Intraday Market Thoughts Archives

Displaying results for week of Jun 04, 2017How Far Can GBP Fall?

It will be a generation before a UK leader, perhaps any democratic leader, pushes his or her luck with a snap election when the polls show they're in command. Cable is down 230 pips as election results roll in and PM May's calculated gamble increasingly looks like the end of her political career. The latest forecasts show Conservatives win by about 318 seats, which may require negotiations into the weekend for the Tories to achieve a working coalition. 2 new GBP and 1 new EUR Premium trades have been issued. The previous GBPUSD long was stopped out at 1.2700, 5 pips above the session lows.

Theresa May called an election because she had a small majority and was confident she could extend it on a message of strong, stable governance. Instead, she stumbled during a campaign that the public rightly saw as opportunistic and destabilizing.

3450 of 650 seats have been reported so far but if the trends hold and the exit polls are correct, it looks like a managable hung parliament. Or, will Jeremy Corbyn's rebounding Labour Party extend its advances through the night for a possible coalition with SNP and LibDems?

Either way a hung parliament appears certain and that's challenging for the pound. The 230 pip fall to 1.2730 so far doesn't full capture the extent of the newfound uncertainty. The EU wanted to begin Brexit negotiations next month, now we don't even know who they will be negotiating with. And if it is a hung parliament, the negotiators could be changed by another election.

We continue to monitor the 1.2740-1.2760 territory as the crucial support for GBPUSD. One piece of good news for the pound is that the two-year clock that started after Article 50 was initiated will be extended, maybe by years. Or maybe, just maybe, Corbyn decides on calling another referendum and the UK decides to stay. Another piece of good news is that minority governments love to spend and that kind of short-term stimulus could boost growth.

So while it's not as clear and isn't likely to materialize as quickly, this could be a US election redux, especially if Corbyn can cobble together a stable minority that isn't afraid of deficits.

Strap In for Super Thursday

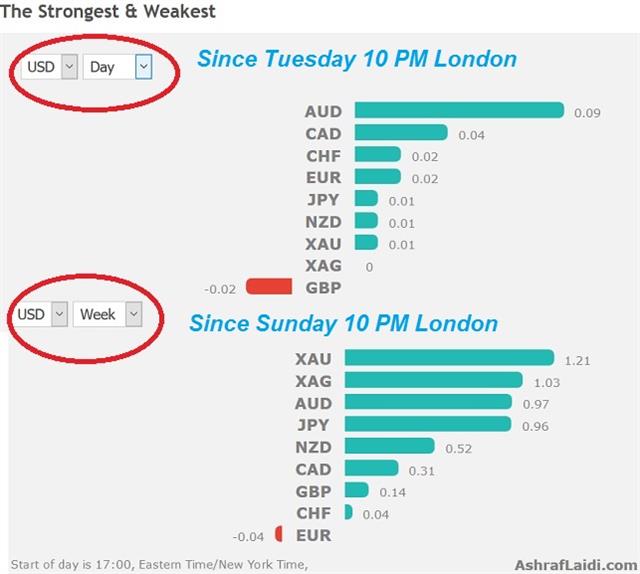

Thursday promises to be a rocking day in the foreign exchange market with a trio of major events. We get set. The Australian dollar was the top performer Wednesday while the Canadian dollar lagged. Australian trade balance is due up before the major news begins to hit. A new Premium trade is due tomorrow in addition to the existing 6 trades.

أهم الأرقام و المصطلحات قبيل الخميس (للمشتركين فقط)

Markets were choppy Wednesday as ECB leaks about softer inflation forecasts and higher growth hit. That was mixed in with the final UK election polls and an early preview of Comey's testimony.

All will be revealed in the day ahead, starting with the ECB. The first sources story said inflation forecast would be cut to 1.5% for this year from 1.7%, largely on energy. It added that 2018 will be cut one tick to 1.5% and 2019 to 1.5% from 1.7%. That was followed by a separate report that said inflation forecast would edge lower and growth would be boosted. The euro fell 70 pips and then recovered on the pair of leaks.

Later, the opening statement from former FBI director Comey was released. In it, he detailed improper requests and hints from the President but it has no bombshells or revelations that hadn't already been reported. In the aftermath, USD/JPY recovered to 109.80 from 109.35.

The final event Thursday will be the UK election. The wide spreads in the polls continued with the showing the Conservatives anywhere from 12 to 1 point ahead of Labour. The final numbers tended to show continued momentum from Labour but not enough to stop May from winning a majority.

Cable touched a two-week high but it was a choppy trade. In anything, watch for last-minute bets in the market on May.

Switching gears to the Asia-Pacific region, yesterday's Australian GDP was in-line with the +0.3% q/q reading expected and the RBA brushed off the soft quarter but the focus now turns to Q2. A big input is trade and April trade balance is due at 0130 GMT. The consensus is for a A$2.0B surplus.

AUD has been perky this week and seasonally it's in a strong June-July period and coming off a recent ebb. A positive surprise would help extend the four-day winning streak. But much bigger moves are coming elsewhere with the ECB, Comey and the UK election results all due later Thursday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance | |||

| 1.91B | 3.11B | Jun 08 1:30 | |

| GDP (q/q) | |||

| 0.3% | 0.2% | 1.1% | Jun 07 1:30 |

| Eurozone Revised GDP (q/q) | |||

| 0.5% | 0.5% | Jun 08 9:00 | |

| BoC Financial System Review | |||

| Jun 08 14:30 | |||

Panda Clouds the USD/JPY Picture

The lockstep correlation with Treasury yields is a driving factor in USD/JPY trading but the revelation that China is on the bond bid changes the equation. The yen was the top performer while the US dollar lagged. Australian GDP is up next.

