Intraday Market Thoughts Archives

Displaying results for week of May 07, 2017Dollar's Next Hurdles

A bull market is like a great trader. The good days are solid and consistent, while the bad days are rare and the losses minimal. We explore the USD below. In response to rising questions about metals from Premium subscribers with regards to our gold and silver trades, a special charts alert has just been posted and sent to members about Ashraf's view on gold, backed by 7 technical arguments.

That's how the US dollar and S&P 500 are performing at the moment. A shudder hit both early in US trading, but it came after days of gains and by late trading, the dip was minimized.

On the day, the yen was the top performer while the New Zealand dollar lagged. The Asia-Pacific calendar winds down with a quiet calendar but US CPI and retail sales are out later.

The Fed is helping to keep a constant bid under the dollar. Comments from NY Fed's Dudley didn't get much attention because he was speaking in Mumbai but he provided the clearest evidence yet that the Fed is committed to a June hike. He said the recovery continues apace, which is seemingly innocuous but in the context of the Fed fund futures market pricing in a greater-than 90% chance of a hike, it's a tacit endorsement, particularly from one of the FOMC's more cautious members.

As has been shown over the last 6 months, everything can change and the swiftest means for that is via economic data. As we noted earlier in the week, the quiet calendar helped the US dollar drift. That changes Friday when CPI and retail sales are released at the same time.

At some point the market (and the Fed) will lose patience with the inability of hard data to catch up with soft numbers. The retail sales control group is expected to rise 0.4% and it will need to at least come close or some second thoughts will creep in.

There is likely more leeway on inflation but beyond the June FOMC, Yellen will need to see a sustained upturn if gradual hikes are to continue.

But even if the numbers are soft, it's proven tough to hold US dollar shorts. The slump on last week's non-farm payrolls was wiped out by Monday and given the strength of the USD market, we can't rule out a repeat.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Evans Speaks | |||

| May 12 13:00 | |||

| FOMC's Harker Speaks | |||

| May 12 16:30 | |||

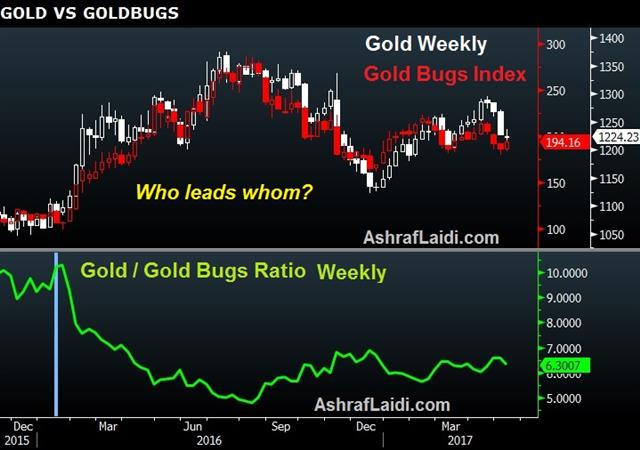

Gold vs Gold Miners

Gold attempts to stabilize above its 100-day and 100-week moving averages, while silver shows the first signs of stabilisation in 4 weeks. Meanwhile, the gold miners index, aka Gold Bugs Index – the first gold miners index to be traded in the NYSE—has bounced off its cycle lows last week. This will evoke the classic questions: “Do miners bottom before gold bullion” “Does gold lead the miners?” Does it matter at all?

Our readers have encountered these questions the last time I discussed the topic 8 weeks ago in the Premium videos. It's about time I gave an update to these important developments shaping bullion and miners with the aim of clarifying my view on gold. Has it bottomed? Is there more downside ahead? We answer the questions with 2 charts and 7 key points, with implications for our existing gold and silvers trades.

Know the Political Risk Framework

What political headlines matter and which ones don't? That's the question we look at today. The New Zealand dollar was the top performer while the yen lagged on Tuesday but after the RBNZ added guidance to its statement, the kiwi plunged.

