Intraday Market Thoughts Archives

Displaying results for week of Oct 30, 2016Risk Aversion Remains, UK Courts Controversy

US election worries ebbed on Thursday but remain the dominant theme. The pound was the top performer after the BOE and a lower UK court ruled May can't unilaterally declare Article 50. Australian retail sales are due up next. The Premium trade in US Crude was closed at 44.90 after opening the short at 48.10. The Dax trade is currently +420 pts in profit.

The market is struggling to price in the chances of a surprise Trump win. Betting sites now him at nearly a 33% probability but market pricing is much lower as traders continue to scrutinize the electoral map and the gambit that Trump will need to run.

US dollar trading was calmer but USD/JPY fell a quarter cent and the S&P 500 was lower for the eighth consecutive day. Oil had declined 10% in a week. Ashraf's Premium Insights has a short in USDJPY from 103.70.

Economic data was mixed. The ISM non-manufacturing PMI was at 54.8 compared to 56.0 expected. That's down from 57.1 previously but still at a healthy level.

Factory orders rose 0.3% compared to 0.2% expected. Initial jobless claims ticked higher to 265K compared to 265K expected; and Q3 nonfarm productivity rose 3.1% versus 2.1% expected as it broke a streak of three consecutive quarterly declines.

The trade remains reacting to the election headlines but we warn there is a high chance of risk aversion on Friday. There are rumours about a possible Wikileaks bombshell on Saturday and that's the kind of thing that would lead to a gap down in risk trades Monday. We think traders will be inclined to safety before the weekend.

The big market mover in Thursday trade was the pound as it rose more than 160 pips. Carney warned that the weak pound will drive inflation and the chance of another BOE cut in the next six months sank. UK courts added another element of uncertainty with a ruling that triggering Article 50 requires parliamentary approval. That will be quickly appealed to the Supreme Court but if it's upheld could ultimately open the door to a reversal in the referendum via another election or a second referendum.

Up next, the Australian dollar is in focus at 0030 GMT with the Q3 retail sales release. Sales are expected to rise 0.4% m/m.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Services PMI | |||

| 54.5 | 52.5 | 52.6 | Nov 03 9:30 |

| Final Services PMI [F] | |||

| 54.8 | 54.8 | 54.8 | Nov 03 13:45 |

| ISM Non-Manufacturing PMI | |||

| 54.8 | 56.2 | 57.1 | Nov 03 14:00 |

| Challenger Job Cuts (y/y) | |||

| -39.1% | -24.7% | Nov 03 11:30 | |

Market Priorities Crystalized

The past two days of trading leave us with no doubt that the overwhelmingly dominant market driver at the moment is the US election. We explain why. The New Zealand dollar was the top performer while the US dollar lagged. Australian trade balance is due later. 2 NZD Premium trades were stopped out, 2 NZD trades remain in progress and the Dow30 trade was locked in at a 295-pip gain.11 Premium trades remain in progress.

The FOMC statement was the talk of markets leading into the decision but the result was largely a dud. The US dollar rose around 25 pips across the board as the Fed tweaked inflation language to something slightly more hawkish.

The Fed removed references to inflation remaining low in the short term and noted that wages have moved up. Those looking for a clear nod to a December hike were left in suspense and that isn't a surprise. If the Fed had repeated last year's semi-promise to hike “at the next meeting,” then they would be stuck making a similar promise every time they planned to hike.

The closest they came to offering a nod to December was adding the word “some” to the line saying they're going “to wait for some further evidence” of economic progress before hiking. The implication is that they only need another month of economic data that isn't terrible and they will hike.

What's most important is the market reaction. It was minimal. In Fed funds, the probability of a December hike remained unchanged at 78%.

Instead, the market continued to focus on the US election. Despite a small bounce on the Fed, USD/JPY finished another 75 pips lower. The market's priority is clearly the election and that's the lens to filter news. When non-farm payrolls rolls around, it matters less whether it impacts Fed policy than the risk it impacts the White House.

