Intraday Market Thoughts Archives

Displaying results for week of Aug 09, 2015ما معنى"تقاطع الموت" في التحليل الفني؟

Recording of Last Night's Webinar

Here is the link to the recording of my webinar last night with Bob Lang of Explosive Options, delving through the meaning and implications of China's FX revaluation, EURUSD, GBPUSD, oil, S&P500, Dax-30 and an inside look at Death Crosses. Recording Link

Another China Weekend Rate Cut?

Oil touched a six-year low Thursday but markets were generally calmer as China worries dissipate. The pound was the top performer while the kiwi lagged. The yuan setting and a speech from the RBA's Kent are Asia-Pacific highlights ahead of Eurozone GDP later. Ashraf's Premium Insights issued a new note & key EURUSD volatility chart & rationale ahead of Friday's key Eurozone GDP & CPI data. The trade, opened 5 days before the last NFP, is +130 pips in the green so far.

Rumours of Chinese action are ever-present in markets but expect them to ramp up on Friday ahead of the weekend. Every PBOC move on rates this year has come on a Saturday and it's been six weeks since the June 29 cut.

A cut this weekend would be unwise. It wouldn't be seen as an effort to strengthen the economy, but rather as a sign of panic due to a plunging economy. China has no doubt slowed but we don't believe it's cratering. Still, official moves lately have been haphazard and a weekend cut can't be ruled out.

For Friday, the trade is the rumour and it will first be reflected in Shanghai Composite trading to close out the week. It will rally but might be set up for disappointment Monday.

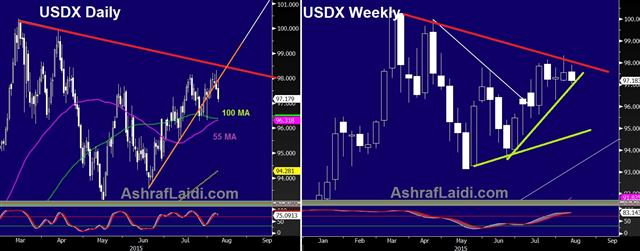

The main news item Thursday was the US retail sales report. Given the upward revisions, it was stronger than expected but after a brief rally, the US dollar faded. That strengthens our conviction that the dollar trend may be coming to an end.

The main event to watch in Asia-Pacific trading is the yuan fix at 0115 GMT. Yuan closed fractionally above the previous day's fixing so the rate will likely reflect that and end the three days of devaluation. Any kneejerk moves should be faded similarly to yesterday's AUD/USD drop.

Along with the fixing, the RBA's Kent speaks at 0215 GMT on 'recent labour market developments.' The battering of the Australian dollar earlier this week on China fears wasn't justified and upbeat comments about the jobs market could help the Aussie rally into the weekend.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone GDP s.a. (Q2) (q/q) [P] | |||

| 0.4% | 0.4% | Aug 14 9:00 | |

| Eurozone GDP s.a. (Q2) (y/y) [P] | |||

| 1.3% | 1.0% | Aug 14 9:00 | |

| Eurozone CPI (JUL) (m/m) | |||

| -0.6% | 0.0% | Aug 14 9:00 | |

| Eurozone CPI (JUL) (y/y) | |||

| 0.2% | 0.2% | Aug 14 9:00 | |

| Eurozone CPI - Core (JUL) (y/y) | |||

| 1.0% | 0.9% | Aug 14 9:00 | |

| Advance Retail Sales (JUL) | |||

| 0.6% | 0.6% | -0.3% | Aug 13 12:30 |

| Retail Sales (ex. Autos) (JUL) | |||

| 0.4% | 0.4% | 0.4% | Aug 13 12:30 |

| Retail Sales Control Group (JUL) | |||

| 0.3% | 0.5% | 0.2% | Aug 13 12:30 |

| Retail Sales Ex Auto and Gas (JUL) | |||

| 0.4% | 0.4% | 0.2% | Aug 13 12:30 |

| Retail Sales (Q2) (q/q) | |||

| 0.5% | 2.7% | Aug 13 22:45 | |

| Retail Sales ex Autos (Q2) (q/q) | |||

| 2.9% | Aug 13 22:45 | ||

German-US Yield Spread Breaks out

Bond yields fell across the board since mid-June, but the more meaningful fact for currency traders remains yield differentials. For EURUSD watchers, the rate of decline in 10-year bund has been slower than its US counterpart, which led to a stabilisation in the German-US spread (not US-German) to the extent of breaking above an important 3 ½ year trendline.

