Intraday Market Thoughts Archives

Displaying results for week of Aug 31, 2014NFP won't interrupt end of QE3

The 6-currency USD index is on its way to completing its eighth consecutive weekly rise for the first time since 1997 –a time when US-bound capital flows were bolstered by the tech boom and by the prevailing strong dollar policy. Full charts & analysis.

Draghi Delivers, What’s Next for the Euro?

The combined announcements of broad rate cuts, ABS purchases and covered bond buying were a surprise on Thursday and punished the euro. It was easily the worst performer while the US and Canadian dollars jumped on better economic data. It will take days for the market to digest the moves and we look at what's next. 700 pips realized today: Our Premium short in GBPUSD, entered in 1.6600, hit its final 1.6400 target for 200 pips, 1 of our 2 EURJPY shorts hit its final 136.10 target from the 138.10 entry with 200 pips, and the USDCHF long at 0.9020, hit its final 0.9320 target for 300 pips. All these trades are found in our Premium Insights.

The ECB is taking assets onto its balance sheet in the first sign of QE from Draghi. Some of the shock of the announcement was tempered by a leak to Reuters ahead of time but the combined measures along with the looming TLTRO smashed the euro more than 200 pips lower to 1.2920 before a modest rebound to 1.2935.

The only mitigating factors were that Draghi said there was some dissent, despite a comfortable majority in favor, and that the size of the program wasn't announced. Draghi did say the ECB wants to increase its balance sheet back to the 2012 size and that would mean 1 trillion euros but how much is divided between ABS, covered bonds and the TLTRO remains murky.

For traders and the general public the message is clear. The ECB finally grasps the severity of the economic malaise in Europe and is prepared to take dramatic steps. That's not the sort of declaration that results in a one-and-done move. Asset managers and hedgers will change course over the coming weeks and although there will be euro inflows into risk assets like stocks or anything that could be boosted by ABS buying, the sellers on lower carry will eventually win out.

We believe that many fast money euro shorts will have taken profits on today and the lack of any sort of bounce shows the selling demand. That said, it's very tough to initiate new shorts after a 6 big-figure move. A good sense of the speed of the move down to 1.27 or 1.25 will come from how quickly and aggressively traders sell the next bounce.

We will also keep an eye on the other side of the EUR/USD trade with non-farm payrolls looming. In Asia-Pacific trading, watch for comments from the Fed's Powell, Fisher and Kocherlakota. Powell will likely stick to regulation and Fisher will be predictably hawkish but if Kocherlakota softens his dovish tone it could boost the US dollar.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Richard Fisher's speech | |||

| Sep 05 0:15 | |||

| Fed Minneapolis's Narayana Kocherlakota speech | |||

| Sep 05 1:00 | |||

| Philadelphia Fed's Plosser speech | |||

| Sep 05 14:15 | |||

| Nonfarm Payrolls (AUG) | |||

| 225K | 209K | Sep 05 12:30 | |

ECB balance sheet ready to soar after rate cuts

EURUSD plunged 1.6%, its biggest percentage day decline since October 2011 as the ECB cut interest rates on all three main rates and announced its ABS purchases. See what we said about EURUSD, EURCAD and EURAUD yesterday then check out today's charts. Full charts & analysis.

Challengin some Beliefs, Aussie Sales Next

Good traders develop themes and trade ideas then find ways to challenge with new developments. The day ahead is a wonderful opportunity with some top tier US data due along with the ECB rate decision. On Wednesday, the Australian dollar led the way while the pound lagged. Later this evening, 21:30 ET, 2:30 BST, Aussie July retail sales are expected to have risen 0.4% from 0.6%. Our Premium long in AUDNZD hit its final 1.1220 target for 220 pips today, while our NZDCAD short neared its final target, with 140 pips in the green so far.

We wrote about the major themes in markets yesterday and there's a widespread believe that the US economy is improving and that the ECB will be forced to do more. Traders are positioned accordingly but the risks are extremely high in the day ahead.

The euro climbed for the second day on Wednesday as shorts pared bets in anticipation of Draghi's press conference tomorrow. The ECB may lower rates 10 bps or announce ABS purchases but they can get away with neither Draghi promises near-term action.

Officials believe in the TLTRO and with the euro falling they may want to see how the first round goes later this month before acting. There is an opportunity for a squeeze higher but it may be one of those days to tread carefully.

The dollar side of the trade could be equally volatile with ADP employment, ISM non-manufacturing and jobless claims all due. Traders confidence in the US economy is growing and a record high in factory orders along with a blockbuster vehicle sales report Wednesday underscored the optimism.