In the short term, we struggle to see a scenario where the jitters we highlighted yesterday fade before election day. Instead, look for continued gains in the Swiss franc, yen and euro on an smidge of Trump-supportive news.

Looking abroad, the next release is the 0030 Australian trade balance report. It's expected to show a $1.7B deficit. At 0145 GMT, the Caixin China services PMI is out. The prior was 52.0. Again, expect these releases to be quickly forgotten is politics dominates.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance | |||

| -1.71B | -2.01B | Nov 03 0:30 | |

| Final Services PMI [F] | |||

| 54.8 | 54.8 | Nov 03 13:45 | |

| ISM Non-Manufacturing PMI | |||

| 56.2 | 57.1 | Nov 03 14:00 | |

| PMI | |||

| 52.5 | 52.0 | Nov 03 1:45 | |

| Eurozone Spanish PMI Manufacturing | |||

| 53.3 | 52.7 | 52.3 | Nov 02 8:15 |

| Eurozone Final PMI Manufacturing [F] | |||

| 53.5 | 55.3 | 53.3 | Nov 02 9:00 |

This Can’t End Well

The first trading day of November ended in angst and, if anything, it's a surprise to us that it hasn't been worse. The Swiss franc was the runaway top performer while the British pound and US dollar lagged. New Zealand jobs are due up next. The short AUDJPY Premium trade was stopped out at 80.50, shortly before sliding nearly a 100 pips. Another AUD trade remains open and in progress. 3 of the 4 trades in indices are over 150 pts in the green.

(فيديو للمشتركين فقط) الأسواق تهتز و ترامب يقترب لكلنتون

Risk aversion was the theme in New York trading as the S&P 500 fell 14 points to close at the worst level since July. The winners were the yen, euro and Swiss franc while the US dollar lagged. Gold and silver had the best day since the Sep 21 Fed meeting. Does that say something about tomorrow?

The rally in the Swiss franc in particular was notable as it came despite comments from Jordan who said the two pillars of SNB monetary policy are negative rates and FX intervention. EUR/CHF broke below support near 1.08 to the worst levels since the Brexit aftermath.

To us, the flight to Swiss francs screams of political risk. There is a small but rising tail risk that Donald Trump wins the election. He still has a brutal electoral map to overcome but the FBI investigation has clearly reinvigorated his supporters and given him momentum, something the latest polls confirm.

In the next day or two, we will get far more polling data from the post-FBI period and a further swing to Trump will cause some major jitters. Also worrisome is that she narrowly wins and Trump doesn't conceded. At best, it seems she will inherit the White House under a cloud of suspicion, not trusted and disliked.

Hawkish talk in the Fed decision may spark US dollar buying but there is a good chance any bounce is sold on election fears. Even position squaring could weigh on the US dollar, which is held at the most net-long since January.

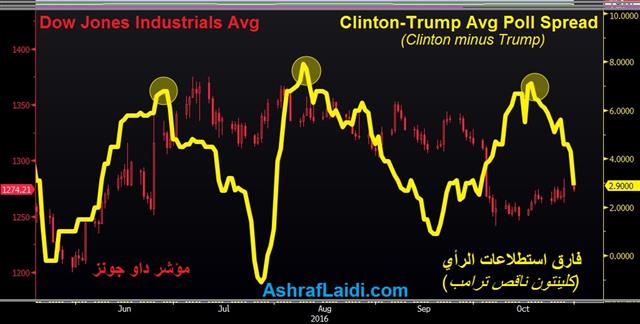

Taking a step back, the price action today is a microcosm of the kind of we may see if Trump wins. The dollar will hold its own against commodity currencies and the battered pound but will fall against the euro and yen.

