Intraday Market Thoughts Archives

Displaying results for week of Aug 30, 2015Yields vs Stocks & the Fed

The widely anticipated US August jobs report headlined with a disappointing 173k increase in nonfarm payrolls (lowest since March). The silver lining was in the 44k upward revision of the previous two months and the decline in the unemployment rate to fresh seven-year lows of 5.1% from 5.3%. The decline 41K decrease in the labour force was too small to reduce the participation rate, which remained unchanged at 62.6%.

Average hourly earnings rose by a 5-month high of 0.3% m/m and 2.2% y/y in August. Both series are above their 3-month average, but they remain far below their 2007 highs of 0.6% m/m and 4.0% y/y. Some economists deem the rates as disappointing given the notable increases in minimum wages.

Are both the establishment and household surveys strong enough? Fed hawks require continued evidence of tightening labour markets at a time when the inflation mandate remains undershot. The evidence was obtained in the unemployment rate but not in non-farm payrolls. Renewed decline in energy prices will further drive inflation below the Fed's goal while jobs continue to offer low-paying employment.

Don't forget the Fed's other goal

Aside from the Fed's goal price stability and maximum employment, its3rd goal is to preserve financial system stability. A 10% decline in most US indices off their highs is no tragedy, neither is a 16% decline in Germany's Dax-30 or a 26% plunge in the Hang Seng Index. But tightening of financial market conditions becomes an issue when the borrowing environment becomes treacherous. We're not only talking about energy debtors, but all-sector high yield debt, which is at its worst measure since 2011 when using 10-year junk spread.Asian corporate spread is also on the rise. After reaching 8-month highs back in January, Asian spreads are back up near 7-month highs. USD-based debt gone turned highly expensive is part of the problem. Relying on demand from a slowing China is another.

Fed's 1998 Backtrack

For those who claim the Fed is and should be focused on domestic issues and ignore China, think again. In spring 1998, the Fed was mulling a rate hike as US GDP growth was at 14-year high s and CPI was stabilizing. But as the 1997 emerging market route spiralled into a crisis from Brazil to Russia and Hong Kong in 1998, the Fed was forced to cut rates in Sep, Oct and Nov of that year. The collapse of LTCM also helped. Today, US growth remains subpar and the exogenous risks are considerable.

Back in the US, financial market stability is not exactly an ocean of calmness. But the rise in high-yield spreads and escalation in the VIX will grow more notable.

Finally, the uncharacteristically high level of US 10-year yields relative to the recent declines in US equity indices raises the following question: “If China were not selling treasuries to prevent CNY declines, then how low could yields be?” And if stocks continue to plummet (expect another 7% from today's close in US indices), then the relative relationship between indices and yields should reveal less tightening.

The above chart highlights the declining SPX/Yields ratio, suggesting that it's a matter of time before yields catch-down with stocks, regardless of whether the Fed raises rates or not. Earlier in the year, stocks were seen as too high relative to yields. Things have changed, but this too, will be temporary.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Change in Nonfarm Payrolls (AUG) | |||

| 173K | 217K | 245K | Sep 04 12:30 |

| Change in Manufacturing Payrolls (AUG) | |||

| -17K | 5K | 12K | Sep 04 12:30 |

| Change in Private Payrolls (AUG) | |||

| 140K | 204K | 224K | Sep 04 12:30 |

| Unemployment Rate (AUG) | |||

| 5.1% | 5.2% | 5.3% | Sep 04 12:30 |

| Average Hourly Earnings (AUG) (m/m) | |||

| 0.3% | 0.2% | 0.2% | Sep 04 12:30 |

| Average Hourly Earnings (AUG) (y/y) | |||

| 2.2% | 2.1% | 2.2% | Sep 04 12:30 |

Cable Stuck in Reverse

GBP/USD fell for the eighth consecutive session on Thursday to match the longest losing streak in six years. The New Zealand dollar was the best performer while the euro lagged on dovish signals from Draghi. Asian-Pacific trading features data on Japanese wage inflation. A new Premium note has been issued in the aftermath of the ECB-driven selloff and ahead of Friday's NFP.