ادارة اتجاهات الدولار المختلفة (للمشتركين فقط)

Perhaps we were premature to expect that political risks would fade in the months ahead. Or maybe not, for all the hand-wringing about the Comey firing, markets didn't show any sign of caring. Theoretically, it could derail or delay the legislative agenda but Trump could also appoint someone new who buries the investigation and lets him move on.

Trump doesn't matter to markets as as he does to newspapers. Let's backup and look at the framework since election night. Markets rallied not because Trump became president, but due to Republicans' win in all three branches on an agenda of stimulus and tax cuts.

So what are the risks? Assume the longshot scenario of a Trump impeachment. Even then, Pence as president and Republicans would have control. So the real risk is disarray and disorganization within the Republican party. That's a genuine risk and is the factor to watch rather than troubles at the White House.

In the meantime, it was another light data day with more hawkish Fed talk. That led to another steady US dollar bid in North American trade – especially in USD/JPY. Also note that a Treasury auction was soft for the second day and that boosted the dollar late in the day. A long-bond sale is scheduled for Thursday.

In Asia-Pacific trading, the New Zealand dollar was hammered more than a cent lower. The RBNZ held rates unchanged as expected but said policy will remain accommodative for a considerable period. They said inflation was expected to moderate further and the fall in the kiwi since February was welcome. NZD/USD plunged through stops to the lowest since last June on the headlines.

متى تنكسر العلاقة المنعكسة بين الدولار والذهب؟

Ceteris Paribus

Ceteris Paribus, what does it mean? Read on. How good is good enough? That's the growth question in 2017 and the answer is increasingly that mediocre is an FX winner. The pound was the top performer and the only currency to have risen against the USD on Tuesday, while the Swiss franc lagged. China inflation data is up next. USDJPY was stopped out and a new JPY trade was issued. Below is the Premium video, dissecting the spectacular fall in volatility relative to lack of gains in the Dow over the last 14 days.

The US dollar flexed its muscles for the second day on Tuesday. USD/JPY climbed above 114.00 before closing just below on North Korea nuclear test worries. EUR/USD sank below 1.09 as the Macron trade continued to unwind.

At the end of the day, the FX market is a beauty contest. But in 2017 it's more of a small town pageant than Miss Universe. US economic data has been mediocre for weeks and the Atlanta Fed cut its Q2 GDP forecast Tuesday. Yet, Ceteris Paribus (holding other things equal in Latin), growth around 2% with a central bank hiking rates and no obvious domestic risks is good enough for the US dollar, assuming no real developments elsewhere. We will need at least 4 weeks before judging whether Macron's presidential success translates into parliamentary success.

In addition, it's the second week of the month and that means the US economic calendar is light and broader market volatility is ultra low. Meanwhile, Fed officials continue to brush off weak growth in a sign that they want to hike in June.

The main event on the upcoming calendar is the China CPI for April. The consensus is for a 1.1% y/y rise, that's an increase from 0.9% in March. With inflation so low, the latest moves by Chinese officials to cool the economy seemingly don't make sense. But the 'dual mandate' of China's government isn't just economic growth, equally important is stability and efforts to curb credit growth are more about attempting to de-risk the economy.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Prce Index (y/y) | |||

| 1.1% | 0.9% | May 10 1:30 | |

USDJPY Marches on, Aussie Data next

Disappointment at the nonfarm payrolls report was a distant memory on Monday as USD/JPY rose to a fresh six-week high. On the day, USD was the top performer while the Swiss franc lagged. Australian retail sales and the budget are due up next.

USD/JPY broke 113.20 in a rise to the highest since March 16. It's been a steady 500 pip climb since April 16 as the S&P 500 continues to hit fresh highs. The Federal Reserve is one reason why. Mester spoke Monday and brushed aside week economic data while touting sentiment indicators and jobs data.

