Intraday Market Thoughts Archives

Displaying results for week of Jan 27, 2019During a Losing Trade

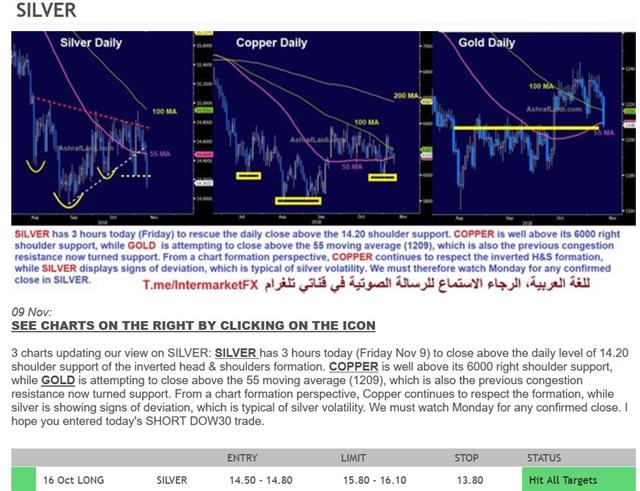

Here's an example of how proper inter-metal technical analysis can improve confidence during a losing trade. On Oct 16, we issued a LONG trade in silver for the Premium subscribers at 14.80 with the rationale that the impending inverted H&S formation was about to break above the neckline resistance. Well, it did not break it right away. Instead, silver continued to drop, extending towards the head (lows) of 13.96 over the ensuing 4 weeks. The stop remained at 13.80. So how did we manage the positon and thinking? (here's the snapshot of the trade below)

On Nov 9th (as the trade was deteriorating), I issued a trade update with 3 charts, highlighting my confidence in the silver long based on positive technical dynamics occurring in copper and gold, with each respecting key support levels. (Please see the text under the charts and feel free to look at your own charts for a better view). Gold remained above the trendline support from the Nov 14 lows and continued to chart a series of higher lows since the August lows, while copper continued to respect its right shoulder support. Some may say copper went on to break below the right shoulder later in early Jan and test the head (low). Yes, but by the time that occurred, silver was well off its low and gold remained above the Aug trendline support.

The message was crucial. Silver, being the smaller and relatively less liquid market was vulnerable to accelerating downside momentum, before gaining important support. A similar approach was applied to USDX vs EURUSD vs USDCNY. I long said in summer and autumn during the days of USD strength that only a break above 7.0 in USD/CNH would indicate the next leg-up in USD momentum and not EURUSD 1.11, USDJPY 115 or GBPUSD 1.26. Sometimes, it is invaluable to know where to look without moving the goal-posts too much.

النفط والذهب والمؤشرات

ما يعني تفوق النفط على الذهب منذ بداية السنة و ما يعني العكس منذ آخر أسبوعين المؤشرات؟ نلقي نظرة تحليلية قبيل بيانات الوظائف و الأجور الأميركية في الفيديو

FX Caught in Central Bank Rhetoric

Trump signaled optimism on a China trade deal Thursday but the ECB's Weidmann warned on growth. The ECB wasted little time in sending out dovish comments after the dovish twist FOMC statement. Expect more of this in 2019 as central banks grow immobile on the interest rate front. Watch out for flows ahead of China's week of holidays on Friday. The Silver long Premium trade at 14.80 from mid October reached the final target of 16.10. All existing FX and index Premium trades are currently in the green. EURUSD regains 1.1460s on higher than expected estimated core CPI. The US jobs and ISM manufacturing reports follow next with questions on the extent of the shutdown on the figures.

الإدارة داخل الأرباح (فيديو للمشتركين)

The S&P 500 closed out its best month since October 2015 with another strong day after Trump hinted at progress on a deal with China. He sent a letter to Xi saying he hopes both sides can meet halfway as the pair planned a meeting for late February. USD/JPY also got a slight lift from the progress but was bogged down by continued post-Fed softness and month-end sales.

Earlier yestyerday, euro skidded to 1.1440s from 1.1480 after a dovish message from a surprising place. Bundesbank leader Weidmann warned on soft growth this year and said inflation forecasts are likely to miss to the downside. EURUSD is back above 1.1470 as traders placed more emphasis on the 1.1% core CPI than the 1.4% headline.

