Intraday Market Thoughts Archives

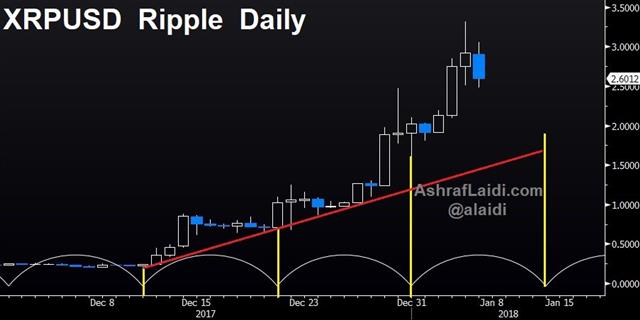

Displaying results for week of Dec 31, 2017Ripple's Next Move

Finally, Ripple experiences disappointing news, or not the usual bit of good news, falling 30% from this week's record high. Here is what we should focus on next. Full analysis.

Ripple's Next Move

Finally, Ripple experiences disappointing news, or not the usual bit of good news, falling 30% from this week's record high. Here is what we should focus on next. Full analysis.

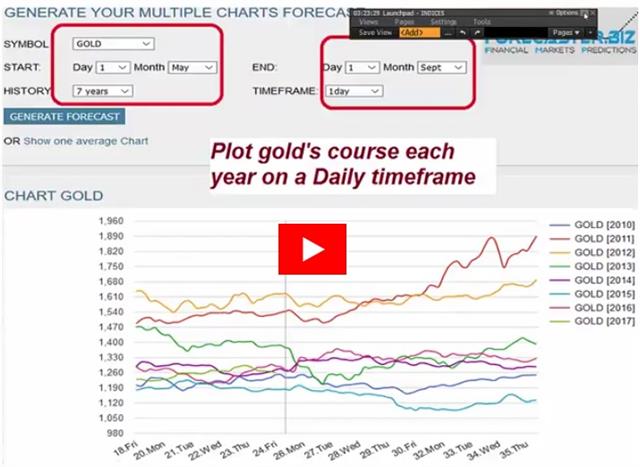

فيديو داخل علاقة الين والذهب

يعتمد الكثير من المحليلين في الأسواق المالية على العلاقة السلبية بين زوج الدولار/ الين و أسعار الذهب لتوقع الحركة القادمة لاسعار الذهب , لكن أين تتجه الأسعار عندما تتغير هذه العلاقة السلبية ؟ تعرف على الإجابة من أشرف العايدي في الفيديو الأسبوعي مفتوح للجميع

January Seasonals: Fact or Fiction?

In my latest video for GKFX, I look at the gold and EURUSD and whether their previous January performance is a relevant indication for the future. I also tackle GBPUSD technicals. Full video.

Dollar Picks Up Where It Left Off

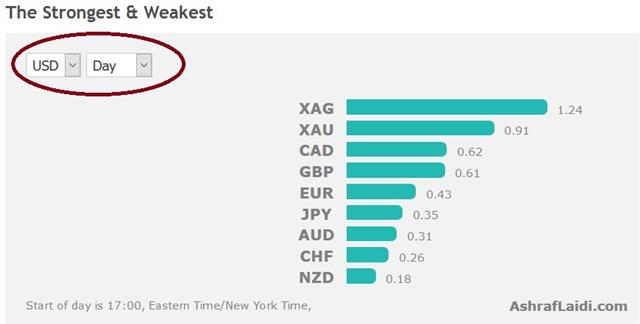

The first trading day of the year ended the same way as all of 2017 – with the US dollar struggling. Will it be a rise in US bond yields to turn the tide in the greenback after the currency slumped in the first full trading day of the year? The pound was the top performer on Tuesday. The Asia-Pacific calendar is bare. Most of the damage was done in European trading as strong PMIs lifted the euro and pound. The first part of a strategic EURUSD Premium has been issued to subscribers moments ago.

As New York arrived a strong selloff hit bonds and 10-year yields rose 5 bps to 2.46%. That momentarily lent a bid to the dollar but it didn't last.

The S&P 500 also roared to start the year in a 22 point climb to a record 2695. Tech was particularly strong in a great sign for stocks going forward. One worry was that would-be sellers were going to wait until after year-end to take the capital gains hit but the index climbed 1.5%.

The pound particularly took advantage of US dollar weakness as cable rose 90 pips to 1.3595. That's now within striking distance of the September high. One worry is that as newsflow picks up it will mean Brexit news picks up. For the past year, that's generally rattled nerves and led to selling.

Another move to continue to watch is gold as it ripped $15 higher to $1317. It was the ninth consecutive day of gains as a strong seasonal kicks off.

In terms of economic data, it was a slow start to the week with only the Markit US manufacturing PMI on the agenda. It was at 55.1 from 55.0 previously. The calendar stays quiet throughout Asia-Pacific trade.

Euro Turns the Year in Style

After ending 2017 as the top currency performer, the euro built further gains towards the 1.2080s, joined by gold and silver. But it was the GBP and CAD that took the mantle in the first full day of trading of 2018, with GBPUSD reaching 1.3590s and USDCAD testing 1.2500. The long GBPUSD trade from late Nov remains open. A new strategic trade in EURUSD will be released later this evening.

Eurozone normalization and recovery will be a major 2018 theme if it isn't derailed by another Italian election. A look at the long-term chart shows that the 14% rise in the past 12 months could be followed by more advances ahead.

Underscoring that theme was a weekend comment from the ECB's Mersche who warned against exiting QE too slowly. Coeure, meanwhile, said the latest QE extension can be the last.

In geopolitics, Iran tops headlines amid anti-government protests. Economic malaise and corruption have contributed to unrest. Trump added his voice, calling for change in 'failing' Iran.

Early in the week, Bitcoin is up 2% to $14,555 and Ethereum up 19% to a new record high of $887. Expect the year ahead in crypto currencies to be as drama-filled as 2017.

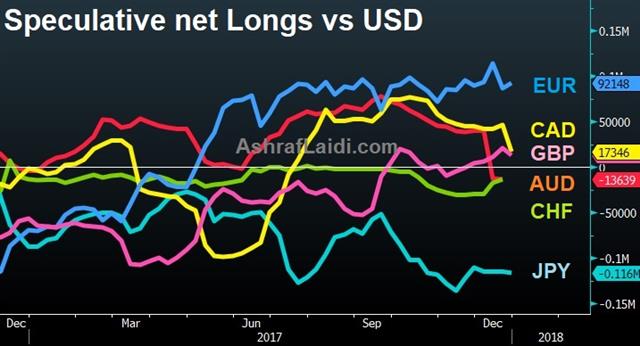

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +92K vs +86K prior GBP +12K vs +20K prior JPY -116K vs -114K prior CHF -13K vs -17K prior CAD +17K vs +45K prior AUD -14K vs -13K prior NZD -17K vs -16K prior

There was a fairly dramatic swing in AUD positioning at the end of the year as it switched to negative 13K from +40K in a single week two weeks ago. A large swing also hit CAD in the final week of the year as the market soured on commodity currencies (despite the late-year rally). That could have been year-end shifts or a long-term repositioning. The week ahead will offer clues. In any case, specs betting on the euro and against the yen into 2018.