Today's release of US July retail sales rose by a robust 0.6%, with the bulk of the sales occurring in autos and online, while sales in department stores and of electronics were negative.

The dissipation of Greece risks and near deal with creditors has cemented stabilisation of the single currency, while the probability of a September Fed hike hovers between 40% and 50%. The disinflationary consequences of further CNY weakness could still occur as long as the CNY does not reverse its recent declines.

A deeper CNY devaluation may not be in the cards, but it is somewhat too late to avoid disinflation risks from China when the post-devaluation action suggests the currency will remain neutral-to-weak following an established 50% decline in oil prices over the past 13 months, including a 30% decline since May.

EURUSD today ended a 5-day winning streak, which was the longest since April. The last time the pair had risen 7 days in a row was in December 2013. We stick with our view that the peak of the US dollar bull market (measured in USDX) is already behind us.

Our EURUSD long opened six days before the Aug 7 release of the US jobs report at 1.1020 remains in the green, and is halfway its final target. A fresh update is due today, alongside the other five existing Premium trades.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Advance Retail Sales (JUL) | |||

| 0.6% | 0.6% | -0.3% | Aug 13 12:30 |

| Retail Sales (ex. Autos) (JUL) | |||

| 0.4% | 0.4% | 0.4% | Aug 13 12:30 |

| Retail Sales Control Group (JUL) | |||

| 0.3% | 0.5% | 0.2% | Aug 13 12:30 |

| Retail Sales Ex Auto and Gas (JUL) | |||

| 0.4% | 0.4% | 0.2% | Aug 13 12:30 |

Ashraf's Webinar Today

My webinar this evening with Bob Lang on currencies, oil, indices the Fed & China starts at 16:30 ET, 21:30 BST, 0:30 Dubai Time. I will discuss currencies, oil, the Fed and China. Registration Link

China Fear Begins to Fade

The kneejerk reaction to the yuan devaluation was that it meant the economy in China was much worse than believed. However, as Ashraf explained earlier, it was a perfectly understandable move that was poorly communicated and executed. Confusion continued to lead to risk aversion in European trading Wednesday but as the day continued markets began to get a handle on the situation. Ashraf's premium long EURUSD from 1.1020 on Jul 31 is +140 pips in the green. USDCAD is at brekeven and AUDCAD was stopped out at 0.9500.

With China in sharp focus, the main event in Asia-Pacific trading once again today is the 0115 GMT yuan fixing. Expect a further 0.9% to 1.0% decline, given how the central bank has pledged to shift the peg to where the market is trading. Yesterday we explained the same mechanism and predicted a 1.5% devaluation. It was announced at 1.6%.

The second devaluation was entirely predictable but the kneejerk reaction was to sell the Australian dollar once again. A market that moves like that is irrational. It's been a similar story throughout asset classes.

Confusion on China has led to a series of puzzling market moves but there are signs traders are beginning to get a grip. The first is the aforementioned Australian dollar. It climbed 2.3% from the lows. The S&P 500 also reversed more than 30 points to close in positive territory.

China is no doubt going through some growing pains but the economy isn't imploding. Even if growth is softer, policymakers have a full set of tools to stimulate growth. The takeaway from the past month is that China will use them. The communication and execution have been sloppy so far but ultimately the actions will support domestic and global growth.

Keep a close eye out for continued AUD strength. It's still early but that would be the clearest sign that confusion about China is ebbed.

Other events on the Asia-Pacific calendar today include Japanese June machine orders at 2350 GMT. The consensus is for a 17.6% y/y increase.

It's China's turn

Devaluing currencies from the US to Japan, Eurozone and China. Although Japan started zero interest rate policy back in the mid-1990s, for a more relevant comparison, we start the analysis post-2008/9 crisis.

