Intraday Market Thoughts Archives

Displaying results for week of Mar 09, 2014Risk Rattled in Wild Ride

Ukraine worries and Draghi jawboning reversed risk trades and hit the euro on Thusday. The yen was the best performer while EUR lagged. The BOJ minutes are up next.

What looked like a day of multiple breakouts turned into a day of mass disappointment. EUR/USD, NZD/USD hit long-term highs early in the day but finished in tatters. Several yen crosses were surging higher then were cut down.

The jobs report in Australia and a rate hike from New Zealand set the stage for upbeat US traders. The momentum continued when initial jobless claims beat expectations and fell to the lowest since November. Worries crept in with the US retail sales; the February data beat marginally but sharper downward revisions to January data showed a stunted trend. The control group rose 0.3% compared to 0.2% expected but the prior was revised to -0.6% from -0.3%.

The report left the market uneasy but it was Ukraine that turned doubts into fear sending the S&P 500 22 points lower and yen crosses more than 100 pips from the highs.

The New York Times featured a story about troop buildups near the border and there were various reports of scuffles and rumors of invasions of Eastern Ukraine. The final straw may have been comments from Kerry promising “serious steps” if Crimea holds a planned referendum to join Russia on Sunday.

Previous US threats have been vague and this one was too, but it contained a timeline for US action and gave the market the sense the crisis is escalating.

EUR/USD was already slumping from the two-year high of 1.3967 when Draghi hit the wires and said the euro exchange is increasingly relevant in assessments of price stability. It's his first direct comment on FX in months and knocked EUR/USD as low as 1.3846 before a modest recovery later.

The main focus will be on Ukraine in the day ahead but the BOJ minutes (of the Feb 18 decision, not this week's meeting) will be released at 2350 GMT. Discussion about possible counter measures to the April tax cut will be the highlight.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (FEB) | |||

| 0.3% | 0.2% | -0.6% | Mar 13 12:30 |

| Retail Sales (ex. Autos) (FEB) | |||

| 0.3% | 0.2% | -0.3% | Mar 13 12:30 |

| Continuing Jobless Claims (APR 01) | |||

| 2855K | 2925K | 2903K | Mar 13 12:30 |

| Initial Jobless Claims (APR 08) | |||

| 315K | 329K | 324K | Mar 13 12:30 |

Copper Divergence & Ominous Leading Signals

As copper drops 13% & the CRB Commodity Index rises 8% YTD, the 20% decline in the copper/CRB ratio year-to-date is the biggest divergence between copper and the rest of commodities since the peak of the Eurozone debt crisis in 2011. Charts & analysis of the deepening divergence and copper's leading signal to the recent major equity selloffs.

RBNZ Hikes, Kiwi Jumps, Aussie Jobs Next

The RBNZ hiked rates and promised more hikes to come, sending the kiwi to the highest since October. The euro came within one pip of the highest levels of the year. The focus later shifts to Australia with the February employment report due.

RBNZ Governor Wheeler's attempt to talk down the New Zealand dollar after hiking rates failed. The 60 pip surge in NZD/USD after the decision is hardly surprising considering that Wheeler raised rates, touted the economy, warned about inflation and said 125 bps in hikes could come this year -- more than the 75 bps priced in. He said the exchange rate is a concern and that the current NZD level is not sustainable but actions speak louder than words.

Another currency that rallied Wednesday was the euro as it popped to 1.3914, just shy of the 2014 high set on Friday. Dollar weakness was one catalyst but the ECB's Coeure also didn't have the same urgency in his warnings about deflation and the ECB's willingness to act. He had been one of the most vocal doves and unless inflation data rapidly turns, a rate cut or other action is less likely.

Concerns about China and Ukraine remain at the forefront and gave gold the push it needed to break above the October highs to $1370. Stock markets remain blasé and the S&P 500 shook off an early 14 point decline to finish unchanged.

The Australian dollar finally found a footing at 0.8924 after retracing nearly all of last week's gains. AUD/USD finished just below 0.9000 but the day ahead promises to be volatile with the employment report on the docket at 0030 GMT. The consensus is 15K with unemployment unchanged at 6.0% but economists have overestimated jobs growth in 6 of the past 7 reports.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Employment Change s.a. (FEB) | |||

| 18,000 | -3,700 | Mar 13 0:30 | |

| Fulltime employment (FEB) | |||

| -7,100 | Mar 13 0:30 | ||

| Part-time employment (FEB) | |||

| 3,400 | Mar 13 0:30 | ||

| Unemployment Rate s.a. (FEB) | |||

| 6% | 6% | Mar 13 0:30 | |

China Chill Deepens, Copper Breaks Support

A wall of worry about the Chinese economy struck risk assets on Tuesday. For the second day in a row the Australian dollar was the laggard and the yen led in the classic risk-off trade. Up later, Japan releases CPGI data and consumer confidence while Australia posts home loan data.

The intricacies of intermarket trading were on display Tuesday as a breakdown in copper prices spilled over to broader markets. Prices broke a double bottom at $300 from 2011 and 2013, setting off a wave of selling in risk assets.

The problems from copper originated in China. Copper and iron ore are popular collateral for loans in China and a number of invoicing and stockpiling scams have been uncovered. The government began cracking down on abuse late last year and copper prices have been under pressure.

Fears ramped up after the plunge in exports reported on the weekend and the flames were fanned Tuesday when shares of a Chinese power company were suspended and rumors of a bankruptcy circulated.

After copper broke down, AUD/USD and USD/JPY followed. The Australian dollar broke below 0.9000 and the 61.8% retracement of last week's rally – a bearish signal. USD/JPY slumped through 103.00 but found support at 102.85. WTI crude also fell to the lowest in a month at $99.32.

