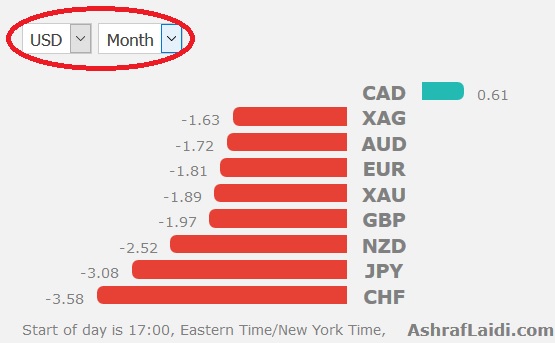

The US dollar is up against all major currencies with the exception of the Japanese yen since 10 pm London yesterday. European indices are back in positive territory but US futures indices are in the red. The pain in cable continued on Thursday with a drop to a fresh low dating back to January 10. Non-farm payrolls are due up next (see details below) and Premium trades are likely to emerge following the release of the figures.

Cable attempted to bounce but a broad bid in the US dollar on risk aversion sent it as low as 1.3535. That number is significant because it's exactly the 200-day moving average. Whether due to technical buying or a reversal in equity market fears, cable bounced to 1.3570 from there to finish flat on the day. A report in the Telegraph said the UK could remain in the customs union until 2023 due to problems implementing a border, not to mention the seeming inability of anyone in the UK government to find a workable transition deal.

On net, that's good news as a lengthened timeline will encourage some medium-term investment. We're also now less than a week away from the BOE meeting and with odds of a hike at 9%, the headline risk is skewed towards a signal of a hike sometime in the next few months. The market is pricing just a 52.6% of a rate rise through the September 13 meeting.

Onto US Jobs

In the short-term, the US dollar side of the equation is the bigger risk. Friday brings non-farm payrolls and a renewed focus on wage inflation. The consensus for jobs is 192K but note that the employment component of the ISM non-manufacturing report was at a one-year low at 53.6 compared to 56.6 prior and that's a downside risk.Still, the market will be overwhelmingly focused on wage growth with average hourly earnings forecast at 0.2% m/m and 2.7% y/y. A higher reading could send 10-year yields right back to 3% from 2.94% Thursday. If so, the dollar could make broad gains outside of USD/JPY where risk aversion would hit.

We also continue to keep an eye on emerging markets after Argentina's central bank hiked rates for the second time in a week, bumping them 300 bps to 33.25%. The Argentine peso continued to fall Thursday and is now down 8.2% over two days and other EM currencies are suffering as well, adding a board bid for dollars.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Average Hourly Earnings (m/m) | |||

| 0.2% | 0.3% | May 04 12:30 | |

| Eurozone Spanish Unemployment Change | |||

| -86.7K | -100.2K | -47.7K | May 04 7:00 |

معنى هدف الفيدرالي المتماثل للدولار الأمريكي

جاء في بيان اللجنة الفيدرالية للسوق المفتوحة يوم الأربعاء عبارة مثالية لمشترين الذهب. هل سيكون البائعون الأمريكيون متحمسين بنفس القدر؟ (التحليل الكامل)

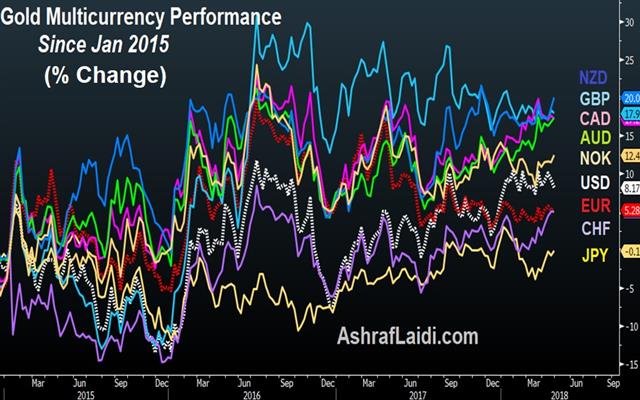

USD Implications of Fed’s Symmetric Objective

Wednesday's FOMC statement had a phrase that was ideal for gold bulls. Would it be welcomed by USD bears? Full analysis here

English Webinar Today

Don't forget to join my webinar this evening with Swissquote at 6 pm GMT, 7 pm London/BST, 8 pm CET. Full details & registration

Emerging Worries

The Fed was the focus on Wednesday, at least for a short period, but underlying moves for the dollar stem from half-a-world away. AUD edged out USD as the top performer on the day while the euro lagged. Australian trade balance is due up next. Our DAX30 short was stopped by 15 pips (before the index headed lower) for 300 pt loss. The DOW30 short was closed for 450-pt gain.

