Intraday Market Thoughts Archives

Displaying results for week of Jul 15, 2018What to do about 30-1 Leverage?

In light of the upcoming ESMA regulations, clients with EU-based brokers will see their leverage fall to 30-1 from 100-1 or 200-1 as of July 28. In order for you to keep 100-1 or 200-1 leverage, you can do so by either: i) proving you have an investment portfolio greater than € 500,000 or ;) proving you have worked for 1 year in a financial services in a professional capacity. If you can't meet these criteria and would like to maintain the higher leverage, then please contact us.

China to Hit Back?

China's Commerce Ministry said it will have to take further measures to respond to US tariffs on Wednesday and that initially weighed on the dollar. But as USD/CNY hits hit fresh 4-week lows, it is sending all major currencies lower against the USD, including AUD despite a stellar Australian jobs report. A new JPY Premium trade will be issued for subscribers.

مكافأة خاصة للمشتركين

GBP broke below $1.30 after an unexpected decline in UK retail sales. USD pushes higher after jobless claims fell by 8K to a fresh 48-year low, while the Philly Fed survey rose to 25.7 from 21.5 after a previous dip.

The trade war this year has confounded most analysts, it's the boogyman of markets. It seems to appear from time to time and sends a fright into the market only to disappear. Each time a few bulls are spooked out of the market while the rest seem to carry on in the belief that the boogyman doesn't really exist.

The problem here is that the trade war is real. The US revealed a new proposal for uranium tariffs Wednesday and China's Commerce Ministry said it will take further measures. The boogyman is real and analysts and economists continue to talk about it.

Does the market believe it? USD/JPY fell on Wednesday on the China headlines Wednesday before later rebounding for most of the day. If you've been following this story, that's a recurring theme. Every trade war scare headline-move has been erased so far. Sometimes it's quick, other times it's slow but a portion of the market is increasingly conditioned to buy every dip.

How does it end? Either the dip buyers continue to dominate and it ends with equities and USD/JPY continuing to climb; or the dip buying lulls the market into a false sense of security that's spectacularly shattered once the trade war hits some kind of tipping point.

What might that tipping point be? Most would point to the tariffs on $200 billion Chinese goods the US has under consideration. Until then, the dip-buying trade will slowly get more crowded.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| -0.5% | 0.1% | 1.4% | Jul 19 8:30 |

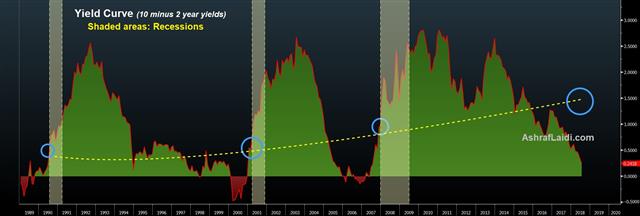

Yield Curve Considerations

The US yield curve fell to its flattest level since the crisis on Tuesday as Fed chair Powell dismissed the potentially recessionary signal. All currencies are down against the USD. GBP is the biggest loser on weaker than expected UK inflation, but with the headline CPI at 2.4% 00 well over the BoE target, the case for an Aug 2nd rate hike remains. The Premium DAX short was stopped out.

Not always recessionary but.

There is a raging debate inside the Fed about the implications of an inverted yield curve. Over the past half-century every inversion has triggered an interest rate cut by the Fed but not always a recession. On Tuesday, the difference between 10-year and 2-year yields fell to just 24 basis points. If the Fed hikes as anticipated, it will almost surely invert in the year ahead. Chapter 6 of Ashraf's book goes deeper in each of the yield curve inversions over the past 40 years. In it, Ashraf asserts that the inversion of 1998 did not lead to recession, but certainly predicted a series of Fed rate cuts in autumn of that year in light of the LTCM debacle. For traders, it is more important to be able predict rate cuts, or changes in the tightening cycle, than actual recessions.So is it a signal? Powell doesn't think so. On Tuesday he weighed in to say that the only real signal from the yield curve is in regards to neutral rates. Time will tell if that's true or not but in the short term, the takeaway is that an inverted yield curve, or the threat of it, won't pevent Powell from continuing to hike rates.

Like in quantum physics, since the market now knows Powell won't stop hiking because of an inverted curve, it makes a recession more likely. That's because 1) it's a sign Powell will be more aggressive 2) Yields won't be restrained (as much) by the implied or real threat of the Fed slowing down because of inversion.

In the short run, Powell's comments helpe boost the US dollar, but in the longer-term, his stance may prove to be a risk to the US and global economy.

