Intraday Market Thoughts Archives

Displaying results for week of Oct 06, 2019GBP Analog, Fractal Realized

Saying there is a Brexit deal or no-deal is not helpful in these markets. Making the prediction that GBPUSD will rise, or will not fall below 1.18 is fine, but will not make you money. Committing funds to a tradable idea with price parameters is what this market is all about. 3 weeks ago, I identified the similarity of the pattern in GBPUSD price action in Sep 2019 to that in Sep 2018, suggesting a temporary pullback will emerge prior to an shar recovery. A repeated pattern is often called a fractal or analog (scale and duration does not have to be exact). This was issued as a long trade for the Premium susbcribers. Other factors such as GBP cycles and peaking USD peak also helped us take the trade. OUTCOME: GBPUSD's 3rd biggest weekly gain in over 10 years.

Biggest GBP Jump in 2 years

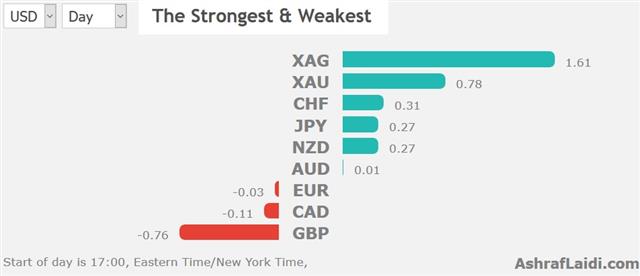

Sterling made its biggest weekly percentage gain vs USD in over 2 years and its 4th fastest rise in 10 years amid successive positive news on the Brexit negotiations front (more below). The Premium long trade in GBPUSD hit its final target for 260-pip gain. A solid Canadian jobs report dragged USDCAD lower by nearly 80 pips to 1.32. Markets now await comments from Trump on his meeting with China's vice premier as the US-China talks enter their 13th round. The other story is that of USDX selloff as the index broke its 55-DMA.

GBP extended its rally this morning when UK Brexit minister Stephen Barclay told ambassadors from the 27 EU member states earlier on Friday that sufficient progress had been made with his EU counterpart Michel Barnier in order for discussions to intensify. More developments are awaited ahead of next week's EU summit as well as the reaction from the DUP. GBP bulls are now reasoning that Boris Johnson had little choice (either to ask for a delay, or accept a deal) instead of being ready to leave without a deal.

GBP is now the best G10 currency performer since the start of Q3 (beginning of H2) and is the 3rd best performer year-to-date (behind CAD & JPY)

Onto US-China Talks

The market is pricing in a US-China trade deal that includes no new tariffs in exchange for agricultural purchases and a hollow FX pledge. That's nothing like the comprehensive deal many were hoping for but there is a reason the market liked it anyway. The Canadian jobs report is due on Friday but trade headlines will continue to dominate.A 'trade deal' is the wrong term to describe what appears to be shaping up between the US and China. This is more of a ceasefire that includes the bare minimum for both sides to save face at home and mitigate economic damage.

This wasn't what anyone was hoping for but markets are signaling it's good enough for now. Why? Mainly because it appears the US is backing down. If the truce comes together (and that's still far from certain at this point), it's because the US has backed down. They have been the aggressor in this fight and if Trump has had enough for now then he's not likely to escalate it until after the election.

In addition, this type of deal leaves enough uncertainty intact to keep the Fed easing cycle going. Or at least the market thinks it does. We will be watching for any signals to the contrary ahead of the Oct 19 blackout.

Looking further out, the deterioration in the US-China relationship is dire. The 'uncertainty' that the Fed has been lamenting on trade is now a permanent feature. It's entirely clear that a decoupling is underway and the only variable is the pace.

There are also important questions outside of the two countries. Those who can continue to trade openly with both sides stand to benefit, even if the overall picture means slower global growth.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Rosengren Speaks | |||

| Oct 11 17:15 | |||

Trade Talks & Low Inflation Weigh in

Wild fluctuations in indices during the least liquid time of the day (post-US, pre Asia) gave way to a gradual rebound into the US session. Sudden declines in equity markets on reports that China's delegation could leave the US early were reversed higher later after Trump tweeted he would meet China's vice Premier. US CPI came in lower than expected. GBP spiked over full cent to 1.2315 on an optimistic joint statement from UK and Irish PMs Johnson and Vradkar. The Premium short in the DOW30 was stopped out and a video for Premium members has been released below.

Trade Talks' Low Bar of Expectations

Headlines will continue to dominate in the hours and days ahead but judging by the positive reactions to some of these headlines, expectations have been lowered to the point where any kind of a ceasefire would be a moderate win (but perhaps a fleeting one).The trade meetings this week are dominating markets but a secular theme in global economies is low inflation. It was something the Fed highlighted in the FOMC minutes and will be a focus in the day ahead with the US CPI due. On Wednesday, the euro was the top performer while the yen lagged.

Fed's Low Inflation Trap

The Fed argument for lowering interest rates has slowly shifted from one primarily about trade risks and uncertainty to broader concern about low inflation. It's all a bit rich considering the Fed has missed its inflation target for years and was hiking rates but it's pertinent nonetheless.That's especially true because there are signs of a turn in the economy. Wednesday's JOLTS report showed the third consecutive decline in job openings, something that hasn't happened since 2009. The level of opening remains high and the overall jobs market is very strong but there are few signs that it will strengthen further and that means any wage pressures could soon dissipate.

With just 9 days until the blackout period begins, officials will need to make a concerted effort to tame cut expectations, which are at 78%.

