Intraday Market Thoughts Archives

Displaying results for week of Jun 29, 2014Two Spots Where USD Couldn’t Rally

Let's start with the news. Non-farm payrolls rose a sparkling 288K compared to 212K expected. The unemployment rate fell two ticks to 6.1% with no change in the participation rate. Combing through the finer details of the report, it's a challenge to find a significant concern.

The strong report underlines the better tone in US data that we have emphasized and the US dollar caught a broad bid. USD/JPY jumped to 102.20 from 101.90 and EUR/USD fell a half cent to 1.3600. From there the ECB meeting sent out some ripples (but no waves) and the market moved sideways with US traders sneaking out early for the long weekend.

Similar sized moves hit USD/CAD and cable but there it was a different story. From 1.7103 cable stormed back to 1.7155. USD/CAD rose to 1.0680 but sharply turned around and fell to a six-month low of 1.0621.

It's painful to buy the pound or loonie after the long runs they've been on. Indicators are overbought and the feeling of having missed out is prevalent. But if those pairs were going to retrace, Thursday's data would have been a prime opportunity.

The next focus shifts to the holiday trade. Asian and European markets are open as usual but many trading desks will take advantage of the US holiday on a summer Friday to take a break. The calendar is light through European trading with only May German factory orders at 0600 GMT on the schedule.

Watch out for whippy, flow-driven moves. If they're not connected to news, they rarely last.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Change in Manufacturing Payrolls (JUN) | |||

| 16K | 10K | 10K | Jul 03 12:30 |

| Change in Nonfarm Payrolls (JUN) | |||

| 288K | 215K | 224K | Jul 03 12:30 |

| Change in Private Payrolls (JUN) | |||

| 262K | 213K | 224K | Jul 03 12:30 |

| Unemployment Rate (JUN) | |||

| 6.1% | 6.3% | 6.3% | Jul 03 12:30 |

| Germany Factory Orders s.a. (MAY) (m/m) | |||

| 3.1% | Jul 04 6:00 | ||

| Germany Factory Orders n.s.a. (MAY) (y/y) | |||

| 6.3% | Jul 04 6:00 | ||

Record Dow Jones Industrials Dwarfed by Transport Index

As the Dow Jones Industrials Average (DJIA) breaks above the 17,000Record Dow Jones Dwarfed by Transport Index level for the first time, we focus on the Dow Jones Transportation Average (DJTA), which grew twice as much as the Imdustrials. And with today's "jobs" bazooka, here is how the equitie slansdcape may look. Full charts & analysis.

Signs of Life in the US Dollar

A strong ADP report breathed life into the US dollar but it also underscored the asymmetry of USD reactions to news that we wrote about yesterday. ADP employment shattered the 200K consensus with a 281K surge in June. The reaction was a 20-30 pip rally in the US dollar but most pairs were unable to hold the gains.

Contrast that to yesterday where the ISM manufacturing index missed expectations by six-tenths of a point and it resulted in substantially larger moves. One caveat today is that markets might have been shy to react with non-farm payrolls less than 24 hours away but it's discouraging for the US dollar bulls, especially when 10-year yields moved up 6.5 basis points.

The more general theme of the day was a pullback in AUD, CAD and GBP after multi-month/year highs yesterday. That's not a surprise given the gravity of non-farm payrolls.

The other major story on the day was oil. Libyan rebels struck a deal with the government to re-open two ports that handle about half of the nation's crude exports. Technically, crude fell back below the March/April highs that were broken with the trouble in Iraq flared.

Oil prices got a brief respite on bullish US inventory data but the bounce was quickly sold in another sign of the underlying tendency of the crude market.

The focus now shifts to the Australian dollar, which has been a big mover the past two days. Trade balance numbers curbed some of the recent enthusiasm but a speech from Stevens at 0000 and retail sales at 0030 GMT add fresh risks.

The pullback Wednesday after the breakout is a somewhat standard reaction but the next move will prove whether it was a false breakout or something sustainable.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (MAY) (m/m) | |||

| 0.0% | 0.2% | Jul 03 1:30 | |

| RBA's Governor Glenn Stevens Speech | |||

| Jul 03 1:00 | |||

| Building Approvals (MAY) (m/m) | |||

| 3.1% | -5.6% | Jul 03 1:30 | |

| Building Approvals (MAY) (y/y) | |||

| 8.0% | 1.1% | Jul 03 1:30 | |

| ADP Employment Change (JUN) | |||

| 281K | 200K | 179K | Jul 02 12:15 |

| Nonfarm Payrolls (JUN) | |||

| 213K | 217K | Jul 03 12:30 | |

| Trade Balance (MAY) | |||

| $-45.20B | $-47.24B | Jul 03 12:30 | |

| Trade Balance (MAY) | |||

| -1,911M | -780M | Jul 02 1:30 | |

Aussie or Sterling?