Insurance

The crux of the problem continues to be that developed-market inflation remains restrained due to globalization and automation. The Fed is hiking because it believes a tighter jobs market will inevitably lead to inflation but that may no longer be true. More importantly, the Fed intends to normalize interest rates as far as it want in order to secure sufficient firepower in the event of the next recession. i.e. Fed funds rates will be high enough to be reduced.| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (y/y) | |||

| 2.4% | 2.6% | 2.4% | Jul 18 8:30 |

كيف تحتفظ على الرافعة المالية إثر القوانين الجديدة؟

من يريد المحافظة على رافعة ١٠٠-١ أو ٢٠٠-١ إثر القوانين الجديدة (بدون ما يبرهن أنه موظف في شركة مالية) فهناك طريقة شرعية و سهلة وواضحة مع شركة ذو مصداقية عالية، خاصة للمقيمين في الشرق الأوسط يمكنكم التواصل معي هنا

مؤشر الدولار و بتكوين

ماذا تخبرنا الفنيات في الرسم البياني لواحد من أهم الأزواج التقاطعية ؟ و نظرة فنية على بتكوين (الفيديو الكامل)

Retail Sales Questions ahead of Powell

Some key metrics on US retail sales were soft Monday but revisions helped to bolster the dollar. The Swiss franc was the top performer while the Australian dollar lagged. New Zealand CPI is up next. A new Premium trade in CHF has been issued ahead of tomorrow's Congressional testimony by Fed chair Powell. The Premium video on today's new trade and existing trades is found below.

US retail sales matched the +0.5% consensus expectation in June but with May's revision to +1.3% from +0.8%, the overall tone of the report was stronger. The effect was less-pronounced once volatile categories like autos, gas and building materials were stripped out but the report was still enough to halt a decline in the US dollar on the day. Can the true health of the US consumer be assessed via volatile items? And will Powell sound relaxed about the recent gains in inflation in tomorrow's testimony?

Cable climbed as high as 1.3295 before backing off to 1.3230. Part of GBP weakness was due to uncertainty about May's government but she eventually won a Brexit amendment vote 303 to 300. She remains in an extremely precarious, almost impossible position and it would be remarkable if she managed to hang onto her job until the 2022 election.

It's also not entirely clear what would be the reaction if she were forced out or quit. Initially there would be turmoil and GBP selling but others might see it as a path to a soft Brexit or another referendum, which could be positive. Ultimately, it's tough to see any future where both Brexit sides call a truce and move on.

The big move in financial markets in the past week has been oil and that extended with a 4% decline on Monday. Key levels from the recent run-up have been broken and the 61.8% retracement of the June-July rally is now hanging by a thread.

Interestingly, USD/CAD finished lower despite the drop in oil price. If crude continues to fall, that surely won't last.

Looking ahead, New Zealand CPI is due up at 2245 GMT and expected up a modest 1.6% y/y. Later, sterling will be back in focus with jobs data at 0830 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.5% | 0.5% | Jul 16 22:45 | |

| Fed Chair Powell Testifies | |||

| Jul 17 14:00 | |||

ندوة مساء الأربعاء

هل كان ارتداد الدولار الأميركي في الأشهر الستة الأخيرة تصحيح داخل موجة هابطة, أم ارتداد نحو قمم جديدة؟ ما هو تأثير النفط على سياسة البنك المركزي الأوروبي واليورو؟ (إحجز مقعدك)

China Tensions Ease, onto Retail Sales

US-China Trade worries ebbed last week as Trump turned his gaze towards Europe but will it last? The US dollar was the top performer last week while the yen lagged. CFTC positioning showed a fresh appetite for cable sales. All eyes turn to US retail sales and the IMF's latest global forecasts. Here is a Bitcoin chart posted late Friday. Bitcoin is now $400 higher. A new CHF Premium trade will be issued momentarily.

FX markets opened the new week with minimal fanfare. On the weekend, the ECB's Weidmann warned about downside risks to the economy in a meeting with German cabinet but said the ECB wouldn't be able to help much in the event of a downturn.

The focus overnight was on on China, especially with Japan on holiday Monday. The CSI 300 posted its best week in two years but it comes after five weeks of declines. A quick reversal after a long trend isn't often a lasting reversal and it could evaporate in a heartbeat given the tensions and the weakness in the currency.

China's Q2 GDP rose 6.7% y/y, the slowest in 2 years with industrial output data weakern than expected. On the weekend the Chinese press was instructed not to 'over-report' on the trade war with the US. That could just be the usual effort to control the media and an effort to keep the public calm, but it may also be a sign that China is ready to make a deal.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +20K vs +37K prior GBP -40K vs -29K prior JPY -40K vs -39K prior CAD -53K vs -49K prior CHF -40K vs -40K prior AUD -41K vs -39K prior NZD -27K vs -26K prior

Euro longs are scaling out as selling the pound expands in popularity. The net short in cable is the most-extreme since September 2017 in another sign that the market isn't on the same page as the Bank of England governor.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Gross Domestic Product | |||

| 6.7% | 6.7% | 6.8% | Jul 16 2:00 |