Cable is in the midst of the longest decline since April 2008. At just under 500 pips, it's by no means the most dramatic fall but the uninterrupted duration of the decline bears a closer look.What stands out is that very little has changed in the UK outlook. Notable economic data in that period included a better GfK consumer confidence report and solid Q2 GDP.

A trifecta of disappointing UK PMIs (construction, manufacturing and services) further pushed away BoE hike expectations.

Another reason is related to PM David Cameron's compromise over the referendum question on Britain's EU membership. The question would no longer ask whether Brits wanted to remain or exit the EU, which would have a "yes" or "no" answer, but become two questions; asking whether people wanted to leave or remain. The "No" camp believes the new approach carries less negative connotations associated with leaving the EU.

Also weighing on the pound was a survey for Scottish broadcaster STV by Ipsos Mori showing most Scots would back independence from the UK if there were another referendum today.

The pound remains a desirable currency in a country that's outgrowing its peers. A dip like this beckons for opportunism and the June lows near 1.52 present a support level worth watching.

But the main event most were watching today was the ECB. Ashraf stressed how Draghi used it to cap the euro. For the remainder of the year, ECB meetings will be 'live' in the sense that Draghi could signal more QE or other measures at any time.

Another standout from the ECB was how Fed funds futures fell to a 30% of a hike from 38% beforehand. That was despite ISM non-manufacturing beating estimates at 59.0 vs 58.2 expected. The lowered Eurozone growth forecasts are something the Fed will note but Draghi's broader concern about emerging markets is probably a larger factor.

Up next is the July Japanese report on labor cash earnings at 0130 GMT. It's expected to show a +2.0% y/y gain after a 2.4% drop in the previous month. Signs of wage inflation would curb the chance of BOJ easing and increase our confidence in the USD/JPY top.

More important in the near-term is Friday's non-farm payrolls report. The market has grown complacent about jobs with estimates tightly bunched around 200K. Ashraf notes that August is historically one of the best bets for a disappointing report. The best trade on a miss would be selling USD/JPY, at least on the kneejerk.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit US Services PMI (AUG) [F] | |||

| 56.1 | 55 | 55.2 | Sep 03 13:45 |

| Markit US Composite PMI (AUG) [F] | |||

| 55.7 | 55 | Sep 03 13:45 | |

| ISM Non-Manufacturing PMI (AUG) | |||

| 59.0 | 58.1 | 60.3 | Sep 03 14:00 |

| Markit Services PMI (AUG) | |||

| 55.6 | 57.6 | 57.4 | Sep 03 8:30 |

| Nikkei Japan PMI Composite (AUG) | |||

| 52.9 | 51.5 | Sep 03 1:35 | |

| Nikkei Japan PMI Services (AUG) | |||

| 53.7 | 51.2 | Sep 03 1:35 | |

| Eurozone Spanish Services PMI | |||

| 59.6 | 59.3 | 59.7 | Sep 03 7:15 |

| Eurozone Markit PMI Composite (AUG) | |||

| 54.3 | 54.1 | Sep 03 8:00 | |

| Eurozone Markit Services PMI (AUG) | |||

| 54.4 | 54.3 | 54.3 | Sep 03 8:00 |

| ISM Non-Manufacturing Composite (AUG) | |||

| 59.0 | 58.2 | 60.3 | Sep 03 14:00 |

| Labor Cash Earnings (JUL) (y/y) | |||

| 2.1% | -2.5% | Sep 04 1:30 | |

| Nonfarm Payrolls (AUG) | |||

| 220K | 215K | Sep 04 12:30 | |

ECB Preempts Fed Inaction, PBOC Action

The ECB succeeded in weakening the euro and bund yields with an aggressive downgrade of 2015-2017 forecasts for GDP and CPI, while announcing an increase in the issue share limit of bonds included in QE purchases to 33% from 25%. The increased limit means the ECB can buy a higher share of an individual nation's bond issue, giving it more freedom of concentration in particular issues.

