Intraday Market Thoughts Archives

Displaying results for week of Dec 03, 2017Bitcoin Bonanza

We are fast approaching the make-or-break moment for Bitcoin. Prices gyrated wildly Thursday with some exchanges nearing $20,000 but systems clearly came under a strain. In FX, sterling gathers upward momentum on news that DUP intends to strike a deal with PM May and on firm services PMI and the Australian dollar quietly fell to a six-month low. The US jobs report is up next. 2 new trade actions in the Premium Insights were issued on EURUSD.

It's impossible to avoid talking about Bitcoin at the moment, which is now surely the defining mania of our era. What's not clear is how and when it will end but aside from the violent price swings, the warnings signs are mounting. The first is the increasingly slow and expensive transaction costs. It's clear that Bitcoin will never replace fiat currency – long one of the tenants of the bull theory. It currently costs $13 to do any transaction and takes upwards of 7 hours to verify a transaction at that price.

One thing everyone will be hearing more about in the days ahead are the mempool. This is the backlog of transactions and it's growing at a fast rate. If there is ever a stampede to the exits, this problem will be a devastating bottleneck. At the same time, the exchanges are under increasing strain. Outages hit the main trading hubs again on Thursday. That's a major red flag.

Bitcoin has proven significant resilience to bad news. The dip after hitting $10,000 was bought and reports of hacks, theft and fraud are brushed aside. That's a sign of a roaring market.

The catalyst that everyone is watching is the introduction of futures trading this week at CBOE and next week at the CME. Both are cash-settled contracts so they shouldn't affect the underlying market, especially since short-term arbitrage is nearly impossible because of the transaction times.We will be watching closely.

Elsewhere, the US dollar founds its legs on Thursday as USD/JPY rose to a three-week high and AUD/USD fell to a six-month low. Non-farm payrolls is due on Friday and indications from the ADP report was another strong jobs print but the focus will remain on wages. If they tick up, then the dollar could start to recover much of the July/Aug declines.

See you in London This Evening

Looking forward to seeing you at my seminar at GKFX's London heaquarters this evening. Register

EURUSD Copy & Paste 2002

The EURUSD analog with 2002 continues to apply. Here is how to trade it + a look at USDJPY. Full video.

Euro Slides, Big Questions

The euro tested the 100-day moving average as the market sorts through political and central bank questions. The New Zealand dollar was the top performer while the euro lagged. The Bank of Canada is due shortly. Earlier in Asia, Australian Q3 GDP grew by less than expected, promptinng broad AUD selloff. The BOC decision later, with less than 20% chance of rate hike expected, but expect an optimistic spin. US ADP weakened to 190K as expected. The Premium CAD trade remains in the green.

Economic data on Tuesday featured the ISM non-manufacturing index. It slipped to 57.4 from a 12-year high of 60.1. The reading was below the 59.0 expected but the market hardly moved on the results because hurricane effects were the likely driver.

More broadly, the market is pondering three big questions. The first is what is next for global central banks. A series of decisions are due in the next 9 days and that will clarify the path for rates next year. The second is the US tax reform bill. The details are what matter now and small changes are driving the US equity market, with sentiment also swinging back and forth, with the usual pre-Santa rally selloff in view. Thirdly, even if those questions are answered, year-end flows could swamp fundamentals and leave the market vulnerable.

On the central banking front, the RBA offered some hints at what coming. Lowe talked about improving global growth and how that is an upside risk for inflation.

The BOC is up next to weigh in on the global outlook. The market is pricing in a 17% chance of a hike. That's high but understandable given past BOC surprises. If they hold, a CAD rally can't be ruled out if they signal a more hawkish stance in 2018. Currently a hike is 70% priced in for March.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (q/q) | |||

| 0.6% | 0.7% | 0.9% | Dec 06 0:30 |

| Eurozone Revised GDP (q/q) | |||

| 0.6% | 0.6% | Dec 07 10:00 | |

| ADP Employment Change | |||

| 190K | 189K | 235K | Dec 06 13:15 |

نراكم في دبي يوم السبت

آمل أن أراكم في ندوة السبت في دبي -- إستراتيجيات تداول العملات والمعادن مع ظهور العملات الرقمية هذا السبت 6 مساء في فندق جميرا بيتش لحجز مقعدك الآن

حدود إيرلندا تهدد الإسترليني

فشلت رئيسة الوزراء البريطاني تيريزا في التوصل إلى اتفاق مع الاتحاد الأوروبي بشأن المرحلة الأولى من مفاوضات خروج بريطانيا من الاتحاد الأوروبي نتيجة خلافات في اللحظة الأخيرة حول الحدود الإيرلندية التحليل الكامل

GBP Borders on Brexit Failure

Northern Ireland's DUP says it will not accept “regulatory alignment” between Northern Ireland and the Republic as a requirement to keep the border open. How long will the dissent last and what it means for GBPUSD's path road to $1.38? Full analysis.

Wednesday Webinar with Ashraf Laidi

In case you cannot attend Thursday's London seminar, Ashraf is holding a WEBINAR tomorrow evening at 7:30 pm London/GMT with GKFX, previewing Friday's US jobs report and next week's key ECB/FED decisions. Click here for registration.

