Intraday Market Thoughts Archives

Displaying results for week of Jul 06, 2014Beware of IBEX-35 Seasonality

Spain's IBEX-35 could be at risk falling into a seasonal vicious cycle. The index has sustained sharp losses around this time of the year in each of the last three years. Will Portuguese woes be the catalyst? Full charts & analysis.

Sea of Troubles Plants a Seed of Doubt

A handful of negative headlines hit a fragile market on Thursday and sparked round of fear but as traders began to wade through the headlines the fear diminished. The Canadian dollar shook off the worries and was the best performer in a sign of its underlying strength, while its Australian cousin lagged. A busy week in Asia-Pacific trading ends with Australian home loans as the lone economic data point. In today's Premium Insights, we added two new trades in EURJPY, while confirming our existing USDJPY trade with charts to highlight a technical similarity on EURUSD, USDJPY and EURJPY.

European banking worries have been lurking in the background ahead of the ECB stress tests but the worries flared up with a default at a major shareholder of Portugal's second largest bank Banco Espirito Santo. The Groupo Espirito Santo owns 25% of the bank and missed a short-term bond payment.

Banking problems can quickly snowball if depositors make a run on the bank and that's always possible after how accounts were treated in Cyprus. Portugal's central bank tried to ease worries but that's expected and they will try to shore up confidence in the day ahead.

Alone, the headlines might not have sent EUR/JPY to the lowest since February but very weak French and Italian industrial numbers added to the fear. In addition, Japanese machine orders collapsed 14.3% y/y, Chinese exports were soft and US retailers have been cautious early in earnings season.

Amidst all those headlines, the market hardly noticed initial jobless claims at 304K compared to 315K expected and the 4-week moving average falling to the lowest since 2007.

The ECB's Nowotny underscored that no decisions on QE will be made until year-end so the euro is essentially on its own. To us, the combination underscores once again the skew in this market. Traders are much more sensitive to bad news compared to good headlines. Those kinds of jitters are likely to linger.

Looking ahead, the focus shifts to second-tier data from Australia with housing finance for May due at 0130 GMT. Loans are expected to fall 0.5% but even a large fall in lending wouldn't rock AUD.

Yesterday's soft full-time jobs data along with weak Chinese exports weighed on the Australian dollar but it continues to chop around 0.94, which has been a magnet for the past month.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Home Loans (MAY) | |||

| -1% | 0% | Jul 11 1:30 | |

| Core Machinery Orders (m/m) | |||

| -19.5% | 0.7% | -9.1% | Jul 09 23:50 |

| Core Machinery Orders (y/y) | |||

| -14.3% | 9.5% | 17.6% | Jul 09 23:50 |

| Exports (JUN) (y/y) | |||

| 7.2% | 7.0% | Jul 10 0:00 | |

| Chinese Exports (y/y) | |||

| 7.2% | 10.6% | 7.0% | Jul 10 2:00 |

| Initial Jobless Claims (JUL 4) | |||

| 304K | 316K | 315K | Jul 10 12:30 |

| Continuing Jobless Claims (JUN 27) | |||

| 2.584M | 2.567M | 2.574M | Jul 10 12:30 |

Yields-Yen in Action, Portugal Dips

Eurozone woes return to the headlines amid news that Portugal's Espirito Santo International has missed its interest rate payment, causing fresh reverberations in to Portugal's biggest bank. Portugal's 10-year yield rises for the 4th consecutive weekly gain, while Spain 10-year yield may be doing something this month not seen since December 2013. Meanwhile, the mystery of falling US bond yields despite back-to-back solid US jobs reports is reconciled by weak US GDP figures and the lack of conclusive assessment from yesterday's FOMC minutes. If the Fed does indeed complete its tapering by October, then will Yellen effectively maintain bond yields at lower levels simply by talking down inflation and improvements in labour markets? Or, will yields fall due to concern with the economy following the full tapering off of QE3?

EUR/USD Death Cross Looms, AUD Jobs Next

The FOMC minutes were the main event in US trading and dollar bulls were looking for any hint that the Fed could be thinking about hiking rates. In the run-up to the release the dollar grinded higher and traders sent the US dollar a dozen pips higher as the headlines hit.

But looking through the headlines there was little the market didn't already know. The Fed will wrap up the taper in October and is mildly upbeat on a pickup in growth. The initial move faded quickly and the US dollar sank to session lows shortly afterwards.