The FOMC decision was a one-hour event in the sense that it moved markets for a grand total of one hour. The initial move was lower in the dollar and then it rebounded completely. The statement added two nods to the symmetric 2% inflation target and omitted a line saying that the economic outlook had strengthened. The symmetric reference is a subtle warning that the Fed will see 2.5% inflation in much the same was as 1.5% inflation in that it won't immediately react. It's a signal that 2% isn't the ceiling of tolerable inflation.

At the same time, that's something many FOMC members have emphasized recently and it's no surprise to the market. It didn't change the markets 96% implied probability of a June hike. From there it will continue to be all about economic data, which is in heavy supply for the remainder of the week.

So why the US dollar rally? Aside from the themes about rate differentials, jitters and growth that we've written about extensively, there are flows. Big flows at the moment are emanating from emerging markets where trouble is brewing.

Argentina's peso fell 3% Wednesday despite a panicky 3 percentage point hike from the central bank and massive FX intervention. The Turkish lira fell 2% and the Russian ruble continues to struggle.

Emerging market money tends not to be overly discriminating and problems in one place can quickly become problems everywhere. Higher US rates have changed the equation for many investors and trickle can become a flood overnight.

In developed markets, the Australian dollar continues to struggle but has so far held Tuesday's lows. It could get some help at 0130 GMT in the March trade balance report. The consensus is for a healty $865 million surplus.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance | |||

| 0.68B | 0.83B | May 03 1:30 | |

Cable Calamity Continues

Sterling took another beating on Tuesday after the UK manufacturing PMI. The US dollar was the top performer once again while cable fell more than 1%. The US dollar is suddenly knocking down some major technical levels. A new USD trade has been posted to Premium clients. The member video is posted below, highlighting the rationale for existing and potential trade.

It was all about the 200-day moving average on Tuesday. EUR/USD, gold and the dollar index all fell below the key marker while cable neared it. It's part of the rapid reversal in the US dollar of the past two weeks. Disappointing US manufacturing ISM went unnoticed and so did conerns about the US expansion being in a late cycle.

The combination of higher Treasury yields and jitters about global growth started a trickle into the dollar that's grown into a flood as USD-shorts squeezed as the Fed remains hawkish while other global central bankers waiver.

The BoE will now almost-certainly blink at the May 10 meeting. The probability of a hike has fallen to 16% from 96% two week ago. Cable has fallen 800 pips in that time starting with some less hawkish hints from Carney and followed by a series of poor data releases and Brexit woes. The latest was a drop in the UK manufacturing PMI to a 17-month low on Tuesday. Cable fell more than a full-cent on the day and came within a half-cent of the 200-dma.

It was a cascade of US dollar technical victories to start the month. The euro fell below 1.20 for the first time since January 10, albeit on a day with large parts of Europe on holiday. AUD/USD broke the December low to the worst since June in a move that was helped by an altogether dovish stance from the RBA.

Going ahead, the question is whether this was a blow off move or a continuation? The dollar has three tailwinds at the moment, depending on what comes next in markets. If jitters continue, it benefits from a save-haven bid, especially from emerging markets. If Treasury yields rise, it benefits from rate differentials. And if the momentum continues, it can benefit from a continued short squeeze.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| PMI Manufacturing | |||

| 53.9 | 54.8 | 54.9 | May 01 8:30 |

| Construction PMI | |||

| 50.5 | 47.0 | May 02 8:30 | |

| Final Manufacturing PMI [F] | |||

| 56.5 | 56.5 | 56.5 | May 01 13:45 |

| ISM Manufacturing PMI | |||

| 57.3 | 58.4 | 59.3 | May 01 14:00 |

| Eurozone Final PMI Manufacturing [F] | |||

| 56.0 | 56.0 | May 02 8:00 | |

فيديو عن الذهب والين

هل ما زالت العلاقة العكسية بين أسعار الذهب والين الياباني قائمة؟ في هذا الفيديو يشرح الأستاذ أشرف العايدي خبيرالأسواق العالمي كيف يمكن الإستفادة من هذه العلاقة ومعرفة تحركات الزوج رابط الفيديو

