Intraday Market Thoughts Archives

Displaying results for week of May 06, 2018Jobs Report Leave BOC in Tough Spot

The headline on the Canadian April jobs report was soft but the details were encouraging and that will make the BOC decision May 30 a tricky one. The Swiss franc was the top performer Friday with the loonie lagging but CAD is tops for the week and the quarter. Both the FTSE and the DOW30 trades were stopped out, while the USDCAD trade was closed at a gain.

Canada lost 1.1K jobs in April compared to the +20K reading expected but the headline doesn't tell the full story. Full time jobs increased by 28.8K with all the losses in part time. Moreover, hourly earnings for full time employees rose 3.3% compared to 3.1% previously to match the best since 2014.

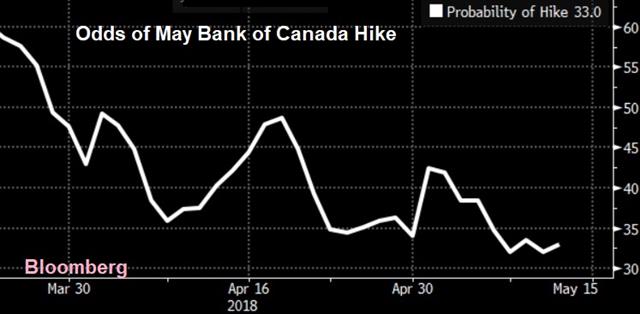

The implied odds of a BOC hike at the end of the month remain at 33%. A speech from Wilkins Friday didn't touch on monetary policy and the only remaining scheduled BOC speech before the decision is from Lawrence Schembri and he rarely weighs in on policy.

In terms of economic data, next Friday's Canadian CPI and retail sales are the only top-tier numbers to come so the market will likely head into the decision off balance. We will be watching closely for any BOC signals in the week ahead – likely in the form of a Poloz press interview.

The US dollar softened a bit on Friday with the euro rising to the highest since Monday. The same economic questions continue to plague the Fed and markets. U Mich consumer sentiment beat estimates at 98.8 vs 98.3 expected and one-year inflation expectations ticked up to 2.8% from 2.7% but for months (if not years) survey data hasn't translated into hard data and the Fed will need to see that transition before hiking later this year.

Ashraf at Old Trafford Saturday

Don't forget tomorrow's once in a lifetime opportunity to attend Ashraf's seminar at Old Trafford in Manchester United in cooperation with Swissquote. Full details.

كوب و عروة يروي عطش المتداول

تشكل نموذج الكوب و العروة على الرسم البياني لأحدى الأزواج التقاطعية , سيروي عطش المتداول الباحث عن صفقة تداول بنسبة نجاح دقيقة . ما هو هذه الزوج ؟ تعرف عليه الآن من أشرف العايدي في الفيديو الاسبوعي

Loonie Lurches Higher, BOE Next

After a slow start to the week in the way of data, get ready for some Thursday action with BoE rate decision, minutes, inflation report and Carney speech. And don't forget US CPI. Crude jumped more than 3% to fresh highs since 2014 in the aftermath of the US decision to leave the Iran nuclear deal. The loonie took advantage to lead G10FX while the yen lagged. The BOE decision is next and a new GBP trade will be issued in the next 12 hours in addition to the index trade issued earlier today. And don't forget Ashraf's Thursday London Seminar and Ashraf's Saturday Old Trafford event in Manchester.

تفسير الصفقات الجديدة (فيديو للمشتركين)

It was appropriate that CAD and JPY were on the opposite side of the equation Wednesday as they're on opposite sides of the commodity trade. CAD/JPY climbed more than 100 pips and USD/CAD dropped by the same amount in win for the loonie that keyed off Tuesday's rejection of 1.30.

The loonie hasn't reflected the recent climb in oil prices because Canadian producers were struggling with bottlenecks that sparked a wide spread between Canadian oil and WTI. That's now narrowed to $15 from $30.

There are also signs of a pickup in investment with several Canadian firms making deals to sell assets this week in a sign that money is ready to go to work again in energy. CAD event risk remains high with the employment report due on Friday.

The USD side of the trade remains in flux as well. The big dollar is approaching 110.00 against the yen, with the 200-dma at 110.17 as well. On Thursday, the CPI report is a major risk but be sure to watch for quirks in the data as cell phone services inflation rolls off. Recent quirks in hotel prices, apparel and healthcare costs could also skew the numbers.

Early in Asia-Pacific trading the RBNZ held rates as expected but new Governor Adrian Orr hurt the kiwi with a statement that warned about weak inflation and keeping rates low for a considerable time. NZD/USD fell to 0.6940 from 0.6980 in the immediate aftermath.

