Intraday Market Thoughts Archives

Displaying results for week of Feb 19, 2017Markets can no longer wait

Much has been said and promised by president Trump and French Independent presidential candidate Emmanuel Macron. Now it's time for details. In the case of the US, the Fed has become not only increasingly tight-lipped with regards to Trump's fiscal plans (Yellen's 2-day testimony last week and this week's FOMC minutes), but the Fed's lack of certainty on the topic will begin to impact its ability to make forecasts. In addition to Friday's Yellen/Fischer speeches, look out for Tuesday's event risk (coinciding with month-end flows):

Super Trump Tuesday: Markets will shift attention to next Tuesday's Trump's address to the joint session of Congress Feb 28, expected to unveil more details on the border adjustment tax. The implications for labour costs, consumer prices and the budget deficit are considerable for the Fed and the US economy.

In the case of France (& euro), Macron has climbed in the polls to the extent of dampening market fears of a Le Pen victory, but lately, he has been criticized for failing to provide a coherent set of campaign promises -- something he pledged to clarify by next week. France-German spreads starting to matter to the extent that they have turned inversely correlated with the euro. This has several implications: i) Forcing the ECB to carry out asymmetric QE policy by focusing on French bonds at a time when inflation is on the rise. ii) As the 10-year France-Germany spread hits 5-year highs, the euro is unable to hold on to its daily session gains, which will raise the issue of currency depreciation with the US.

23 days after we issued our SILVER long, backed by 6 factors, we have just issued a new set of 6 technical factors and 3 fundamental forces underpinning the trade in our Premium Insights.

Using the FX & Metals Performance Chart

Here is a quick a video on how to use our FX & Metals Performance Chart. And yes, the chart IS REAL TIME. Play video.

Dollar Hit By Washington Grind

A market that rallies on promises is taking a leap of faith, especially political promises. The pound was the top performer Thursday while the US dollar lagged on signs Trump will be slow to deliver. The RBA's Lowe lamented the high AUD in early Asia-Pacific trading.

The shortest version of Trump's campaign promises included less regulation, lower taxes, repealing Obamacare and infrastructure stimulus. Naturally there was much more than that but he talked like a man who was used to getting things done and his slowly finding out that Washington moves slower than an arctic construction project in January.

One third of his first hundred days have already been lost without any blueprints for major reforms. Something is coming on taxes early next week but that promises to be an arduous process. An Obamacare replacement will have to come before a budget and the fiscal hawks are circling.

Trump's team evidently looked at a realistic Washington timeline and decided that infrastructure spending will be kicked into 2018. The fringe benefit is that it's anticipated to be less of a fight ahead of the mid-term elections.

The first sign was Kellyanne Conway hinting at an administration playing the long game. That was followed up by Mnuchin lowering expectations for the government to provide stimulus this year. Finally, a report confirmed the suspicions. It said the longer timeline was Plan B but it sounds like the only realistic way forward.

The dollar was the victim as it slid across the board. It was balanced somewhat by less aggressive comments on the dollar by Mnuchin.

The market was unwise to believe Trump's agenda could easily be achieved but the dollar was swept higher in the post-election squeeze. That same squeeze may still be fuelling the stock market as it closed higher Thursday despite a beating in infrastructure-sensitive stocks.

The next question is how badly hobbled will the agenda be? The market may still be too optimistic that any effective action will be taken. The Congressional reception to Tuesday's tax plan may offer a clearer picture.

Turning to Asia-Pacific trading, the Australian dollar rose to a fresh post-election high as USD sagged. The RBA's Lowe said he would like to see AUD lower and said commodity prices are likely to fall but he tempered that by saying that it's hard to argue that AUD is fundamentally overvalued.

The rest of the calendar for Friday Asian trading is light.

Ashraf on BNN Earlier Today

Ashraf on the Fed's next step in light of Trump's fiscal plan. Play.

How Soon Is ‘Fairly Soon’?

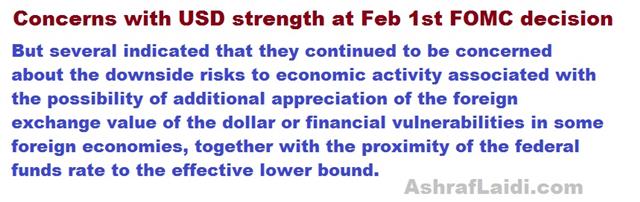

The March Fed meeting is shaping up to be a tough call but the FOMC Minutes offered some helpful hints. The yen was the top performer while the pound lagged. Australian capex numbers are due later. The paragrah below is among the reasons USD fell across the board after the release of Fed minutes.