The bond market might not be all that it seems. US 10-year yields fell to the lowest since the US election night on Tuesday in what looks like a sign of risk aversion and waning hopes for Fed hikes.

Or maybe not

A Bloomberg story, citing sources, said that China has been on the bid since March and may continue to buy. It's no coincidence that 10-year yields peaked at 2.62% in March and have tracked down to 2.14%. The latest leg lower broke the April lows and threatens a return all the way to pre-election levels near 1.80%.The tight correlation with USD/JPY would imply a corresponding drop back to 100.00.

The China news changes things. It's a sign that 10-year yields are more a reflection of what China reserve managers want to hold, rather than a view of market participants on the economy.

Regardless of who is buying bonds, yield differentials will be important for USD/JPY. But they're not the whole story and the correlation shouldn't be the whole story for USD/JPY either. For the near term, the technicals may dominate as the April low of 108.13 comes into view.

Up next is Q1 Australian GDP. The RBA yesterday brushed off a weak quarter and that helped AUD/USD rise to a one-month high above 0.7500 but the market wants to see just how bad the quarter was. The consensus is for +0.3% q/q growth but some estimates are in negative territory.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (q/q) | |||

| 0.2% | 1.1% | Jun 07 1:30 | |

AUD Lost in the Shuffle

All the focus is on the UK election and Comey's testimony this week, but news out of Australia has the potential to steal the show. AUD was the top performer Monday benefiting from Qatari gas isolation following its neighbours' blockade. The RBA decision is up next. The Premium video below is contains the current and future positioning for major instruments ahead of the week's key events.

2017 hasn't gone according to plan for many central banks but the RBA might be the most astray. They forecast 2.5% growth this year and 3.3% in 2018. It's part of the longest unbroken streak of developed single-country growth in the modern era.

At the start of the year there were few skeptics, but suddenly there are worries. Some economists a small contraction in Q1 and the consensus is for just +0.3% growth. If the number is positive, it will largely be due to climbing inventories.

The sudden slowdown is likely to be temporary but it won't be brushed aside by the RBA. Policymakers meet today and are fully expected to leave rates unchanged at 1.50%. But the market is increasingly expecting a rate cut by year end. The implied probability has risen to 20%, doubling from a month ago.

That rise was in large part responsible for the Australian dollar's recent struggles. Now, the RBA has an opportunity to validate it. The decision is at 0430 GMT. The May 2 statement was entirely neutral and Lowe said then that forecasts for the Australian dollar were little changed. Complicating his message is that Q1 GDP is due a day later. The RBA is likely to get some insight on what's coming but won't want to be seen as hinting at the results. For traders, a dovish statement and a weak print could set up a quick fall in the Aussie. There is one AUD trade in progress in the Premium Insights.

ندوة الثلاثاء :الانتخابات البريطانية

سيركز الاستاذ اشرف العايدي على اللانتخابات البريطانية التي ستجري مساء غدا الثلاثاء - ما الأهم للباوند: فوز حزب المحافظين ام هزيمة حزب العمال؟ - ما معنى الإنتخابات لخروج بريطانيا من الاتحاد الاوروبي؟ -كيفية توازن إيجابيات تيريزا ماي و بركزيت؟

Fed Silence Speaks to June Hike

Fed silence speaks to the likelihood of a hike on June 14 despite a disappointing non-farm payrolls report on Friday. Last week the New Zealand dollar was the top performer while the Canadian dollar lagged. The week begins with survey and inflation data. CFTC data showed euro net longs at a six-year high. Aussie is the day's winner after Gulf nations and Egypt break ties with qorld gas leader Qatar.

A new ICM poll for the Guardian shows Conservatives at 45%, Labour at 34%, little changed from the weekend poll for the Sunday Sun.UK May services slowed to 53.8 from 55.8. Eurozone final Apri services services PMI was at 56.3 from 56.4 in March. China's Caixin services PMI edged up to 52.8 in MAY from 51.5 in April.

The Fed has now entered its blackout phase ahead of the FOMC decision. That means there will be no official communication before the statement that day. It's important because official passed up opportunities to alter expectations this week.

FOMC members would know that markets are pricing in an 85% probability of a hike and they would make an effort to lower than if they weren't confident of a hike in less than two weeks.

So why did the dollar weaken after non-farm payrolls? The jobs headline was soft, revisions were lower and wages missed expectations. The only positive sign was the drop in unemployment but that was entirely due to people leaving the workforce. What's happened is that the market has cut the chance of another hike in September to 30%. The market's base case is now that the Fed will hike but offer a more dovish message, likely saying that inflation and growth will need to accelerate before a third hike this year.

In terms of economic data, it's another busy week ahead with the ECB decision, UK election and Comey's testimony to bring an added twist.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +73K vs +65K prior GBP -30K vs -24K prior JPY -52K vs -52K prior CHF -19K vs -20K prior CAD -98K vs -99K prior AUD +3K vs +3K prior NZD -5K vs -9K prior

Specs are feeling downright giddy about the euro's future prospects. EUR/USD finished on Friday at the highs of the day and at the best levels in 7 months.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Services PMI | |||

| 53.8 | 55.1 | 55.8 | Jun 05 8:30 |

| PMI | |||

| 52.8 | 51.4 | 51.5 | Jun 05 1:45 |

| Eurozone Retail PMI | |||

| 52.7 | Jun 06 8:10 | ||