Both AUDUSD and GBPUSD have rallyied but which of the two pushes us to issue a fresh long trade with 2 charts in the latest Premium Insights. 6 days after our 2nd AUDUSD long hit its final target for a +200-pip gain, and 8 weeks after our existing GBPUSD hits 300 pips (final target at 1.6180) our Premium clients ask the question. With our existing EURAUD short currently netting +120 pips, we revisit these currencies. Tonight's release of the May Aussie retail sales may show a slight slowdown but the release of the May building approvals is expected to show an increase/improvement on both the month/month and year/year series. All our existing trades and charts are in the latest Premium Insights.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (MAY) (m/m) | |||

| 0.0% | 0.2% | Jul 03 1:30 | |

| Building Approvals (MAY) (m/m) | |||

| 3.1% | -5.6% | Jul 03 1:30 | |

| Building Approvals (MAY) (y/y) | |||

| 8.0% | 1.1% | Jul 03 1:30 | |

USD Finding It Easier on the Downside

Plenty of good and bad headlines have hit the US dollar in the last month but the larger moves are on the negative news. The Australian dollar was the top performer while the yen lagged on Tuesday as risk trades rallied. The Aussie will stay in the spotlight with trade balance later.

Manufacturing and US auto sales vied for the spotlight on Tuesday. The ISM manufacturing index was at 55.3 compared to 55.9 expected but new orders rose to the highest since December. Meanwhile, June auto sales numbers were blockbuster, erasing all the crisis losses and climbing to a 16.9m annual pace from 16.3 expected.

The news was mixed but the market wasn't. The clear reaction was to sell the US dollar. The main beneficiaries were cable (5-year high), AUD/USD (7 month high) and CAD (5 month high). The momentum trade and a beginning of quarter flows were part of the reason but it's not a new phenomenon. The US dollar has been unable to react to good news since Q1 GDP revisions and traders need to be cautious with ADP, NFP and ISM services due.

Yesterday we wrote about the bullish case for the RBA decision and the upbeat technical setup in AUD/USD yesterday and the pair delivered with a surge to the highest since November. The pair closed narrowly below 0.9500 but could get a boost from trade balance at 0030 GMT. Alternatively, the USD side of the equation is a risk with ADP employment due Wednesday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance (MAY) | |||

| -122M | Jul 02 1:30 | ||

| ISM Prices Paid (JUN) | |||

| 58.0 | 60.3 | 60.0 | Jul 01 14:00 |

| ADP Employment Change (JUN) | |||

| 205K | 179K | Jul 02 12:15 | |

RBA, Tankan and China PMI Welcome Q3

Cable ended the quarter at the highest levels since 2008 as the US dollar slumped. On the day the Swiss franc was the leader while the kiwi lagged. The RBA decision and Japanese Tankan are major events to start Q3.

The Asia-Pacific calendar is filled with risks that could set the stage for Q3 and beyond. The first is at 2350 GMT when the Q2 Japanese Tankan is released. Measures of manufactures, capex and expectations are all key for the BOJ as officials mull whether to unleash more QE.

So far the economy has navigated the higher consumption tax without any hiccups. Signs of a continued smooth ride might eliminate the chance of QE and pull USD/JPY toward 100.00.

Next is the Chinese official manufacturing PMI at 0100 GMT. The consensus is for a rise to 51.0 from 50.8. The market didn't initially cheer the strong manufacturing numbers in the HSBC survey last week but confirmation and a fresh calendar could spur a larger reaction.

We fear AUD/USD traders are complacent ahead of the RBA decision at 0430 GMT. The market is looking for more of the status quo as the RBA plays a game of wait-and-see but there's a small chance of a hawkish surprise. Although employment was soft last month there are better signs on investment and CPI, plus China may be turning a corner.

Technically, AUD/USD rebounded once again Monday and remains close to the April high of 0.9461. A break could signal a renewed round of Australian dollar excitement and jawboning from Stevens is almost powerless to halt AUD gains.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Chicago PMI | |||

