Intraday Market Thoughts Archives

Displaying results for week of Nov 03, 2019Cracks Appear in Trade Deal

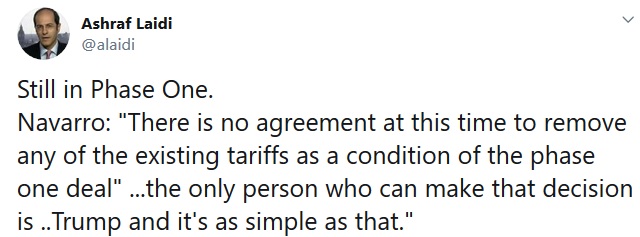

The US-China trade deal may be pushed back with sides struggling to agree on a location, and more likely on the contents of an agreement. On Friday, US indices moved further away from their highs after pres Trump told reporters the US has not agreed to roll back tariffs on China (more below). The US dollar ends the week higher against all currencies as gold and silver were pummeled relative to coppper in a sign of growing optimism. Some key market levels are outlined below.

US-Chinese disagreements about the location of signing the trade deal appear to be the least of traders' concerns at this point.

Those Market Levels

Fundamentals apart, XAUUSD broke below the 1480 horizontal base, now attempting to a hold above the 1455 (prev resistance extension). A break below it, risks dragging it to 1429. US 10 year yields broke the 2-month trend line resistance, paving the way for a required breach of 1.95% in order for the 3-month uptrend to remain intact. Similarly, USDJPY faces trendline resistance at 110.10, but only after a confirmed close above 109.55.With regards to indices, we were stopped out of 2 shorts in indices after 5 consecutive trades hit their targets (4 shorts and 1 long). In this week's video, we mentioned an upside target, which was hit. Next week, the Premium Insights will be the time to act on that rationale and formulate a trade for it. Stay tuned.

The yield curve is further steepening after a brief inversion, which helps explain the records in US indices. The Fed wants to stay out of the conversation, leaving the US-China trade talks approach a positive compromise. Said differently, the Fed aims at returning to a phase where it makes minor changes to its assessment and no changes in rates. Such would be the ideal scenario for stocks. The only issue, is whether the world (and US) economy manage to shake off their pockets of weakness and if stocks avoid another round of VIX indigestion. Watch the sectors and their technicals--The leaders vs the laggards --the defensives vs cyclicals.

https://twitter.com/alaidi/status/1192832427401580544

Don't Overinterpret the News

Be careful out there. Do not immediately jump into shorting after each and every not-so positive headline from the US-China talks. US indices pushed to fresh new highs as both sides agreed to roll back tariffs. We have yet to get a confirmation from the US. We argued in this week's English and Arabic Premium videos against rushing into trades, highlighting our suggested entry level in terms of price and time.

The Negative

On Wednesday afternoon US time, reports emerged that the US-China trade deal may be pushed back with sides struggling to agree on a location, and more likely on the contents of an agreement. Some said the agreeing on the location of the US-China trade deal signing could be the canary in the coalmine. The latest reports say China has refused Trump's proposal to have a ceremony in the US.This would have seeming been an easy thing to give up for Beijing but Xi must be wary of a last-minute surprise by Trump or by being used as an election prop. Now reports say there are proposals for a meeting in Europe.

Worse is a Reuters report saying that the deal may not get done until December. Until this week, markets were fed a steady diet of politicians saying the deal was virtually done. That goosed risk assets but now it appears there are more than just scheduling and location problems.

China is demanding the removal of Sept 1 tariffs and perhaps others in exchange for deal. On their side, they have moved to protect intellectual property and on Thursday there was the announcement of a joint prosecution on fentanyl; an issue the US has tied to a deal.

Yet it's tariffs at the heart of the trade deal and the market is beginning to worry. AUD/JPY traded at the lows of the week on Thursday after the rally in the trade-sensitive pair stalled well-ahead of the 200-dma.

The Positive

Still, the market remains decidedly optimistic. Pushing back a deal a few weeks isn't itself a problem but if there are any further signs of a breakdown, the market's patience will be exhausted. Also seeming to help sentiment, is China's announcemen of high-profile convictions to cut the illegal flow of fentanyl opioid to the US.A good example of how much trade is dominating the market is AUD this week. The news has been good and that extended to Thursday when the Sept trade surplus jumped to $7180m compared to $5050m expected. The prior was also revised higher. Lately, trade numbers have been showed falls in both imports and exports but they both rose 3% in Sept in Australia. Yet a 10-pip rally was wiped out in minutes and it's a laggard again today.

China Funds Thru Euros

China borrowed in euros for the first time in 15 years on Tuesday as President Xi signaled increasing cooperation with France. The euro lagged on the day while the Australian dollar led the way. Odds of an RBNZ rate cut next week rose after a small miss in jobs numbers. Speeches today from Fed officials include Chicago Fed's Evans, New York Fed's Williams and Philadelphia Fed's Harker. EIA oil inventories are later in the afternoon. Where is the next high for stock indices? If you're still short and partly hedging them, at which point would you close the longs? All this in the detailed Premium video below.

China sold euro-denominated bonds for the first time since 2004 in a quiet move that is highly significant and telling. The sale was only for four billion dollars of 7, 12 and 20-year bonds but there was extremely high demand, around 20 billion euros worth. With that, the bonds priced about 20 basis points below China's initial target, according to a report.

The move is the culmination of a handful of factors. For FX traders, the big one is that the euro is increasingly the preferred funding currency. Rates are as low as Japan but without the same levels of indebtedness and without the risk of a single government.

