Intraday Market Thoughts Archives

Displaying results for week of Jan 05, 2014Recording of Ashraf's Pre-NFP Webinar

Ashraf's Thursday Pre-NFP webinar focused on the technicals and fundamentals of USDCAD long trade. The next day, the biggest rise in Canada's unemployement in 6 years pushed up USDCAD by over 80 pips. Ashraf also went over the 21-year performance of 11 currencies and 14 commodities, which can be found in the Premium section. For a full recording of the webinar, click on this link and scroll down to the text in red and select "Download AL, GC & FH"

ECB a Draghi But Euro Not Laggy

Draghi did his best to knock down the euro without committing to any real action but after a dip the euro bounced back. The Swiss franc was the top performer while CAD lagged for the third consecutive day. Chinese trade figures are a focal point ahead of non-farm payrolls.

Draghi sparked a quick 80-pip euro selloff but the 100-day moving average at 1.3548 caught the declines and EUR/USD finished the day near 1.3600. The ECB 'firmly' recommitted to its vague guidance but Draghi said action will only come if there is pressure in money markets or the medium-term inflation picture softens. That wasn't enough for a sustained move.

The market was also reluctant to buy more dollars ahead of Friday's NFP report. Positioning figures shows speculators already deep into USD longs and late in the day there were some signs of profit taking. The ideal dollar scenario for the jobs report would +250K growth, something that could signal a faster pace of tapering. A downside miss from the 200K consensus is possible due to weather or holiday skews and that could clear the way for a rebound in beaten down currencies like CAD, AUD and JPY.

One data point that might attract more attention than usual is the Canadian jobs report. The loonie has fallen every day this week and there is talk the BOC could shift to a more dovish stance at the Jan 22 meeting. Jobs growth faster than the 14.6K consensus could cause some rethinking in the crowded anti-CAD trade.

Another trade that has been particularly one-sided recently is oil, which tumbled to an 8-month low oat $91.46 on Thursday. Late in the day, crude prices rebounded $1.20 in the first sign of life from oil in more than a week.

A speech that caught our attention came from the Fed's George as she nicely highlighted the two main assumptions of central bankers this year – that inflation will begin to trend higher and that business investment will pickup. If one or the other falters, it will be a gamechanger so we're watching closely.

In the near-term, look to Chinese trade data at 0200 GMT. The balance of trade is less important than growth in imports and exports. Both are expected up 5.0% y/y but softer readings would be an early sign of sagging global growth.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Nonfarm Payrolls (DEC) | |||

| 196K | 203K | Jan 10 13:30 | |

| Imports (DEC) (y/y) | |||

| 5.3% | 5.3% | Jan 10 2:00 | |

| Exports (DEC) (y/y) | |||

| 4.9% | 12.7% | Jan 10 2:00 | |

Draghi's Guidance not Strong Enough

Euro is dragged down after Draghi said the ECB “strongly emphasizes” its “accommodative stance on monetary policy”. But Draghi also downplayed speculation of a near-term rate cut, by associating the latest slowdown in December Eurozone inflation to temporary seasonal factors in Germany. The ECB is neither ready to cut rates again, nor it will signal...full article & chart

Ashraf's Webinar Tonight

Ashraf's webinar today is at 16:00 Eeastern Time (21:00 London/GMTon “Currency, Debt & Equity Markets Timing” with Fari Hamzei (stocks, indices and market timing) and George Cavaligos (bonds & Elliott Wave). CLICK on REGISTRATION LINK. After registering you will receive a confirmation email containing information about joining the Webinar.

USD Moves Up with NFP Estimates

Economists raised forecasts for Friday's non-farm payrolls report after upbeat ADP employment data on Wednesday. The pound beat out USD as the best performer while CAD lagged for a second day. Chinese CPI is the top item on the upcoming calendar.

ADP employment for December rose 238K compared to 200K expected. Afterwards, numerous economists raised their forecasts for Friday's non-farm payrolls report. The median is at 200K but market expectations have ticked higher.

A reading above 250K would spark speculation about an acceleration in tapering at the January or March FOMC meetings. In the FOMC minutes released Wed there was no indication of an appetite for anything other than a 'measured' pace in the reduction of asset purchases but that was before the Fed saw the sanguine market reaction to the taper.

The US dollar initially cheered the ADP release but the market was tentative to push the gains ahead of the BOE, ECB and non-farm payrolls. EUR/USD remains vulnerable to the downside but technical support at the 100dma at 1.3544 remains in place. The initial technical breakout in EUR/USD came on Friday after the 55dma gave out.