| 62.6 | 63.0 | 65.5 | Jun 30 13:45 |

| Markit Manufacturing PMI (JUN) | |||

| 57.5 | Jul 01 13:45 | ||

| ISM Manufacturing PMI (JUN) | |||

| 55.9 | 55.4 | Jul 01 14:00 | |

| Nomura/ JMMA PMI Manufacturing (JUN) | |||

| 51.1 | Jul 01 1:35 | ||

| SVME - PMI (JUN) | |||

| 52.9 | 52.5 | Jul 01 7:30 | |

| PMI (JUN) | |||

| 50.8 | Jul 01 1:00 | ||

| PMI (JUN) | |||

| 49.4 | Jul 01 1:45 | ||

| Tankan Non - Manufacturing Index (Q2) | |||

| 19 | 19 | 24 | Jun 30 23:50 |

| Tankan Large Manufacturing Index (Q2) | |||

| 12 | 15 | 17 | Jun 30 23:50 |

| Tankan Large Manufacturing Outlook (Q2) | |||

| 15 | 17 | 8 | Jun 30 23:50 |

| Tankan Non - Manufacturing Outlook (Q2) | |||

| 19 | 21 | 13 | Jun 30 23:50 |

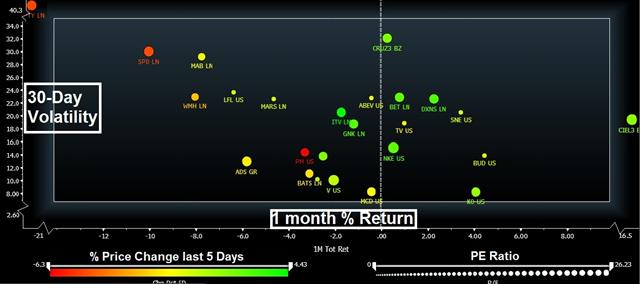

Our World Cup Companies’ Performance

Here is a June Return/Volatility matrix in of our chosen 25 companies deemed to benefit from the World Cup, with parameteres for PE & 5-day price performance. Full analysis & charts.

Quarter Ends, CAD Shorts Squeezed

The market is search for a theme in early trading. Early week moves have been miniscule, last week's best performers were NZD and CAD while the US dollar lagged. Weekly positioning data showed a rush out of Canadian dollar shorts. A brand new edition of the Premium Insights will be issued tomorrow.

The week ahead may be treacherous due to a holiday-shortened week that includes the ECB decision and non-farm payrolls but it's a different risk in the day ahead. Monday is the final day of the month and quarter and that invites unusual flows.

Bonds, stocks and gold all performed well in the quarter and could attract quarter-end window dressing trades that are likely to reverse due to rebalancing in the days ahead.

On the fundamental side the question hanging over markets is the strength of the US economy. There were positive and negative signs last week but the most outsized reaction came after a small miss in US personal spending. That shows the headline risks are more towards fear rather than optimism.

On the weekend, Japanese PM Abe wrote an op-ed in the FT. The aim of the commentary was to boost confidence in reforms, which he said ramped up this month. He touted employment improvements and brushed aside demographic concerns.

The first report of the week to watch is Japanese May industrial production at 2350 GMT. The consensus is for a modest +1.5% y/y increase but unless the numbers are far out of line, the market is unlikely to react.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -58K vs -62K prior JPY -71K vs -68K prior GBP +50K vs +53prior AUD +33vs +27 prior CAD -5 vs -21 prior CHF -5 vs +4prior NZD +6 vs +4 prior| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (m/m) | |||

| -0.7% | 1.7% | Jun 29 23:50 | |

| Industrial Production (m/m) | |||

| 1.5% | -2.0% | Jun 29 23:50 | |

| Industrial Production (m/m) [P] | |||

| 0.5% | 0.9% | -2.8% | Jun 29 23:50 |

Quarter Ends, CAD Shorts Squeezed

The market is search for a theme in early trading. Early week moves have been miniscule, last week's best performers were NZD and CAD while the US dollar lagged. Weekly positioning data showed a rush out of Canadian dollar shorts. A brand new edition of the Premium Insights will be issued tomorrow.

The week ahead may be treacherous due to a holiday-shortened week that includes the ECB decision and non-farm payrolls but it's a different risk in the day ahead. Monday is the final day of the month and quarter and that invites unusual flows.

Bonds, stocks and gold all performed well in the quarter and could attract quarter-end window dressing trades that are likely to reverse due to rebalancing in the days ahead.

On the fundamental side the question hanging over markets is the strength of the US economy. There were positive and negative signs last week but the most outsized reaction came after a small miss in US personal spending. That shows the headline risks are more towards fear rather than optimism.

On the weekend, Japanese PM Abe wrote an op-ed in the FT. The aim of the commentary was to boost confidence in reforms, which he said ramped up this month. He touted employment improvements and brushed aside demographic concerns.

The first report of the week to watch is Japanese May industrial production at 2350 GMT. The consensus is for a modest +1.5% y/y increase but unless the numbers are far out of line, the market is unlikely to react.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -58K vs -62K priorJPY -71K vs -68K prior

GBP +50K vs +53prior

AUD +33vs +27 prior

CAD -5 vs -21 prior

CHF -5 vs +4prior

NZD +6 vs +4 prior

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (m/m) | |||

| -0.7% | 1.7% | Jun 29 23:50 | |

| Industrial Production (m/m) | |||

| 1.5% | -2.0% | Jun 29 23:50 | |

| Industrial Production (m/m) [P] | |||

| 0.5% | 0.9% | -2.8% | Jun 29 23:50 |