Economic data in the hours ahead is noteworthy but probably won't move markets. At 2350 GMT, Japan releases the tertiary index, corporate goods price index and the quarterly business sentiment index. At 0030 GMT, Australian home loans are expected to rise 0.5% m/m. Much later, at 0500 GMT, it's Japanese consumer confidence which is expected at 40.0. Skittish consumers ahead of the April tax hike could encourage more BOJ easing.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Confidence Index (FEB) | |||

| 40.3 | 40.5 | Mar 12 5:00 | |

| Home Loans (JAN) | |||

| -0.5% | -1.9% | Mar 12 0:30 | |

China Chill, BOJ Preview

The fallout from the soft Chinese trade data reverberated Monday but the fear trade was limited. The yen was the top performer while the Australian dollar lagged. The focus now switches to today's Bank of Japan decision.

Chinese trade data was almost certainly skewed by holidays but it was also very weak and it spurred some paring of risk leading and a fall in AUD/USD to 0.9015 from 0.9070 on Friday. The low matched the 50% retracement of last week's rally in a sign the move could be more of a standard bounce than genuine concern about China.

One market that hit the panic button was iron ore as prices fell more than 8% in one of the largest declines on record. Most traders believe the declines were partly due to invoicing fraud in the Chinese banking system and a more-recent crackdown.

Aside from pound weakness, the rest of the FX market was quiet. EUR/USD was reluctant to move with some details of the ECB bank stress tests to be released on Tuesday.

Yen trading was light as the broader risk trade failed to captivate the market. US stocks were flat and USD/JPY traded in a 103.15-40 range.

Yen volatility will pick up with the BOJ decision due around 0400 GMT (there is no scheduled time). The Bank of Japan is likely on hold until May as they wait to sort through the impact of the April consumption tax hike but the yen could weaken on any hint of willingness to ease further.

China Trade Figures & Deflation Risk

Rather than attributing the weakness in China's trade figures to CNY decline, it is more accurate to view the latter as an effect of the general slowdown in the economy and authorities' concerns with speculative carry trades. There are also risks that deflation may set in China. Full charts & analysis

Chinese Exports Crash due to Holiday, AUD Lower

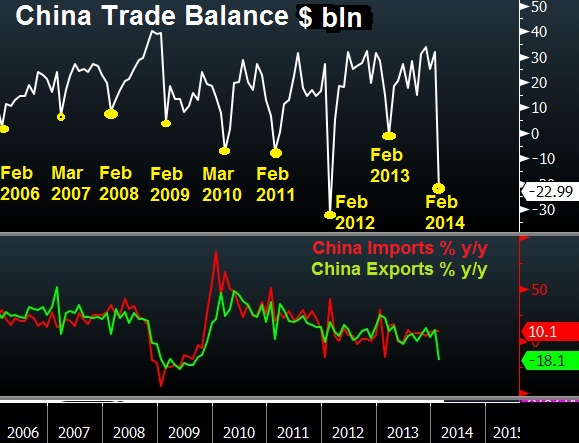

A shockingly weak Chinese trade balance report sent a shiver through the markets on the weekend. Last week, the Australian dollar led and the yen lagged. Japanese GDP and trade data is up early in the week. Jaws dropped after the February trade data from China as the country posted a nearly $23 billion monthly deficit compared to a $14 billion surplus expected and a nearly $32 billion surplus in January. Following Friday's pre-NFP moves, the latest Premium Insights had 1 of 2 EURUSD longs hit final 1.3900 target (1.3750 entry), 2nd NZDUSD long hit all targets, 1 USDJPY long awaits at 103.80, 1 GBPUSD long in progress, 1 of 2 EURJPY longs hit final 143.30 target (140.30 entry). AUDCAD and AUDNZD remain in progress. All trades and charts are in the latest Premium Insights.

The numbers will weigh on the Australian dollar in early trading but there are reasons not to panic. First, the lunar new year skews trading in February, pushing orders forward. Second, the weakness was all in exports. Chinese imports were up 10.5% y/y compared to a 7.6% rise expected and that continued buying from importers suggests they see demand in the pipeline. On the other hand, the 18.1% y/y drop in exports suggests they may have misread the global marketplace.

It's tough to imagine that global trade plummeted so severely in February but traders will now be keeping an extra-close eye on the numbers.

The good news for China is that CPI was at 2.0% y/y compared to a 2.1% rise expected. Softer inflation gives officials some latitude to stimulate the economy if economic data continues to slide.

On net, the market could overreact to the Chinese data and provide an opportunity to buy the Australian dollar. In early trading, AUD is down 15 pips but liquidity is thin.

The situation in Ukraine should also provide a boost to risk trades. There were no major developments or shots fired on the weekend. Heading into Friday's close some traders were hedging or closing out positions to cut risk.

Trade data continues to roll out with Japanese current account numbers at 2350 GMT and the final reading on Q4 GDP at the same time.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR +23K vs +14K prior JPY -79K vs -85K prior GBP +30K vs +29K prior AUD -41K vs -39K prior CAD -61K vs -59K prior CHF +2K vs +1K prior NZD +13K vs +11K prior

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Annualized (Q4) | |||

| 0.9% | 1.1% | Mar 09 23:50 | |

| GDP (Q4) (q/q) | |||

| 0.3% | 0.3% | Mar 09 23:50 | |

| GDP Deflator (Q4) (y/y) | |||

| -0.3% | Mar 09 23:50 | ||

| Consumer Prce Index (FEB) (m/m) | |||

| 0.5% | 0.8% | 1.0% | Mar 09 1:30 |

| Consumer Prce Index (FEB) (y/y) | |||

| 2.0% | 2.0% | 2.5% | Mar 09 1:30 |

| Current Account n.s.a. (JAN) | |||

| ¥-638.6B | Mar 09 23:50 | ||