The Canadian dollar is quickly becoming the dog of 2014. The break yesterday extended to a 3-year extreme in USD/CAD at 1.0831. Up next is the 2010 high of 1.0853.

At 0130 GMT, China releases CPI and PPI data for December. Consumer prices are forecast to rise 2.7% y/y after a 3.0% rise in Nov. The PPI has been in negative territory since early 2012 and is expected to decline 1.3% y/y.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change (DEC) | |||

| 238K | 200K | 229K | Jan 08 13:15 |

FOMC Minutes Show Return to Taper on-Taper off Mode

The release of the minutes of the December FOMC reveals little more than what was shown in the policy statement. But it's important to put it all in perspective considering the new guard at the 2014 FOMC. Full charts & analysis here

USD/CAD Hits 3-Year High

The Canadian dollar tumbled Tuesday on soft economic data and a technical breakout. It was the worst performer while USD and GBP led the way. Up later, it's the Australian job vacancies report.

A hat trick of negative news swamped CAD.

- The trade deficit at $0.9B in Nov was worse than the $0.1B expected and the prior number was revised $1B lower.

- The Ivey PMI fell to the lowest since 2009 at 46.3 vs 54.5 exp

- BOC Governor Poloz said his biggest worry is under-performing inflation

Elsewhere in the market, the US dollar outperformed on trade balance numbers as the deficit hit $34.3B compared to $40B expected. Numerous economists boosted Q4 growth estimates after the report, some by more than 0.5 percentage points. The initial market reaction was subdued but as the day continued, gains mounted.

Early in Asia-Pacific trading, the AiG performance of construction index tumbled to 50.8 from 55.2. The big drop isn't a major surprise after the survey jumped to 55 from 35 in the middle of 2013. At 0030 GMT, Australia releases the job vacancies report for November. It's rarely a market mover but with AUD/USD teetering on Tuesday, it could tip it over. The prior reading was +3.1% m/m.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Ivey PMI | |||

| 46.3 | 55.0 | 53.7 | Jan 07 15:00 |

| Trade Balance | |||

| -34.25B | -40.00B | -39.33B | Jan 07 13:30 |

| Trade Balance | |||

| -0.94B | -0.15B | -0.91B | Jan 07 13:30 |

US Data Disappointment Boosts Yen

Yen strength to start the year continued as USD/JPY fell to the lowest of the year. The Japanese currency was the top performer while the Canadian dollar lagged. Australian trade balance is the highlight in the hours ahead.

A disappointing US ISM non-manufacturing survey led to a broad round of risk appetite that cut down yen crosses. The survey slid to 53.0 from 54.6 expected but more tellingly the new orders component fell into contractionary territory for the first time since 2009. An open question about the US economy was whether growth was generated by unsustainable inventory accumulation and this is only one report but it's worrisome.

Ahead of the numbers, USD/JPY was trading in the 104.80 range but it began a rapid fall afterwards, hitting a 2014 low of 103.90. The commodity currencies also fell hard against the yen while GBP/JPY and EUR/JPY were able to maintain the lows from Asian trading. Those two are the high flyers against the yen and their resilience – especially GBP/JPY after the weak services PMI – is a positive signal.

Speaking of signals, the bullish reversals on the yen charts from Friday were all but wiped out on today's moves. Strength in the yen crosses remains a top theme in 2014 but the timing is now less clear. January tends to be a weaker month for yen crosses but the Feb-April period is bullish.

Another technical picture that grew cloudier was EUR/USD. On Friday, it cracked below several support levels including the 55dma and it continued lower to 1.3571 in Asia but the resilient euro rebounded again and closed above those markers. The ECB decision on Thursday looms.

Early in US trading the market was abuzz with talk about a fat finger in gold prices after a near-instant $30 fall to $1213. It was likely a fat finger but it triggered huge volumes of trading. Gold eventually recovered the drop but it undermined what had been a solid gain in the metal and prices ended slightly lower on the day at $1238.

The technical breakdown in oil prices also continued as WTI fell to a 5-week low despite OPEC production numbers falling to the lowest since May 2011.