Brexit Bringdown, RBA Next

Ireland is a fresh thorn in the side of Theresa May as she attempts to score a Brexit victory. The Canadian dollar was the top performer while the Swiss franc lagged. The RBA decision is up next. The EURUSD Premium short was closed for 60-90 pip gain (depending on entry), while a new JPY trade was issued.

من الوظائف الأمريكية إلى البنوك المركزية (أحدث فيديو للمشتركين)

Cable climbed early in trading on Monday on expectations for a breakthrough in EU/UK negotiations. Rumors of a divorce settlement were rampant last week and today was supposed to be the announcement. However, May and Juncker were forced to call off meetings after May's coalition partners from the Irish DUP said they wouldn't accept any form of regulatory divergence between the Britain and Northern Ireland.

The breakdown sent cable more than 100 pips lower on the headlines to just above 1.3400. It eventually bounced to 1.3475 but the quick rise and fall on the day were a reminder of a large intraday risks for GBP traders.

Meanwhile, the optimism from the Trump-Russia story faded in stocks as tech led a retreat. The Nasdaq closed 1% lower in a fresh sign of weakness. The drop came despite the GOP passing tax reform in the Senate and the correction on the ABC story. That's a sign that the good news might be priced in and that markets are increasingly concerned about a hawkish Fed.

USD/JPY followed stocks lower to close near 112.50 after rising above 113.00 early.

Looking ahead, the Australian dollar will be hogging the spotlight. First are the Aussie Q3 current account and October retail sales reports at 0030 GMT. Those are followed by the RBA decision at 0330 GMT. The overwhelming consensus is for no move from the 1.50% cash target and no signs of a shift. We will look for comments on wages and global growth as potential market movers.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Current Account | |||

| -9.1B | -8.8B | -9.7B | Dec 05 0:30 |

| BRC Retail Sales Monitor (y/y) | |||

| 0.6% | -1.0% | Dec 05 0:01 | |

Washington Whipsaw

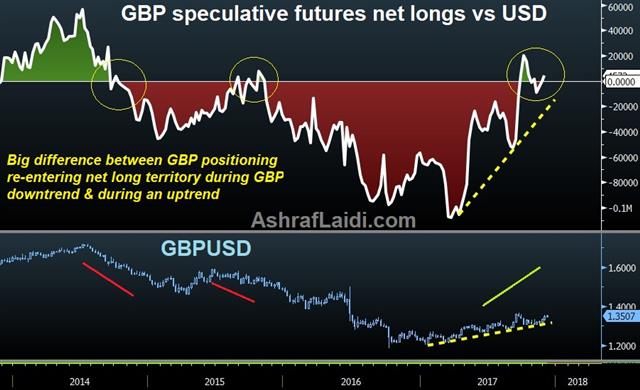

Buying the dip on Trump-Russia news proved to be the right trade again Friday as a reporting error led to an oversized market reaction. The US dollar bounces strongly to kick off the new week, with the exception of against the GBP and CAD, which are holding firm. CFTC positioning data showed yen shorts easing up and GBP positions re-entering net long territory. The EURUSD short Premium trade was closed for 60-90 pip gain (depending on point of entry), leaving one EURUSD trade open.

A half-dozen times this year, markets have been swept away by bombshells about the Trump government and Russian connections. On Friday, former national security advisor Mike Flynn pled guilty to lying to the FBI and promised to cooperate. That Flynn headline put a chill in markets but when ABC reported he would testify he was instructed to contact Russian officials before the election, then a full-scale flight to quality hit. USD/JPY dropped 130 pips to 111.40 and the S&P 500 fell more than 40 points. There were holes in the report from the start and markets slowly recovered. But it wasn't until the weekend that the news was retracted. The new report was that he was instructed to lobby Russian officials after the election and before the inauguration. That was still inappropriate and likely illegal but it's nowhere near stealing an election.

As a result, the US dollar opened stronger with USD/JPY rebounding 50 pips to 112.70, which is where it was before the Flynn news.

At the same time, the Senate voted on the tax bill on Saturday and that's likely to boost US stocks on Monday. At the same time, Flynn's cooperation will mean some fresh blame is laid and that the Russia story continues to roil markets – or at least provides a dip to buy.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +90K vs +95K prior GBP +5K vs -1K prior JPY -110K vs -123K prior CHF -30K vs -30K prior CAD +46K vs +45K prior AUD +39K vs +40K prior

The shifts this week were relatively small but the crowded yen short remains a highly-vulnerable trade. Canadian dollar longs will be feeling better after the ultra-strong jobs report on Friday.

Ashraf's London Seminar Thursday

This Thursday, Ashraf will hold a special in-house seminar in partnership with GKFX, one week before the year's final decisions of the ECB & Fed. - Will a Fed rate hike matter for the US Dollar, or will the ECB steal the show? - Will gold's technical stability turn to the breakout long anticipated by gold bugs? - Technicals of UK100, GER30 and US30 Reserve your seat