Intraday Market Thoughts Archives

Displaying results for week of Jul 01, 2018حقائق الذهب والدولار واليوان

هل وقعت الأسواق المالية العالمية رهينة بسبب الحرب التجارية بين الولايات المتحدة والصين؟ أم أن البيان الأكثر دقة وصراحة هو أن الحركات الأساسية في اليوان الصيني تسيطر على مؤشرات الأسهم والمعادن؟ (التحليل الكامل)

إنطلاق الهجوم التجاري

من المقرر ان تدخل الرسوم الجمركية على البضائع الصينية والبالغة 34 مليار دولار في الساعة 12:01 صباحا في واشنطن

Countdown to US-China Trade Blows

Markets on Thursday reacted to reports sttaing the US could make a deal to avoid placing tariffs on European cars but the details aren't as rosy as the market moves suggest. NZD was the top performer on the day while JPY lagged. Japanese earnings data is due up next. All eyes turn to the US kicking off tariffs on China later tonight and the subsequent reaction from Beijing. There are 8 Premium trades currently open ahead of the trade announcements and US/Canada jobs reports.

The German press first reported Wednesday that the US was prepared to relent on talk of European auto tariffs and as the talk made the rounds it underpinned a climb in the euro and global equities. We're afraid this is an overreaction. The story – which cites the US ambassador to Germany, suggests the US would suspend auto tariffs on European cars if Europe removed its barriers to US imports. Don't forget Wednesday's ECB story on the timing of the next rate hike also helped boost the euro.

The euro climbed 30 pips on the day and the S&P 500 rose nearly 1%, led by automakers.

Meanwhile, US tariffs on China are slated to go into effect on Friday and China has promised to retaliate. Trade worries are something the FOMC Minutes highlighted but the market was more tuned into commentary on a 'very strong' economy and continued gradual hikes. That helped to lift the US dollar.

Headline risks also dominated in the UK. BOE Governor Mark Carney brushed aside the recent poor data, blaming bad weather. Surely, he will have to finally pull the trigger on a rate hike on Aug 2 rather than performing yet-another embarrassing walk-back. That was reflected in a 50-pip rally in cable to 1.3275. At the same time, the risks of a one-and-done also mount as Brexit turmoil continued. The pound gave back all its gains on a report that Germany had dismissed the latest exit plan – one that May had to acrimoniously put together among warring factions of her own party.

We don't envy her job but we can't help but notice that cable has hung tough in the past week. We continue to watch for signs of a bottom. The Premium long in EURGBP deepens in the money.

All eyes will be on trade to close out the week but data releases include Japanese labor cash earnings, German industrial production and non-farm payrolls.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Labor Cash Earnings (y/y) | |||

| 0.9% | 0.6% | Jul 06 0:00 | |

| Germany Industrial Production (m/m) | |||

| 0.3% | -1.0% | Jul 06 6:00 | |

PBOC Blinks, USD Drops

The recovery in the Chinese yuan helped all currencies recover against the US dollar, including gold. Last week's CNY decline was the biggest since that fateful 3rd week of August 2015 when equity markets collapsed, VIX spiked and the yen soared. But Beijing cannot use the currency as a weapon for too long as that would risk capital flight, lack of trust in its currency (not a good idea when you're trying to add legitimacy to your currency system) and negative for global commodities. The euro remains the highest performer on the day after ECB members were reported to have considered market pricing for a December 2019 rate hike to be “too late”. Again, as long as oil remains elevated and the euro below 1.20 for too long, Eurozone inflation will have nowhere to go but up, which makes an ECB rate hike in Q2 or early Q3 all too possible.

Penalties of Another Kind

As England celebrated shaking off the World Cup penalties curse on Tuesday evening, US microchip giant Micron was hit with a different kind of penalty after being temporarily banned from China in a fresh front in the trade war. The Australian dollar was the top performer as China's currency posted its biggest gain vs USD in over months. GBP is the day's biggest performer after UK services PMI rise to its highest since October 2017. US markets are closed on Wednesday for Independence Day Holiday but activity should resume fast and heavy on Thursday for US services ISM, Fed minutes, ADP and jobless claims, followed by the US and Canada jobs report on Friday.

Micron has been a stock market darling for the past year and does half its sales in China but more importantly, the market took it as a signal of fresh barriers in the trade dispute. US equities had been comfortably higher then slumped in the final hour of trade on the headlines.

Earlier in the day, markets were cheering a reversal in yuan weakness and comments from the PBOC that the currency won't be used in any trade dispute. That had led to a broad slide in the US dollar, especially in USD/JPY as it fell to 110.50 from 111.10.

Oil made some dramatic moves as WTI jumped up to a fresh three-year high at $75.27 then almost immediately plunged, falling all the way to $72.73. There were no headlines to justify the move and it might just have been a case of flows ahead of the US holiday. WTI eventually crawled back up to $74.28 to finish higher on the day again. The Canadian dollar was dragged along for the ride before finishing at 1.3143.

Economic news was rosy for the US as factory orders rose 0.4% compared to 0.0% expected. Positive revisions and upbeat secondary metrics underscored the beat. One concern is that inventory-building is pushing up production because of fears of tariffs and, if so, that could skew growth and central bank thinking in the months ahead. However a sign of upbeat consumers also came from US auto sales at a rate of 17.38m compared to 17.00m expected.