CPI forecast for 2015 was downgraded to 0.1% from a previous 0.3% reading, while 2016 CPI was revised to 1.1% from 1.5%. GDP forecasts for 2015 and 2016 were also downgraded to 1.4% from 1.5% and 1.7% from 1.9% respectively.

The ECB's decision to deepen (not broaden) the purchase of individual issues does not imply an increase in the size of QE but allows it more flexibility in producing results from current level of purchases. Although Draghi asserted there was no discussion on increasing QE size and cutting interest rates, the possibility for more stimulus cannot be ruled out before year-end --another reference to "We'll do what it takes".

Draghi's pre-Fed Inaction

On a day when Eurozone composite PMIs (combining services and manufacturing) hit a 4-year high, Draghi aggressive downgrade is widely designed to cushion the impact of potentially euro-boosting events such as a Fed decision hold rates unchanged later this month, further PBOC easing and fresh CNY devaluation. All of these factors are seen as euro-positive, which would further complicate the ECB's task to achieve price stability at a time of prolonged energy prices.The question on EURUSD implications remains that of relative interest rate differentials as much as it is about the reality of capital flows and further unwinding of euro-carry trades from unavoidable CNY weakness, once China's president returns home from G20 tour.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Lacker speech | |||

| Sep 04 12:10 | |||

| Eurozone ECB Interest Rate Decision (SEP 3) | |||

| 0.05% | 0.05% | 0.05% | Sep 03 11:45 |

| Markit US Services PMI (AUG) [F] | |||

| 56.1 | 55 | 55.2 | Sep 03 13:45 |

| Markit US Composite PMI (AUG) [F] | |||

| 55.7 | 55 | Sep 03 13:45 | |

| ISM Non-Manufacturing PMI (AUG) | |||

| 59.0 | 58.1 | 60.3 | Sep 03 14:00 |

| Eurozone Spanish Services PMI | |||

| 59.6 | 59.3 | 59.7 | Sep 03 7:15 |

| Eurozone Markit PMI Composite (AUG) | |||

| 54.3 | 54.1 | Sep 03 8:00 | |

| Eurozone Markit Services PMI (AUG) | |||

| 54.4 | 54.3 | 54.3 | Sep 03 8:00 |

أشرف العايدي في العربية و الأسباب الأربعة

أشرف العايدي في العربية عن الأسباب الأربعة التي تضغط على الأسترليني و تحليل اليورو قبل المركزي الأوروبي و الوظائف في الولايات المتحدة

Inflation Signs Muted

A jobs report was the headline story of the day but inflation is what matters right now and more signs pointed to subdued price pressures Wednesday. On the day the Aussie was the top performer in a rebound after breaking 0.70 while the Swiss franc lagged. Australian trade balance and retail sales are highlights along with a BOJ speech.

ADP employment was essentially in line with estimates at 190K compared to 200K expected. A similar story played out in factor orders where the headline missed by 0.5 percentage points at 0.9% but the prior was revised 0.4 pp higher.

The more intriguing reports was Q2 nonfarm productivity. It showed unit labor costs down 1.4% and real compensation falling at a 1.1% annualized pace. That's nowhere near the wage inflation the Fed expects to see materializing.

The Fed's Beige Book was similarly downbeat on inflation. It said that across all districts input and selling prices were stable or up only slightly with wages flat in most districts. These two reports strengthen our conviction that the Fed won't hike in September. Fed funds pricing of a hike has fallen to 32%.

The US dollar inched higher throughout North American trading Wednesday as risk appetite returned. But despite a nearly 2% rally in the S&P 500, EUR/USD suffered only marginal losses while USD/JPY couldn't break the Asian highs.

Looking to the hours ahead, the focus is on Australia. Trade balance and retail sales data will be released at 0130 GMT. The market is tepid on the prospect of a rate cut this year but signs of deteriorating exports and consumers could quickly change that. A trade deficit of 3.16B is expected with retail sales up 0.4% m/m.

