Intraday Market Thoughts Archives

Displaying results for week of Jul 22, 2018بعد الانتاج الاجمالي

كيف ستؤثر بيانات الناتج المحلي الإجمالي على القرار الفيدرالي مع توقعات تسجيلها لأرتفاعات نحو مستويات تاريخية؟ (الفيديو الكامل)

From Draghi's ECB to Trump's GDP

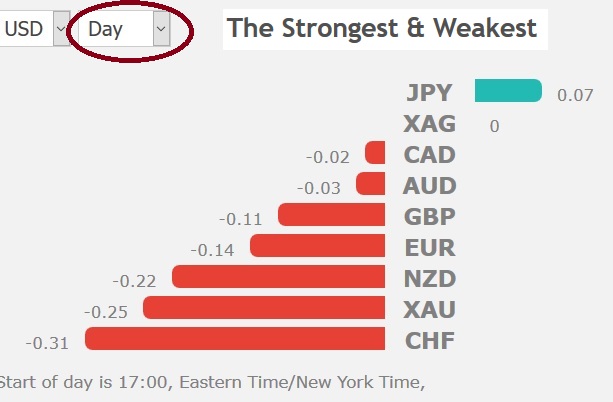

A subtle change in Draghi's messaging sent the euro lower on Thursday. The US dollar was the top performer while the Australian dollar lagged, reversing Wednesday's move. An intriguing US Q2 GDP number is due up next (more on this below). A new Premium trade has been issued alongside 4 technical reasons.

The ECB had a chance to tweak its forward guidance in order to clear up confusion about the meaning of 'through the summer' but instead chose to reiterate the line, leaving the option of hiking anywhere from June 2019 and beyond.

However later in the press conference, he said that officials were comfortable with market pricing, which currently shows a 57% chance of a September 2019 hike. That endorsement diminished that chance of an earlier hike an contributed to the euro's slide to 1.1622 from 1.1715.

Looking ahead, Friday's first look at US Q2 GDP is especially interesting. The consensus is 4.2% but a report earlier in the week from Charlie Gasparino, who is a reliable business reporter at Fox Business, said Trump had told at least one associate it was 4.8%. On Thursday, Trump also said that GDP would be 'terrific'.

If we ignore the President's talk, however, the final indicators were mixed. Wholesale inventories and trade balance for June were a touch soft while the shipments component in the durable goods report was strong. On net that roughly balances out and estimates range from 3.0%-5.0%.

In terms of positioning, it's likely that some specs bought the rumor of a strong number so all else equal, there should be some USD selling on the release. Equally important is the composition of GDP. Inventory building and trade will add about 2 percentage points to GDP in this quarter, but that won't last while if the consumer is particularly strong, that would be a tailwind.

Inventories & Soybeans

Ashraf reminds us that in order to assess the true strength of US GDP figures, we must watch for inventories i.e. how much of the GDP growth was driven by inventory surplus, which is not necessarily a result of true rise in the P in "GDP". For this, we must watch the "final sales" figure. Yet, even if final sales are high enough (close to GDP), traders are being cautious in interpreting the figures because of the possibility that US agricultural exports shot up temporarily ahead of tariffs.FInally, all eyes will be on the 3% barrier in US 10 year yields.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Advance GDP (q/q) [P] | |||

| 4.1% | 2.0% | Jul 27 12:30 | |

ECB Scenarios

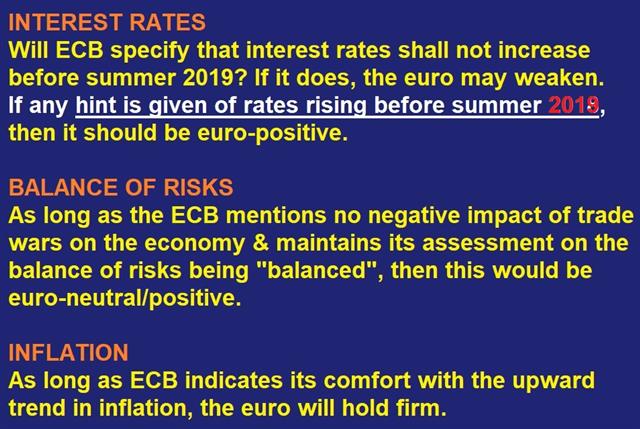

Here's a list of possible scenarios in today's ECB announcement/press conference. Pay attention to the announcement at 12:45 (London time) for any changes in guidance, followed by the press conference 45 mins late. Full Analysis.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone ECB Press Conference | |||

| Jul 26 12:30 | |||

اليورو: بعد ترامب و قبل دراغي

شاهد اليورو قفزة مجددة بعد اتفاق مبدئي بين الاتحاد الأوروبي والولايات المتحدة، لكن ينصح بأخذ الحذر قبل المؤتمر الصحفي للبنك المركزي الأوروبي اليوم (التحليل الكامل)

Trade Winds Boost Euro ahead of ECB

Trade headlines continue to dominate trading as upbeat comments from Trump and Juncker sent the euro higher. The Canadian dollar was the top performer while the US dollar lagged. The ECB decision is up next on Thursday.

إشارة الدولار/ ين (فيديو للمشتركين فقط)

Trading around the headlines was an adventure Monday but ultimately led to a jump in euro, commodity currencies and risk trades.