Gold and oil both hit new highs for the month late in the day then reversed to finish lower. January has proven to be positive month for gold, rising in 10 out of the last 13 years. That could be a sign of worry or simply reflect strong months for both.

One worry on Friday will be repositioning for the new month and bracing for the week-long holiday in China for lunar new year. The event sparks a widespread need for liquidity and gold tends to suffer early in the week before rebounding. Leveraged trading is also ramped down and that can cause swings especially in industrial metals.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone CPI Flash Estimate (y/y) | |||

| 1.4% | 1.4% | 1.6% | Feb 01 10:00 |

هرع البنوك المركزية إلى الذهب

في مقالي الذي نشر خلال الأسبوع الماضي عن الذهب، أكدت بأن الحجج الأساسية والفنية في صالح شراء المعدن الأصفر. اليوم، نتلقى بيانات من مجلس الذهب العالمي بأن شراء الذهب من قبل البنوك المركزية ارتفع لأعلى كمياته منذ عام 1971، وهو العام الذي هرع فيه العالم لشراء الذهب بعد أن قررت الولايات المتحدة الابتعاد عن معيار الذهب في عام1971 التحليل الكامل

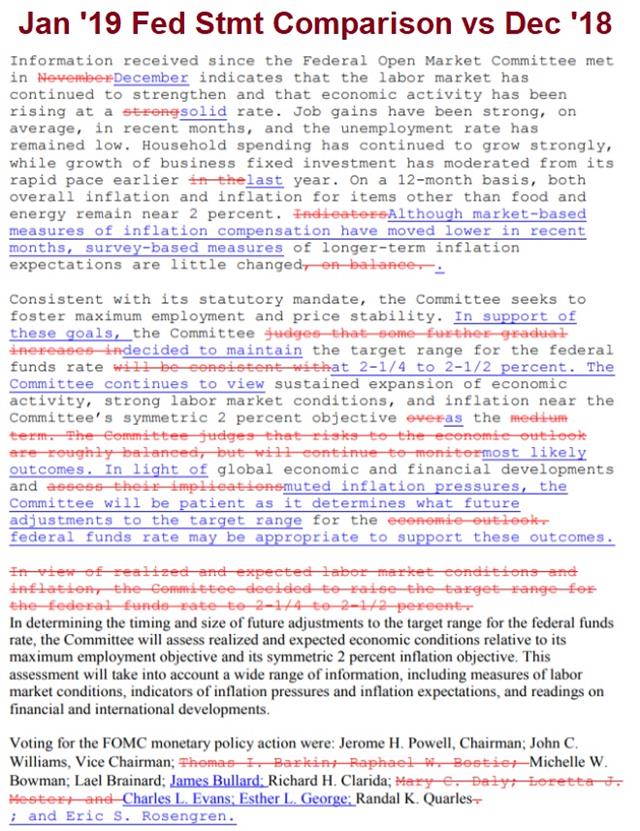

Fed's Firmly Enters Neutral

The Fed abandoned any hints of a hawkish bias and shifted to a neutral, 'patient' approach. The US dollar sank on the FOMC while the Australian dollar was the top performer on the day. The China PMIs are up next with Canadian GDP due later. A new Premium trade has been issued with 2 charts and 5 supporting points.

The FOMC statement made some major changes in the continued U-turn from the stubborn hawkish stance late last year. Replacing the reference to 'further gradual increases' by a phrase indicating the Fed would be patient on rates was the principal force against the USD. In addition, the reference to a roughly balanced risks was removed and economic activity was downgraded to 'solid' from 'strong'. In a separate statement the Fed also said it would be flexible in its balance sheet if needed.

Powell didn't shift from that script in the press conference. He touted the domestic economy but said slower growth in China and Europe were drags, along with the government shutdown and tighter financial conditions. He also said it was difficult to indicate whether or not we're at the end of the rate hike cycle.