It also signals the increasing cooperation of China and Europe. Macron and Xi met on Wednesday and the Chinese President touted multilateralism and pushing relations to a new level. Italy has embraced the belt-and-road initiative.

Finally, it signals China's efforts to diversify its FX and economic exposure away from the US. While it underscores the decoupling theme, it also highlights the battle for Europe and the old institutions like the WTO.

With this demand and the near-certainty that eurozone rates will remain pinned to the floor, expect more countries and corporates to issue euro-denominated debt and promptly invest it elsewhere. That will keep the downward pressure on the euro, but could also give it further positive potential during risk-off phases.

Early in Asia-Pacific trading, New Zealand Q3 unemployment rose to 4.2% compared with 4.1% expected. Average hourly earnings rose 0.6% compared to 1.0% y/y expected. That miss pushed the odds of an RBNZ rate cut next week to 60% from 54% and mildly weighed on the kiwi.

Will US Concede to China's Tariffs Demands?

US indices extend to new highs, but a late push by China to remove tariffs in order to complete a Phase One trade deal may have cornered Trump. The Australian dollar got a lift as the RBA settled into a comfort zone. The crucial ISM non-manufacturing index is up next (more on this below). USDCNY regains 7.0, while XAUUSD nears the 1482 support, a break of which could call up 1471 (100 DMA). With the DOW30 breaking our 27530 stop, where is the next high? What is the next course of action. If you're hedging your shorts with partial longs, at which point to close the longs? All this in this evening's detailed Premium video (after the NY close).

قمة الداو جونز القادمة (فيديو المشتركين)

China is pressing the US to remove Sept 1 tariffs as part of a trade deal, according to multiple reports on Tuesday. Top US officials are debating whether to make the concession as part of the phase one trade deal. The report says the US wants more on IP protection and enforcement along with a signing ceremony in the US in exchange. The latter point may be the area to watch because revelations about a signing location could come before a deal announcement.

Yen crosses and risk trades rose on the reports but they're not necessarily good news. The market has 99% priced in a deal and China pressing on such a key point so late suggests there is still the risk of a blowup. USDJPY is back to where it was before the FOMC meeting.

China has undoubtedly been listening to a bevy of US officials who have touted how close a deal is and watched markets rise in anticipation. That talk may have cornered US officials into bending on final requests from Beijing. At the same time, Trump has already shown he's not afraid of a U-turn, so there is a risk that China overplays its hand.

Overall, this report alone is no reason to fight the optimism in markets but if signs of strain mount in the days ahead, then we could see an abrupt revesal.

Looking ahead, the October ISM manufacturing index is a key risk in New York trade. The consensus is for an improvement to 53.5 from 52.6 previously. An unexpected bump would help to cement the momentum in risk trades and yen crosses.

Dow Joins SPX Record, Asia Fault Lines Sharpen

The ASEAN summit in Thailand isn't going to get the headlines it deserves but 16 south east Asian nations agreed to the text of massive trade deal in an area that will be at the heart of the trade war. DOW30 joins SPX500 to to new highs a, helped by Chevron and Intel, while Friday's US jobs reports maintained the goldilock thesis for the economy and interest rates. Comments from US officials that Chinese firms would be granted licences to purchase from the US helped sentiment, but a formal announcement has yet to be made. CFTC positioning showed dollar net longs at the narrowest since June 2018 and GBP net shorts tumbled by the biggest percentage in 5 months. Markets turn to Christine Lagarde's first official speech in her capacity as ECB president at 17:30 London time.

South east Asia is where the trade war will be fought and China made a major advance on the weekend as the group concluded the text of a market access deal called RCEP. A telling moment came in a meeting with Chinese Premier Li and Australian PM Morrison. Australia's finance minister recently had harsh criticism about Chinese human rights and Australia also accused China of cyber espionage on its parliament and three largest political parties. Yet both sides were all smiles.

China has been increasingly retributive in the face of criticism but for Australia, it turned the other cheek. China also agreed to a new comprehensive free trade agreement with New Zealand. It's all part of a push to shore up trade ties in the Indo-Pacific.

The US is undoubtedly watching. Indices were alse helped by comments from US Commerce Sec Wilbur Ross that licenses for US companies to sell to Huawei were expected 'shortly'.

After the conclusion of the talks, Trump invited ASEAN leaders to the US for a summit. At the moment, the market is cheering a US-China trade truce. In the short-term that's likely to continue as risk assets break out and USD/CHF falls to a two-and-a-half month low. The sense right now is that the truce will last until the US election.

In the bigger picture, both sides are angling for a long-term economic battle and south east Asia is the area to watch as the US pits its military, cultural and historal power against China's geographic and economic advantages.

If countries like Australia and New Zealand can parlay their importance into better trade deals and open market access to both countries, they will be the winners. That could come crashing down if they're forced to choose sides.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -53K vs -51K prior GBP -32K vs -52K prior JPY -20K vs -18K prior CHF -12K vs -11K prior CAD +44K vs +33K prior AUD -40K vs -48K prior NZD -40K vs -40K prior

The fall in cable shorts was the story even though the pound was virtually unchanged during the week ending Tuesday. That said, heading to the sidelines during any highly-charged election is prudent. If/when there are inevitable polling blips, there will be outsized reactions. It's tough to get an edge in that situation. At the same time, the fall in shorts may also reflect a collective belief that on Dec 13, Conservatives will wake up with a stronger majority.

The other notable change is the rise in CAD longs. Again, it demonstrates the importance of politics today. The rise in longs comes after the fog was lifted on the election and left what looks to be a stable minority for Trudeau.

In the bigger picture, the overall USD net long is now at the narrowest since June 2018.