But all beliefs are subject to change and positions are at the most one-sided levels of the year. One spot to ride out the storm could be the Australian dollar, it posted an outside bullish reversal Tuesday and has quietly hung with the surging US dollar over the last 7 weeks.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone ECB Interest Rate Decision (SEP 4) | |||

| 0.15% | 0.15% | Sep 04 11:45 | |

| Retail Sales (JUL) (m/m) | |||

| 0.4% | 0.6% | Sep 04 1:30 | |

| Eurozone Retail Sales (m/m) | |||

| -0.4% | -0.4% | 0.3% | Sep 03 9:00 |

| Eurozone Retail Sales (y/y) | |||

| 0.8% | 0.9% | 1.9% | Sep 03 9:00 |

| FOMC's Powell Speech | |||

| Sep 04 4:00 | |||

| FOMC's Mester speech | |||

| Sep 04 16:30 | |||

| Eurozone ECB Monetary policy statement and press conference | |||

| Sep 04 12:30 | |||

| ADP Employment Change (AUG) | |||

| 220K | 218K | Sep 04 12:15 | |

| Factory Orders (JUL) (m/m) | |||

| 10.5% | 11.0% | 1.5% | Sep 03 14:00 |

| Domestic Vehicle Sales (AUG) | |||

| 13.87M | 13.20M | 12.95M | Sep 03 19:12 |

| Challenger Job Cuts (AUG) (y/y) | |||

| 46.887K | Sep 04 11:30 | ||

| Continuing Jobless Claims (AUG 22) | |||

| 2.510M | 2.527M | Sep 04 12:30 | |

| Initial Jobless Claims (AUG 29) | |||

| 300K | 298K | Sep 04 12:30 | |

Euro braces for ECB, Draghi

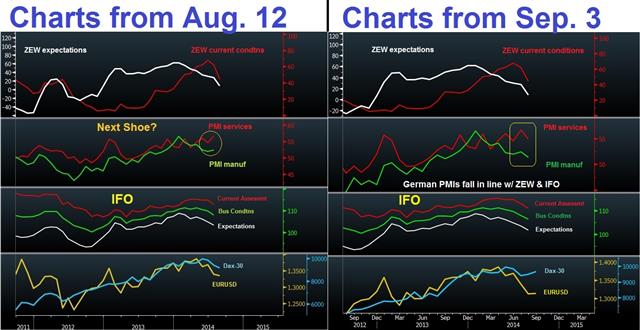

German PMIs fall in line with the IFO & ZEW surveys, paving the way for possible new ECB options and impact on EUR crosses. Full charts & analysis here.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Spanish Services PMI | |||

| 58.1 | 55.5 | 56.2 | Sep 03 7:15 |

| Eurozone Markit Services PMI (AUG) | |||

| 53.1 | 53.5 | 54.2 | Sep 03 8:00 |

| Eurozone Markit PMI Composite (AUG) | |||

| 52.5 | 52.8 | 53.8 | Sep 03 8:00 |

| Germany Services PMI | |||

| 54.9 | 56.4 | 56.4 | Sep 03 7:55 |

September Themewatch

Theme 1: US economic recovery and coming rate hikes

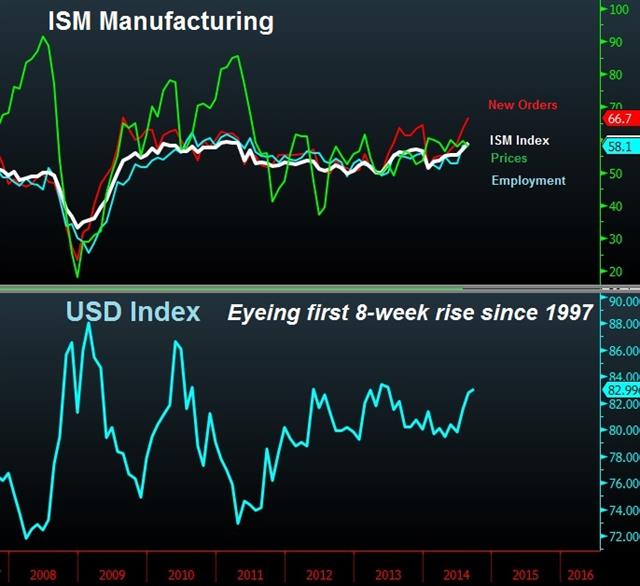

This is by far the dominant theme and the burgeoning USD bull market is the result. On Tuesday, the ISM manufacturing index rose to a 10-year high at 59.0 versus 57.0 expected. In many ways it's truly astounding that the Fed is still at 0% and printing $25 billion per month.

