Intraday Market Thoughts Archives

Displaying results for week of Dec 06, 2015Third Avenue Blockade, Beijing FX Coup

Another market tumble stands in the way of the Fed's artificial normalisation, saw EUR & JPY pushing higher against the USD, while AUD, NZD and the rest of commodity FX sustained fresh damage. China's announcement earlier today that it had officially launched a new trade-weighted index for the yuan in order to more accurately reflect the currency's value is a departure from solely focusing on its valuation against the US dollar, towards valuing it against a set of currencies. Although the announcement did not entail an outright devaluation or an expansion in the 2.0% daily trading band, markets have interpreted the changes as an easier means to weaken the yuan.

The publication of the new basket removes the yuan from being principally tied to a rising USD, allowing Beijing to weaken its currency against a basket of currencies, which would be deemed less USD-specific and less controversial. Either way, China's currency will have to depreciate further-not only due to prolonged easing ahead from the PBOC, but also due to the fact that the currency remains overvalued after being tied to the appreciating USD and having risen against the tumbling yen by 65% between 2013 and 2014. So far, CNY has fallen by only 7% against JPY over the past five months. More CNY declines lie ahead and Monday's (and Tuesday's) fixing will be only the start.

Third Avenue Blockade for High-Yield Seekers

The day's biggest headline emerged from the credit front, as US high-yield bond fund Third Avenue Management took the rare step of blocking investor withdrawals from its $788 million credit mutual fund. The fund announced that the only way to fulfil investor withdrawals would have forced it into selling already tumbling bunds, sending yields further higher and endangering the entire US credit market, days before the Fed embarks on normalisation.As in 2007-8, skeletons have a way to drop off investment funds closets. If Third Avenue sustained nearly $1 bn of redemptions in the 11 months ending in November, and as much as $3.46 bn in withdrawals from all high-yield funds last week, then what would happen next year. Whether these junk bond funds are energy-related or not, the situation remains parlous and could turn perilous if the Fed hikes. Our stance of expecting no Fed hike in 2015 may have turned unsustainable as far as probability, but not in validity.

With the ECB decision and strong NFP report behind us, both the US dollar and yields are at 5-week lows. That's NOT what these markets are supposed to look like five days before liftoff. Regardless of the Fed's outcome next week, were already looking past the meeting into a fresh round of easing in H2 2016.

Ahead of US Retail Sales

Economists overwhelmingly expect the Fed to hike rates next week but it's not because the economy is roaring. The New Zealand and Australian dollars were the top performers while the euro lagged. The economic calendar is relatively light until US retail sales. In our latest Premium Insights, two new trades were issued.

The Fed clearly 'wants' to hike rates and is willing to suspend its fears just to get off the zero bound. But make no mistake, if the Fed funds rate was at 3.00%, the lone discussion would be about whether or not to cut.

Consider this:

The Nov ISM manufacturing index fell below 50 to the lowest since 2009.

The Nov ISM non-manufacturing survey missed estimates by 3 points and fell to the lowest since May.

Today's initial jobless claims report rose to the highest since July.

Inflation is running at +0.2% y/y and commodity prices are falling.

Consumer sentiment data is trending lower.

To be sure, signals from employment remain strong but that's a lagging indicator. At best, the US economy is continuing to slog at about a 2.2% pace with headwinds from weaker global growth and the strong US dollar coming.

The question is when and where to sell the US dollar.

In the bigger picture, we will aim to trade what the Fed does; not what they should do. If the Fed hikes next week and forecasts remain optimistic, there is a chance of a second hike in Q2. El Nino will continue to bring excellent weather to North America and that will boost economic activity and may fool the Fed into believe the economy is truly accelerating in Q1 2016.

That might set up the start of a larger US dollar short mid-2016 but, could come sooner if the market sniffs out the problems. At the moment, market volatility continues to concern us but separating year-end flows from signals is challenging. We will be paying close attention to Friday's US retail sales report.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (NOV) (m/m) | |||