Oil Nudged By Nukes

We warned earlier to watch the Iran nuclear situation closely, and it became the dominant theme to start the week with Israeli prime minister Netanyahu arguing for action against Iran. The US dollar was the top performer on the day while the New Zealand dollar lagged. We take a look at May seasonals as the new month begins. A new Premium trade in a major index was posted earlier today. It is currently 150 pts in the green.

Geopolitics is always a guessing game. The talk always exceeds the action but people and markets are fearful by nature. On Monday, Netanyahu revealed that Israeli intelligence uncovered a trove of documents showing how Iran had worked on nuclear weapons from 1995-2003 and had preserved the knowledge it acquired in that time.

Without getting into the details, there are two questions: 1) Will anyone attack Iran? 2) Will there be new sanctions with the US leaving the Iran nuclear deal at the May 12 deadline.

The first remains extremely unlikely at this point, despite some hawks in the White House. War is unpopular in the US and would have no support in Europe. On the second question, the market is leaning towards expecting sanctions, despite opposition from European leaders. Oil jumped more than $1 from the lows Monday on Netanyahu's speech.

That might be the wrong takeaway. Instead, this could be the next wave of a coordinated US-Israel PR campaign aimed at new sanctions against Tehran. If so, it didn't appear very coordinated Monday. In comments after Netanyahu's speech, Trump said the same things he's been saying about Iran for more than a year and highlighted that all options were still on the table. More likely, it was a solo attempt by Israel to influence leaders in the west who are reluctant and that perhaps Trump himself is reluctant.

We will be watching Trump's twitter closely for clues. The calendar now turns to May for the forex market. Seasonal patterns performed well in April and some seemed to get a head start on May.

One is Australian and New Zealand dollar weakness. They were strong to start April but cratered late in the month. The seasonal picture remains dark with May as the worst month for AUD and third-worst for NZD. It shouldn't be a surprise that it's also a tough month for base metals.

Global equity markets were strong in April, especially outside the United States. The old adage about selling in May doesn't really apply. It's a weaker month than April, but by no means a poor month.

It is, however, the weakest month on the calendar for the euro and with EUR/USD testing 1.20, it could get weak in a hurry.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Gov Lowe Speaks | |||

| May 01 9:20 | |||

Geopolitical Grenades

UK interior minister Amber Rudd resigned on Sunday in a hit to PM Theresa May and the loss of a soft-Brexit supporter. Coupled with positive Korea developments and mixed signals on Iran, that sets up a delicate week. Key US inflation figures follow next alongside personal income and spending. The March core PCE price index is seen at 1.9% from 1.6%.

The US dollar was the top performer last week while the New Zealand dollar lagged. CFTC positioning data showed a squeeze on the crowded EUR-long trade. Rudd resigned after accusations of mishandling and misleading on immigration. That will make life even more difficult May, who has finally scored a few Brexit wins.

In North Korea, the meeting between Kim and Moon on Friday was a success, at least in terms of the first steps as both promised complete denuclearization of the peninsula. North Korean media said Kum plans to invite foreign observers to oversee the complete dismantling of its nuclear facilities. Many remain skeptical but cautious optimism is creeping in.

A delicate situation remains in Iran where the US must recertify the nuclear deal by May 12. After a meeting with France, Iran was defiant and said it will not renegotiate. European leaders appear to be pushing for the US to maintain the status quo.

In the week ahead, the Iran deal is likely the one that bears the closest watching. It has a firm dealing and several sides who are inflexible.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +131K vs +151K prior GBP +48K vs +48K prior JPY +1K vs +3K prior CAD -25K vs -30K prior CHF -10K vs -11K prior AUD -3K vs -10K prior NZD +24K vs +27K prior

The euro net long in the prior week hit a record and we warned it was a precarious position. The shorts were squeezed last week in a drop to the lowest since mid-January. Even with the drop, a +131 net is still a very crowded trade that's under pressure.