Intraday Market Thoughts Archives

Displaying results for week of Sep 07, 2014Next week's flash crash?

Wednesday's Fed decision, Yellen's conference and Thursday's historic Scottish independence could prompt a mini crash in euqities. Here is why we think so.

New Poll Shows ‘No’ Ahead, Loonie Cracks

The latest Scotland poll showed sliding support for independence with the vote a week away. The pound was the best performer on the day while the loonie lagged. The Asia-Pac session will be quiet data-wise to wind down the week. Another poll (ICM) is due on Friday, published by the Guardian newspaper. Existing Premium trades iclude USDCHF, EURJPY, CADJPY, NZDUSD and NZDCAD.

Cable trading is all about the latest polls and a YouGov survey on Thursday showed support for independence sliding to 48% to 52% for the No side. It's the same firm that showed the Yes side ahead on Sunday so it carries additional weight.

Cable promptly rallied a half cent after the results were released and the pair has now closed most of the week-opening gap. On Friday a poll from ICM Research is due but there's no scheduled release time so traders will be on guard for leaks

The technical move that grabbed our attention Thursday was in USD/CAD as the pair finally closed above 1.10. The move extended all the way to 1.1059 before sliding back to close at 1.1040. The April high of 1.1053 is a level to watch in the day ahead but with the US dollar rally hardly slowing down the Canadian dollar could begin to wilt like its AUD and NZD cousins.

Speaking of the Australian dollar, the turnaround in AUD/USD on Thursday was prolific. A currency that can't rally on good news like the employment report (even if there were caveats) is weak. A currency that hits a 5-month low despite blockbuster jobs data is downright nasty.

Aussie traders will get a chance to take stock in an Asia-Pac session that doesn't feature any top tier data. The next big release to watch is US retail sales. A week ago the dollar dipped on soft non-farm payrolls but ultimately it was a wonderful buying opportunity. Retail sales could be a repeat.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (AUG) (m/m) | |||

| 0.6% | 0.0% | Sep 12 12:30 | |

| Retail Sales (ex. Autos) (AUG) (m/m) | |||

| 0.3% | 0.1% | Sep 12 12:30 | |

| Full Employment Change | |||

| 14.3K | 22.9K | 15.4K | Sep 11 1:30 |

| Unemployment Rate | |||

| 6.1% | 6.3% | 6.4% | Sep 11 1:30 |

Yen downside & Nikkei rally

Japan has long spoken about the need to address the nation's aging population and offer better returns to meet growing pension payouts. It is finally addressing the problem, and the yen is falling accordingly, helping the Nikkei. Full charts & analysis here.

GBP Swings on Polls, RBNZ Pause, Aussie Jobs Next

Headline risk was the theme on Wednesday as news jarred a few currencies. The pound was the top performer on the day while the yen lagged. The RBNZ left rates unchanged in early Asia-Pac trading but a busy day still awaits including Australian employment. Both of our Premium shorts in NZDCAD and NZDUSD are nearing their final targets following the RBNZ announcement. All details are in the Premium Insights.

We've emphasized the importance of referendum polls and they swung the other way on Wednesday along with the pound. Two separate Scottish referendum polls showed pro-UK supporters with a 5-6 point lead and that quickly sent cable nearly 100 pips higher. The move crested just below the 1.6233 week-opening gap. That's a key level to watch if the bounce continues.

Two separate headlines from the SNB's Moser and Meier sent EUR/CHF as high as 1.2118 from 1.2075. They took a similar tone and said extra measures including negative rates remain options to defend the EUR/CHF floor and prevent deflation. There was really nothing new in the comments but with the SNB meeting coming on Sept 18, the market is growing weary.

The final headlines were from the RBNZ decision. Rates were left unchanged, as expected, but the kiwi tumbled to 0.8175 from 0.8230 when Wheeler said it's prudent to pause before considering more rate hikes. He also said the current level of NZD is unjustified and unsustainable.

The other notable move on Wednesday in what is suddenly a highly-volatile market was in USD/CAD. The pair crested above 1.10 twice in the past two days but promptly reversed down to 1.0933, market a potential false breakout.