| 0.3% | 0.1% | Dec 11 13:30 | |

| Retail Sales (ex. Autos) (NOV) (m/m) | |||

| 0.3% | 0.2% | Dec 11 13:30 | |

| Continuing Jobless Claims (NOV 28) | |||

| 2243K | 2155K | 2161K | Dec 10 13:30 |

| Initial Jobless Claims (DEC 5) | |||

| 282K | 270K | 269K | Dec 10 13:30 |

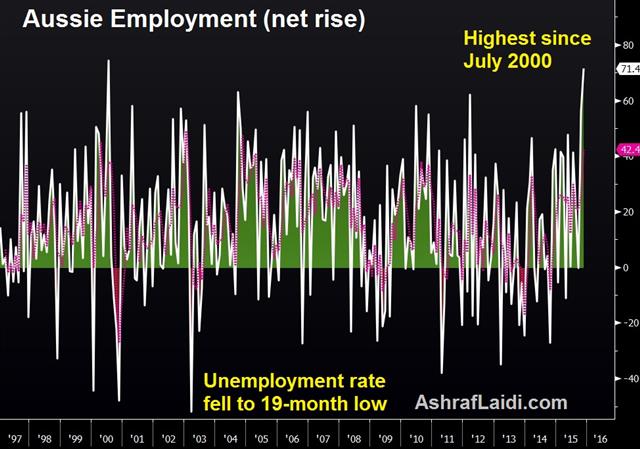

AUD Jobs Shocks again, RBNZ Cuts, USD Sinks

Year-end is tricky time to draw any conclusions about market moves but we're watching a few trouble spots closely. The US dollar was weak across the board while the euro and yen led the way. The kiwi jumped despite an RBNZ cut and the Australian jobs once again shocked to the upside (more below). The Premium Insights saw GBPNZD short stopped out with 20 pips below the session high before the pair plunged. An AUDNZD long was issued ahead of of the RBNZ and the Aussie jobs report. USDJPY short was closed with a 155-pip gain.

The latest move in FX was a 100-pip jump in the New Zealand dollar to 0.6720 after the RBNZ decision. Wheeler cut rates to 2.50% from 2.75% in a move that was mostly expected but the market rallied because there was no explicit hint of further cuts. He pushed out the forecast for hitting the 2% inflation target by only one quarter.

What was more striking on the day was the volatility. The S&P 500 was up as much as 20 points and then fell by as many as 26 and finished down 16. Oil rallied on tighter US inventories and then fell to session lows.

The yen was unusually strong, even on a day with US stocks falling. It was accompanied by a 5% swan dive in the South African rand to record low. We may look back in six weeks and see it as an early sign of a big carry trade unwind but for now it's tough to assess.

Australia produced another stellar jobs report, with employment soaring 71K in November vs expectations of a 10K decline, following a massive 56K jump in October. Another positive is that 42K of the 71K jobs were full time. The unemployment rate fell to 5.8% from 5.9%, defying expectations of a rise to 6% and the participation rate rose to 65.3% from 65%.

AUD/USD soared to 0.7335 from 0.7222 after coming off the boil for the past three days. Before that it had shown a remarkable resilience to bad news. Today's news pit the strength of the Aussie against the ongoing bad news from the commodity space.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Business NZ PMI (NOV) | |||

| 53.3 | Dec 10 21:30 | ||

| Food Price Index (NOV) (m/m) | |||

| -1.2% | Dec 10 21:45 | ||

| Consumer Prce Index (NOV) (m/m) | |||

| 0.0% | -0.1% | -0.3% | Dec 09 1:30 |

| Consumer Prce Index (NOV) (y/y) | |||

| 1.5% | 1.4% | 1.3% | Dec 09 1:30 |

| FDI - Foreign Direct Investment (YTD) (NOV) (y/y) | |||

| 8.6% | Dec 11 | ||

| Unemployment Rate s.a. (NOV) | |||

| 5.8% | 6.0% | 5.9% | Dec 10 0:30 |

| Employment Change s.a. (NOV) | |||

| 71.4K | -10.0K | 56.1K | Dec 10 0:30 |

| Fulltime employment (NOV) | |||

| 41.6K | 38.5K | Dec 10 0:30 | |

| Part-time employment (NOV) | |||

| 29.7K | 18.6K | Dec 10 0:30 | |

BoC Outlines Arsenal in Commodity War

If commodities collapse in 2016 or some other crisis hits the Canadian economy, the Bank of Canada is ready. The BOC laid out the different ways it could ease if necessary in what could be blueprint of what's to come. The Swiss franc was the top performer on the day while the Australian dollar lagged. Chinese CPI is due up next. Ashraf's Premium Insights closed out of the GBPUSD and DAX shorts at a gain of 182 pips and 270 pts respectively.

Five things to keep in mind regarding CAD:

1. Oil fell to the lowest levels since 2009 and that pushed USD/CAD to the highest in 11 years.

2. BOC Governor Poloz said rates could be cut as low as -0.50% along with forward guidance and QE if a shock hits the Canadian economy.

3. Canada's main equity benchmark closed at the lowest level since 2013 and is down 16% since April. Benchmark Canadian oil is trading at a $13 discount to WTI – just $24/barrel.

5. The commodity super-cycle began in the late 1990s and lasted more than 15 years. The bust has been ongoing for 15 months.

5. Mining giant Anglo American announced 85,000 job cuts, 62% of its workforce. The company doesn't have significant operations in Canada but it's a sign of things to come in the commodity sector.

Economists and central bankers have a particular tendency to assume the distant future will look like the past. The BoC repeatedly under-estimates the pain in the commodity sector and assumes a CAD-driven rebound in manufacturing will absorb the blow.