EUR/USD was one of the pairs to take advantage is it climbed to 1.3648 from 1.3612. It's the highest in a week but understates some of the risks. Technicians will be eyeing a death cross with the 55-dma set to fall below the 200-dma in the next day or two.

It's the first such cross in a year. The previous instance lasted only a few days but a death cross in 2011 eventually led to a 1500 pip decline. There's usually no rush to enter on a long-term bearish cross but if the Fed finally signals a hawkish stance that might be the signal.

In the near term, the Australian jobs report is down at 0130 GMT. The consensus is for a 12K rise in jobs but the key is always the breakdown of part-time/full-time work along with the unemployment and participation rates.

AUD/USD reversed after breaking to an 8 month high last week on the comments from Stevens and non-farm payrolls but it has recouped about half of the losses and the inability of the US dollar to rally could give the pair new life if the jobs report is strong. A poor report would likely complete the reversal.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Employment Change s.a. (JUN) | |||

| 12,300 | -4,800 | Jul 10 1:30 | |

| Fulltime employment (JUN) | |||

| 22,200 | Jul 10 1:30 | ||

| Part-time employment (JUN) | |||

| -27,000 | Jul 10 1:30 | ||

| Unemployment Rate s.a. (JUN) | |||

| 5.9% | 5.8% | Jul 10 1:30 | |

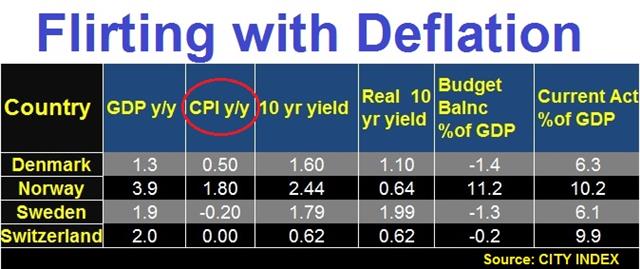

Disinflation risk & FX performance

As more central banks grapple with falling interest rates, here is a look at some low inflation nations. Full charts & analysis

Another Jobs Number Fails to Boost USD

The employment picture is clearly improving in the United States. The JOLTS report surged in May for the third month as job openings rose to 4635K compared to 4350K and nearly matched the pre-crisis high. It's a laggy report but it's one that the Fed follows closely and confirms that the trend in other employment indicators is real.

The tightening labor market may also be spilling over to wage hikes as the NFIB survey showed 21% of small business hiking wages in the past three months. The small business sector is often at the front end of a wage lifting cycle.

Still, there are concerns that jobs growth is happening in quality industries and that job advertisements are promising higher pay. The market certainly isn't giving the US dollar any credit. USD/JPY has wiped out all the ADP/NFP gains and other pairs continue to eat away.

Two of the most notable are GBP and NZD. The pound easily shrugged off a very weak manufacturing report and a 50 pip decline. Cable closed near unchanged on the day at 1.7129. The New Zealand dollar rose to a fresh cycle high after Fitch upgraded its outlook to positive. The pair is closing in on the 2011 high of 0.8842.

The focus stays on the Asia-Pacific region in the hours ahead with June Chinese PPI and CPI due at 0130 GMT. The CPI report is key and is expected to moderate to 2.4% y/y from 2.5%. The Chinese government has enough leeway to add stimulus or wait so the market won't be too volatile on a 1 or 2 tick miss.| Act | Exp | Prev | GMT |

|---|---|---|---|

| JOLTs Job Openings | |||

| 4.64M | 4.53M | 4.46M | Jul 08 14:00 |

| Consumer Prce Index (JUN) (m/m) | |||

| 0.1% | Jul 09 1:30 | ||

| Consumer Prce Index (JUN) (y/y) | |||

| 2.4% | 2.5% | Jul 09 1:30 | |

The Ingredient That’s Always Missing

Whenever a recovery begins to gather momentum it's always seems to falter on poor business investment. The Canadian dollar stumbled Monday after a BOC survey showed companies unwilling to invest. The upcoming session features Japanese trade balance, Australian business confidence and BOJ comments but a natural disaster threatens to steal the headlines.

The Canadian dollar was the high flyer in Q2 after a round of robust economic data. The Bank of Canada said there were two elements that needed to fall into place – exports and business investment.

