Intraday Market Thoughts Archives

Displaying results for week of May 31, 2020Stocks Jump, Yields Soar on Jobs, ECB, Corona Narrative

Thursday's bond yield break out was joined by broad and intense rallies in indices after jobs reports in the US and Canada showed an unexpected advance in net employment in May. US 10-year yield jumps 43% for the week, its biggest rise on record and double the previous record rise seen in March. DOW30 shot-up more than 3% to break further away from its 200-DMA, while Nasdaq pushed to new highs, stopping us out. The US dollar extended its longest losing streak in three years and EURUSD extended its biggest divergence from the 200-DMA in over 3 months.

أهم سؤال في الاسواق

The new wave of buying intensified in Friday's Asia session on a combination of the ECB's decision to add a higher than expected €600 billion in stimulus, oil extending rally near $40 and news of zero increase in NY Corona cases for the first time since March. Let's look at some trading questions below.

In the US, the bond market painted a positive picture in a different way as 10-year yields rose to the highest since late March. In that case, it's a sign of dwindling demand for safety as the market continues to look past the virus and towards heavy government spending and ultra-low interest rates for longer. Given that the Nasdaq hit a record high, the trade has already run a great deal in the US but that's not the case in emerging markets and parts of Europe. That paradigm continues to draw dollars out of the US.

Trading Questions

The question I raised in this week's English and Arabic videos as to whether S&P500 and DOW30 will regain their February highs has been largely answered according to the last 90 years. This now helps us figure out whether sell EURUSD for the 1.10s, or wait for further pullbacks to buy for higher targets. Gold traders watch the 1677 support and bonds fixated on the 100-DMA at 1.01%, with the highest daily RSI since October 2018.فرص في النفط والعملات والمؤشرات

تعرّف على المستويات الحالية لأهم المؤشرات وأداء النفط والعملات وأفضل فرص التداول التي يمكن الاستفادة منها الآن! تابع التفاصيل واحصل على مشورة الخبير أشرف العايدي في هذا الفيديو

As if There was no Virus

A big question is to what extent the market will await the economic recovery to appear in the data, especially given that additional US unemployment benefits run out at the end of July. It's a heavy week for US economic data leading up to Friday's non-farm payrolls report, expected to show 19.5% unemployment. A new Premium trade was posted earlier before the NY close. Will the undervaluation in European indices relative to their US peers further drive the euro as was the case in 2017? More below. The weekly Premium Video has been posted below, detailing the thinking behind the trade and the accompanying trades.

One way to grasp the divergence between economic data and market performance is simply believing the virus has disappeared. Tuesday was another huge day for risk assets with AUD leading and JPY lagging. The BOC decision will be closely followed with Macklem leading for the first time.

The virus won't last forever. It continues to rage in parts of the world, but the market is acting like it's terminated. Along those lines, there have been good signs. ICU numbers globally are falling even as infections continue. Some say it's a sign of a mutated virus or the effect of low viral loads. In any case, the market is looking to a future where the virus is gone and yet ultra-easy central banks and loose fiscal policy continues. As tough as it is to look past the virus, that's truly what the market is doing.

There was chatter of Congress ready to hash out another stimulus spending bill in light of the current US riots. That speaks to the theme of elevated US government spending and that should spill over into commodities and commodity currencies first. Meanwhile the real economy remain a deep concern despite the ongoing enthusiasm in markets. The May ISM manufacturing index was at 43.1 compared to 43.7 expected; up from 41.5 in April. All the underlying metric showed only modest improvement.

DAX and the Great Catch-up

In equity markets, Europe is playing catch-up to the US indices, with sharp equity market gains. The spill-over to the euro is beginning to percolate. It's tempting to say it can't continue but it goes on day after day. Ashraf raised the question whether market recovery in Europe will intensify to the benefit of the euro as was the case in 2017, following the Eurozone gloom of 2014/2015. Markets await this week's ECB meeting and whether it will committ to higher asset purchases. On Tuesday the moves were spectacular with yen crosses slammed lower and EM currencies soaring, including LatAm currencies where the virus is currently raging.Obviously the fear is that when everyone piles into the trade it will reverse. Certainly Wednesday's economic data will be another test with ADP employment, the ISM non-manufacturing report and factory orders on the agenda.

Yesterday's RBA decision boosted AUD after Lowe said it's possible the depth of the downturn will be milder that expected. The BOC may strike the same tone on Wednesday at 1400 GMT but the main thing to watch will be Macklem in his first press conference as BOC leader. He already slipped up with a garbled comment about negative rates in his introductory appearance and now the real pressure will be on.

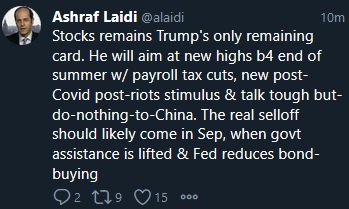

The Protest Playbook

The rapid escalation of social discord in the United States highlights another reason that debt this decade will spiral out of control. The US dollar starts the month on a down note after May showed the biggest monthly USD decline since December. Aussie, silver and CAD lead, while JPY and CHF lag. The USDX chart highlights the latest headfake from the US dollar, possibly justifying Ashraf's repeated calls for shorting USD bounces, instead of joining the herd calls of buying USD rallies. CFTC positioning data showed few notable changes. Our Premium Insights' trades long EURUSD and XAGUSD hit their final targets for +200-pips each. There are currently 3 remaining open trades.

The scope and spread of US protests is truly shocking with more cities implementing curfews than any time since Martin Luther King Jr's assassination in 1968. Markets were paying very little attention on Friday but to start the week the US dollar is slumping and gold is higher.

The protests are also another reason to be skeptical about growth and wary of a further spike in virus cases (not just because of the protests themselves, but because they show that people are quickly abandoning social distancing).

Without touching on the social causes of the protests (you can find plenty of that elsewhere) the economic playbook is clear. Historically, there are two ways governments deal with social unrest: By increasing social spending; or by increasing authoritarianism.

Both are costly. Given that the virus has already extinguished fiscal discipline and that there's no appetite for tax hikes, this adds another reason to expect this decade to be dominated by runaway fiscal spending and debt monetization.

What's interesting in early trade is that the US dollar is lagging, suggesting this is a uniquely American problem. That's an interesting potential paradigm.

What's also notable is that the Australian dollar broke above resistance near 0.6700. It's a country that's levered to global growth but it's also one that has largely defeated the coronavirus and where runaway fiscal spending is less of a concern – at least for now.

Less surprising is that gold and silver are higher again. At a time like this, there's no need to overthink the simple safe haven trade.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +75K vs +72K prior GBP -22K vs -19K prior JPY +35K vs +28K prior CHF +9K vs +9K prior CAD -34K vs -35K prior AUD -40K vs -39K prior NZD -15K vs -16K prior