The risk in 2016 is that commodities fall much further and don't rebound. At least you can say that the BOC is ready but if that arsenal of tools is deployed, USD/CAD could rise much higher . The pair broke the 61.8% retracement of the 2002 to 2007 decline yesterday. A full retracement would hit 1.60.

Whether it's a hard or soft landing for Canada has as much to do with China as with anything. The Shanghai Securities News reported the PBOC will cut the RRR in December in what would surely be welcome news for the BOC.

The PBOC at the moment isn't limited by inflation, especially with oil falling. The risk is that inflation falls even further and gives them more space for aggressive stimulus. Watch the CPI report at 0130 GMT; it's expected to show prices up just 1.4% y/y.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (NOV) (m/m) | |||

| -0.1% | -0.3% | Dec 09 1:30 | |

| Consumer Prce Index (NOV) (y/y) | |||

| 1.4% | 1.3% | Dec 09 1:30 | |

Commodity Crunch-Time, China Trade Data Next

USD/CAD rose to an 11-year high as oil prices broke down. Routs on other commodity prices also hit the Australian and New Zealand dollars while USD was the top performer. Japanese Q4 GDP revisions are due late with Australian business conditions. China's Nov Trade figures is set for a possible release tonight. The Video for Premium subscribers has been posted. Full table of contents is found below.

The oil production war will be a major theme of 2016 and it's the worst possible news for the Canadian dollar. USD/CAD broke above the Sept high of 1.3457 and then cruised through 1.3500 on Monday to the highest levels since 2004.

We've repeatedly made the case for why the oil market is oversupplied. The US continues to produce near record levels, OPEC reaffirmed there are no limits to its production and Iran is weeks away from ramping up exports. Global demand is edging higher but week-after-week, oil is going into storage and soon (maybe now) it will be dumped on the market.

The commodity super-cycle ran further than almost anyone believed it would but it's busting now and the main risk is that there is a symmetrical response on the downside. In many raw materials the heavy investment in commodity projects is just beginning to produce. With all the start-up costs already absorbed, there is ample reason for indebted producers to continue mining at extremely low prices.

Iron ore is another example. AUD/USD has been remarkably resilient in the face of falling commodity prices over the past month but surely there is a limit. Iron ore fell below $40 on Monday and exposed some cracks in AUD as it fell 1%.

The broader market themes were limited. EUR/USD retraced back to 1.08 but held there and bounced. The US dollar was strong across the board despite a soft day for stocks and falling Treasury yields.

In the hours ahead, Japan will release its final Q3 GDP print. It currently stands at -0.8% q/q (annualized) but it's expected to be revised to +0.2% after some improved economic numbers late in the quarter. That would mean that Japan had avoided recession – something that will help remove pressure on the BOJ to act. The data is at 2350 GMT.

Another spot to watch is the Australian NAB business conditions survey. It's a lower tier indicator due at 0030 GMT but it may offer some insight into how the broad Australian economy is responding to soft commodities and a weak AUD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Annualized (Q3) | |||

| 0.1% | -0.8% | Dec 07 23:50 | |

| GDP (Q3) (q/q) | |||

| 0.0% | -0.2% | Dec 07 23:50 | |

| GDP Deflator (Q3) (y/y) | |||

| 2% | Dec 07 23:50 | ||

| Exports (NOV) (y/y) | |||

| -5.0% | -6.9% | Dec 08 2:00 | |

| NAB's Business Conditions (NOV) | |||

| 9 | Dec 08 0:30 | ||

SNB in Focus, Euro Shorts Were Ripe

With the ECB in the rearview mirror we look ahead of the repercussions elsewhere. In early-week trading, CAD is marginally softer alongside oil. Weekly CFTC positioning data showed euro shorts rising ahead of the ECB decision. It was likely a sleepless weekend at the SNB. The Swiss franc was the top performer last week and now the pressure is on to response to ECB measures.

The SNB decision is on Thursday and some analysts have scaled back expectations for action because the ECB didn't deliver a euro-crippling package. Still, broader rise in the franc last week will concern the SNB. EUR/USD is trading at 1.08 when they were prefer to see it above 1.20. We will be keeping a close eye on headlines out of Switzerland in the lead-up to the decision.

On the weekend a Reuters report revealed that ECB hawks felt like Draghi was trying to corner them with his dovish tone last month. Instead of bowing, they dug in their heels and with the backing of staff forecasts that were little changed, Draghi didn't even table a seriously dovish proposal.

The euro opened the week flat at 1.0885 but the volatility is surely unfinished.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -182K vs -175K prior

JPY -75K vs -77K prior

GBP -28K vs -32K prior

AUD -47K vs -57K prior

CAD -39K vs -39K prior

NZD +5K vs +4K prior

This week's data showed the largest euro short position since May 5 as traders bet on Draghi delivering. Looking ahead, the dollar long position is high across the board and after the ECB surprise, speculators may be feeling a bit less comfortable ahead of the Fed, especially with US economic data slipping