Intraday Market Thoughts Archives

Displaying results for week of Sep 03, 2017Draghi Prattles, Dollar Rattled

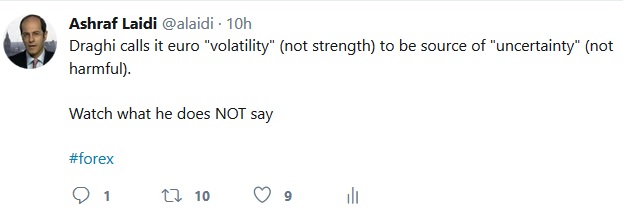

Draghi made a half-hearted attempt to talk down the euro but the inevitability of the taper ensured his efforts failed. The euro led the way in a broad dollar rout. A handful of notable events are coming up in Asia-Pacific trading. A new USD trade has been added, bringing the number of open trades to 5; 3 in FX and 2 in indices.

Draghi confirmed the inevitable in his press conference, that the ECB will make some kind of decision in October regarding the QE programme. Leaks later showed that the staff was preparing a set of options that would give the Governing Council to buy more bonds but the market continues to push the narrative that a taper is certain. That meant a quick rally to 1.2059 before a pullback ahead of the cycle high.

As the euro climbed, the US dollar sagged -- partly due to the incredible hurricane that's headed towards Florida. The path is still uncertain but the most-likely forecast takes it straight towards the Miami area in what would be another hit to GDP. We send our thoughts to those in its path and expect the dollar to bounce if the forecast shifts.

The bond market continues to warn about trouble in the US despite a bill to extended the debt ceiling. Ten-year yields hit 2.03%, which is the worst since election night. That helped to send USD/JPY to 1.0804, which is the low since April.

USD/CAD was in the spotlight as flows took over and pushed the pair down to 1.2119, breaking the May 2015 low and setting up a test of 1.20.

The Australian dollar finished at the best levels of the day and 80 pips above the Asia-Pacific lows. It will be in focus later with July home loan numbers expected to show a 1.0% increase at 0130 GMT. That will be followed by an appearance from Debelle at 0300 GMT.

Japan is likely to get some enthusiasm-dampening news with 2Q growth expected to be revised down to 2.9% from 4.0% in the last revision. Also on the agenda is a key speech from the Fed's Dudley at 2300 GMT. He's the final core member on the schedule before next week's FOMC. George also speaks at 0015 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final GDP (q/q) [F] | |||

| Sep 07 23:50 | |||

ما وراء ارتفاع الجنيه الاسترليني؟

BoC Does It Again

The Bank of Canada hikes interest rates on Wednesday and left the door open for more. The Canadian dollar soared and was easily the top performer while the New Zealand dollar and yen lagged. Australian retail sales are up next. A new Premium trades in major index has been issued alongside 3 supporting charts and notes.

إدارة مخاطر الداكس و اليورو (فيديو للمشتركين فقط)

The Bank of Canada is all about the output gap and proved it once again Thursday. Stronger growth numbers were inputed to the model after Q2 GDP data and the machine spit out an earlier close, which means sooner rate hikes and that led to a hike.

What the model may be missing is that a narrow or closed theoretical gap in potential growth isn't leading to inflation anywhere, especially not wage inflation. Poloz and company maybe overlooking the disinflationary impacts of a higher currency and lower commodity prices; never mind the risks to Canadian housing.

In any case, the BOC wields the power and USD/CAD bulls were crushed. The pair fell to 1.2143 from 1.2405 immediately after the announcement before a bounce to 1.2220 late. It's a fresh two-year low in the pair. It kept the door open for more hikes (without committing) and said the focus will be on the labor market and household debt. We will look for more clarification in upcoming BoC speeches.

Otherwise Thursday, the US dollar was bounced around. It sold off after Fed Vice-Chair Fischer announced his resignation. He was a hawkish voice at the core of the FOMC. The dollar bounced back later after a bipartisan deal to lift the debt ceiling and fund the government through Dec 15, when the fight will renew again.

The next items on the agenda are from Australia with retail sales and trade balance for July due at 0130 GMT. Will the RBA be the next to make a hawkish shift?

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| Sep 07 1:30 | |||

USD Dead Cat Bounce, BoC Preview

The US dollar took another tumble to start the week, we look at five reasons why it was the worst performer on the day. Aussie is the worst performer after weaker than expected GDP figures. Before we look at today's BoC decision, here's a quick explainer on the latest USD damage. Below is the latest trading/charts video for Premium subscribers ahead of the ECB and BoC.