Happy 4th of July to our US readers.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Services PMI | |||

| 55.1 | 54.0 | 54.0 | Jul 04 8:30 |

| PMI Manufacturing | |||

| 57.1 | 56.2 | Jul 03 13:30 | |

| PMI | |||

| 53.9 | 52.7 | 52.9 | Jul 04 1:45 |

| Factory Orders (m/m) | |||

| 0.4% | 0.1% | -0.4% | Jul 03 14:00 |

Cracking Chinese Dam

Money continues to leak out of Chinese markets and the risk that problems could burst into global turmoil is rising. The US dollar was the top performer Monday while the Australian dollar lagged. The RBA decision is due up next. The euro had a late session boost following news from German interior Minister Seehofer indicating a “clear agreement” was reached with Chancellor Merkel and her Christian Democratic Union over immigration after more than four hours of negotiations. The subscribers' video on existing and future trades is found below.

The Shanghai Composite fell 2.5% on Monday and is now down 13.5% since the final week of May. The PBOC lowered reserve ratios on June 25 but the market fell the next day, in something we warned at the time was a troubling development.

There are two main catalysts for the trouble in China: The main one is trade worries and that increased after last week's chatter on IP protection from the US and potential harsh retaliation from Beijing. The second is weakness in the Chinese yuan, which is also tied to trade but increasingly obvious that the currency is being managed lower. USD/CNY has risen in 11 of the past 12 days in a 4% rise. For perspective, the China-sparked tantrum in markets in 2015 came after just a 3% move.

Industrial metals are being hit hard alongside China and copper is now testing the lows from December and March. In turn, that's weighed on the Australian dollar, which fell nearly a cent Monday and broke the May 2017 low. Technically, that leaves little support within the next 120 pips.

However, the RBA meeting will steal away the spotlight at 0430 GMT. The overwhelming consensus is for no change from the 1.50% with no clear signal on rates. The most-recent meeting highlighted some risks from Europe and emerging markets. Those have ebbed but global trend tensions have certainly risen. The baseline is that the statement will remain upbeat but there is a small risk of something more dovish.

ندوة مساء الاربعاء

محور ندوة الإلكترونية القادمة قبل يوم من موعد صدوربيان محضر اجتماع الفدرالي الأمريكي حول السياسة النقدية و 48 ساعة قبل إصدار بيان الوظائف الأميركية للتسجيل من خارج السعودية للتسجيل من السعودية فقط

Trump Teases on Oil, CAD Key

A Trump tweet on Saturday set the stage for a wild trading week in the oil market. The new month gets underway after the US dollar and euro led the way in May, with the kiwi lagged. The latest CFTC positioning data showed Canadian dollar shorts increasing just as Poloz whipsawed the market. On Friday, a special charts note on USDJPY was issued for subscribers. The week starts with US manufacturing ISM and construction at 15:00 London time. US markets are shut on Wednesday due to Independence Day Holiday, but activity resumes fast and heavy on Thursday for services ISM, Fed minutes, ADP and jobless claims, followed by the US and Canada jobs report on Friday.

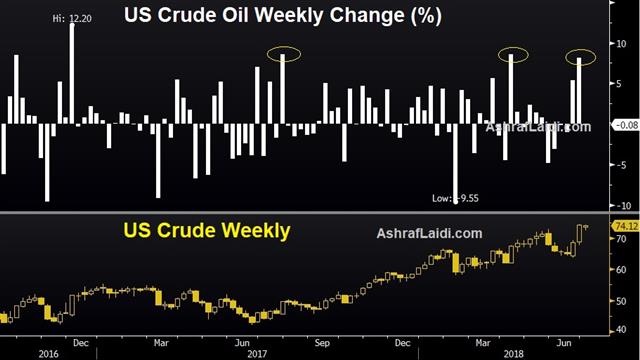

3rd Biggest Weekly Rally of the Year

Oil has been on a tremendous run, climbing more than 13% in the past six trading days to reach the best levels in four years, but Donald Trump ensured the bulls weren't sleeping easy on the weekend. The President tweeted Saturday that he had called Saudi Arabian King Salman to ask him to pump more oil “maybe up to 2,000,000 barrels” and that he had agreed.That kind of tweet would have created mayhem if it came during trading hours but with markets closed, it gave the Saudis and White House time to go into damage control. The White House said that King Salman affirmed 2 million barrels of spare capacity that it can use if necessary and Saudi statements made no mention of more production.

Ramping up to that level is possible in a number of months but it would severely strain – if not break – OPEC's alliance. However that may be a price Saudi Arabia is willing to pay to ensure its alliance with the US against Iran.

Oil opens the week above $74 (crude) and $78 (brent). Counteracting the Saudi headlines somewhat is the closure of four Libyan oil ports, removing 850K bpd of crude from the market. Dip buyers have been waiting on every small slide in the past week.

On Thursday, we wrote about the likelihood that the selling in cable was overdone. It responded with a 130 pip bounce into month end but the weekend was a reminder of the ever-present Brexit risks as pro- and anti-Brexit factions in her party ramp up the pressure ahead of key party weekends late this week. Other weekend news included the China manufacturing PMI at 51.5 compared to 51.6 expected and the non-manufacturing PMI at 55.0 compared to 54.8 expected.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +34K vs +36K prior GBP -22K vs -19K prior JPY -34K vs -36K prior CAD -33K vs -14K prior CHF -38K vs -32K prior AUD -41K vs -43K prior NZD -18K vs -16K prior

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final Manufacturing PMI [F] | |||

| 54.6 | 54.6 | Jul 02 13:45 | |

| ISM Manufacturing PMI | |||

| 58.2 | 58.7 | Jul 02 14:00 | |

| PMI | |||

| 51.0 | 51.1 | 51.1 | Jul 02 1:45 |

| Eurozone Final PMI Manufacturing [F] | |||

| 54.9 | 55.0 | 55.0 | Jul 02 8:00 |