Intraday Market Thoughts Archives

Displaying results for week of Oct 09, 2016ستزيد أسعار خدماتنا الإثنين

Ashraf's Oct 27 Webinar

On Oct 27, (5 pm Eastern, 10 pm London time), Ashraf Laidi, will walk you through his view on global markets, using the mechanics of a new game-changing software. Register for the webinar here.

The Retracement Test

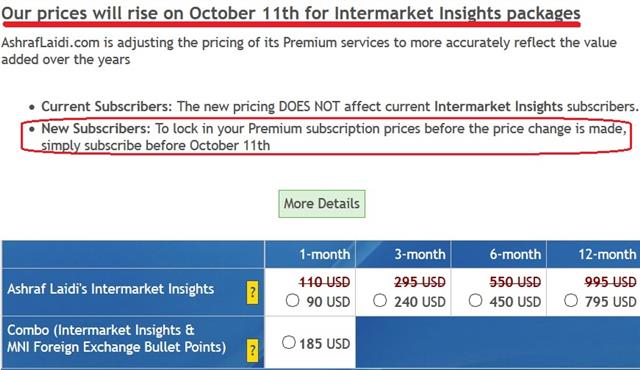

Often times the scope of the retracement tells you more about the trend than the initial moves. That was the case in the US dollar Thursday as it lagged after several days of strong gains. The Canadian dollar was the top performer. Chinese CPI is due later on a follow up to the dismal trade figures yesterday. Friday marks the final day for non-Premium members to lock in the existing fees before prices rise next week for all packages. More details here.

فيديو للمشتركين فقط) دعوة زيارة من المؤشرات)

The early theme in trading Thursday was disappointing Chinese trade data but it later morphed into a broad US dollar pullback. The scope of the pullback was telling. For instance, NZD/USD had fallen for seven straight days in a 220 pip decline but it bounced just 40 pips. Cable was higher for the second day but the bounce has been limited to 150 pips after a 900 pip dive.

It's a similar story elsewhere and it underscores the lack of panic from dollar bulls. Taking a look at the broader US dollar picture, the Fed has been a disappointment, economic growth has repeatedly been downgraded and politics are in the sewer and yet the US dollar has outperformed every G10 currency over the past six months except JPY and NZD.

What has kept the US dollar bid is potential. America remains a dynamic economy full of potential, the Fed still wants to hike and Washington is likely to loosen the purse strings after the election. Even if just one of growth, rates or politics improves, there is plenty of upside in USD.

China remains a place of unpredictable worry --- an opaque economy where worry flares up from time to time and spreads to global markets. The good news is that the PBOC and Beijing have plenty of ammunition to treat most types of trouble (a housing crash would be the exception). Today's CPI report is likely to underscore the space on interest rates as the consensus for the 0130 GMT report is a 1.6% y/y rise.

Another event to watch is the 0030 GMT RBA financial stability review. Lowe could offer hints on the framework for attacking inflationary risks like housing or market risks without adjusting interest rates.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (y/y) | |||

| 1.6% | 1.3% | Oct 14 1:30 | |

Fed Hits a Sweet Spot

The Fed plan of attack came into sharper focus after the FOMC Minutes. The pound was the bounce-back best performer while the yen lagged. The Asia-Pacific calendar is light. There are 12 Premium trades in progress-- 7 in FX, 2 in equities, 2 in metals and 1 in energy.

The best measure of Fed communication is the FOMC Minutes. When the market doesn't move after the release it shows that policymakers have already effectively communicated their thinking.

That was largely the case on Wednesday as FX chopped 20 pips on either side of unchanged on the release and then returned to pre-Minutes levels.

For the first time in a long time, there is a small sense of clarity around the collective Fed thinking and how the market interprets it. The Fed is strongly leaning towards a hike soon and will act in December if jobs and markets co-operates. The Fed funds futures market is pricing in about a 67% chance of a December cut and that sounds just about right.

If it were only the Fed on the agenda right now, we might be seeing quiet markets. But the daily barbs from Theresa May and US politics are keeping volatility high.

Confusion reigned on the pound Wednesday after reports suggesting May would allow a Brexit vote in parliament. Cable ripped+ 200 pips from the lows but the reports were later revealed to be a misinterpretation. Rather than a vote, she will allow a full debate in Parliament. But if the result is the same, what's the point?

In any case, it underscore the headline risks around riding a trade that's completely one-sided at the moment. On any good GBP news, it's best to get out of the way asap and look to sell bounces. The pound finished more than a 100 pips from the highs.

Looking ahead, the lone notable indicator on the calendar is at 0430 GMT with Japan's tertiary industry index. The consensus is for a 0.2% but it's unlikely to move markets.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Tertiary Industry Activity (m/m) | |||

| -0.2% | 0.3% | Oct 13 4:30 | |

GBP Disturbing Correlation

Most traders are aware of the positive correlation between equity indices and high yielding currencies such as the AUD and NZD. But something else has come up as of late. GBPUSD has grown positively correlated with equities, especially US indices (DOW30 and SP500). I have already mentioned this in several tweets earlier this month, asking followers why GBPUSD outperforms EURUSD and USDJPY during rallying stocks and why it is among the big losers during risk-off. Said differently, EURGBP tends to rally as stocks decline and vice versa.