The US dollar sold off after the FOMC Minutes, presumably because the market sees less of a chance of a hike. That might not be the right reaction.

The market is pricing in a 34% chance of rates rising at the March 15 meeting and that nearly doubles for the May 3 decision. The Minutes said many participants said it might be appropriate to hike 'fairly soon' if data on jobs and inflation is inline or better than Fed forecasts. Since then, the economic numbers have beaten expectations with the lone (and important) caveat that wage growth has been soft.

On top of that, Yellen clearly made an efforts to keep March in play and on Wednesday Powell said it was 'on the table'. Next Friday, Yellen and Fischer have both scheduled speeches for after non-farm payrolls in what will be a blockbuster day of trading.

In the past, the Fed has been accused of passing up solid opportunities to hike and with the stock market at record highs, the hawks will be putting on some pressure. Ultimately, any bump in the road could derail Yellen but if data is close to expectations for the next three weeks, a hike is a 50/50 proposition at worst.

The US dollar selloff in the aftermath of the minutes reiteartes that USD bulls are shy. A big part of that is politics but comments from Mnuchin in the WSJ are a hint that Trump is rethinking a currency war. The new Treasury Secretary said long-term USD strength is a good thing and that he expects more gains in the long term.

At the same time, we saw another wave of political risks are dominating trading Wednesday when a centrist Presidential candidate threw his support behind Macron. The headlines sent the euro 40 pips higher and tightened French spreads.

Turning to Australia, the key risk in the hours ahead is the 0030 GMT release of private capex data. The consensus is for a 0.5% decline in Q4. Any signs from the mining industry will be interesting. We can't remember a rally that's more disliked and disbelieved than the current run up in iron ore prices.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Kaplan Speaks | |||

| Feb 23 18:00 | |||

| RBA Gov Lowe Speaks | |||

| Feb 23 22:30 | |||

USD to the Fore

The new US administration still hasn't fired its first real salvos in the FX war but comments today revealed they are coming. The pound was the top performer while the euro lagged. Australian job openings and wages data is due later. The Premium shorts in oil and the Dax were both stopped out. A new note was issued on the existing gold and JPY trades.

(فيديو للمشتركين فقط) ماذا يعني الارتفاع المتزامن في الدولار و الذهب؟

Mnuchin introduced himself to the IMF's Lagarde today and the Treasury had a short recap of the call. Notably, it said that the new Treasury Secretary “underscored his expectation that the IMF provide frank and candid analysis of the exchange rate policies of IMF member countries.”

The comments are another signal that Trump and his team are preparing a new strategy on the currency market.

At the same time, the Fed is coming into increasing focus with the March meeting now three weeks away and the market pricing a 38% chance of a cut. There's a very real chance we go into this meeting unsure about what will happen. Harker pointed to data on inflation and GDP as key to his outlook and hinted that it would take some weak data to dissuade him from supporting a hike.

The market is also beginning to refocus on the numbers. The Markit services and manufacturing PMIs both missed estimates on Tuesday and weighed on the USD dollar lower, but the currency remains well off its lows. Existing home sales and the FOMC Minutes are due Wednesday.

Turning to Asia-Pacific trading, Australia is in focus. Note that AUD/USD quickly recovered Tuesday despite the broad US dollar bid. It remains near the top of its recent range and specs have slowly been building.

On the docket first is the 0000 GMT report on January skilled vacancies. The prior reading was 0.2%.

Reports that are more-likely to move the market hit 30 minutes later with the Q4 wage price index expected to rise 0.5% w/w and Q4 construction work done forecast to rise 0.5%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Flash Manufacturing PMI | |||

| 54.3 | 54.7 | 55.0 | Feb 21 14:45 |

| Eurozone Flash PMI Manufacturing | |||

| 55.5 | 55.0 | 55.2 | Feb 21 9:00 |

| Existing Home Sales | |||

| 5.55M | 5.49M | Feb 22 15:00 | |

| Construction Work Done (q/q) | |||

| 0.5% | -4.9% | Feb 22 0:30 | |

| FOMC Meeting Minutes | |||

| Feb 22 19:00 | |||

ماذا يعني الارتفاع المتزامن في الدولار و الذهب؟

GBPJPY Narrows Wedge

The pound was the top performer while the yen lagged on Monday, we take a look at some key levels. Japanese manufacturing and the RBA minutes are due later. The video for Premium subscibers focuses on gold's increasingly independent flows of yields and USD developments.