Geopolitics Join Trade Talks

Tuesday's speech from Fed Chair Powell is currently being displaced by Turkey's military operations in Northern Syria and the lead up to Thursday's resumption of US-China Trade Talks. This means more swings in indices and no clear trends in FX. US crude oil remains well below the 54.00 cap ahead of inventories. far frBut it's worth mentioning Powell's speech ahead of this evening's minutes release of the September FOMC meeting. The Fed put may finally be reversing on markets as Powell showed some reluctance to cut rates in the event that geopolitical conditions stabilise. The yen and franc are the weakest currencies of the day as indices find a floor for now. The pound remeains weak as the message from the EU-UK noise is increasingly pointing to no-deal one week ahead of the UK-EU Summit.

نشاط المؤشرات و هدوء العملات فيديو للمشتركين

Fed chair Powell mentioned 'data dependence' seven times in his speech on Tuesday in a strong hint that policymakers aren't as certain about cutting rates as the 77% chance priced into October and 45% chance of two cuts before year end.

One major factor that the Chairman highlighted was geopolitical risk and he's undoubtedly referring to US -China trade. Should there be some kind of positive conclusion, or even a face-saving punt down the road, it may not be the positive risk event that markets are hoping for because the Fed may pause.

On the flipside, if talks break down, risk trades will certainly be hit hard.

That leaves a negative skew ahead of an event that's largely binary, with commodity currencies particularly vulnerable. The market sensed that on Tuesday and it reacted to more signs of unease between both sides, including a Chinese report saying that Beijing could leave early.

The S&P 500 fell 43 points and commodity currencies softened.

Powell also touched on balance sheet expansion and unambiguously highlighted that it's not a new QE program. That may be debatable but the important point is that the Fed doesn't consider it to be easing or a reaction to anything in the economy. We may hear more about what's coming in the FOMC minutes due at 1800 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed Chair Powell Speaks | |||

| Oct 09 15:00 | |||

| BoE Gov Carney Speaks | |||

| Oct 10 9:20 | |||

| FOMC Meeting Minutes | |||

| Oct 09 18:00 | |||

More Twists & Turns Pre Trade Talks

Just as China appeared not to be interested in the type of comprehensive trade deal that Trump wants, matters got worse for indices on re-emerging reports that the White House is studying proposals to limit US govt pension investments in Chinese stocks. A similar story was denied late last month, but seems to be making the round again. GBP is the worst peformer on mixed reports indicating the UK govt was readying for a no-deal Brexit. A new Premium trade has been issued moments ago. Markets await comments from Fed chair Powell later this evening.

Several reports at the start of the week indicated that China won't even discuss some of the issues the US is demanding like industrial subsidies and IP theft. That puts us back towards something akin to buying soybeans in exchange for lifting tariffs.

Last month, Trump said he wanted a comprehensive deal or nothing but on Monday he softened the tone, saying he would prefer a big trade deal. That difference could be splitting hairs as Trump isn't fond of subtlety and we're now at the point where a wait-and-see strategy beats jumping the gun on every headline.

The market was whipsawed Monday after a Fox Business report saying China was open to a smaller trade deal. That boosted risk trades but they later reversed when the report added that China wouldn't negotiate on IP.

Looking ahead, Fed chairman Jay Powell has an opportunity to manage rate cut expectations at an event at 14:30 Eastern (19:30 London) in Denver. There is a prepared text and Q&A so there will be plenty of opportunity for market moving headlines. At the same time, Powell will surely want to avoid tipping his hat before US-China trade talks conclude. The Fed funds futures market is currently pricing in a 71% chance of a cut on Oct 31 but that will swing about 30 percentage points depending on the results of trade talks.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Evans Speaks | |||

| Oct 08 17:35 | |||

| Fed Chair Powell Speaks | |||

| Oct 08 17:50 | |||

Advantage China Ahead of Trade Talks

Non-farm payrolls were good enough to sooth recent economic nerves, while keeping rate cuts in play but the market will now quickly shift its focus from economics to trade negotiations, resuming Thursday. China is already signalling it is opposing the terms under Trump's broad trade deal. Sunday remarks from hawkish FOMC dissenter Esther George indicating her readiness to turn dovish if the facts change. CFTC positioning data showed an extension of bets against the Australian dollar. Fed Chair Powell speaks again on Tuesday. The minutes of the Sep FOMC meeting are due on Wednesday.

US jobs report had something for everyone. The headline at +136K was slightly softer than 145K expected but the prior two months were revised a total of 45K higher. Unemployment also fell to 3.5% from 3.7% -- a 50-year low. On the wages side, US earnings rose only 2.9% y/y compared to 3.2% expected.

For equities it was an ideal report because it showed the economy remains strong but low wages mean the Fed doesn't need to hike. That led to a 41 point rally in the S&P 500 to erase all but 0.9% of the weekly loss. DOW30 had a late 100-py push towards the 26580s mentioned in Friday's piece here. Bonds and FX were torn by the good-and-bad parts of the report and stuck closer to unchanged.

That unease is also a symptom of the US-China trade talks starting Thursday. Leaks are already revealing some of the fault lines, including a report suggesting that China won't consider reforming industrial policy or government subsidies.

The report ties the hardening stance to the impeachment crisis facing the President and suggests China suddenly feels like it has the upper hand. If they have miscalculated, it could lead to a spectacular blow-up. Expect a tepid tone until there is some clarity.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -66K vs -61K prior GBP -77K vs -81K prior JPY +14K vs +13K prior CHF -12K vs -11K prior CAD +6K vs +5K prior AUD -52K vs -47K prior NZD -42K vs -45K prior

The market was relatively stable for the second week. That highlights a wait-and-see attitude around US-China trade talks and the global economy. One position that extended was the short-AUD bet and it comes at a time when risks to both sides of the trade are high.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed Chair Powell Speaks | |||

| Oct 07 17:00 | |||