Intraday Market Thoughts Archives

Displaying results for week of Jul 07, 2019If you're taking time off

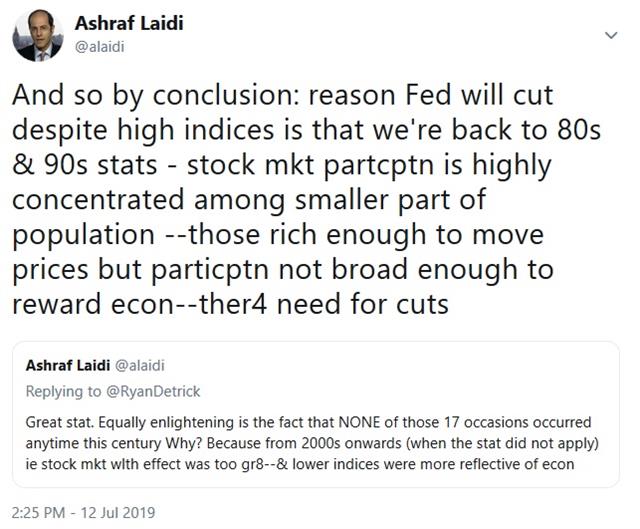

If you're planning to take a short holiday and return just in time for the Jul 31st FOMC decision, make sure to keep an eye on next week's release of US June retail sales, industrial production and a few Fed speakers. But there are some crucial items FX traders need to be aware of next week and the one that follows (excluding a very busy US earnings week). And here is a tweet on Fed cuts and indices.

Since you're aware that the new UK PM will be announced on July 23rd, next week should witness some volatility in GBP pairs as articles, reports and breaking stories unfold about candidates Hunt and Johnson. UK and inflation data will also be key. So far, cable has managed to hold the January lows.

Next week is the final week we hear from Fed speakers before the 2-week silent period begins. Speeches from Williams, Bowman, Evans and Powell will be most relevant to USD and gold traders. USD remains held at 1.1240 and 109.00 vs EUR and JPY, while gold must secure the 1382/3 support.

And we close from my April 12th IMT piece titled “Could we see DAX 12700?” when DAX was at 12000. This is a piece from which we can learn a lot. I was very bullish indices from January into April, but changed my stance midway through the May decline. It was a poorly taken decision. Take a look at the index over the last 4 months. Since then, we focused our Premium trades on FX and metals, where action should remain for the rest of the summer.

أشرف العايدي على العربية

من فاتته مقابلتي أول أمس مع العربية بخصوص الإحتياطي الفدرالي، الميزات التاريخية لحملات البنك المركزي و أهمية القطاعات الدفاعية، فليتفضل بالمقابلة هنا

Charts Held up by Powell's Fundamentals

It was another blatant example of fundamentals rushing to line up with technicals. Just as the pain suffered by USD shorts was escalating on Tuesday, Fed Chair Powell's Wednesday testimony turned the table around. To those starting out in currencies, this is not the first time the US dollar stood at multimonth highs or cycle highs -- such on Tuesday-- only to be whipsawed 24 hrs later by a Fed-related event. This is also frequent in the case of the euro and the ECB, when the currency pushes near extremes ahead of a key event. US CPI up next. List of today's Fed speakers with times (see below)

No, no.. Powell's main objective is NOT to talk down the US dollar. Rather, he simply reminded markets of might have been lost on them -- That rate cuts are coming, even as the NFP part of the Friday's US clouded traders' judgments (or erased their memory of the clearly dovish twist at the last FOMC meeting).

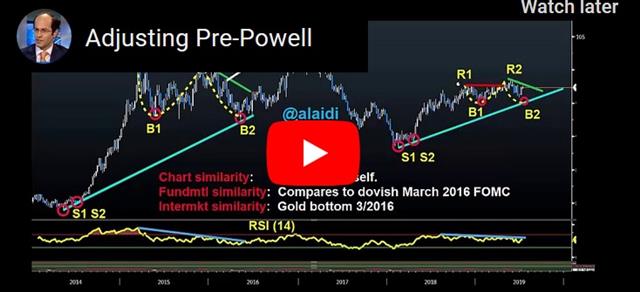

What does it all mean to traders? 2 hours prior to Powell's testimony, I issued a special video for subscribers highlighting the stress points in FX and focusing on the importance of the similarity of point "R2" and its implications for the 3 Premium trades in USD pairs and metals. As we speak, EURUSD is testing 1.1280 ahead of US CPI, while GBPUSD leads near 1.2570s. Tune in for the 2nd day of Powell's testimony (to the Senate).

Here's the list and times of today Fed speakers: (all times are London or NY +5)

Williams 16:10 Bostic 17:15 Barkin 17:30 Quarles 18:30 Williams 18:30 Kashkari 22:00

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed Chair Powell Testifies | |||

| Jul 11 14:00 | |||

| FOMC's Quarles Speaks | |||

| Jul 11 17:30 | |||

باول يوقف حفلة الدولار

إليكم فيديو تقلبات الدولار و الذهب بعد صدور خطاب باول. لكن هل يعتبر كل ذالك فرصة دخول مجدد في الدولار؟ الفيديو الكامل

Ahead of Powell's Testimony

Thin summer trading volumes will sustain a brief jolt as Fed Chair Powell testifies to Congress today (testimony starts at 15:00 London time but speech is released 90 mins before i.e. 8:30 Eastern/13:30 London) and tomorrow. The testimony and ensuing Q&A will shed further light on the probability of a rate cut later this month. It may be too soon for Powell to hint at the magnitude of the rate cut for Jul 31, but is it too soon to guarantee a rate cut at all for this month? Below is the video for Premium subscribers, detailing yesterday's udpated 3 charts & analysis for one of the three USD trades.

FX traders bear in mind the following: Powell has already stated the economic slowdown goes beyond the retreat in global trade i.e. not limited to the trade war.

USD bulls argue that any rate cut would only be a one-time adjustment instead of an extended round of easing. USD bulls will also state that the magnitude of the rate cut does not matter because the ECB will inevitably follow with rate cuts and/or policy stimulus.

USD bears could point to the fact that the Fed has never conducted a policy easing shorter/smaller than two or three rate cuts over the last 30 years. Additionally, limited or no Fed easing will exacerbate the disinflationary challenge from USD strength. Powell can't afford to get his price stability objective off the markt. And don't forget the export-reliant sector of US companies desparate for relief valve from USD strength as the economy slows.

Regardless of Powell's message, it will be unlikely for him to be so committal 21 days before the Fed decision, during which we'll get a few more vital macro data points. While trading opportunities should return, no trend-breaking moves are expected.

As important as the speech will be, do not disregard the Q&A with congressmen today and tomorrow, which could lead to several potentially market-moving unscripted remarks/ansers from Powell. For the tradable implications of my extensive analysis, tune in to the Premium video.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| JOLTS Job Openings | |||

| 7.32M | 7.51M | 7.37M | Jul 09 14:00 |