Intraday Market Thoughts Archives

Displaying results for week of May 20, 2018فيديو عن فنيات الدولار واليورو

عندما يواجه الدولار مقاومة تناسب ٣ مدارس في التحليل الفني - فيديو مفتوح للكل

Fed & Korea Factors Loom Large

Today's decision by the White House to cancel the much anticipated meeting with North Korea's president boosted the yen & gold at the expense of equity indices, while a small hint in the FOMC Minutes yesterday weighed on the US dollar and helped to underscore how vital the Fed outlook is for broader markets. A new Premium trade had been issued ahead of the Fed minutes.

The minutes of the May 2 FOMC meeting sent the US dollar lower largely because a line said a temporary period with inflation above 2% would be consistent with its goal. What that means is that even if inflation runs a bit hot over the summer, the Fed isn't going to rush to hike rates beyond the 2-3 times that are already expected.

In the aftermath, the US dollar slipped broadly and US stock markets recovered. The shift helped to mitigate what had been a rough day for risk assets. EUR & GBP bounced from the worst levels of the day but only after making fresh cycle lows on poor growth numbers in Europe. Cable rallied on better than expected UK retail sales.

In the bigger picture, the dollar moves after the FOMC minutes helps to underscore the tentative state of markets right now. Emerging markets, in particular, are vulnerable to higher Fed rates. If inflation were to heat up beyond what the Fed wanted and rapid hikes came to fruition, money would race out of risky assets and emerging markets in what would be a shock to the system.

The latest woes in the Turkish lira and Argentina peso help to underscore how quickly confidence in the developing world can evaporate. Today, Turkey's central bank took a desperate step with a surprise 300 basis point rate hike.

Naturally, the yen and swiss franc also benefit in any flight to safety and both were strong on Wednesday and today.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| 1.6% | 0.8% | -1.1% | May 24 8:30 |

ثلاثة نقاط على الفرنك السويسري

امتدت قوة الفرنك السويسري الأخيرة مقابل جميع العملات الرئيسية بما في ذلك الدولار الأمريكي خلال الأسبوعين الماضيين. كما وتزامنت بداية هذه الفترة مع اندلاع الدراما حول السياسة الإيطالية. لكن هناك عوامل أخرى تفرض قوة الفرنك. هل ستتطلب العملة مخاوف مستمرة من أجل الحفاظ على مكاسبها؟ التحليل الكامل

Black Smoke & Franc Divergence

Recent Swiss franc strength extended to the point of gaining versus all major currencies, including the US dollar over the past 2 weeks. Not coincidentally, the start of this period coincided with the breakout in Italy's political drama. But there are other factors enforcing franc strength. Will the currency require continuous fear in order to maintain its gains. Full analysis

Yen Wakes ahead of Fed Minutes

USD strength is back in full force today, but this time the yen is outperforming it due to falling indices. This implies the yen remains the ultimate safe-haven currency, even gaining versus the Swiss franc, which flexed its muscles over the past 2 weeks due to escalating political uncertainty. 1.1700-1.1720 remain the key level for EURUSD as far as the daily and weekly close.

These levels face a hard test ahead of today's release of the Fed minutes from the May 2nd decision. Recall that USD had a temporary selloff (mainly against gold) following the Fed announcement due to a phrase in the Fed statement indicating the willingness to let inflation rise above target. But the EM selloff changed everything, feeding the USD into a carry trade unwinding frenzy. So keep an eye for any more details on the Fed's symmetrical target.

As for the realities of the market, our Premium trade shorting DOW30 last week was stopped out at 25050. The market extended to 25080 before tumbling 200 pts in the futures. Well done to those who stuck with the trade. Meanwhile, here is the Premium video (above) for the latest trades and why I am sticking with them.

Indices Heat up, USD Cools on Relations Thaw

Monday's equity rally was another confirmation that the year's dominant market worry is the trading relationship between China and the US. Improved relations and detente over the past 2 days have led to a rally in risk assets with the Australian dollar being the top performer and the pound trailing. Earlier today, BoE's Carney reiterated that interest rates will rise at a timid pace, while USD broadens selloff. Silver and the ppund are the highest gainers since Tuesday's Asia open. The DOW30 Premium was stopped out at 25050 (High was 25085). Yesterday's trade is +70 pips in the green.

