Intraday Market Thoughts Archives

Displaying results for week of Feb 25, 2018هدية ترامب لبائعين الدولار

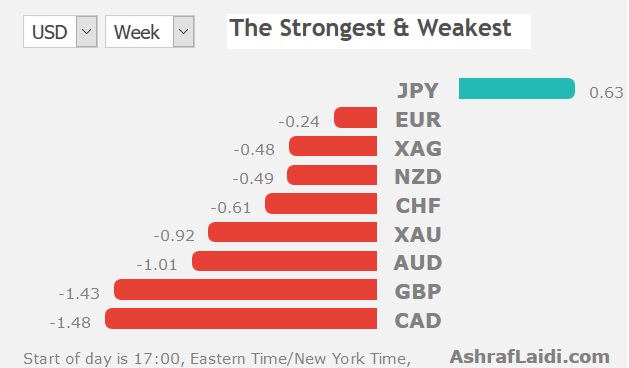

كما تشير الرسوم البيانية أعلاه، لم يعد بوسع المتداولين بالعملات أن يواصلوا دعم الدولار الأمريكي على الرغم من استمرار البيع في المؤشرات بعد إعلان ترامب، ودخلوا بيعا واسع النطاق للدولار الأمريكي. ويدعم مخطط الذهب نفس الفكرة التحليل الكامل

Trump's Latest Gift for USD Bears

As the charts indicate, currency traders may no longer support the USD despite the prolonged selloff in indices following Trump's announcement. Here is what we should expect next. Full analysis.

Tariffs Trip Up Dollar

Stocks tumbled and the US dollar followed after Trump finally announced harsh trade tariffs. The euro was the top performer while the US and Australian dollars lagged. Japanese CPI and comments from Carney are up next. The Premium trade shorting DAX30 was closed at 12040 from 12470 entry for a 430 pt gain. Several alternative options on locking gains were shared to subscribers.

Earlier this week we wrote about the US twin deficits. Many analysts have emphasized that they are a large and growing problem. We don't dispute that, but an even bigger problem reared its head on Thursday: How Washington will react to those deficits.

We got a taste of the answers on Thursday after Trump announced that he will use national security provisions to slap tariffs on steel and aluminum imports. The duties on imported steel will be 25% and they will be 10% on aluminum. Trading partners have already said they're planning to take counter-measures.

The move by Trump shouldn't come as a huge surprise – he's been threatening it throughout his time in office. But there was some hope that his words were hollow and that he could be convinced otherwise.

The growing fear in markets is that this is just the start of a trend. Risk aversion hit for the third day as the S&P 500 fell 36 points to 2677. The US dollar slumped on the news across the board. In particular, USD/JPY sank down to 106.20 and is now less than 100 pips from the February low.

Aside from yen strength, the FX market will likely struggle with how to deal with anti-free market measures from Washington and the threat of a trade war.

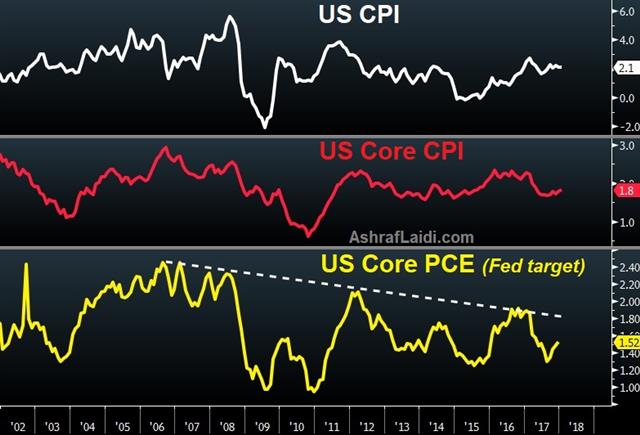

At the same time, the Fed is trying to navigate mixed signals. The PCE report was in-line with expectations aside from a 0.1 pp beat on personal income. Core PCE inflation was just 1.5% y/y and has been below target on a year-over-year basis in 96 of the past 100 months. However there are some positive signs with 3-month annualized inflation hitting 2%.

More notably, the ISM manufacturing index rose to 60.8 compared to 58.7 expected. That's the highest since 2004 and the commentary in the report was littered with anecdotes about capacity shortages. Prices paid rose to the highest since May 2011.