Theme 2: Disinflation in Europe

Deflation fears capture many different themes that all point to a lower euro. The main one is the potential for ECB asset purchases and/or another minor rate cut this week. The euro fortitude on Tuesday likely reflected some position squaring ahead of Thursday's ECB decision.

Theme 3: War in Ukraine

If it wasn't clear that Russia wouldn't back down when the Malaysian Airlines plane was shot down, it's abundantly clear now. Ukrainian forces demolished the Luhansk airstrip as they retreated in a sign that they don't plan to be back soon.

Minor-theme 1: Can it only be Brazil

Terrible GDP data last week showed Brazil in recession. It's improbable that what's happening there isn't hitting other emerging markets. Fear is building.

Minor-theme 2: Scottish referendum

The latest poll put the side voting for independence at 47%, up 6 points in the past week. What was once a curiosity is now a pressing matter with the Sept 18 referendum looming. Traders hadn't seriously considered the implications of a breakup but they are now.

In the hours ahead, Australian Q2 GDP at 0130 GMT is the top release. The consensus is for 3.0% annualized growth. Stevens also speaks at a 0320 GMT function in Adelaide and could add some colour to yesterday's RBA decision.| Act | Exp | Prev | GMT |

|---|---|---|---|

| ISM Manufacturing Employment | |||

| 58.1 | 58.4 | 58.2 | Sep 02 14:00 |

| ISM Manufacturing Prices | |||

| 58.0 | 58.0 | 59.5 | Sep 02 14:00 |

| Net Exports of GDP (2Q) | |||

| -0.90 | -0.70 | 1.40 | Sep 02 1:30 |

| Gross Domestic Product (Q2) (q/q) | |||

| 0.4% | 1.1% | Sep 03 1:30 | |

| Gross Domestic Product (Q2) (y/y) | |||

| 3.0% | 3.5% | Sep 03 1:30 | |

USD Pattern Last seen in 1997

The US dollar index is set to post its 8th consecutive weekly increase, a pattern last seen in 1997.The tenacity of the US dollar rally is highlighted by an unusually broad advance, against each of the six components in the basket. Today's manufacturing ISM helped trigger those moves. Full charts & analysis here.

SNB: 3 years minus 5 days

3 years minus 5 days, the Swiss National Bank delivered its stealth intervention to the cap the soaring franc as capital fled into the safety of the Swiss currency during the Eurozone debt. Now that EURCHF has fallen to 21-month lows, losing 5% from its 2013 highs, the SNB is back to reminding markets of its pledge to defend the franc and that the “environment has deteriorated for Switzerland”. What would this mean 3 days ahead of the ECB decision? Any impact on the already falling EURCHF? Will the ECB do the work for the SNB, or will the Swiss intervention army be deployed yet again? One of our CHF Premium trades is currently netting more than 150 pips. Today, we added a new CHF trade with 2 charts ahead of tomorrow's Swiss Q2 GDP. Trades & charts here.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (Q2) (q/q) | |||

| 0.5% | 0.5% | Sep 02 5:45 | |

| GDP (Q2) (y/y) | |||

| 1.7% | 2.0% | Sep 02 5:45 | |

Fear or Fundamentals?

The separatist counteroffensive in Eastern Ukraine means violence and sanctions will be a main theme in the day ahead but the underlying story US economic improvement and European malaise continues. Last week the Canadian dollar was the top performer while the euro lagged. CFTC positioning data showed more sellers in the euro and yen.

The Ukraine counteroffensive has put the region back on the front pages and Western leaders are already talking about fresh sanctions. A round of risk aversion on an escalated war of words or any dramatic developments on the ground could rattle markets. On the weekend, Putin called for Eastern Ukrainian “statement” but a Kremlin spokesman appeared to take back the remarks.

The turn of the calendar also brings a wave of tier 1 data and announcements. Ultimately the situation in Ukraine will resolve and fundamentals will be the driver. US data has been a non-stop positive surprise and good numbers from the ISM surveys and non-farm payrolls would almost certainly cause a hawkish shift at the Fed.

The dollar was less robust last week but with traders returning from holidays and the turn of the month, a renewed push into dollar longs is possible.

At the same time, the most-anticipated announcement in the week ahead is the ECB. Some type of announcement, either a rate cut or ABS purchases is about a 50% probability but traders are unsure what to expect and volatile trading is almost a sure thing. We'll have more as the week rolls on.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.- EUR -151K vs -139K prior

- JPY -103K vs -87K prior

- GBP +15.5K vs +13K prior

- AUD +42K vs +37K prior

- CAD +6K vs +7K prior

- CHF -13K vs -15K prior

- NZD +12K vs +12K prior