A recent survey showed better sentiment for exporters, likely due to CAD weakness but once again investment is nowhere to be found. The BOC business outlook survey showed disappointment intentions and that will give Poloz a reason to maintain a slightly dovish tone next week.

The Canadian dollar struggled after the report and it weakened further after the June Ivey PMI fell to 46.9 from 48.2. The market was expecting a rise to 52.0 but this could be an early indication that the rebound in the loonie is already hurting Canadian manufacturers.

The overall tone in markets was risk aversion and US dollar softness. The excitement from non-farm payrolls has quickly faded and USD/JPY has given back all its gains.

Looking ahead to Asia-Pacific trading, the main headline will be the May Japanese trade deficit at 2350 GMT as it's expected at 822 billion yen from 780 billion in April. Other headlines include NAB Australin business confidence at 0130 GMT and comments from the BOJ's Nakaso at 0345 GMT.

The main story, however, could be Typhoon Neoguri as the Category 5 storm bears down on Okinawa on Tuesday morning followed by the main island that night. The typhoon path is well-prepared for storms but flooding and damage could prompt some repatriation of funds.

The event to watch later is Swiss CPI, as Ashraf wrote about earlier.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (JUN) (m/m) | |||

| 0.1% | 0.3% | Jul 08 7:15 | |

| CPI (JUN) (y/y) | |||

| 0.2% | 0.2% | Jul 08 7:15 | |

| Retail Sales (MAY) (y/y) | |||

| 1.8% | 0.4% | Jul 08 7:15 | |

| Ivey PMI (JUN) | |||

| 49.7 | 52.2 | Jul 07 14:00 | |

| Ivey PMI s.a (JUN) | |||

| 46.9 | 52.5 | 48.2 | Jul 07 14:00 |

| NAB's Business Confidence (JUN) | |||

| 7 | Jul 08 1:30 | ||

Big Swiss Data Coming up

As the euro sustains the burden of disinflationary risks in the Eurozone, what about the Swiss franc; whose inflation drifts at 0.2% y/y and could hit 0% y/y on a EU-harmonized level according to tomorrow's data. On May 20, we issue a Premium trade on USDCHF, with a chart warning of a potential triple top in CHF net longs vs USD. Today, CHF net commitments have plunged to their biggest net shorts since June 2013. Tomorrow's key data on Swiss CPI and retail sales will be watched by SNB, whose Governing Council member Zurbruegg issued a warning two days ago. Today, we issue a new note on USDCHF and on AUDUSD ahead of this week's key Aussie jobs data.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (JUN) (m/m) | |||

| 0.1% | 0.3% | Jul 08 7:15 | |

| CPI (JUN) (y/y) | |||

| 0.2% | 0.2% | Jul 08 7:15 | |

| Retail Sales (MAY) (y/y) | |||

| 1.8% | 0.4% | Jul 08 7:15 | |

IMF Set to Cut Forecasts, Yen Shorts Cover

The IMF is set to cut global growth forecasts in a reminder of how disappointing 2014 has played out. The US dollar struggled last week despite the blockbuster jobs data. The calendar is light to start the week around the globe but markets will have some weekend news to digest.

The main geopolitical headline was from the Ukraine where government forces seized control of separatist stronghold Slovyansk. It's now clear that Kiev has the upper hand in the conflict and that Russian forces aren't poised to storm across the border.

Markets had mostly moved past the conflict in Ukraine but some mild relief trades could begin. The larger flows are likely to be euro negative if and when the conflict is finally resolved. Money flooded into euros as a safe haven during the height of the crisis and most of it likely hasn't returned to Russia and Ukraine.

The more-lasting event in the week ahead is likely to be a cut in global growth forecasts from the IMF. On the weekend, Lagarde said forecasts will be “very slightly different” from the ones in April. The US along with some developing markets have lagged but another culprit the IMF will cite is disappointing investment spending.

Companies have been loath to spend on plants, production, equipment and IT. Economists repeatedly remark that the conditions are right for those types of outlays but in markets around the world but the results continue to disappoint and governments, central banks and traders will need to adjust.

Commitments of Traders Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

- EUR -61K vs -58K prior

- JPY -59K vs -71K prior

- GBP +56K vs +50K prior

- AUD +39K vs +34K prior

- CAD -3K vs -5K prior

- CHF -7K vs +5Kprior

- NZD +9K vs +6K prior