Intraday Market Thoughts Archives

Displaying results for week of Jan 14, 2018Yen-Yields Divergence: How Long?

The correlation between USDJPY and bond yields has been largely positive since 2003. But a divergence has occured since late October. What is the reason to the recent divergence and will it continue? Full analysis.

الدولار الكندي، بيتكوين، ريبل و إثريوم

ارتفع ريبل ٩٣% منذ قاع يوم أمس و ٤٠% الاثيريوم و ٣٥% لبتكوين. نعالج التذبذبات و الاتجاهات في العملات الرقمية بالإضافة الى الكندي و اليورو الفيديو الكامل

Bitcoin Seasonals. Really?

Watch out FX traders. Wednesday was another tumultuous day in the currencies following BoC hike and US dollar initially continued to wilt but caught a strong bid late in the evening. Overnight, Aussie jobs slowed to a higher level than was expected but unemployment edged up, capping AUD at 0.80. Earlier today, US Philly Fed survey eased as well as US jobless claims. Here is a chart suggesting a possible January-February seasonality in Bitcoin's price change. Could it be a result of Chinese selling Bitcoin in January to help Chinese New Year purchases?

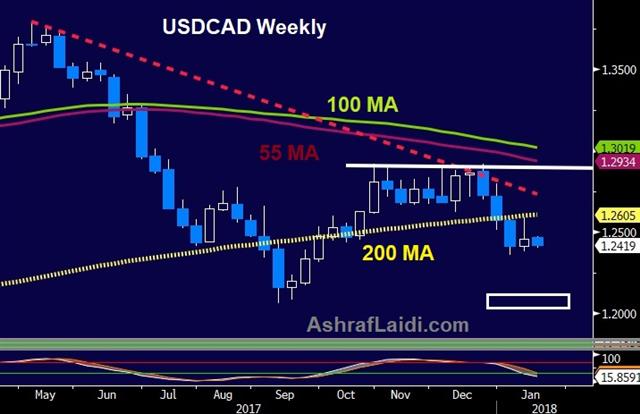

The Bank of Canada delivered a rate hike that was 90% priced in but left the market with few clues about what's coming next and when. The initial reaction in USD/CAD was higher on talk of a dovish hike but the commentary from Poloz didn't back that up. He spoke about wanting to get back to 2.50%-3.50% and increased confidence the economy was on track. At the same time, he spent half the press conference talking about NAFTA risks.

After hitting 1.2520 USD/CAD slowly reversed down to the lows of the day at 1.2370 but part due to a broad US dollar selloff. At the same time, cable soared to a post-Brexit high of 1.3940 as part of a rout on the dollar.

However the selling stopped after the Beige Book. It offered a slightly more-optimistic take on wages and the economy. Earlier in the day, Dallas Fed President Kaplan also made a hawkish shift, saying that his base case is now three hikes this year with the possibility of more.

With that, the dollar began a broad reversal and cable fell back to 1.3820 – more than 120 pips from the high. The euro also fell below 1.22 and USD/JPY rose to 111.30. As part of the same move, bonds sold off and US 10-year yields rose to 2.59% while gold suffered a $10 decline, which is the worst in five weeks.Through it all, the S&P 500 ripped another 26 points higher to close just below the record high.

Sorting through all the 'why' in the market right now is a mammoth task. More important is the 'what' and that's heightened volatility. It was evident in FX lately and it could spread. If so, that's a broader negative for stocks and risk appetite.

It's getting close to the time for caution.

Will the Bank of Canada Surprise?

Will the Bank of Canada surprise markets by not raising rates today? The decision is at 10 am ET, 3 pm London/GMT. Full analysis.

هل سيرفع بنك كندا أسعار الفائدة ؟

في حال صدور قرار مفاجئ بعدم رفع أسعارالفائدة اليوم الساعة السادسة مساء بتوقيت مكة المكرمة, أين سيتجه زوج الدولارالكندي مقابل الدولار? التحليل الكامل

Crypto Shakeout, USD Wilt Continues, BOC Next

Tuesday was a brutal day for cryptocurrencies with falls from 20-40% before a late bounce but in FX the bounce for the dollar was fleeting as it sank late. The Swiss franc was the best performer Tuesday while the New Zealand dollar lagged. The BOC decision is coming later. There are 4 existing Premium trades in progress, all of which are in the green. Here is a tweet from Ashraf on Dec 12, 6 day before Bitcoin's peak.

Bitcoin fell 20% on Tuesday as the US returned from a holiday and talk of a regulator crackdown continued. Ripple fell 40% as well.

One story was the collapse of the cryptoscam from Bitconnect and that may have played into the larger jitters. Impressively, the dip buyers stepped in on a few fronts and Bitcoin rebounded from $10,200 to $11,500 while Ripple rebounded to $1.20 from $0.87.

In FX, the US dollar finally staged a rebound and EUR/USD briefly fell below 1.2200 but it couldn't even sustain itself for the day as EUR/USD rebounded to 1.2270 and USD/JPY made fresh lows, in part due to the first negative day of the year in stocks.

Taking a step back, it's clear that the animal spirits have been unleashed throughout markets. Some tipping point has been reached and the crisis-era wounds have finally been healed. That is changing the way markets behave and adapting with it will be a major theme this year.