Fed in 2009

The Fed's ZIRP began in December 1998, before heading off QE in March 2009, followed by QE2, Operation Twist and QE3 in the ensuing four years. As a result, the US dollar index fell more than 18% on two occasions; in 2009 and in 2010-2011 with a brief pause during the eruption of the Eurozone debt crisis.Japan in 2012

Japan finally succeeded in combatting yen strength by voting in a new Prime Minister who's campaign was largely based on yen devaluation with the blessing of the IMF aka the US. Thanks to two waves of QE in 2013 and 2014, the Bank of Japan's asset purchases extended beyond government bonds to corporates and equity funds. The result was a 32% decline in yen's trade-weighted index and a 60% plunge against the US dollar.Eurozone in 2015

In March 2015, the European Central Bank inaugurated a full scale €1.1tn QE program, at the tune of €60.0 bn in monthly purchases of public and private sector assets until September 2016. The program aimed primarily at reversing deflation and easing financial conditions to revive growth in most recessionary Eurozone members.China in 2015

This week, the China reported the 9th consecutive monthly decline in imports (longest since 2008-9), the 5th decline in exports over the last seven months and a 7% decline in China's currency reserves to a 2-year low. With most business surveys indicating a contraction, China's economic situation was exasperated by pegging its currency to the appreciating US dollar. After weakening the yuan by nearly 3% earlier in the year, the People's Bank of China reversed course in March to stabilize escalating capital outflows. But the rising dollar made things worse.Yesterday's yuan 1.9% devaluation and today's subsequent 1.5% decline means that 5% depreciation is inevitable. Any devaluation greater than 7%-10% would be a serious threat for global markets and China's trading partners. Let's not forget the CNY appreciated 11% after the 2008-9 crises and that it remains overvalued by most measures following the appreciating USD and deepening slowdown in the China.

A CNY decline of such magnitude could occur if China mismanages the balance between maintaining CNY competitiveness and curbing capital outflows. Another risk to such balance would be renewed Chinese data disappointments and prolonged USD appreciation. The likelihood of all this materializing is about 40%.

Yuan manipulation?

With regards to accusations against China continuing to manipulate its currency, it is a fallacy to confuse China's lack of full currency convertibility with undervaluation. This is no longer 2005 or 2006, when minimal revaluations were dwarfed by China's expansion. The currency may not fully function according to perfect market forces, but it has appreciated more than 10% against the US dollar between summer 2010 and winter 2014. During that time, China GDP slowed from 10% to 7%, exports fell from a rate of +30% to -8% and credit growth plummeted. The IMF and most economists deem the yuan to be overvalued against the US dollar.Why the PBOC is Cornered

There's a temptation to believe China is operating with a well-designed plan but we look at how the latest series of moves have been reactionary. Markets wilted in confusion on Tuesday. The next big test is today's yuan reference rate setting. The latest in the Premium trades, USDJPY hit its final 125.25 target from the 123.90 entry, while EURAUD extended into the green at 1.5120 from the 1.4690 entry. AUDCAD has slipped back into the red.

The problem with a 'one-time' devaluation is that markets need to believe you. The PBOC doesn't have that kind of credibility. So when they announced the move, market participants instantly came to believe that more devaluation was coming. Almost instantly, the capital outflows began. By extension, that will devalue the yuan further.

The rate-setting mechanism for the yuan is still somewhat market based. It was set at 6.2298 to the US dollar Tuesday and allowed to trade in a 2% band. Throughout the course of the day, it fell another 1.5% to 6.325 and remains under pressure. That means there is a good chance the PBOC will 'devalue' by another 1.5% today.That will underscore the devaluation theme and exacerbate outflows further, causing a viscous cycle and undermine PBOC credibility. The daily announcement is usually at 1:15 GMT (21:15 ET) and expect more of what we saw today if/when it takes place.

Alone, that might have been seen as a cunning strategy from Chinese officials. But the Australian Financial Review also reports that in June the PBOC was very explicit in telling fund managers it wouldn't devalue. That, in addition to the haphazard incursions into the stock market over the past 6 weeks reek of desperation.

Warren Buffett's most-famous saying is that we find out who is swimming naked when the tide goes out. 20 years of blockbuster growth have made every official in China appear oracle-like but endless rising growth has begun to flounder and Chinese officials appear to be splashing around madly trying to stay afloat.

