Intraday Market Thoughts Archives

Displaying results for week of Jun 21, 2015Weekend Danger Looms

Greek negotiations have entered a period of extreme uncertainty. Headlines cross the newswires within minutes that are entirely contradictory. Some optimism remains but major compromise is still essential for a deal and time is running out.

Tsipras was rumored to have offered to resign as his party hardliners fight back against austerity. Other reports indicate there has been progress.

What's certain is that there are no high level meetings planned until Saturday and a leaders summit was called off. That means we'll head into the weekend without a deal and in danger of a breakdown in negotiations. Watching the headlines is essential but unless there is a breakthrough risk trades are in danger ahead of Friday's close.

Overall, Thursday trading was subdued. The PCE report continued to show benign inflation but consumer spending rose 0.9%, the most since 2009 and beating the 0.7% consensus. The Markit services PMI, however, was on the soft side.

The SNB's Jordan was jawboning again and weighed on the franc. He told an industry lobby association that the central bank can counter CHF strength with intervention and lower rates.

The yen was generally stronger on risk aversion but the range was tight in US trading. The key reports in the hours ahead are Japanese jobs and inflation. The May national CPI report is expected to show a meager 0.4% y/y rise and flat core reading. The June Tokyo CPI number is expected up 0.5% y/y.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Tokyo CPI (JUN) (y/y) | |||

| 0.5% | Jun 25 23:30 | ||

| Tokyo CPI ex Food, Energy (JUN) (y/y) | |||

| 0.1% | Jun 25 23:30 | ||

| Tokyo CPI ex Fresh Food (JUN) (y/y) | |||

| 0.1% | 0.2% | Jun 25 23:30 | |

| National CPI (MAY) (y/y) | |||

| 0.6% | Jun 25 23:30 | ||

| National CPI Ex Food, Energy (MAY) (y/y) | |||

| 2.2% | Jun 25 23:30 | ||

| National CPI Ex-Fresh Food (MAY) (y/y) | |||

| 2.2% | Jun 25 23:30 | ||

| Markit PMI Composite (JUN) [P] | |||

| 54.6 | 56.0 | Jun 25 13:45 | |

| Markit Services PMI (JUN) [P] | |||

| 54.8 | 56.7 | 56.2 | Jun 25 13:45 |

Greek Optimism Fading

The sense of compromise and urgency to keep Greece in the Eurozone has vanished. Significant gaps remain in Greek talks with the IMF digging in its heels on tax hikes and military spending. Greece continues to insist on debt relief.

EU finance ministers were said to leave the latest meetings angry. A deal is highly unlikely in the hours ahead and that jeopardizes the entire Greek timeline. Talks at the highest levels are continuing but there is suddenly very little progress.

Trading the euro around Greek talks has been fraught with pitfalls. It may prove that yen crosses and risk-sensitive trades prove to be a better metric. The yen rallied late in the day and stocks fell as a stream of headlines raised eyebrows.

The S&P 500 fell 15 points on the day while USD/JPY skidded back to 123.90 from as high as 124.37.

The lone data point on the agenda is Australian job vacancies at 0130 GMT so it will all be about the tone of Eurozone meetings and leaks.Dax Technical Failure & Euro Support

The DAX resistance point is especially resilient, representing a confluence of the: i) April trendline resistance; ii) Death Cross highlighted by the 55-moving average crossing below the 100-moving average.

These technicals are a concrete reminder of the intermarket dynamics at play in favour of the uptrend in EURUSD, bund yields and the downtrend in DAX-30 and Eurostoxx.

EURUSD seen supported at $1.1050s before regaining $1.15. 10-yr bund yield seen supported at 0.80% before regaining 1.10. Dax-30 unlikely to break below 10K but remains capped at 11,650.

Three Factors Driving Euro Moves

The US dollar roared back on Tuesday, aided by a hawkish comment from a core Fed member. The Aussie joined USD as the top performer while the euro lagged. The BOJ meeting minutes and Japanese PPI are up next. The Premium AUDNZD has depeened into its gains, whole both EURAUD and EURCAD are in the red. A new Premium update is due tomorrow.

EUR/USD hasn't been straightforward for the past month and that continued Tuesday. We look at why this pair has been so volatile and where Greece fits into the picture. The pair tumbled to 1.1150 from 1.1340 in European and US trading.

The final flush lower came after the Fed's Powell said there was a 50/50 chance of a Fed hike in Sept. That's higher than markets are pricing.

Other factors including a surge in new home sales, a beat in the Richmond Fed and slightly soft durable goods orders added to USD volatility.

In the bigger picture, the three key factors for EUR/USD are: 1) Fed expectations 2) The carry trade 3) Greece. In general, that's also the order of importance. Greece grabs the headlines but the correlation with Fed expectations (based on Fed funds futures) is convincingly high.

Greece and the carry trade also interact. Some fresh snags appeared in closing a deal. The IMF is reluctant to allow SMP profits to go to Greece and debts to be restructured. Fresh meetings are scheduled Wednesday but a deal still looks 90% likely, even if it's only a six-month extension.