The main event to watch in the day ahead is the Australian employment report at 0130 GMT. The consensus is for 15K new jobs with unemployment ticking down to 6.3%. A soft reading would confirm the breakout in the Australian dollar and could pave the way for a move much lower.

At the same time, China releases CPI data that's expected at 2.2% y/y. Comments about further stimulus yesterday hit at a low number, or at least one that matches estimates.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (AUG) (m/m) | |||

| 0.4% | 0.1% | Sep 11 1:30 | |

| Consumer Prce Index (AUG) (y/y) | |||

| 2.2% | 2.3% | Sep 11 1:30 | |

| Employment Change s.a. (AUG) | |||

| -300 | Sep 11 1:30 | ||

| Fulltime employment (AUG) | |||

| 14,500 | Sep 11 1:30 | ||

| Part-time employment (AUG) | |||

| -14,800 | Sep 11 1:30 | ||

| Unemployment Rate s.a. (AUG) | |||

| 6.4% | Sep 11 1:30 | ||

Dollar does more damage before pullback

The US dollar hit some fresh long-term highs but a late-day pullback may have dulled the near-term momentum. On the day the euro was the top performer while the Australian dollar lagged. Japanese PPI and machine orders are due later. Our latest Premium Insights issued 2 new trades on NZDUSD. The pair has dropped in 8 out of the last 9 weeks and most NZD traders expect RBNZ to hold rates unchanged on Thursday. Is there more room for NZD declines? See today's Premium Insights.

The US dollar bulls began to charge again on Tuesday and were able to do some technical damage. USD/JPY rose to a fresh cycle high of 106.46; USD/CAD finally broke 1.10 and AUD/USD fell below 0.9200 to the lowest since November.

But what happened afterwards might have raised some red flags. USD/JPY later fell to a US low of 106.05, AUD/USD rebounded from the 200-dma at 0.9200 and USD/CAD closed at 1.0980.

The catalyst for the US dollar selling was weakness in the S&P 500 as stocks posted their worst day in a month and the index finished at the worst level since Aug 22. The move was more about Apple than the macroeconomy so it might be a one-off.

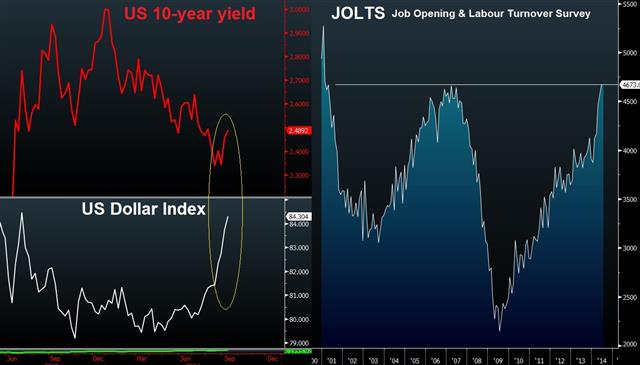

The lone economic data point was the US JOLTS report and it showed job openings in July near the highest levels since 2001 – a sign that the fall in non-farm payrolls was likely temporary.

The two market moves that will keep us thinking are in the euro and aussie. The euro finally staged some kind of bounce as it traced up to 1.2958 from as low as 1.2860. Is a 100-pip bounce enough to sell?

The selling in the Australian dollar was a bit of a mystery because there were no headlines behind it. The underlying issue might be weakness in emerging markets. Moody's cut Brazil's outlook after it fell into recession and USD strength may cause problems in the developing world.

Technically, AUD/USD is now crippled and the potential for a range breakdown is a worrisome signal. Tomorrow's Aussie jobs figures will be key.

The focus shifts to Japan at 1950 GMT with reports on the PPI for August and machine orders for July. The latter report interests us more and we'll be watching to see if it can hit the 0.5% y/y expected.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| JOLTS Job Openings | |||

| 4.67M | 4.72M | 4.68M | Sep 09 14:00 |

Carney no longer matters before referendum

BoE's Carney told unions today interest rates will begin to “increase by the spring and thereafter”, considering rates follow the path expected by the markets. The assessment strikes a balance between those who were still anticipating a Q4 2014 rate hike and those seeing a tightening after Q2 2015. Carbey returns tomorow when he speaks to Parliament. Full analysis & charts.