In the global economy, the big question right now is how deeply central bankers believe that we've turned a corner. One big clue will come Wednesday in the Bank of Canada decision. Here is Ashraf's piece on the BoC. It's unlikely that Poloz badly wants to hike but he painted himself into a corner by committing to data dependence and saying that 'caution' doesn't mean they won't hike. He's also limited in his statement communication by the same misstep.

However, he may also increasingly believe that an acceleration in growth and inflation is right around the corner. In that case, a hike with a hawkish stance is appropriate and USD/CAD will be on its way to 1.20.

Yen, Yields Aussie & Loonie

In this video for GKFX, I examine the persistent divergence between yen pairs and bond yields with a focus on USD/JPY pair. I also looking at tonight's Australia jobs figures and Wednesday's Bank of Canada decision on interest rates. Full Video.

USD/JPY Break Adds to USD Woes

A miserable 2017 has turned into a dismal 2018 for the US dollar and Monday's breakdown in USD/JPY is a fresh reason for worry. The New Zealand dollar was the top performer while USD lagged. Japanese PPI is due up next. The Premium long GBPUSD hit its final target of 1.3820 for 330 pip gain, closing automatically ahead of Tuesday's relase of UK CPI. The week's video for subscribers is posted below.

The US was on holiday Monday but that was no respite for the dollar as it crumbled for the second day. On Friday, the euro and pound broke out while Monday it was USD/JPY as the November low of 110.84 gave way.

Comments from Estonian ECB member Hansson accelerated EUR gains and underscored the dollar's challenges. He spoke about shifting to more-hawkish ECB language and ending bond purchases cold turkey in September. It's part of the increasingly aggressive rhetoric form global central bankers.

Contrast that with the US, where the Fed is basically paralyzed until Powell takes over at the end of this month.

Looking ahead, Japan is the focus of a light Asia-Pacific calendar with PPI due at 2350 GMT. The consensus is for a healthy 3.2% rise. Later, the November tertiary industry index is due at 0430 GMT but the real focus of the day comes later with German and UK CPI numbers due out. Both are risks to the high-flying EUR and GBP.

FX Lala Land

I called it "FX LalaLand": when I heard that the overwhelming majority currency economists and strategists this time last year were arguing for USD strength. Here is why & how in that full interview from 2nd January 2017.

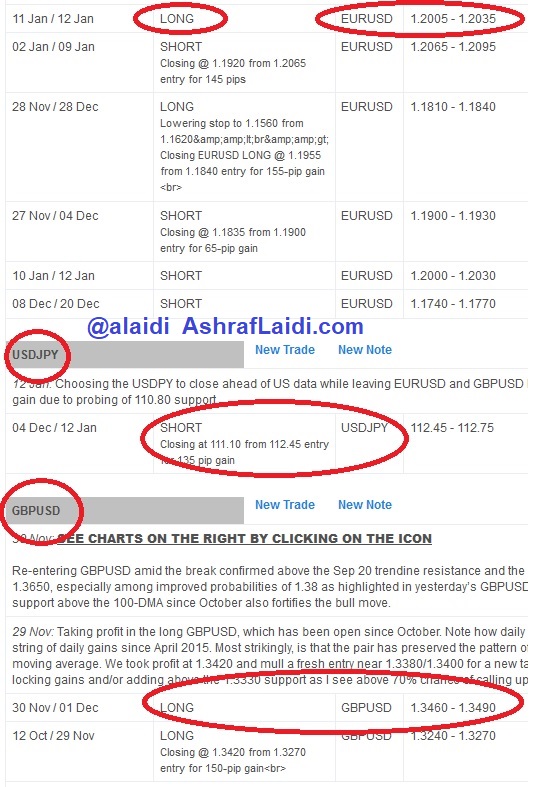

Cable Highest Since Brexit

Last week's strong finish helped the pound break some critical levels and break through the September high. The euro was the top performer last week, while the Canadian dollar lagged. CFTC positioning showed the market's infatuation with the euro. On Friday, we closed the Premium USDJPY short at 111.10 from 112.45 entry for a 135-pip. The EURUSD short was stopped out, while the existing EURUSD and GBPUSD longs netting a over a 450-pip gain so far.

The pound has some of its swagger back. No doubt it's benefiting from the struggles of the US dollar but it's also about better domestic news and hope for a better Brexit deal. On Friday, a report said Dutch and Spanish finance ministers had agreed to work for a Brexit deal that would keep the UK as close to Europe as possible.

This is a potentially huge development as it's the first crack in the united EU front against Britain. The Germans and French had hoped to carve up the UK's financial services industry but others – like Spain – benefit from closer ties via things like tourism and agricultural exports.

It's far-from-clear which faction will rule out. At this point, Holland and Spain appear to be alone, but it's a desperately-needed opening for Theresa May and an opportunity for cable bulls.

At the same time, the chart is increasingly positive as is shown below. With Friday's break of the September high, cable is trading at the best levels since the Brexit vote. There isn't much resistance standing in the way of 1.40 but watch out for UK CPI numbers Tuesday and retail sales on Friday.

Note that Monday is a holiday in the US.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +145K vs +128K prior GBP +26K vs +16K prior JPY -126K vs -122K prior CAD +17K vs +15K prior CHF -22K vs -16K prior AUD +K vs -20K prior NZD -11K vs -17K prior

Euro longs have risen 63% in the past two weeks but it hasn't stalled the euro, which was up nearly 2% last week. At some point the jitters will hit, but something will need to happen to inspire some USD buying. In contrast, sterling longs are still relatively low with cable breaking out as is shown on this chart, that could be the new darling of the market.