Intraday Market Thoughts Archives

Displaying results for week of Oct 08, 2017Pound Gets a Glimmer of Hope

The Bank of England meeting draws ever-closer but Thursday's big rebound in the pound shows it's still all about politics and Brexit. The New Zealand dollar was the top performer while the euro lagged. Chinese trade balance isn't on most economic calendars but it might be released early. A new GBP trade was issued to Premium members today, 6 days after the last GBP trade was closed at a profit.

شرح تفاصيل الاسترليني و اليورو (للمشتركين فقط)

A report in the German press said that the EU's Barnier wants to offer Theresa May a two year transition period before the full Brexit. Cable had been slumping on the day but immediately shot to 1.3250 from 1.3175 and continued another 40 pips higher from there before running into resistance at 1.3300.

In a sense, the headline shouldn't come as a surprise. The term 'transition period' is a misnomer. The EU will basically offer the UK another two years in the EU, under all the same EU terms. There is no transitioning, it's the same old deal.

At the same time, it's the first actual attempt at negotiating from the EU. Up to this point, all the signals suggested they were intent on punishing the UK so as to dissuade anyone else from exiting. Still, this may prove to hardly be an effort to negotiate. What we did learn for sure is that any negotiation-positive headlines provide longer lasting pound gains than any hawkish BoE chatter. It will be interesting to compare that to BOE headlines in the weeks ahead as we sort out whether May or Carney is the hand guiding GBP. But before November's BoE decision/inflation report, stay tuned for the next week's crucial UK-EU talks.

In US news, PPI numbers were released Thursday and core measures were a touch on the high side. Normally, that wouldn't be notable but it sparked a 20-pip rally in the US dollar. It was later erased but the initial reaction underscores how sensitive the market will be to Friday's CPI report.

Another report that could move markets (and the Aussie) is the September China trade balance report at 0200 GMT. The balance is less-important than imports and exports, where are expected up 16.5% and 10.9%, respectively.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Germany Final CPI (m/m) | |||

| 0.1% | 0.1% | Oct 13 6:00 | |

التضخم، مبيعات التجزئة و الدولار

Minutes for Now, Minutes for Later

The FOMC Minutes sent differing signals about the near and long-term. The euro was the top performer while the US dollar lagged. Japanese PPI and Australian home loans data is due up next. Below is the video for our Premium members on existing and upcoming trades.

Former St Louis Fed President Bill Poole once said that markets too often focus on signals about the upcoming FOMC meeting rather than signals that will persist over many meetings.

That's the conundrum after the FOMC Minutes. They had something for everyone. The main headline was that many officials saw another rate hike warranted this year; that's something that's 88% priced in at the December meeting. However, many officials were also concerned that low inflation is not only transitory. So there was a strong signal about one hike but a weak signal beyond. That left the market divided and a whipsaw that ultimately saw the US dollar weaken after an initial burst higher.

Other data Wednesday included JOLTS, which was soft at 6082K compared to 6135K expected. All the metrics ticked lower but the drop was from very healthy levels.

A 4-day barrage of central bank speak starts tomorrow as policy makers gather for the annual IMF/World Bank meetings in Washington, DC.

Looking ahead, Japan is out with PPI data at 2350 GMT and expected to report on a 3.0% y/y rise. It surely won't be a market mover. A more-sensitive sector is Australian housing and with August home loans due at 0030 GMT, the Aussie could get a bump. The consensus is for a 0.5% m/m rise after a 2.9% jump in July.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Home Loans (m/m) | |||

| 0.5% | 2.9% | Oct 12 0:30 | |

| JOLTS Job Openings | |||

| 6.08M | 6.13M | 6.14M | Oct 11 14:00 |

Lost Amid Friday's Report

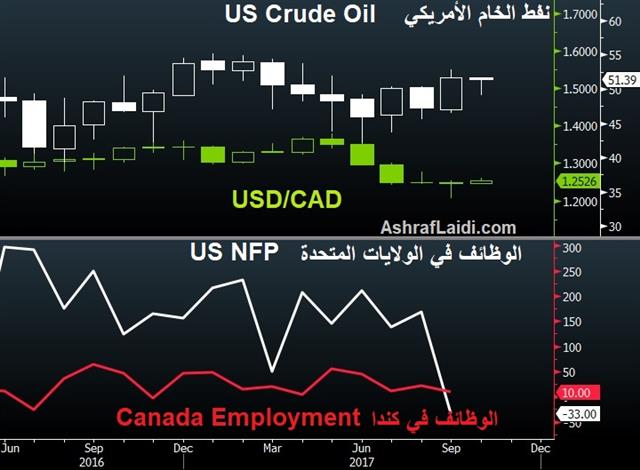

Could we see renewed declines in USD/CAD without a sustained rally in oil prices? Full analysis.