USD Speeds up Momentum

The US dollar rally since mid-July has been impressive but on Monday it was downright scary. The USD was easily the best performer on the day while the pound languished on referendum fears. The BOJ minutes and some second tier releases are due next. Our Premium Insight trades currently include USDCHF, EURJPY, AUDUSD, NZDCAD, with USDCHF +150 pips in the green.

We warned yesterday that “the fundamentals are so divergent between the US and its major rivals that unless the economic story changes, any USD selling will be temporary.” Today we learned just how much the market is falling in love with dollars.

Asset managers and hedgers who sat on the sidelines during last week's ECB drama and non-farm payrolls jumped into the fray. What started as started as selling in cable turned into selling everything against the dollar.

The late-day move started in USD/JPY as it broke last Thursday's high of 105.71 and then quickly broke through 106.00. Dollar buying then spread to commodity currencies and eventually to EUR/USD as it fell 50 pips to 1.2880 in an hour. The EUR/USD daily RSI eventually fell to the lowest since the depths of the 2008 crisis. In the end, nothing was spared the wrath of King Dollar.

Overall economic news was light but US consumer credit surged to $26B, easily beating the $17B expected in a sign of better willingness to borrow and lend.

Up next on the schedule are the BOJ minutes from the Aug 8 decision and the tertiary industry index, which is expected to rise 0.2%. At 0130 GMT, Australian housing finance data is due but it's unlikely to move the market.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Credit Change (JUL) | |||

| $26.01B | $17.35B | $18.81B | Sep 08 19:00 |

GBP fears Carney Speech after Referendum blow

Another possible factor adding to sterling's losses this week--not related to Scotland referendum--is BoE governor Carney's speech at the Trades Union Congress in Liverpool on Tuesday, which will likely reiterate the importance of wage growth. Full charts & analysis here.

Pound Gaps Lower on Referendum Fears

A weekend poll showed pro-independence voters in Scotland taking the lead and the pound has tumbled in response. Cable gapped nearly 150 pips lower in early trading down to 1.6167. We also explain why it may not be time to worry about the crowded USD trade … yet.

A single YouGov poll put 'Yes' voters at 51% ahead of the Sept 18 vote. We reiterate that polls will overshadow UK fundamentals ahead of the vote. Other polls still show the pro-Britain side ahead but what's clear is that a comfortable lead has turned into a close race.

Ultimately, a Great Britain split may not be negative because Scotland will likely continue to use the pound. But one of the oldest market axioms is that uncertainty breeds contempt and a "Yes" vote would bring uncertainty in spades. Separation would be a messy and likely emotional affair at a sensitive time in the UK recovery.

Technically, the fall in cable has been dramatic since the first polls showed narrowing polls on Aug 31. The pair has fallen 430 pips in a week. The week-opening gap blew through the Feb 2014 low of 1.6250 and that may act as resistance if cable bounces when cooler heads prevail. The big figure is now in focus on the downside because it's also the 50% retracement of the 2013-14 rally. That's followed by the Nov 2013 low of 1.5851.

Other early moves put AUD and NZD 10-20 pips lower; the yen is also slightly lower. Other weekend developments questioned the validity of the Ukrainian ceasefire, especially late-breaking reports of shelling near Donetsk.

Early-week economic data focuses on Japan. Up first, at 2350 GMT, it's trade balance for July, expected at ¥444.2B. Final Q2 GDP is due at the same time.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -162K vs -151K prior JPY -118K vs -103K prior GBP +10K vs +15.5K prior AUD +49K vs +42K prior CAD +13K vs +6K prior CHF -13K vs -13K prior NZD +10K vs +12K priorThe rush into EUR and JPY shorts continues and will soon be followed by cable shorts. The overall net USD long is stretched but the fundamentals are so divergent between the US and its major rivals that unless the economic story changes, any USD selling will be temporary.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Annualized (Q2) | |||

| -7.1% | -7.0% | 6.1% | Sep 07 23:50 |

| GDP (Q2) (q/q) | |||

| -1.8% | -1.8% | 1.5% | Sep 07 23:50 |