Also at the same time, the BOJ's Kiuchi speaks and four hours later he will hold a press conference. He's the least dovish BOJ member so the chances of an endorsement for more QE are nil but his comments on the global economy could be interesting.

Finally, note that China is on holiday for the remainder of the week.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance (AUG) | |||

| $-42.40B | $-41.87B | Sep 03 12:30 | |

| Trade Balance (JUL) | |||

| -3,100M | -2,933M | Sep 03 1:30 | |

| Retail Sales (JUL) (m/m) | |||

| 0.4% | 0.7% | Sep 03 1:30 | |

| ADP Employment Change (AUG) | |||

| 190K | 200K | 177K | Sep 02 12:15 |

| Nonfarm Productivity (2Q) [F] | |||

| 3.3% | 2.8% | 1.3% | Sep 02 12:30 |

Sell in Beijing, Buy in Ankara, Sell after Lima

It's been just over three weeks since China rocked the world with its devaluation announcement, prompting fears of an ominous drop in demand from the world's biggest buyer of commodities and more important trading partner to most of the globe. The Chinese yuan depreciated by nearly 4.0% in two days before gradually gaining back 1.5% from August 12 til today. So when will we see renewed CNY weakness?

Initial Devaluation

The CNY devaluation was needed as there was no question the currency had been overvalued. The yuan had appreciated more than 10% against the US dollar between summer 2010 and winter 2014, during which China GDP slowed from 10% to 7%, exports fell from a rate of +30% to -8% and credit growth plummeted. The initial devaluation was needed, especially as the currency was pegged to a rising US dollar. But then it stopped.So why has the People's Bank of China fought off further CNY weakness since mid-August? The main reason is to prevent an escalation of capital outflows from China, especially as the central bank is widely expected to engage in prolonged interest rate cuts, further eroding the yuan's carry trade allure. Beijing was also careful in avoiding beggar-they-neighbour criticism from the world community at a time when the rest of the world is slowing markedly.

Timing is Crucial

The latter point is especially crucial in considering Beijng's halting the yuan's depreciation. September and October are filled with international meetings and the last thing for Chinese president Xi Jinping to be on the defensive. Starting this week, is the G20 meeting in Ankara, where world leaders will discuss climate, disarmament, immigration and international trade/global economy. Finance ministers and central bank chiefs of these nations will also be present. At a time when global bourses are suffering their worst decline in four years, the last thing Beijing needs is a scapegoat for this too.On September 16-20, China's president will meet US president Obama in Washington. The topic of foreign exchange will best be avoided by China.

Finally, on October 8-10, the annual autumn IMF/World Bank Meetings will be held in Lima, Peru, another chance for G20 finance ministers and central bank chiefs to gather. By that time, expect the IMF to have made public another downgrade of global growth as well as a warning against US interest rate liftoff. By Haloween time, the PBOC will remove its “steady-CNY” face mask and a policy of gradual depreciation would return, until 6.50-6.75 yuan/USD is seen reached. Further CNY weakness is unavoidable. The impact on commodities is not yet done. How it will go about it remains to be seen.

استقرار أو هدوء؟ و ماذا عن مؤشر تداول السعودي؟

Manufacturing isn’t a Zero Sum Game

The traditional thinking is that FX strength somewhere means weakness somewhere else and the winners and losers will balance out. Like all things in economics, that may be true in the long run but it means more pain that prosperity in the short term. Ashraf issued a new Premium trade on USDJPY, with 2 essential charts capturing a multi-year rarity.