ماذا كان مفقوداً في ضجيج الجمعة؟

هل ممكن ان نرى هبوط مجدد في زوج الدولار الأميركي مقابل نظيره الكندي بدون إرتفاع حاد في أسعار النفط؟ التحليل الكامل

Catalonia & Corker

Separatist leaders in Catalonia did not declare independence on Tuesday. Instead, they called for dialogue. The euro pushed across the board before stabilizing in Wednesday trading ahead of the FOMC minutes. The post-Puigdemont euro moves helped the Premium EURUSD trade into a 100-pip gain. The trade remains open.

The coalition of separatist parties in Catalan parliament is struggling to find a way forward amidst threats from Madrid. Leader Puigdemont attempted inching closer towards independence without a formal declaration on Tuesday. Instead, asserted his mandate to declare independence, but asked for weeks of dialogue and hinted at international mediation. The hardcore ranks of separatists called it a betrayal while the government hinted he could be prosecuted for declaring independence anyway.

The euro climbed about 15 pips after failure to declare independence. For the past few weeks, the currency has shown diminishing sensitivity to the Catalonya story; in part because Catalonia will continue to use the euro. The downsides at the moment relate to Spanish growth and that's a small part of eurozone GDP. Nor is it likely to derail ECB plans to taper. EUR/USD rose above 1.1800 on the day, a 70 pip rise.

USD softness is re-emerging due to two main reasons: Renewed uncertainty about taxes after Trump picked a fight with high-ranking Republican Senator Bob Corker. Trump can only afford to lose two votes in the Senate and his spat with Corker has taken a personal tone.

The other reason is China, which seems to be undertaking a concerted effort to boost the yuan ahead of the party congress and Trump's visit in a month. USD/JPY has fallen 1.3% in two days this week.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC Meeting Minutes | |||

| Oct 11 18:00 | |||

Sterling Stoked by Inflation Revision

Politics vs economics. They dont always go hand in hand. A surprise correction in UK wages from UK statistics officials on Monday helped to spark a relief rally in the pound, which was the top performer. This morning's UK data on trade (negative) and industrial production (positive) were the sole development of the day. The decision to close the Premium long in EURGBP on Friday for 100 pip gain before Monday's dip was the right one. Now we look for a better entry.

Cable gained a full cent after the ONS revised Q2 labour unit costs to 2.4% from 1.6% y/y. That's a big shift for the BOE and helps to underpin hopes for a Nov 2 hike. The market is pricing a 78% chance that Carney pulls the trigger then.

NZD remains the worst performer of the week because of an election where the nationalist First Party finished a distant third but holds the balance of power. Coalition negotiations are ongoing but the uncertainty could continue to weigh on NZD.

It was an unusual day in North American markets. Canada was closed while in the US the bond and futures markets were closed but stocks traded. After a hitting a record high, the S&P 500 stumbled late to finish down 5 points and that worked to drag down USD/JPY to 1.1740.

Expect a barrage of speeches from global central bankers and finance ministers in Wahsington DC ahead of the weekend's autumn WB/IMF meetings. This coincides with the 10-year anniversary of the peak in gobal indices.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +91K vs +88K prior GBP +20K vs +5K prior JPY -85K vs -71K prior CHF –3.2K vs -1.8K prior CAD +75K vs +75K prior AUD +72K vs 77K prior NZD +8K vs +8K prior

Sterling traders are really licking their wounds. They finally put on a sizeable long and it blew up on political drama. Those holding CAD and AUD longs are likely beginning to feel some jitters.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Kashkari Speaks | |||

| Oct 10 14:00 | |||

| FOMC's Kaplan Speaks | |||

| Oct 11 0:00 | |||

| Gov Council Member Wilkins Speaks | |||

| Oct 10 18:00 | |||