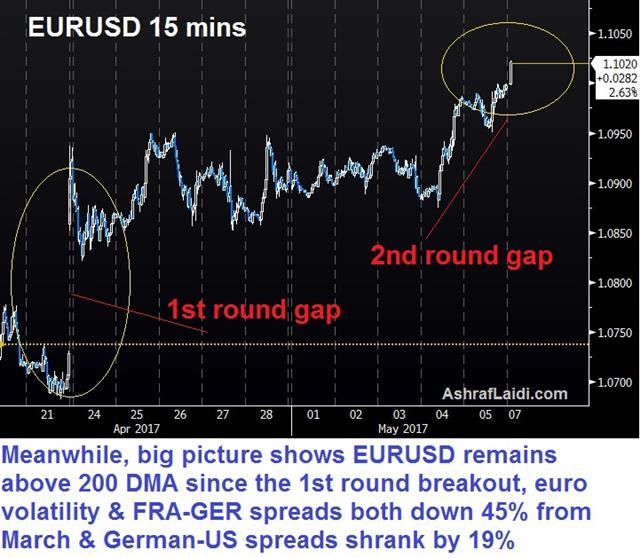

The euro was a classic 'sell the fact' trade as the opening gap above 1.10 in EUR/USD quickly closed and the pair fell to 1.0920. The March26 high of 1.0906 and psychological support at 1.0900 are the next levels to watch.

With the French election ending and Trump leaving his first 100 days, expect the markets to shift gears. Political risk has been at generational highs but it's likely to ebb over the Summer months. In that time, the focus will shift back to economic data and central banks.

A third focus will be China. Officials have been tightening credit in an attempt to cool the economy. The fallout has been felt through the commodities market and we will be looking for signs it's hitting more broadly.

In terms of economic data, next we look to Australian retail sales at 0130 GMT. The consensus is for a 0.3% m/m rise. AUD/USD finished near the lowest levels since January on Monday and it has struggled to hold gains on good news.

What will eventually prove to be a bigger driver of AUD is the government's budget, which will also be released Monday. One accounting proposal is to separate regular government debt from infrastructure debt. It's an interesting development and more of a PR move that would make road and bridge building an easier sell but it could also mean more debt issuance, for better or worse.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| 0.3% | -0.1% | May 09 1:30 | |

| France Gov Budget Balance | |||

| -21.5B | May 09 6:45 | ||

اشرف العايدي على سكاي نيوز العربية

Macron Burns Sceptics by 36% Margin

France elected Emmanuel Macron President with a larger-than-anticipated margin on Sunday and the euro opened above 1.1000. The euro was also the best performer last week while the yen lagged. CFTC positions showed narrowing GBP shorts. After closing our EURUSD long at a profit on Friday, we opened a new long ahead of today's elections, while sticking with the cable long from 2 weeks ago.

With most votes counted, Macron leads the election with more than 64% compared to 36% for Le Pen. His victory underscores how markets and many commentators failed to understand France. It's also a reminder that while the political sands are shifting globally, the regional differences are profound.

His win was no surprise although email leaks late Friday added some angst. There was always the minute risk of a shock win for Le Pen but more than anything, the reason for the small euro climb at the open was that the margin of victory exceeded the 60-40% anticipated.

At times like this, markets often focus on the message from the incoming President but we believe Le Pen's comments are more profound. She said her party must reinvent itself and there is talk that will start with a new name. But more important was a hint of what's to come from her father, who was the former partly leader. He said her message was undermined by threats to quit the euro and EU.

If he's right (and if he's reading the political mood correctly) then populist voices across Europe might begin to redirect their energy away from the euro and more towards immigration or economic nationalism. That will leave the currency far less vulnerable in future elections. In the short term, it's a better potential reason to buy the euro than Macron's win alone.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -2K vs -21K prior GBP -81K vs -91K prior JPY -23 vs -27K prior CHF -18K vs -17K prior CAD -48K vs -43K prior AUD +43K vs +43K prior NZD -12K vs -15K prior

The market continued to pile into Canadian shorts through Tuesday but the sharp retracement on Friday and bounce in oil prices showed the danger of joining in a crowded trade. Meanwhile, the exodus from cable shorts continues as it flirts with 1.30.