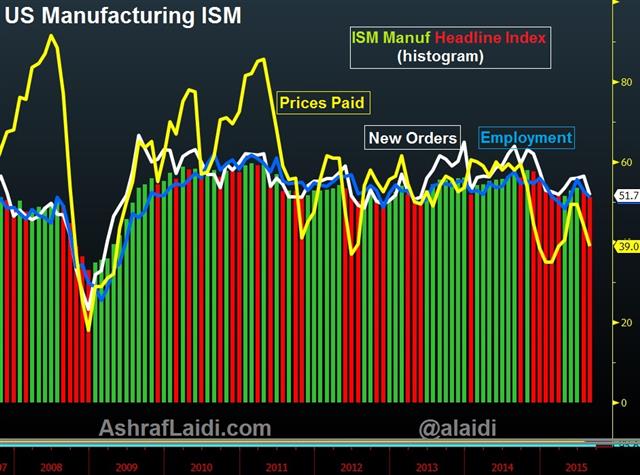

Risk aversion returned with a vengeance Tuesday as US stocks fell 3%, oil dropped 10% and the yen surged. One factor was that the ISM manufacturing survey fell to the lowest since May 2013, missing the consensus estimate by 1.6 points. That probably doesn't come as a surprise because at the moment, US manufacturing is one of the 'losers' in the global FX war.

What isn't in the textbook is why Canada posted a contractionary PMI. The RBC survey fell to the lowest since April at 49.4 from 50.8 and the country entered a recession with a second-consecutive GDP report in contraction. That's despite a 25% decline in the loonie.

Another major US trading partner is Mexico but the latest PMI there was at the second lowest of the year. Yesterday, China's unofficial PMI from Caixin hit the lowest since the crisis.

What the models don't account for is the difficulty in switching suppliers, reorienting investment and plain reluctance to change. The US dollar rally (and effective yuan rally alongside it) have created a 'great reshuffling' of global production and at the same time the collapse in commodity prices has changed the mathematics of investment.

Eventually, low cost, well-located manufacturing centers with an abundance of labour like Mexico will win the spoils of the strong US dollar but not before months of pain.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ISM Manufacturing (AUG) | |||

| 51.1 | 52.5 | 52.7 | Sep 01 14:00 |

| ISM Prices Paid (AUG) | |||

| 39 | 39 | 44 | Sep 01 14:00 |

| Markit Manufacturing PMI (AUG) | |||

| 53.0 | 52.9 | Sep 01 13:45 | |

| ISM Manufacturing PMI | |||

| 51.1 | 52.6 | 52.7 | Sep 01 14:00 |

| RBC PMI Manufacturing (AUG) | |||

| 49.4 | 50.8 | Sep 01 13:30 | |

| PMI (AUG) | |||

| 49.7 | 49.7 | 50.0 | Sep 01 1:00 |

| PMI (AUG) | |||

| 53.4 | 53.9 | Sep 01 1:00 | |

| PMI (AUG) | |||

| 51.5 | 53.9 | 53.8 | Sep 01 1:45 |

| PMI (AUG) | |||

| 47.3 | 47.2 | 47.1 | Sep 01 1:45 |

| GDP (JUN) (m/m) | |||

| 0.5% | 0.2% | -0.2% | Sep 01 12:30 |

| GDP Annualized (Q2) (q/q) | |||

| -0.5% | -1.0% | -0.8% | Sep 01 12:30 |

Forget Decoupling

USD under renewed pressure from a combination of renewed China data disappointment, weak US manufacturing ISM and lingering chatter of a September Fed hike. US stock futures began selling off 6 hours before the release of China's manufacturing PMI, which showed the first contraction in six months and the lowest figure in three years. The largely-weaker than expected manufacturing ISM (lowest in 27 months) was accompanied by broader weakness in all components.

We reiterate since December that the Fed will NOT raise rates this year and any rate hike this year will be policy mistake.

The disinflationary impact of USD strength and inevitable depreciation of the Chinese yuan will continue to supress US inflation to the extent of shadowing declines in US jobless rate. Saudi Arabia, a key strategic partner of the US is already suffering from the combination of plunging oil prices, rising budget deficit and having its currency –riyal-tied to a strong USD. Not dissimilar from China FX situation.

We reiterate that the cyclical peak of the US dollar against both the yen and euro is already behind us. USDJPY will not return to the 125.00 yen highs and EURUSD will not return to the $1.0530 lows seen earlier this year.

