Intraday Market Thoughts Archives

Displaying results for week of Jun 07, 20202nd Virus Wave Mutes Powell Effect

Fed Chair Powell left no doubt that the Fed is unconcerned about the rally in risk assets and that there is no intention to slow easing. But the escalating number of Covid-19 cases in the southern US is weighing on indices. JPY and CHF are the only gainers vs the USD. The question now is whether the Fed's 'all-in' is enough for risk assets. A new Premium trade will be issued ahead of the London Close.

Before we cover Powell, it's worth mentioning that Texas reported over 2500 new cases of coronavirus cases, the highest since 1-day rise since the outbreak of the virus. Florida had over 8K new cases, the biggest of any 7-day period. Experts have yet to determine whether the latest surge is a result to recent re-openings.

The main action from the FOMC was to pledge at least $120B per month in combined Treasury and MBS purchases for the coming months. It was an upside surprise and ensures that the taper has been halted.

The initial reaction was strong selling in the dollar but that receded when Powell shied away from promising yield curve control. The market may have gotten that one wrong because his message on YCC wasn't that the Fed didn't want to support the recovery, it was that they aren't sure yield curve control will work, especially with yields already so low.

Otherwise he uttered what was were some of the most-dovish phrases ever said by a central bank leader in: "We're not thinking about raising rates, we're not even thinking about thinking about raising rates." and "We will continue to use our powers forcefully. aggressively and proactively."

He addressed the rebound in risk assets directly and dismissed it outright by saying that acting to hurt an asset bubble wouldn't be desirable if it hurt the jobs market. The Fed is focused on 2% inflation and low unemployment and high stock prices aren't going to derail that goal. Add it all up and the message was extraordinarily dovish. That was reflected in strong rallies in gold, silver and copper.

Today, the DOW30 is back below its 200-DMA, but gold is stabilising around 1730 as another question becomes unavoidable: "Will Corona Case become a US-specific problem?"

Fed Can't Quit Now

The FOMC decision on Wednesday is a chance to see whether Powell will shy away from an extremely dovish stance or cement his reputation and the Powell put. Expect surging volatility in FX and indices following the Fed dot plots and ensuing press conference. US CPI posted its 3rd consecutive monthly drop. All currencies are up against the US dollar with the exception of CAD. 4 of the 5 Premium trades currently open are in the green. Below is the video for Premium susbcribers.

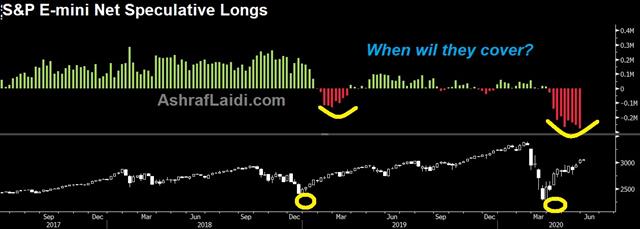

The equity market has undoubtedly gotten ahead of itself but the question the FOMC faces is if that's their problem. The countless programs, bailouts, QE, ZIRP and junk bond buying halted the decline in equity markets and have been the biggest factor in the +45% rebound.

But those things are also a great help to the economy, workers and home prices. Any kind of a hint in unwinding those programs would take some of the air out of stocks but is that a worthwhile goal when so many jobs are at stake? In the Fed's estimation, probably not.

So the message Wednesday is likely to be the same as it was April 29 when the FOMC said it was “committed to using its full range of tools to support the U.S. economy.” The added wrinkle this time is that economic projections are due. Those were cancelled in March so we have to go back to December when the Committee median was for 2.0% growth this year. That's out the window and so is the 3.5% unemployment rate.

Less important than the numbers themselves will be how the Fed frames them. If Powell says the rebound has been surprisingly strong and the bottom not as bad as anticipated, the market may take that as a message of potential tightening. The caveat would be that if he emphasized that they will let the economy run hot and pin rates low until the economy is well on track to achieve its maximum employment and price stability goals.

Also, keep an eye on any hints regarding yield curve control and whether Powell will signal any potential ouvertures about the topic.

As for the market reaction, it will be an important test for dollar weakness, equity market strength and the breakout in 10-year yields. If the Fed doesn't inspire a strong reversal, then those trends will be solidified.

Indices Tire Despite Fed's Main Street Punch Bowl

Global equities continued to roar on Monday with the S&P 500 wiping out all its losses for the year. In the bigger picture, there are inbalances brewing. Treasury yields were lower at the long end Monday and crude fell. Bears remain fixated on the 200-DMA on VIX, oil's failed break of the March gap and yield's 0.98% resistance.

The yen's Monday rally was a bit of a puzzle. There was talk of short-covering and call buying. US Treasury yields also ticked lower at the long end. Yen repatriation and banking flows are another possibility.

Naturally, we have to consider that risk assets are cycling into safer havens outside of equities but the rally in AUD/USD and decline in USD/CAD doesn't bear that out as both hit post-COVID extremes to start the week.

The Fed also made a surprise announcement about its $600B Main Street lending program that is expected to launch imminently. A host of changes to the program made it easier for the companies to get the money and expanded the interest-free portion to two years from one. There isn't a thought about taking away the punch bowl and if that's the continue message on Wednesday then the euphoric rise in equities will certainly continue.

The day ahead is a light one on the US calendar but we will get a better sense of real-money demand for safety with the Treasury auctioning off 10-year notes.ندوة مساء الثلاثاء مع أشرف العايدي

Emotion Takes Over

Emotion is in the streets and it's in the market. Protests raged around the world on the weekend but markets are anything but angry – they're borderline euphoric about the re-opening along with the cheap-and-easy money trade. The shift to greed from fear has been remarkable and reflects a world in complete flux.

Fundamentals made a foray into the equation on Friday as the US added 2.5m jobs compared to -7.5m expected. That sent the risk trade into overdrive with the S&P 500 up 2.6% and extended the breakout in 10-year Treasury yields to 0.95%.

In FX, examples of the euphoria in markets include the nine-day rally in the euro that finally ended on Friday. The kiwi is in the midst of a seven-day rally.

At times like this, you hope to find a trend and hang on for dear life, because everything overshoots. The amplified emotions amplify market moves.

Even hedge fund giant Stanley Druckenmiller, who said two weeks ago the market divergence from fundamentals was one of the highest he's ever seen, said today he his humbled by the Fed's efforts to lift the market.

What could end it? Certainly everyone is looking for bad news from the virus as a potential catalyst. In the near-term, the Fed meeting Wednesday is a risk. Any sign that the cheap-money party will ever end would be met with some negativity – at least momentarily. Congress and stimulus are in focus too with the latest report citing Mitch McConnell saying it could be less than $1 trillion. That's still a remarkable number at any time in history but it's far enough under the $3.5T package the House passed to tee up some jitters.

For now, the party continues. As former Citi CEO Chuck Prince famously said, “As long as the music is playing, you've got to get up and dance.”