Expectations were low for Juncker's trip to Washington and initially fell even lower on a Washington Post report saying Trump had fallen in love with tariffs and wanted to impose them on autos before year end. EUR/USD fell as low as 1.1661 afterwards but began to turn around after initial positive comments before Trump and Juncker met.

As the meeting extended a report said the leaders were close to a deal and that turned out to be accurate as Juncker promised to import more soybeans and LNG with both sides agreeing to work towards zero tariffs and promising not to impose new tariffs so long as negotiations continued.

Juncker doesn't have the power to unilaterally make these deals but we have to assume he's got the backing of EU leaders. In any case, the threat of immediate tariffs is lower.

Separately, CAD and MXN made strong gains on a letter Trump sent to Lopez-Obrador saying he hoped to wrap up NAFTA renegotiations quickly.

Calendar Guidance - How Specific?

Looking ahead, the ECB decision is due at 1145 GMT (12:45 London), but it's a foregone conclusion that interest rates won't change. Instead, the focus will be on messaging in the statement and in the press conference 45 mins later. The euro might be higher if not for the looming risk of this meeting. Focus on any rewording of the calendar guidance.

Draghi is in a tough spot as he tries to retain an upbeat stance on the economy and keep a rate hike at this time next year on the table without driving the euro excessively higher. In the past he has been a masterful messenger, but the tweaking and messaging has gotten so precise that he finds himself in a near-impossible spot with a high risk of sending the wrong signal. If he can navigate the choppy waters, the underlying bias may be toward euro strength in the day ahead if Juncker's deal isn't picked apart.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone ECB Press Conference | |||

| Jul 26 12:30 | |||

Pound Wakes as Theresa May Takes Over

In what's either a sign of cunning or desperation, Theresa May revealed she will lead Brexit negotiations herself. The pound gained on the headline but the CAD and CHF remain the leaders in early US trade. So what to make of May pushing aside newly-installed Brexit negotiator Raab? He's been relegated to preparing for a no-deal Brexit. The latest video for Premium subscribers is below, focusing on the yen's latest declines.

This is probably more about the internal squeeze than an external one. May has been in a constant battle with Brexit deputies while soft-and-hard Brexiteers push their agendas. David Davis seemingly used his platform to launch himself into the leadership conversation. For her, this cuts out the middle man, enabling her to negotiate the deal, which could define her.

By streamlining the process, May could reach a more timely agreement with the EU. Time is not on her side as she also must avoid possibilities of an internal rebellion and the risk of a confidence vote. If she stumbles, a collapse in her support isn't necessarily a bad thing because it may lead to a softer Brexit, or even another referendum. That's a GBP-positive.

Overnight, Aussie Q2 CPI rose from 1.9% y/y to 2.1% y/y but below expectations of 2.2% y/y. The RBA is seen sidelined for a long period, while the Aussie remains dragged across the board by the declining Chinese yuan and the impact of China's delevraging.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.4% | 0.5% | 0.4% | Jul 25 1:30 |

Trump Weighs in on GDP Figures

All currencies are up against the US dollar except for the Swiss franc. G20 leaders refrained from any drama over the weekend but highlighted growing risks to the world economy. 2 days before the ECB press conference and 3 days before the advanced Q2 GDP figures from the US, markets cling to slow summer volumes despite Trump's tweets.

Trump weighs in ahead of GDP Data

Aside from Trump's threatening comments towards his Iranian counterpart triggering some oil volatility, the bigger news were reports about Trump telling associates he expects Friday's release of Q2 GDP to rise as much as 4.8%, compared to consensus estimates of 4.2% and Q1's 2.1%. While this should add a new dimension to the expectations parameters, FX traders continue to closely watch the 95.20 resistance on USDX and 1.1550 support in EURUSD.The weekend featured the G20 meeting in Argentina and it featured the usual trade tensions with ministers saying risks to world growth have increased and said growth is less synchronized. They called for better communication, in part to enhance confidence. That's undoubtedly a swipe at the White House but it's not the kind of thing that's going to be remembered.

His ministers, however, were making some peace. At the G20, Canadian and Mexican finance ministers had optimistic comments on NAFTA with Morneau saying that Mnuchin had assured him that the US wants a trilateral agreement. Cable continues to be in focus after racing higher Friday from a 10-month low. Over the weekend, the EU rejected the UK's financial services plan. New UK Brexit negotiator Raab also said the UK wouldn't pay the divorce bill without a deal.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR +21K vs +24K prior GBP -38K vs -40K prior JPY -59K vs -40K prior CAD -47K vs -53K prior CHF -42K vs -40K prior AUD -41K vs -41K prior NZD -25K vs -27K priorAfter a few weeks of big moves, the action was a bit more subdued except for in the yen. Shorts piled in as USD/JPY appeared to break out but Trump ensued all the new JPY shorts were buried under water with his latest salvo. Also consider rumours that the BoJ will terminate or rethink its QE policy as Japanese yields break above the 0% barrier/target.

Ashraf's Interview on BNN

Ashraf's interview with BNN earlier today. Full interview.

ترامب والاحتياطي الفيدرالي والدولار الأمريكي

اربعة أسباب لنهاية إرتداد الدولار ـ (التحليل الكامل)