Intraday Market Thoughts Archives

Displaying results for week of Jul 31, 2016BoE cuts, buys & downgrades

3 of the 4 four big central banks have now made that much feared U-turn; The Bank of Japan did it, the European Central Bank did it and now the Bank of England has finally done it. Cutting rates and diving back into quantitative easing. The BoE cut its base rate by 25 bps to 0.25%, raised purchases of gilts (govt bonds) by £60 bn to £435 bn, while announcing the purchase of £10 bn in corporate bonds of select companies, bringing the total of purchases to £445 bn.

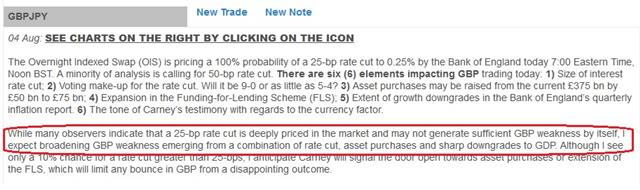

And if there were any doubts about the future of economic growth, the central bank reduced its growth forecasts across the board, slashing its 2017 GDP outlook to 0.8% from 2.3%, the biggest downgrade in over 2 decades. 40 minutes before the Bank of England announcement, gilts priced in a 100% chance of a 25-bp rate cut. Several pundits said 25-bps and QE of less than £50 bn would not be enough in weighing on GBP as it is widely priced in the market. Yet, we focused on the broader picture and issued 2 GBP Premium trades to clients. Above is part of the explanation. The rest was history. We stick with our two GBP trades until further notice.

Latest FX Performance حاسب أداء العملات

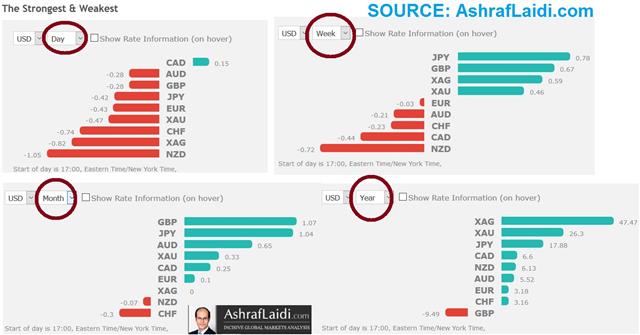

Our performance calculator shows the Canadian dollar is the only currency up against the US dollar so far today following crude oil's rebound to $40.80s, while the kiwi and silver are the worst performers on the day. Year-to-date, silver remains the biggest winner—up against all currencies and commodities, followed by gold and the yen, while the British pound is the only currency losing against the US dollar. This calculator is free of charge, and can be accessed from AshrafLaidi.com by scrolling down the homepage. You can also change the base currency from USD to any of the other 7 currencies by clicking on the pulldown menu at the upper left.

حاسب أداء العملات يشير إلى أن اليوم الدولار الكندي العملة الوحيدة المتفوقة على الدولار الأميركي بعد ارتفاع النفط إلى 40.80. أما الفضة و النيوزلندي فلهم أسوأ أداء مقابل كل العملات منذ بداية جلسة اليوم --أي يوم أمس الساعة الخامسة بتوقيت نيويورك. و منذ بداية السنة، الفضة له أحسن أداء في السلع و العملات، و يتابعه الذهب و الين، و أما الإسترليني فله أسوأ أداء منذ بداية العام. و بإمكانكم إستعمال الحاسب باختيار كل من السبع عملات أخرى للمقارنة.

Convergence, divergence, snapback

I've already mentioned the tri-relationship between US equity indices, yields and USDJPY and what happens when a divergence goes too far. Looks like I'll have to mention it again. The positive correlation between equity indices (using SPX500), G10-yields (using 10-year yields) & USDJPY (general proxy for JPY crosses) has been disrupted for as many as 5 weeks with stocks extending to new highs, while yields and yen crosses dropping lower.

The wider the disruption in the correlation, the greater the risk of a snapback; in this case the harder stocks are likely to fall back in line with falling yields and falling USDJPY (rising yen).

JPY rises as Japanese investors continue to hedge their FX exposure of their foreign-bound holdings for fear of yen gains and the BoJ will not expand QE via JGBs because there are simply not enough bonds to be bought; Yes, the BoJ did expand its purchases of equity ETFs last week, but that does not carry the same leverage in raising money supply and weakening the value of the yen. YIELDS fall, reflecting a low growth-low inflation environment and negative interest rates. The Fed's response to tightening labour markets shall remain muted in terms of policy response as long as low inflation means that REAL yields are high. STOCKS challenged, as they gradually take notice of the macro-economic challenges (bottoming unemployment/jobless claims, bottoming in cost-cutting & lack of material gains in capex), resumption in oil bear market, which will resurrect the earnings challenges of big oil and high yield complications of near-junk oil borrowers.

A fourth variable to the equation is oil. Both crude and Brent have entered bear territory, falling more than 20% off their June highs.

Anticipating further “repair” in the relationship, we issued a new trade in an equity index, adding to the 8 existing trades, which consists of FX, indices and commodities.

In what is the last “serious trading week” of the summer, markets await “Super Thursday” for a possible interest rate cut from the Bank of England as well as the jobs figures from the US and Canada on Friday. Whatever the outcome of the NFP-UnempRate-Earnings combination, Fed chair Yellen will tell us in 3 weeks' time in Jackson Hole.

Will the RBA Cut?

Tonight's RBA decision (00:30 Eastern Time, 05:30 British Summer Time) stands a 67% chance by overnight index swaps market of a 25-bp rate cut to 1.50%, whereas 80% of the 25 economists/strategists polled by Bloomberg expect such a move. Divergences between economists and the market are not new. Aussie macro figures have been mixed as of late, but the more important CPI element suggests a possible rate cut when combined with the FX element.

There are two main reasons for an RBA rate cut: 1) Preventing excessive AUD strength as not only the RBNZ is widely expected to cut rates next week (after it had been revealed that macro-prudential measures will be adopted for the housing market), but the Fed will also not hike rates in September. Thus, an RBA hold on rates would flash the green light for the AUD to rally against USD as well as JPY; 2) CPI Aussie Q2 CPI slowed to 1.0% y/y from 1.3% y/y to reach its lowest level on record. Aussie unemployment rate is near a 3-year low of 5.8% but new job creation has fallen to under 8K, below the 3-month moving average. The minutes of last month's RBA meeting sounded a dovish note on inflation, which weighted on the currency for the ensuing 5 trading days. But the relative stabilisation Chinese macro data as well as eroding chances of a Fed tightening is making the difference between AUD support and rising momentum. AUD is up 4% on a trade-weighted index from its May lows, but is only down 3% from April's 12-month highs.

Earlier today, I issued a tactical AUD Premium trade to hedge against an existing AUD trade, laying out the technical and fundamental reasoning for this particular tactic. Taking into consideration the evolving inter-market landscape, it is important to select the suitable hedge. In addition to the trade and charts, trades and charts ahead of the week's other events (BoE, Canada & US jobs) are detailed in today's Premium video.