It was also the second day of testimony from Powell and it had a slightly-more dovish tinge with an emphasis on low wage inflation. Still, he continued to express confidence that prices and wages will rise.

Elsewhere, Japan will get a look at CPI numbers for Tokyo at 2330 GMT. The consensus is for a 1.4% y/y rise but that falls to 0.5% y/y excluding fresh food and energy. Monetary base data is due 20 minutes later. Another event to watch is an appearance from Carney at midnight GMT in Edinburgh.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Monetary Base (y/y) | |||

| 9.2% | 9.7% | Mar 01 23:50 | |

DAX & Eurostoxx Trading Video

The Dax30 and Eurostoxx50 indices are fairly similar in terms of their exposure. Here is why I issued a short DAX trade last week and what's next ahead with the Eurostoxx? Full video.

Yen Sends Warning Signal

The yen took a bite out of the rest of the foreign exchange market on Wednesday to cap off a strong month. JPY was the top performer while the pound sterling lagged. Aussie is the worst performer in early Thursday Asia after weaker than expected capex data. All eye turn to Thursday's release of the US Jan core PCE price index, expected unchanged at 1.5%. A new trade in CAD cross has been posted & sent to Premium subscribers moments ago.

A calm settled over markets in the past two weeks but if the moves in the US dollar and yen are any indication, more trouble could be brewing. A rally in the yen Wednesday preceded a 30 point drop in the S&P 500. The index finished on the lows for the second straight day.

Technically, there were breaks all over. GBP/JPY fell below the 200-day moving average and the February low. EUR/JPY also hit the lowest since September in a sharp fall.

Against the US dollar, the euro, GBP and Canadian dollar also broke the February lows as they erased the recent bounces. The pound was the biggest Wednesday loser amid snags in the Brexit deal flare up, particularly the Irish border.

Economic data wasn't a major factor as the estimate of Q4 GDP dipped to 2.5% from 2.6%, as expected. One concern was in pending home sales as they fell 4.7% compared to a 0.5% rise expected.

One refuge of the bulls is that Wednesday was month-end and that flows could skew the market moves. However, we remind them that they said the same thing at the end of January, only to be beaten up in the first month of February.

Looking ahead, the Asia-Pacific calendar is buys with several Japanese releases including capital spending, corporate profits, the PMI from Nikkei, consumer confidence and vehicle sales. Those will offer a solid look at the path of the economy.

Aussie is down across the board after private capital expenditure data showed firmes planned to spend AUD $84bn in 2018-19, vs AUD $86.5bn expected, while spending in Q4 fell 0.2% vs exp +1.0%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Capital Spending q/y | |||

| 4.3% | 3.1% | 4.2% | Feb 28 23:50 |

| Chicago PMI | |||

| 61.9 | 64.2 | 65.7 | Feb 28 14:45 |

| Final Manufacturing PMI [F] | |||

| 55.9 | 55.9 | Mar 01 14:45 | |

| PMI Manufacturing | |||

| 55.9 | Mar 01 14:30 | ||

| Eurozone Final PMI Manufacturing [F] | |||

| 58.5 | 58.5 | Mar 01 9:00 | |

| Consumer Confidence | |||

| 44.9 | 44.7 | Mar 01 5:00 | |

| Private Capital Expenditure (q/q) | |||

| -0.2% | 1.0% | 1.9% | Mar 01 0:30 |

بين السعر و التغيير اليومي

في فيديو اليوم، نستكشف العلاقة بين تغير الاسعار و نسبة الحركة اليومية في المؤشرات و كيف تؤثر على السعر و تحديد الإتجاه القادم ؟ أين وصل مؤشر الخوف بعد أول استجواب لرئيس الفدرالي الجديد جيروم باول أمام الكونجرس الفيديو كامل

Powell Paints the Dots

In one breath Fed Chair Powell said he wouldn't prejudge changes to the Fed dot plot but in the next he made it clear it's going higher. The US dollar was the top performer on Tuesday while commodity currencies lagged. All eyes will be on China later, before Eurozone Feb preliminary CPI and US revised Q4 GDP on Wednesday. Below is the Premium video outlining the existing shorts in selected indices. A detailed update/revision has been added to the EURUSD trade.

Powell spent more than three hours answering questions in the US House of Representatives and will do it again in the US Senate on Thursday, but the most important question in markets was posed to him directly: Will the Fed hike three times this year or more?