Why has GBP become a risk-on trade? The UK's swelling current account deficit of 5.7% of GDP and the structural downside risks of Brexit imply it will be more challenging for the UK to draw necessary funds to finance the deficit, especially at a time when the currency has fallen to the mercy of soundbites by bankers mulling departing London, politicians discussing Hard Exit. In otherwords, GBP only draws buying when speculators are in the mood for risk, hece, risk-on flows. For a detailed view on the UK's current account situation, see my Bloomberg interview.

ستزيد أسعار خدماتنا يوم الجمعة القادم

المشتركين الجدد: لضمان الحصول على اشتراك البريميوم قبيل تغيير التسعيرة إلى الرسوم المرتفعة، ما عليك سوى الاشتراك قبل 14 أكتوبرالرجاء النقر على الصورة للمزيد من المعلومات

.

New and Old Worries Surface

Sudden anxiety on earnings added to Brexit and bond market woes on Tuesday. USD and JPY were the top performers while the pound lagged badly. Japanese machine tool orders are due up later. A new trade was issued on a major equity index to exploit a potentially dangerous double top formation. Monday's short of the DOW30 at 18360 missed the fill by 6 points before the index tumbled more than 300 pts today.

The pound sank, the US dollar rose and the S&P 500 slumped on Tuesday. The pound decline was a continuation of the drop on Friday.

The problem for GBP is that the flash crash cleared out all the dip buyers and bottom pickers and will make everyone wary of buying at least until after Article 50 is invoked. Cable fell another 200 pips and neared 1.2100 and a new wave of Brexit anxiety grips the market.

In the stock market, a different kind of anxiety appeared: Earnings. The S&P 500 fell nearly 30 points and closed below the 100-day moving average for the first time since the immediate aftermath of the Brexit vote.

The selling came after poor results from Alcoa and some smaller players. Adding to the worry is the sudden possibility – although it's still a longshot – that Democrats could with the House, Senate and White House. That kind of power would allow for sweeping changes in health care, taxation and regulation. The market doesn't love a constantly deadlocked Congress but it's preferable to the unknown, especially in sectors that have been targeted by Clinton.

The other stock market worry is earnings. Lackluster growth, higher inflation, the potential for a Fed hike and poor global growth leave far more potential for downside surprises than ever-higher earnings multiples.

On the economic calendar, the top event in the upcoming session is at 0600 GMT when Japan reveals machine tool order data for September. It's the preliminary report and comes on the heels of a 8.4% decline in August. It's not likely to be a mover but a larger potential event could be the yuan fixing around 0115 GMT.

Kiwi's Quiet Descent

Sterling has surely dominated currency markets following the momentous referendum in June, but the New Zealand dollar is descending at increasing pace after a remarkable four consecutive monthly increases against USD. The Kiwi carries the highest interest rate advantage among the top traded 11 currencies (USD, EUR, JPY, GBP, AUD, CAD, CHF, NOK, SEK, DKK) yet posts the worst performance this month after sterling. Remarks from the RBNZ's Assistant Governor John McDermott stating the central banks' “current projections and assumptions indicate that further policy easing will be required to ensure that future inflation settles near the middle of the target range”. McDermott added that Q3 inflation is ''expected to be low”. NZDUSD is at fresh 3-month lows on expectations of further rate cuts from the RBNZ following the remarks. Interestingly, kiwi's declined began ahead of the statements, prompting speculation that either the speech was leaked or that traders anticipated the speech would be dovish as had been the case in the last 3 appearances by RBNZ officials. All 3 NZD trades in the Premium Insights are currently showing a gain.

Sterling Washout, Central Bank Chatter

The flash crash in the pound will leave the FX off balance for months and central bankers are offering little in terms of clarity or stability. Sterling was easily the worst performer last week while the US dollar and euro were tops. CFTC positioning showed that even a trade that's already hated, like GBP, can still crumble. 2 new Premium trades were issued on Friday.

Cable finished the week at 1.2463 – nearly 600 pips off the lows but a recovery won't be simple. The drop cleared out speculative longs and it will be months before anyone is willing to attempt to pick a bottom in the pound.

The difficulty in buying GBP is that the inevitable headline shock of the Article 50 announcement is coming. Until those headlines hit, speculators will probably stay on the sidelines and it will be tough for the pound to sustain any rally longer than a few months.

Those won't be the only sources of volatility as central bankers staked out positions at the IMF meetings. Kuroda was notable for comments hinting at the possibility of lower long and short-term rates. He said there were no plans now but the market had been led to believe after the BOJ that the zero-line in 10-year notes was something the BOJ didn't plan to cross again.

Draghi was mum on the talk about tapering bond purchases but said the ECB will reach its inflation goal at the end of 2018 or in early 2019 and that governments know bond buying won't last forever. Reading all the recent ECB comments leaves us entirely unconvinced on any tapering or continued bond buying program but perhaps that's how Draghi feels as he awaits more data.

The Fed's Fischer was back with a fresh round of hawkish hints as he said the Sept decision was a close call. But he also seemed to indicate that there was no urgency to hike in November, saying there was little risk in falling behind the curve.

Coming up in Asia-Pacific trading, China returns from holidays but the calendar is relatively light.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -82K vs -76K prior JPY +69K vs +69K prior GBP -98K vs -88K prior CHF -3K vs -6K prior AUD +25K vs +15K prior CAD -14K vs -12K prior NZD -8K vs -7K prior

Sterling positioning is instructive. The market was already betting heavily against the pound before the flash crash on Friday. It demonstrates that even extreme positioning isn't a signal on its own; sometimes it only says how much the market dislikes something. That said, how much more short-term fuel could the cable bears have?