If somehow the political situation would calm, economic data shows the US in relatively good shape. Despite some poor regional numbers, the ISM manufacturing index was at 51.9 in Oct, up from 51.5 in Sept. The negative news was in construction spending, which was at -0.4% compared to +0.4% expected. That sets the stage for a small downgrade in Q3 growth.

Looking ahead, the first number on the agenda is NZ Q3 employment expected to rise 0.5% q/q.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| AIG Performance of Manufacturing | |||

| 50.9 | 49.8 | Oct 31 22:30 | |

| Employment Change (q/q) | |||

| 0.6% | 2.4% | Nov 01 21:45 | |

Gold & Silver's Trump Rally

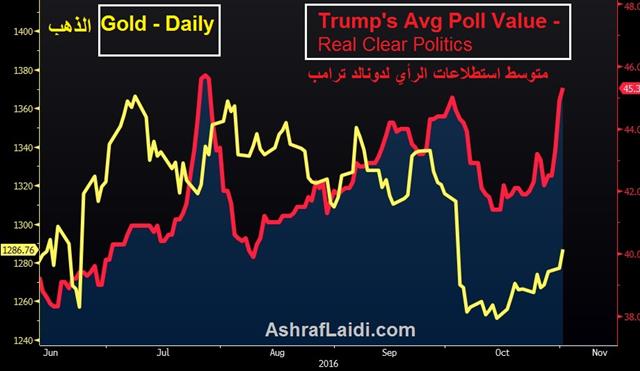

Gold and silver are having their biggest daily gain since the Sep 21 Fed decision, aided by a broadening lead for Donald Trump in most national polls. According to the latest Washington Post-ABC News Tracking Poll, Trump is leading by 1 point as Clinton's support dwindles following the FBI's renewed look at her emails. Gold has regained its 200-DMA, eyeing the previous support of 1300-3, while silver attempts targets 18.60 as it climbs out of the handle part of the Cup-&-handle formation. Both metals are among the existing trades in the Premium Insights, covered most recently in yesterday's Premium Video.

Oil Slumps, RBA, BoJ next

November roars to life in the day ahead with the RBA and BOJ decision on deck. It comes after a sharp fall in oil to end October and the Fed decision looming for Tuesday. We also take a look at November seasonals. The short oil trade in the Premium Insights held since Sep 30 is now in a 105 pt gain. There are also 2 CAD-related trades. The Premium Video below covers the existing trades.

The market understandably ignored US economic data on Monday with so much on the upcoming calendar but the numbers were mixed. On the downside, the Chicago PMI slumped to 50.6 compared to 54.0 expected. On the positive side, personal spending rose 0.5% in Sept compared to 0.4% expected. PCE core inflation was in-line with estimates at 1.7% y/y.

Cable finished a dismal month with a 60 pip gain. Much of it came in a flurry ahead of the London close in what looked like month-end demand but news that Carney will stay until June 2019 was also positive. That's not as long as his full that expires in 2012 but it's longer than the 2018 rumored exit and it will allow him to guide central bank policy through the Brexit.

Oil was the big mover on the day as WTI crude fell 4% to wipe out the monthly gain. Diminishing chances of an OPEC deal as Iran and Iraq look for exemptions hurt prices along with news that OPEC pumped at record rates in October. November is the second-weakest month on the calendar over the past decade for oil and the past two years were especially poor with declines in excess of 10%.

Given that, it's no surprise that November is also a weak month for CAD. Other notable seasonals are that cable traditionally struggles in Nov and EUR/GBP tends to be strong. It's generally a good month for the US dollar and a middling month for stocks, although the S&P 500 has gained in four straight years.