The GBP/JPY pair is a big pip mover and was a post-crisis risk appetite barometer. It still has some of those qualities and climbed a full cent in a quiet market Monday but country dynamics are the dominant theme now with Brexit and BOJ policy driving the pair.

Lately we've been waiting for Article 50 and a BOJ hint on what's next so technicals have taken over. On Friday, the pair tested the uptrend from the January lows and today it held in another sign of indecision. It's now traded close to current levels for 10 weeks but like all the consolidation in current markets, it's due for a break.

Naturally politics will be a driver but looking through many of the charts including this one, inevitable tests of key trendlines will hit before month-end. GBP/JPY is consolidating from an uptrend so the bias may be to continue higher but it will be tough to sustain a single direction until the political and economic dust clears.

What makes the pound and especially intriguing trade is that USD/JPY and EUR/GBP are similarly locked in consolidation moves as we count down to Article 50. But with the declaration all but assured, why is the market in such suspense? There is no easy answer.

Turning to the economic calendar, both highlights will be released at 0030 GMT starting with the Japan Nikkei flash manufacturing PMI. It's not likely to be a market mover and the prior reading was 52.7. At the same time, the Feb RBA monetary policy meeting minutes are due. The statement was upbeat and that kicked off the latest round of AUD strength so the details are likely to have an impact. AUD/USD was up 20 pips on Monday to 0.7684. The 0.7700 level has been a tough area to crack. Late last week, the pair rose up to 0.7732 only to fade back below the big figure.

The US returns from holiday on Tuesday, so expect markets to ramp up.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Flash Manufacturing PMI | |||

| 54.7 | 55.0 | Feb 21 14:45 | |

| Monetary Policy Meeting Minutes | |||

| Feb 21 0:30 | |||

Indecision Time

What breaks the deadlock? The past week demonstrated that strong economic data isn't enough to sustainably boost any currency until the political fog clears. The yen was the top performer on the week while the pound lagged but the overall ranges were small. 1 of the 3 USD Premium trades was closed at a profit, leaving 2 USD trades in progress, 1 of which is in the green and the other in the red.

So what are we waiting for? Is it clarity on Trump's currency policy? Fed policy? Or economic growth? The economic numbers have been very good and barely moved the US dollar needle. Yellen was more hawkish but the dollar shrugged. So we're left to continue focusing on politics but we're also keeping an open mind.

An alternative view is inflation. If we take the view that all governments are poised to spend more in order to either fuel, or extinguish populism then prices could climb globally. But it might be uneven. Conceivably, countries closing borders may lose out on trade and experience some self-inflicted inflation. But overall that strikes as an uncertain and slow-moving factor.

Emerging markets are also in the crosshairs. One fact of globalization that's in little dispute is that it has boosted emerging markets. A retrenchment in trade is inherently negative and it creates an endless series of questions about investment and capital flows.

Taking a wider view, everyone is struggling with these questions but it's tough to believe that's what's kept the market frozen. As the search continues, we will keep a close watch on technicals.

In terms of economic data, the week begins with New Zealand PPI and Japanese trade balance. Note that it's a holiday in North America so trading may remain constrained for at least another day.

CFTC Commitments of Traders

Forex speculative futures positioning. + denotes net long; - denotes net shortEUR -47K vs -45K prior GBP -66K vs -64K prior JPY -51K vs -55K prior CHF -11K vs -14K prior CAD +19K vs +8K prior AUD +24K vs +17K prior NZD +3K vs +1K prior

The commodity currencies extended the slow burn of the past month. The Australian and Canadian dollars continue to flirt with breakouts.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| PPI Input (q/q) | |||

| 1.0% | 0.9% | 1.5% | Feb 19 21:45 |

| Trade Balance | |||

| 0.28T | 0.36T | Feb 19 23:50 | |