What's important to keep in mind is that the euro is now a funding currency. It's not a coincidence that the Swiss franc (also a funding currency now) mirrored the euro's fall on Tuesday. The increased stability in Greece will renew demand for carry trades and may put the euro under pressure so long as Bund yields remain below 1%.

Asia-Pacific traders will continue to focus on China after the Shanghai Composite rebounded 2.2% yesterday. The calendar features the May 22 BOJ minutes and PPI at 2350 GMT. Talk in the minutes about hitting the 2% inflation target could cause some JPY moves but it's unlikely.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| New Home Sales (MAY) | |||

| 546K | 523K | 534K | Jun 23 14:00 |

| New Home Sales (MAY) (m/m) | |||

| 2.2% | 1.2% | 8.1% | Jun 23 14:00 |

| Durable Goods Orders (MAY) | |||

| -1.8% | -1.0% | -1.5% | Jun 23 12:30 |

| Durables Ex Transportation (MAY) | |||

| 0.5% | 0.5% | -0.3% | Jun 23 12:30 |

| Richmond Fed Manufacturing Index (JUN) | |||

| 6 | 3 | 1 | Jun 23 14:00 |

| BoJ Monetary Policy Meeting Minutes | |||

| Jun 23 23:50 | |||

Dax Overtakes Euro on Greece Optimism

The euro-Dax-bunds relationship continues in full swing, led by a rallying Dax and rest of Eurozone bourses resulting from the most notable steps taken by Greece towards reaching a deal with creditors in four months.

The euro's initial rally to $1.1410 following yesterday's comments from EU's Juncker that Athens' proposal was an important step forward, but later gave up gains as other EU officials as as well as IMF's Lagarde indicated that no final agreement would be ironed out by Wednesday's summit. Bourses continued to rally but the euro ignored strong June flash Eurozone PMIs and weaker than expected US May durable goods orders due two possible reasons:

i) Further diminishing of Greece Risk supports European stocks and returns euro to its previous role as a funding currency for higher yielding bets (equities, corporate bonds and currencies).

ii) Continued ECB purchases of Eurozone bonds keep euro under pressure to the benefit of already bolstered German equities/economy as fund managers return to hedging euro exposure by selling euro forward contracts.

10-year bund yields are modestly lower, but this is unlikely to last if Eurozone indicators remains on the rise and if optimism in Eurozone stocks and macro data translates into a more rapid normalisation of Eurozone inflation especially as the ECB keeps EUR60 bn monthly purchases on autopilot.

Yet, the more pressing relation remains between stocks and the euro. As the DAX-30 and Eurostoxx break out of their April trendline resistance, coinciding with a double breakout above their 55 and 100 day moving averages, then the potential for further gains could weigh on the single currency. One exception to this assessment would be renewed gains in bund yields relative to their US counterpart.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit US Manufacturing PMI (JUN) [P] | |||

| 53.4 | 54.1 | 54.0 | Jun 23 13:45 |

| Eurozone Markit Services PMI (JUN) [P] | |||

| 54.4 | 53.6 | 53.8 | Jun 23 8:00 |

| Eurozone Markit PMI Composite (JUN) [P] | |||

| 54.1 | 53.5 | 53.6 | Jun 23 8:00 |

| Eurozone Markit PMI Manufacturing (JUN) [P] | |||

| 52.5 | 52.2 | 52.2 | Jun 23 8:00 |

| Germany Markit PMI Manufacturing (JUN) [P] | |||

| 51.9 | 51.3 | 51.1 | Jun 23 7:30 |

| Germany Markit Services PMI (JUN) [P] | |||

| 54.2 | 53.0 | 53.0 | Jun 23 7:30 |

| Germany Markit PMI Composite (JUN) [P] | |||

| 54.0 | 52.6 | Jun 23 7:30 | |

| Durable Goods Orders (MAY) | |||

| -1.8% | -1.0% | -1.5% | Jun 23 12:30 |

| Durables Ex Transportation (MAY) | |||

| 0.5% | 0.5% | -0.3% | Jun 23 12:30 |

مقابلتي اليوم مع قناة العربية

أشرف العايدي على قناة العربية - 22 يونيو 2015 المقابلة الكاملة

Click To Enlarge

FX Sidelined in Greek Deal, China Returns

A Greek deal is all-but-finished as Juncker signalled a high level of confidence that an agreement is coming this week. Yet the euro was flat on the day while the yen lagged. The China manufacturing PMI from HSBC is next. The Premium EURUSD long at 1.1110 on June 5 hit its final target of 1.1410 last week. EURAUD is in breakeven while the EURCAD and AUDNZD trades remain in progress and in the green. All trades are accompanied by technical charts and fundamental rationale.

Positive signs emerged from Greece throughout the day but the equity market responded much more strongly than the euro. Shares in Greece rose nearly 10% while the rest of the continent gained around 4%. The euro tested 1.14 twice but failed to sustain a break.