ماذا يعني قرار البنك المركزي الصيني؟

PBOC Action to Further Divide the Fed

The 1.9% devaluation in the peg of the Chinese yuan is a balancing act between addressing the slowdown in exports and the economy, and stabilizing the risks of escalating capital outflows. In a nod to the IMF, China has altered the way it announces its daily fixing—the anchor price around which intraday fluctuations are permitted to move by no more than 2.0%-- by using the previous day's close instead of an arbitrary level set by the PBOC. This is no surprise to those who read us here 2 days ago.

The decision to set the daily anchor, or central rate based on the prior day's close is a an important move towards a more market-based setting, which meets a key requirement before including the yuan in the basket of the IMF's Special Drawing Right—a foreign exchange asset created by the Fund for central banks to maintain reserves in a more diversified manner.

Falling Exports, Reserves & Growth

In terms of its current account, China's slowing growth has manifested itself in the 9th consecutive monthly decline in imports (longest since 2008-9), the 5th decline in exports over the last seven months and a 7% decline in China's currency reserves to a 2-year low. The situation had especially deteriorated after the CNY rebounded in early March into early summer following the PBOC's efforts to stem any capital outflows, which arose from the 3% decline between October 2014 and March 2015.

Implications for Fed Policy

Less than 24 hours after the US dollar sustained a notable sell-off following remarks by Fed's Fisher highlighting weak inflation and throwing doubts over a September rate hike, the PBOC acted with a never-seen devaluation, which partially reversed yesterday's USD decline.The plunge in commodities- led by the 30% decline oil since May—is widely seen as a cause of disinflationary pressures. Further devaluation from Beijing could be the coup de grace for commodities, thereby exporting deflation to the US and Europe.

At a time when several FOMC members were considering a rate hike as early as next month, China's devaluation further highlights the importance of low inflation as an obstacle to Fed tightening. The decision also complicates the task of those Fed members, aiming for September liftoff but without further USD gains.

Jackson Hole will be about inflation, not jobs

Considering the disinflationary US dollar and recessionary oil/mining sector, the question to raise rates this autumn should re-emerge at the Fed's August 27-29 annual Economic Policy Symposium at Jackson Hole, where unsurprisingly the topic of this year's conference will be “Inflation Dynamics and Monetary Policy”, following last year's topic, which centered around labour markets. Fed chair Yellen will not be present at this year's conference, but the heated debated about the topic will not be absent, especially as it will take place 3 weeks days before the Sept FOMC and 7 days after the latest Greece deadline.We continue to expect no rate hike this year.

Inflation Question Divides Fed

The final piece of the rate hike puzzle is inflation and Fed Vice-Chair Stanley Fischer said Monday he wants to see progress before making a move. That clashed with continued hawkish rhetoric from Lockhart and that hurt the US dollar in New York trading. The upcoming Asia-Pacific schedule is light but all eyes will remain on China. Ashraf issued new notes and charts on the existing Premium trades in EURAUD and USDCAD, each of which is +110 pips in the green.

The core of the Fed no longer believes that US unemployment is a major problem but officials have yet to see the typical signs of wage inflation from a tight jobs market. For some, like Lockhart, it's just a matter of time. He reiterated that he's prepared to hike in September and said he will look to inflation to guide subsequent hikes.

For others, like Fischer, he's reluctant to move before inflation begins to rise. He said that if the Fed were solely focused on inflation it would have to try and be more accommodative, if possible. He comments kicked off the run on the dollar that extended throughout the market, except against the yen. Cable was particularly perky, rising more than a cent off the lows to 1.56, even as Miles took a less-hawkish approach. This explains why Ashraf pointed out 2 weeks ago the theme of this year's annual Fed conference in Jackson Hole is inflation & monetary policy (rather than labour markets).

Beyond the Fischer comments, the overall theme was a retracement of the trend on a quiet news day. We highlighted crowded bets against the Canadian dollar yesterday and that trade was quick to be undone as oil prices rebounded 3%.