He was diplomatically non-committal on the forecast but then added a list of reasons why the outlook improved. That included better data, the tax cut, stronger global growth and consumer sentiment.

The final one on the list was underscored by the Conference Board, whose consumer confidence indicator rose to the best since 2001 at 130.8 versus 126.5 expected.

The headlines came at short time apart and gave the US dollar a lift. In turn, EUR/USD dropped to 1.2222 from 1.2320 at the start of US trading. Cable fell more than 100 pips with Brexit worries also contributing to the decline.

Commodity currencies were particularly hard hit with USD/CAD climbing to a fresh 2018 high and the first close above the 200-day moving average since June.

Looking ahead, top Chinese Communist officials are wrapping up meetings on Wednesday that focus on high-level appointments. One of those is likely to be at the PBOC where governor zhou xiaochuan is expected to announce his retirement. It would be unusual to get a quick announcement on the Zhou's replacement but any leak or other statements from the meeting could move markets. Early headlines include forecasts for growth to stay above 6.5% this year and next.

Other China news includes the official manufacturing and non-manufacturing PMIs. Both are due at 0100 GMT and forecast to edge lower to 51.1 and 55.0, respectively.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Spanish Flash CPI (y/y) | |||

| 1.1% | 0.9% | 0.6% | Feb 27 8:00 |

| Eurozone CPI Flash Estimate (y/y) | |||

| 1.2% | 1.3% | Feb 28 10:00 | |

| Chicago PMI | |||

| 64.2 | 65.7 | Feb 28 14:45 | |

| PMI | |||

| 51.2 | 51.3 | Feb 28 1:00 | |

| CB Consumer Confidence | |||

| 130.8 | 126.2 | 124.3 | Feb 27 15:00 |

Gold Bulls want this from Powell

Fed chair Powell's testimony to the House Financial Services Committee begins at 10:00 Eastern (15:00 GMT/London) but the actual speech will be released 90 mins before. Here is the (realistically) best scenario for gold from Powell. Full analysis.

Looming Balance of Payments Problem

The market is abuzz with talk about the twin US deficits but one part of the equation is overlooked. The euro was the top performer Monday while the Canadian dollar lagged. German CPI is next and Fed chair Powell will testify to the House Finance Committee in US trading at 10:00 ET (15:00 London/GMT) but the text of the Powell's speech is due for release at 8:30 ET 13:30 London/GMT. The Dow30 trade was stopped out, leaving 2 other indices in progress.

إدارة انعكاس المؤشرات (فيديو للمشتركين)

Here's the issue: The US economy is strong. Unemployment is near all-time lows, corporate profits are soaring, house prices are back at the highs, consumers are in good shape… and yet the government just delivered a gigantic tax cut, among the biggest ever.

What happens to that money? One argument is that it finds its way abroad.

Elaborating further: A US company wants to fill a large order. The US factory is running at capacity and management is unable to find good workers without overpaying, so they forego on filling the order. As a result, the buyer seeks an economy that's relatively slower, such an example is a factory in Mexico that's running at half capacity and eager to complete the order, willing to discount and can deliver ASAP.

That's an oversimplification but that might be what's beginning to happen. It's early but the US trade deficit has grown to $70B/month from $60B/month in two months. That's a big drag on growth. Other drawbacks include debt financing at higher rates, but getting into that would be dancing on thin ice.

Secondly -- and no one is talking about this – is that Trump's tax cut will exacerbate the US twin deficits, making them a larger problem than they already are --a political disaster and an acute economic imbalance.

The Republican brand is tied to fiscal discipline and Trump's brand is tied to balancing trade deficits. So markets haven't particularly cared about the twin deficits for a long time but Washington does care. Markets are increasingly worried about what's coming to solve those problems. Trump will want action on the fiscal deficit, while pressing for action on the trade deficit and on Monday he railed against the WTO so everything is on the table.

Given the ideology of Washington, we could be months away from a trade war and from some harsh cuts to US social spending. In the shorter term, the focus will be on German CPI and Powell's Humphrey Hawkins testimony on Tuesday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Spanish Flash CPI (y/y) | |||

| 0.9% | 0.6% | Feb 27 8:00 | |

| Germany Buba President Weidmann Speaks | |||

| Feb 27 10:00 | |||

| HPI (m/m) | |||

| 0.4% | 0.4% | Feb 27 14:00 | |