The Asia-Pacific calendar is light today with Australian trade balance at 0030 GMT expected to show a $300m deficit for November.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance (NOV) | |||

| $-39.50B | $-40.64B | Jan 07 13:30 | |

| Trade Balance (NOV) | |||

| -300M | -529M | Jan 07 0:30 | |

| Trade Balance | |||

| 183M | -26M | -168M | Jan 06 21:45 |

| ISM Non-Manufacturing Employment | |||

| 55.8 | 52.5 | Jan 06 15:00 | |

| ISM Non-Manufacturing New Orders | |||

| 49.4 | 56.4 | Jan 06 15:00 | |

| ISM Non-Manufacturing Prices | |||

| 55.1 | 52.2 | Jan 06 15:00 | |

| ISM Non-Manufacturing PMI | |||

| 53.0 | 54.5 | 53.9 | Jan 06 15:00 |

| Ivey PMI (DEC) | |||

| 48.2 | Jan 07 15:00 | ||

| Ivey PMI s.a (DEC) | |||

| 52.0 | 53.7 | Jan 07 15:00 | |

| Services PMI | |||

| 51.0 | 51.0 | 51.0 | Jan 06 8:58 |

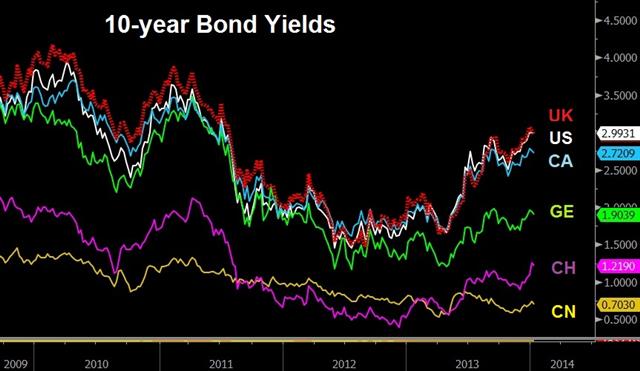

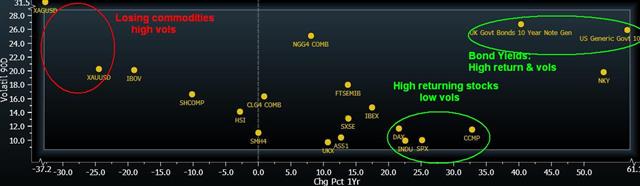

Return & Volatility in 21 Securities

We look chart the risk-return of 21 securities (15 equity indices, 2 bond indices and 4 commodities) over the past 12 months. Bond yield shave the highest rise and highest volatility, while European equities ranked high in return, volatility and currency return. Complete analysis here

Yen Strength Done Already?

Yen crosses staged an impressive comeback late on Friday, tracing out bullish technical patterns. The Australian dollar is the best performer to start the week while the pound is lower. The Asia-Pacific calendar is quiet with only the AiG Performance of Services index from Australia and the private China services PMI.

USD/JPY finished Friday unchanged on the day at 104.85 after falling as low as 104.08. It's early but the dragonfly doji daily candle is a bullish signal. The commodity currencies also posted impressive reversals against the yen.

What stands out about the yen charts is how all the major pair retraced to areas of volume, to the top of the Dec 16-20 ranges before rebounding higher. Volume, and retracing from low volume moves, is a classic technical principle. It's often impossible to know forex trading volumes but the holiday period is an exception because volumes in every asset class are so low.

On the weekend, Fed members continued to speak at a conference in Philadelphia but Dudley and Kocherlakota refrained from comments on the economy. Plosser talked about taper at a faster than pace than $10 billion/meeting if the economy improves while Rosengren preached patience rather than tapering. Plosser and Rosengren are at the opposite ends of the Fed hawk/dove spectrum so their comments are no surprise.

Canadian finance minister Flaherty sent some positive messages on the loonie, saying the forecasted 2015-16 fiscal year surplus 'won't be close' and that the Bank of Canada will face pressure to raise interest rates this year. The BOC has a neutral stance and the market isn't pricing in any chance of a hike this year.

The early-week calendar doesn't feature any top-tier data releases. At 1730 GMT, the Australia Industry Group releases its December performance of services index. In November the survey was at an 8-month high of 48.9. Later, at 0145 GMT, the HSBC China services PMI will be released. The previous reading was 52.5.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ISM Non-Manufacturing PMI (DEC) | |||

| 54.6 | 53.9 | Jan 06 15:00 | |

| PMI (DEC) | |||

| 52.5 | Jan 06 1:45 | ||