No Decoupling again

In 2007, it was erroneously & widely predicted by pundits that emerging markets would decouple from G7 and escape the 2008-9 recession. Although BRICS recovered rapidly in 2010-2011, their decline in tandem with US, UK & Eurozone was notable in 2008-9.Today, the decoupling idea is being peddled again, based on US diverging away from China & EM. This will prove wrong again as the combination of trade and capital flows is stronger than ever.

EURUSD: more than just unwinding

While the recent stabilisation in EURUSD has been widely attributed to unwinding of euro shorts linked to escalating risk aversion, don't forget old fashioned fundamentals. The spread on German-US 10-year yields (Germany minus US) continues to improve in tandem with a stabilizing EURUSD rate. The chart below highlights the improving yield spread in favour of the euro, while US core PCE price index (Fed's target) diverges away from the 2.0% target as Eurozone core CPI holds steady at 1.0% --13-month highs.Draghi is back

We expect ECB president Draghi to re-emphasize his dovish stance in Thursday's press conference, subjecting euro to some pressure, especially if the governing council lowers its growth and CPI projections. Any pullback in EURUSD will be assessed ahead of Friday's release of the US August jobs report, expected at 205K from 210K. But take note that out of the last 15 releases of August NFP reports (due on September), 11 reports had negative surprises. And each of the last four August reports have undershot forecasts.| Act | Exp | Prev | GMT |

|---|---|---|---|

| PMI Manufacturing | |||

| 51.5 | 51.9 | 51.9 | Sep 01 8:30 |

| PMI Construction (AUG) | |||

| 57.5 | 57.1 | Sep 02 8:30 | |

| Markit Manufacturing PMI (AUG) | |||

| 53.0 | 52.9 | Sep 01 13:45 | |

| ISM Manufacturing PMI | |||

| 51.1 | 52.6 | 52.7 | Sep 01 14:00 |

| PMI (AUG) | |||

| 49.7 | 49.7 | 50.0 | Sep 01 1:00 |

| PMI (AUG) | |||

| 53.4 | 53.9 | Sep 01 1:00 | |

| PMI (AUG) | |||

| 51.5 | 53.9 | 53.8 | Sep 01 1:45 |

| PMI (AUG) | |||

| 47.3 | 47.2 | 47.1 | Sep 01 1:45 |

| Eurozone Spanish PMI Manufacturing | |||

| 53.2 | 53.9 | 53.6 | Sep 01 7:15 |

| Eurozone Markit PMI Manufacturing (AUG) | |||

| 52.3 | 52.4 | 52.4 | Sep 01 8:00 |

| Germany Markit PMI Manufacturing (AUG) | |||

| 53.3 | 53.2 | 53.2 | Sep 01 7:55 |

What we Learned in August

1. The Fed likes uncertainty

When more variables are removed, markets function better. The easiest aid for a market in flux would have been for the Fed to signal no rush to hike rates. Instead, top policymakers are comfortable with higher market volatility and uncertainty. If that's what the Fed wants, that's what it will get in September. Don't expect a return to less volatility.

2. China's inexperience is showing

A modest FX devaluation and a rate cut is a logical, normal response for the challenges China faces. They failed, however, in the execution. The devaluation was poorly communicated and undermined confidence. The rate cut was rushed. Meanwhile, the hodge-podge of efforts to stimulate equity markets backfired. The stock market losses and growth can be regained but confidence in Chinese economic leadership will last much longer.

3. Central banks will wait and see

The RBA decision is at 0430 GMT but none of the 27 economists surveyed by Bloomberg is looking for a move on rates. It's a similar story in Japan where the BOJ is edging towards a rate cut but not committing yet. Market participants and central bankers are unsure what is happening with global growth and emerging markets. Ultimately, the divergence between the hawks (Fed & BOE) and doves (BOJ, EM, commodity bloc) will need to close.