1) The bid in bonds

Treasury yields were an early signal as they tumbled right across the curve. Ten-year yields fell 10 basis points to 2.06%, which definitely breaks the June low and is the lowest since the US election. Low yields make US debt less attractive.2) More bad data

Following Friday's release of the triple negatoive in the US jobs report (weaker NFP, higher unemployment rate and lower earnings), US factory orders hit 4-year lows, shedding fresh doubts on the role of manufacturing.3) Brainard, Kashkari & Kaplan

The Fed's Brainard argued for patience and prudence before raising rates and so did Dallas Fed's Kaplan. Brainard is a well known dove but she has also been a swing voice in the past. As a Governor, she is more of a core FOMC member than others who don't want to hike like Minneapolis Fed's Kashkari and St Louis Fed's Bullard. Minneapolis Fed's Kashkari from his part said recent Fed hikes may have been "harmful" to the economy and that inflation may be a "ghost".If Dudley makes a similar point on Thursday, the dollar will fall further.4) North Korea

Risk aversion dominated on Tuesday but that isn't necessarily a bad thing for the dollar. As the S&P 500 fell 20 points, the fears helped to reel in USD/CAD and AUD/USD. The problem for the dollar isn't so much the fear of nuclear war but the potential for it to turn into a trade dispute with China.5) Hurricane Irma

Hurricane Irma is a massive Category 5 storm that will be a major disaster in Puerto Rico in the day ahead. Its sustained winds are near 300km/h, which is very close to the strongest ever recorded for an Atlantic storm. It's all the talk in the energy market but it's not getting as much noise in FX, despite huge risks to Florida, the Gulf or the eastern seaboard. A second disaster would ratchet up the costs and deliver another blow to Q3 growth.5) Congress

US lawmakers have a daunting schedule in the weeks ahead. They have a half-dozen true urgent matters to deal with this month, plus Harvey relief and potential Irma relief. The market has little faith it will all get done without a disruption.Today's big central bank event that will cause major waves is the Bank of Canada decision. The market is truly perplexed on what will happen. The OIS market is pricing in a 43% chance of a hike but believes that even if it comes, there will be some kind of signal that the BOC will head to the sidelines afterwards. The risk – as it was in July – is a hawkish hike. But would they be hurried into a hike when oil fundamenta'ls remain bearish and the currency is already near multi-year highs?

فيديو التداول من أشرف العايدي

Korean Fuse Burns Risk Trades

North Korea detonated its largest test yet as it sprints toward nuclear-power status, and perhaps towards war. The yen and Swiss franc are strongly higher in early trading as a result. Gold gapped up to 1337 from Friday's 1325. CFTC positioning data showed further bets against the pound. US and Canadian markets are closed on Monday. 3 Premium trades are in progress but 2 trades will be added ahead of what will be prove to be a busy 1st week of September (Korea, BoC and ECB).

North Korea tested a nuclear weapon underground on Saturday that appeared to be 5-10x more powerful that previous tests. It was Pyongyang's 6th nuclear test, which triggered a 6.3-magnitude quake and was felt throughout northeastern China. A statement from Kim Jong-Un's government said it was a hydrogen bomb that was small enough that it could be loaded onto an ICBM.

Risk trades are under pressure with the yen and Swiss franc around 50 pips higher across the board. Expect more risk aversion as Europe begins trading and note that markets will be thin with the US on holiday.

The speed of North Korea's progress and testing is alarming. They are evidently years ahead of where experts had believed. In a tweet, Donald Trump said the United States is considering, in addition to other options, stopping all trade with any country doing business with North Korea. That's almost-certainly a hollow threat because China is by far its largest trading partner with India second.

Most of the UN Security Council is angling to cut off North Korea's oil supplies. As recently as last week China said it didn't want further sanctions.

The immediate risk probably isn't nuclear war but some kind of trade spat between China and the United States. According to reports, Trump has already asked aides for tariffs on China for trade and political issues but if they pass and Trumps justifies them geopolitically, then it would certainly be interpreted as an escalation.

Ultimately, the fears and rhetoric will subside but at this point it looks like it will get worse before it gets better.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +87K vs +88K prior GBP -52K vs -46K prior JPY -69K vs -74K prior CHF -2K vs -2K prior CAD +53K vs +51K prior AUD +67K vs +60K prior NZD +19K vs +22K prior

The moves were modest this week but the trend has been a slow build in pound shorts and that's understandable given the endless Brexit risks. One spot that's vulnerable in the week ahead is NZD, which has caught specs off guard in a continuing slide.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone PPI (m/m) | |||

| Sep 04 9:00 | |||