Looking ahead, the RBA and BOJ decisions are both due in the hours ahead. Policy moves are a longshot with no chance of a BOJ change priced in and just a 5.3% likelihood of an RBA move. The BOJ is still rolling out its yield-curve control policy so we don't look for a surprise there but we are always cognizant of Kuroda's love for a surprise and that it's been exactly 2 years his Oct 31, 2014 shock QE announcement. The RBA is out at 0330 GMT and the BOJ in the usual 0230-0330 GMT range, likely at the front end if there are no surprises.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Chicago PMI | |||

| 50.6 | 54.1 | 54.2 | Oct 31 13:45 |

| Final Manufacturing PMI [F] | |||

| 53.3 | 53.2 | Nov 01 13:45 | |

| ISM Manufacturing PMI | |||

| 51.8 | 51.5 | Nov 01 14:00 | |

Clinton-Trump Spread Hit Further

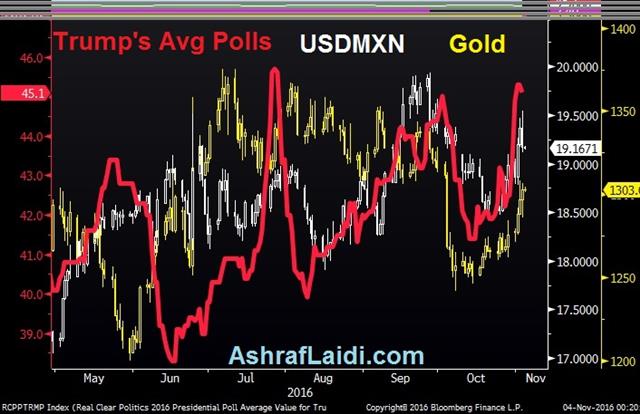

Clinton's lead over Trump in opinion polls hit a 3-week low after the FBI announced to re-open the investigation into Clinton's emails. The late Friday selloff in USD and equities was noticeable. Although the chart shows polls by Real Clear Politics, several polls, such as the ABC/Washington Post indicate a 1-pt lead for Trump. Reports of New Hampshire polls showing a 2-pt lead for Trump. The positive relationship between Clinton's eroding lead and falling US stocks has especially strengthened as the focus shifts from a fading Clinton lead to rising Trump support.

Clinton and Carney Crunch Time

The US election entered its final phase Friday as the FBI reopened its investigation into Hillary Clinton's emails in a move that sparked risk aversion. The early moves in markets have been light but there is a focus on GBP on conflicting rumours about Carney's future. CFTC positioning showed a further move out of the euro, which was the top performer last week. The EURCAD long in the Premium Insights has been closed at 1.4730 for 270-pt gain for now, before considering re-entry later this week.

US election news are now inescapable and market moving. Clinton's chances of winning diminished to some degree on new suspicions of inappropriately handling emails. She remains a favorite but with the surprise Brexit vote fresh on the minds of traders, expect many to move to the sidelines ahead of Nov 8. Such a move could weigh on stock markets, emerging markets and dampen risk sentiment. Commodity currencies, especially CAD and MXN remain vulnerable. We're also at the point where polls are increasingly market moving.

In the UK, the press stirred on a Times report that Mark Carney would announce a 2018 exit before Thursday's BOE Minutes. That was counteracted by the FT on Sunday who reported that Carney is likely to stay on until his term expires in 2021.

At the moment, all UK risks are skewed negatively. If he leaves it adds yet another level of uncertainty into GBP and expect it to be sold. If he stays, it could spark some short covering but we have seen those bounces fade time and time again.

We remain on high alert on politics this week. Other bad news came from South Korea where the government is on the verge of collapse. There was good news, meanwhile, in Spain where Rajoy won parliament's backing and in Brussels where Canada and the EU signed the CETA agreement.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -124K vs -109K prior JPY +45K vs +37K prior GBP -84K vs -91K prior CHF -19K vs -16K prior AUD +32K vs +30K prior CAD -13K vs -14K prior NZD 0K vs 0K prior

The euro net short is at the most extreme since January and it ramped up last week in what was a solid week for the single currency. If the US election were disputed, unclear or led to violence, the US dollar will still benefit on some fronts but the yen and (to some extent) the euro may rally.