مطاردة القيعان (فيديو المشتركين)

The US-China trade war going 'on hold' was cheered by markets as the S&P 500 climbed 20 points to 2733. China has offered to import more US energy and commodities in something we warned last week wouldn't be nearly enough to cut $200 billion from the US bilateral trade deficit. But if it's good enough for Trump and Mnuchin, then it's good enough for markets, at least for now.

It was instructive that the Australian dollar was the top beneficiary in FX. AUD/USD jumped to the highest since late April. Even cable showed some signs of life. After hitting a fresh 2018 low of 1.3391 it bounced back to 1.3433 to finish only narrowly lower.

The risk to the improved tone in markets is bonds. Treasury yields inched higher Monday but are now back within striking distance of multi-year highs. Keep a close eye on that market Tuesday.

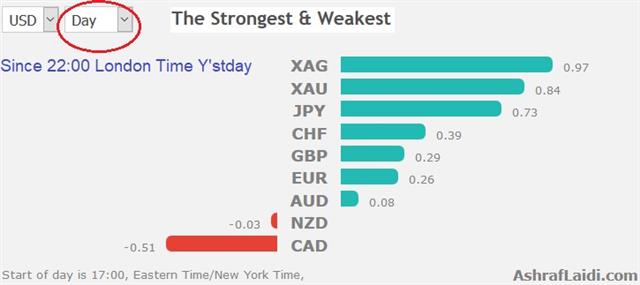

USD, AUD up as US-China Pause Tensions

USD started the week higher thanks to a relief in the US-China trade tensions and further losses in Italian bonds as the new coalition veers away from the basic budget requirement of the euro project. The odds of a Bank of Canada rate hike tumbled after soft reports Friday on CPI and retail sales. The Swiss franc was the top performer last week while the euro lagged. CFTC positioning data showed that kiwi longs have finally squared up. A new Premium trade has been adde with 3 charts & detailed note, identifying a crucial inverse H&S formation. The monthly chart is found below.

Canadian retail sales and CPI were the final two major pieces of the puzzle ahead of the May 30 BOC decision and the market was unsure what was coming. The implied odds of a hike were 42% before the data but plunged to 28% afterwards. Year-over-year CPI was up 2.2% compared to 2.3% while retail sales ex autos were a big disappointment at -0.2% m/m versus +0.5% expected.

In the aftermath USD/CAD jumped more than a cent and touched above 1.29. Also on Friday, the deadline that House leader Paul Ryan set for a NAFTA deal passed without any progress and US Trade Representative Lighthizer said the sides were nowhere near a deal.

At the moment, oil is supporting the Canadian dollar and that will continue to be a factor but no further near-term helps is coming from the BOC or trade negotiations, so the risks are tilted to the downside for the loonie (and upside for USD/CAD) . Note Canada is on holiday Monday. Here is Ashraf's latest on USDCAD.

In Europe, Italy is increasingly weighing on the common currency as jitters about a League/5-Star coalition continue after leaks last week suggested radical plans to cut debt including ECB monetization.

On the weekend, France warned its neighbour not to put regional stability at risk. The drop in EUR/CHF last week was undoubtedly impacted by safe haven flows as Italian stocks and bonds sank.For the week ahead, bonds will remain a major theme. US 10-year yields touched 3.12% on Friday before falling back to 3.05% but the better spot to watch in the short term may be US 30s and the cluster of resistance near 3.25%.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +115K vs +120K prior GBP +6K vs +9K prior JPY +4K vs -5K prior CAD -24K vs -24K prior CHF -36K vs -32K prior AUD -23K vs -17K prior NZD +2K vs +13K prior

The bonfire of the New Zealand dollar may have a bit less fuel in the week ahead as battered longs have now completely covered. The next spot to worry might be the Swiss franc, but when have speculators ever been wrong in that pair before?

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (q/q) | |||

| 0.1% | 1.0% | 1.4% | May 20 22:45 |