The next central bank in focus is the BOE. The market is pricing in a 13% chance of a cut, down from 96% three weeks ago after a string of poor economic data. The focus will be on signals about August, where a hike remains a 50/50 proposition. If Carney strikes a hawkish tone, there is room for a sizeable GBP rebound.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBNZ Rate Decision | |||

| 1.75% | 1.75% | 1.75% | May 09 21:00 |

| RBNZ Gov Orr Speaks | |||

| May 10 1:10 | |||

Rising USD vs Stable Gold

As the US dollar rally enters its 4th week – the longest series of uninterrupted advances since September, we ask the following question: Can the strengthening USD persists without a technical breakdown in gold? Or, is gold's stabilisation a red flag for USD bulls? Full analysis.

هل يعتبر تثبيت الذهب راية حمراء للدولار ؟

مع دخول ارتفاع الدولار الأمريكي للأسبوع الرابع على التوالي – أطول سلسلة من التقدم المستمر منذ سبتمبر – يجب طرح السؤال التالي؟ هل يمكن أن يستمر تقوية الدولار دون أي انهيار فني في الذهب؟ أو هل يعتبر تثبيت الذهب راية حمراء للدولار الأمريكي؟ (التحليل الكامل)

CAD Swings as Trump Quits Iran Deal

Donald Trump fulfilled a campaign promise by announcing the US departure from the Iran nuclear deal in a move thatwas largely expected but still sent oil traders for a ride. The Swiss franc was the top performer while the commodity currencies lagged. The latest Premium Video signals which trades Ashraf will be taking on Wednesday (ahead of Thursday's CPI and Friday's Canada jobs) as well featuring the 6-week curse trade. More importantly, he tackles the importance of figuring out how much of USD gain is caused by EM Selloff and unwinding of EM-USD carry.

After weeks of speculation and international lobbying, Trump opted to quit the Iran deal, formally known as JCPOA. Throughout the day Tuesday, rumors and denials bounced WTI crude oil prices around. From as high as $70.40 to as low as $67.63 before ultimately finishing close to unchanged and near $70. Monday's high of $70.76 will be a key level to watch in the days ahead.

Other markets also fluctuated out of genuine fear or elation. One reason for the largely-muted market reaction suggested there is still room for negotiation. The sanctions have mandatory 90-day and 180-day notice periods to give companies a chance to tidy up so nothing has been imposed yet. In his announcement, Trump invited Iran back to the negotiating table at any future point.

Another interesting move was in USD/CAD as the pair rallied to 1.2998 as oil dropped to the lows of the day. The inability to break above followed by a slide down to 1.2948 suggests firm resistance ahead of the big figure. The pair rallied after hitting its H&S target of 1.25. Does the current rally comprise an inverse H&S? Ashraf answers this in the Premium video.

Ashraf's London Seminar Thursday

I am pleased to invite you to my seminar this Thursday 10th May at 7pm at GKFX Lomdon HQs, titled "Applying Trade Ideas to Action". How to convert an idea into an actual trade. When to chase the price. Hedging vs 'Sticking it out'. This and more. Book your seat.

USD, Indices Firm in Light Day

A slow start to the week from a data vaccum and UK holiday did not stop from the US dollar from pushing higher. Friday's release of US non-farm payrolls threw a curveball at the market as a drop in unemployment overshadowed soft wage numbers, but traders ignored the decline in the labour participation rate. The week's key events are US CPI and BoE inflation report on Thursday, Canada jobs on Friday and more clarity on the Iran nuclear accord. President Trump's tweet that hey may shed more clarity on the US future role in the Iran nuclear deal on Tuesday afternoon.

The US average hourly earnings component of non-farm payrolls has accounted for 90% of post-NFP market moves over the past year so it was no surprise when the knee-jerk in the US dollar was lower on Friday when the report showed wages climbing 0.1% compared to +0.2% expected.

From there, the tide slowly turned. Part of that was likely the underlying momentum that's made the US dollar the best G10 performer in three straight weeks. But part of it was also unemployment falling to 3.9% from 4.1%. A three-handle on unemployment is something that's going to make the Fed more confident that wages will rise, even if recent growth has been lackluster.

The US dollar hit cycle highs Friday, sending EUR/USD and cable to lows. Some profit taking hit late in the day but the underlying demand for the dollar has been impressive.

Things we will be watching this week include the Iran nuclear deal, the fallout from US-China trade meetings and more NAFTA talks.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +121K vs +131K prior GBP +26K vs +37K prior JPY -1K vs +1K prior CAD -28K vs -28K prior CHF -19K vs -10K prior AUD -7K vs -3K prior NZD +17K vs +24K prior

US dollar shorts have covered somewhat in the past two weeks but there is no doubt it's been a painful trade with many now holding positions that are underwater. It will be a slow start to the week with the UK off for a holiday on Monday but the BOE decision Thursday will be a market mover.