One factor that continues to weigh on the euro is the unwind of the bund trade. 10-year yields moved up 13 bps to 0.88%. The market may also be looking past Greece and focusing on the broader market.

Economic data was limited to US existing home sales, which hit 3.35m compared to 5.26m expected. That gave a slight lift to the US dollar but tomorrow's durable goods report will be a larger driver.

The immediate focus now shifts to China where markets reopen after a long weekend. Last week was the worst since Lehman as Shanghai shares dropped more than 13%. Hopes for PBOC action were dashed again but US-listed China ETFs were up more than 1% on Monday so sentiment has stabilized.

But Chinese sentiment can change in a flash. Specifically, the HSBC June flash manufacturing PMI which is expected at 49.4 from 49.2. Perversely, a slightly soft reading could boost stocks on speculation of rate cuts. It's due at 0145 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (JUN) [P] | |||

| 54.2 | 54.0 | Jun 23 13:45 | |

| PMI (JUN) [P] | |||

| 49.4 | 49.2 | Jun 23 1:45 | |

| Eurozone Markit PMI Composite (JUN) [P] | |||

| 53.5 | 53.6 | Jun 23 8:00 | |

| Eurozone Markit PMI Manufacturing (JUN) [P] | |||

| 52.2 | 52.2 | Jun 23 8:00 | |

| Eurozone Markit Services PMI (JUN) [P] | |||

| 53.6 | 53.8 | Jun 23 8:00 | |

| Existing Home Sales (MAY) (m/m) | |||

| 5.1% | 4.8% | -3.3% | Jun 22 14:00 |

| Existing Home Sales (MAY) | |||

| 5.35M | 5.28M | 5.09M | Jun 22 14:00 |

| New Home Sales (MAY) (m/m) | |||

| 0.525M | 0.517M | Jun 23 14:00 | |

| New Home Sales Change (MAY) (m/m) | |||

| 6.8% | Jun 23 14:00 | ||

| Durable Goods Orders (MAY) | |||

| -0.5% | -1.0% | Jun 23 12:30 | |

| Durable Goods Orders ex Transportation (MAY) | |||

| 0.6% | -0.2% | Jun 23 12:30 | |

Greek Deal Nears, Dollar Bets Trimmed

It's the make-or-break moment in Greek negotiations as the highest government leaders prepare to meet in Athens. The euro is only fractionally higher to start the week despite the positive weekend signals. CFTC positioning data showed dollar longs heading for the exits. The Premium EURUSD long at 1.1110 on June 5 hit its final 1.1410 target last week. EURCAD and AUDNZD trades remain in progress and in the green, while EURAUD is in breakeven. Each trade is accompanied by trechnical charts and fundamental rationale.

It's all about Greece at the moment. Optimism is building but we've seen good news turn into disaster many times in the saga. Euro traders are skeptical with EUR/USD up just 10 pips at 1.1361 to start the week.

It seems clear that the tone has changed in negotiations and hat will likely underpin the euro in the hours ahead. Top-level meetings aren't until late Monday so there will be no quick answers.

Extensive talks took place over the weekend and messages were generally positive. Perhaps most revealing was how quiet negotiations took place. Leaders are no longer spewing rhetoric and rushing to the press to spin the message and win political points.

It's often forgotten that Tsipras is fighting a two-front war if he wants to make a deal. Members of his own party will abandon him if he compromises too deeply. But cabinet meetings were held Sunday and Greek finance minister Varoufakis was asked if he's confident of a deal by reporters. “Always,” he said. “We're heading for a deal.”

Other weekend news was light and the Asia-Pacific schedule is bare. One event to watch comes at 0630 GMT when the ECB's Coeure speaks in Paris.

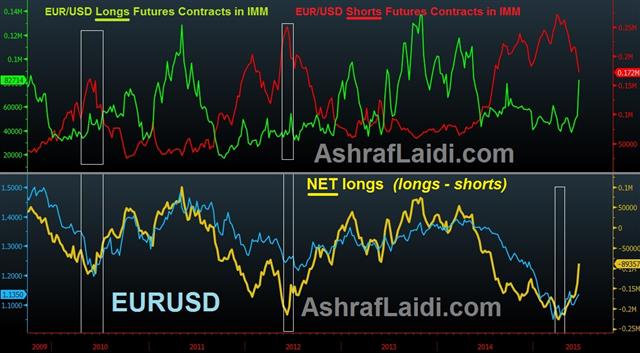

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -89K vs -138K prior JPY -80K vs -116K prior GBP -25K vs -28K prior AUD -4K vs -14K prior CAD -12K vs -14K prior CHF +5K vs +10K prior

Note that this was before the FOMC so positions were probably trimmed further afterwards. The squeeze in euro shorts helps to explain some of the recent strength.

The other thing that stands out is cable shorts. That was an absolutely wretched trade with GBP/USD up in 9 of the past 10 sessions.