For commodities, the focus is on China were the market has gone into a mode where it aggressively bets on stimulus on any bad news. The PBOC is a tough central bank to time but we wonder how long the market will remain patient.

أشرف العايدي في قناة العربية

مقابلتي في قناة العربية عن الصين، الولايات المتحدة، الأحتياطي الفدرالي و اليونان المقابلة الكاملة

Plunging Chinese Exports Put USD at Risk

Jittery Chinese markets will be put to the test early in the week after Saturday data showed very weak exports. The focus will remain on trade with Japanese data up next. Weekly CFTC positioning numbers showed the most-extreme net USD long since early-June.

Chinese exports fell 8.3% y/y in July, far short of the 1.5% contraction expected. That took a chunk out of the trade surplus, leaving it at $43B compared to the $55B forecast. It raises fresh questions about the health of the economy in light of the stock market plunge. It will also put fresh pressure on officials to stimulate growth.

Once source of concern could be CPI at 1.6% y/y versus 1.5% expected but that's still in a safe range for tightening. In addition, the producer price index fell 5.4% y/y which puts deflationary pressures in the pipeline. It was also a six-year low.

There is some talk that China may use exchange rate depreciation as a stimulus tool. That would work provided its competitors don't retaliate. It's also something the Fed would need to consider with more marketwatchers leaning toward a September rate hike.

FX pressures and commodity devaluation aren't high on the Fed's list of worries but towards the end of the year they will be a negative factor for inflation and growth. It could mean a Sept hike is one-and-done and the US dollar is already near a top.

Another economy that may choose to stimulate and depreciate is Japan. A portion of the decision will come down to how exporters are performing in the current environment. Data at 2350 GMT is expected to show a 119B yen surplus in June but a soft reading may get the BOJ thinking about more QE.

Commitments of Traders

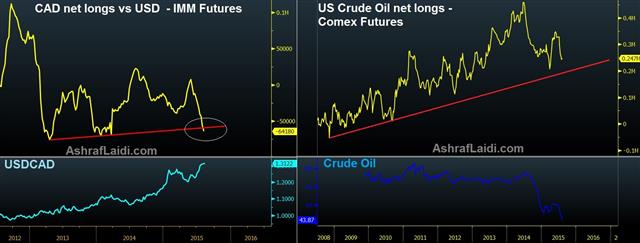

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -113K vs -104K prior JPY -80K vs -63K prior GBP -7K vs -10K prior AUD -50K vs -51K prior CAD -64K vs -56K prior MORE DETAIL ON CAD & OIL CHF -1.5K vs 0K priorThe market is getting increasingly comfortable betting against the commodity currencies. Positions are now near extremes and that's a warning sign.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (JUL) (m/m) | |||

| 0.3% | 0.3% | Aug 09 1:30 | |

| Consumer Prce Index (JUL) (y/y) | |||

| 1.6% | 1.5% | 1.4% | Aug 09 1:30 |

CAD Net Shorts Break Trendline

CAD net shorts vs USD have risen to their highest since March 2014, breaking the 29-month trendline support and suggesting CAD sentiment among speculators is further endangered. Although net longs US crude oil saw their first increase in 5 weeks, CAD sentiment deteriorated. This week's CAD sentiment figures will be closely watched following Friday's Canada jobs report.

Canada: Jobs vs growth

Canada's July jobs report narrowly escaped 2nd consecutive monthly contraction thanks to a net 6.6K rise in employment, underlying the resilience of the labour market despite a technical recession. But there's more inside the numbers.The dichotomy between services and manufacturing industries continues with service-producing sectors added a net 19k jobs in July, versus a net loss of 12k jobs in goods-producing industries. Although natural resources sectors lost only net 2k jobs, four times that amount was lost in construction, with 5k eroded in manufacturing. The bulk of service-sector employment occurred in professional jobs, while finance and insurance saw a net 10k loss.

Canada's technical recession has become the central national topic ahead of the October elections. Whether it is GDP that is leading jobs or the inverse remains to be seen.

Based on our anticipation for US crude to fall below $40, the Bank of Canada will be forced to maintain a dovish bias into the rest of the year. The falling loonie may help damage control in exports, but the looming end of the driving season will further trigger the cyclical shift in Canada's economy.