4. Correlations aren't dependable

Oil is up 27% in the last week while USD/CAD is exactly where it was last Monday. The risk trade tends to lift the euro on a carry trade unwind but only to a certain point. USD/JPY has tracked risk sentiment but only to a point. When correlations break down it's a severe signal of uncertainty. Eventually they will re-establish but assets can disconnect for months.

5. Selected market performance

The yen led the way with a 2.2% rally against the dollar while the kiwi lagged, down 3.8% (including 1.9% on Monday). The S&P 500 fell 6.3% while the DAX fell 9.3% and Shanghai Composite fell 12.5%. The biggest surprise was crude oil, which finished up 2% on the month after falling as much as 20%.

أشرف العايدي على فرانس 24

حوار مع القناة الفرنسي عن النفط، الصين، الولايات المتحدة و مصدر مخاطر الإنكماش العالمي

Fresh questions from Jackson Hole

Central bankers continued with mildly hawkish rhetoric at Jackson Hole and that will ensure elevated volatility into September. In early trading the pound is leading the way while the Australian dollar is the laggard. Japanese industrial production and housing starts highlight a busy start to the week. Over the weekend, Beijing announced it will no longer attempt to boost the stock market through large-scale stock purchases, and will instead focus its efforts to find and punish those suspected of “destabilising the market”, according to the Financial Times.

What's clear from Jackson Hole is that central bankers 'want' to hike, they're just waiting for the right opportunity. If the Fed or BOE was genuinely on the fence, the round of market volatility would have spooked them towards waiting.

Ultimately, we believe policymakers will wait but the undeniable bias toward rate hikes adds fresh risks. On Saturday, BOE Gov Carney continued to stress year-end as the time when he will begin to seriously debate a hike. Carney noted downside risks from China but said recent events hadn't changed the BOE's thinking.

Fischer underscored a positive outlook, saying there is “good reason” to believe inflation will rise toward 2% and then Fed can't wait until it gets there before hiking. The current statement says the Fed wants to be “reasonably confident” about rising inflation. So the question is, how close is “good reason” to “reasonably confident”?

Fed funds futures now price a 38% chance of a Sept hike, up 12 percentage points since Wednesday. So long as it remains a close decision, we struggle to see how risk assets can continue to recover.

In the shorter term the focus will be on Chinese stocks to open the week. However, a series of eco releases will also jar the FX market. The first is Japanese July industrial production at 2350 GMT. It's expected up 0.8% y/y.

Australia is also in focus ahead of tomorrow's RBA decision. Three final data points include TD Securities inflation, HIA new home sales and private sector credit.

Finally, Japanese July housing starts are expected up 11.0% in a report at 0500 GMT.

Remember that Monday is a holiday in the UK so volumes will be thin in European trading. Note that it's also month end so flows will be a major factor.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -96K vs -93K prior JPY -39K vs -90K prior GBP +4K vs -4K prior AUD -47K vs -50K prior CAD -59K vs -67K prior CHF -12K vs -10K prior

Yen shorts were chased out in the huge rally on Monday but we expect they've slowly been rebuilding positions since.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (JUL) (m/m) [P] | |||

| 0.1% | 1.1% | Aug 30 23:50 | |

| Industrial Production (JUL) (y/y) [P] | |||

| 2.3% | Aug 30 23:50 | ||

| Housing Starts (JUL) | |||

| 1.033M | Aug 31 5:00 | ||

| Housing Starts (JUL) (y/y) | |||

| 11.0% | 16.3% | Aug 31 5:00 | |

| TD Securities Inflation (AUG) (y/y) | |||

| 1.6% | Aug 31 0:30 | ||

| TD Securities Inflation (AUG) (m/m) | |||

| 0.2% | Aug 31 0:30 | ||

| HIA New Home Sales (JUL) (m/m) | |||

| 0.5% | Aug 31 1:00 | ||

| Private Sector Credit (JUL) (m/m) | |||

| 0.5% | 0.4% | Aug 31 1:30 | |

| Private Sector Credit (JUL) (y/y) | |||

| 5.9% | Aug 31 1:30 | ||