Overall, this was a clear shift to neutral. The market had expected at least a token lean to the hawkish side but it didn't come. In response there was a classic risk-on response with the US dollar sinking and stocks rallying. EUR/USD rose to 1.1500 from 1.1420 and there were similar-sized moves across the board.

Balance Sheet Management

The Fed statement also reflected a slight shift in its approach to managing (unwinding) its balance sheet of all the govt bonds it purchased during its quantitative easing program. The statement indicated “The Committee is prepared to adjust any of the details for completing balance sheet normalisation in light of economic and financial developments”. That means the Fed will have to slow down the pace of selling those assets in the event that the economic slowdown and/or market volatility becomes a challenge. This "realisation" by the Fed is favoured by gold bulls as it implies a slower pace of quantitative tightening.We expect the Fed to increasingly use references to the balance sheet as a type of policy guidance on monetary policy, especially as no changes in interest ratres are expected for at least the next 9 months.

With the Fed out of the way, the focus shifts back to China. Meetings between high-level officials will continue Thursday in Washington but in the meantime the January official manufacturing and non-manufacturing PMIs are due. The numbers are undoubtedly managed but any tick lower from the 49.3 and 53.8 readings previously would raise concern. They're both due out at 0100 GMT.

USD/CAD was another big mover Wednesday as it fell to the lowest since early November and cut through the 100-dma and (briefly) the 200-dma. A nearly 2% rally in WTI crude to a two-month high gave the loonie a further boost.

But watch out for data in the day ahead. Canadian November GDP is due at 1330 GMT and expected to contract 0.1%. Recent data on retail sales, inventories, trade and whole sale sales points to the chance for a downside surprise and that could quickly erase the loonie's progress.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Chicago PMI | |||

| 61.5 | 65.4 | Jan 31 14:45 | |

| PMI | |||

| 49.3 | 49.4 | Jan 31 1:00 | |

| GDP (m/m) | |||

| -0.1% | 0.3% | Jan 31 13:30 | |

| Eurozone Spanish Flash GDP (q/q) | |||

| 0.6% | 0.6% | Jan 31 8:00 | |

| Eurozone Prelim Flash GDP (q/q) [P] | |||

| 0.2% | 0.2% | Jan 31 10:00 | |

See you at NY Traders' Expo

I'm delighted to inform you that I'll be a featured speaker at this year's NY Traders' Expo in New York city - March 10-12. This is one of the longest running trading expos in the planet, in which I had the honour to take part numerous times and meet great traders, analysts and programmers. I encourage you to reserve a free seat, and join me at the ultimate educational event for active traders in 2019. Full Program.

Fed Balance Sheet in Focus

The FOMC statement is likely to backtrack further away from rate hikes but the market may be more sensitive to talk about the balance sheet. The pound fell 150 pips from its highs on Tuesday after an amendment to delay Brexit and block a no-deal failed. Cable recovered by over half a cent to stand at 1.3100 ahead of US ADP, the FOMC statement and subsequent Powell press conference. Meanwhile, USD/CNY breaks below its 200-DMA for the 1st time in 7 months, helping to propel gold to 1315.

Six Brexit amendment votes unfolded largely as expected on Tuesday but the pound slumped. These events have been tough to handicap but the selling came after the Cooper-Boles amendment (aimed at delaying Brexit) failed. It would have blocked a no-deal Brexit. A later non-binding amendment saying parliament didn't want a no-deal Brexit passed but the threat remains on the table for now.

PM May emerged victorious with the Brady amendment, which endorsed an 'alternative arrangement' on the Irish border backstop, but the EU rejected any changes to the deal. May has two weeks to persuade the EU to change their mind ahead of the next meaningful vote on Feb 13. GBPUSD fell towards its 200-DMA before recovering half a cent to 1.3100.

The dollar side of the equation will be a big factor with the FOMC decision at 1900 GMT on Wednesday. Look for a downgrade in the growth assessment to something like 'solid' from 'strong' and for further less-hawkish language that still retains a tightening bias. The new rules at the Fed mean Chairman Powell will hold a Press conference on each of the 8 Fed meetings of the year and not just 4 times per year as was previously the case.

Fed shifts focus to balance sheet from interest rates

For starters, the FOMC statement should contain a more dovish statement than the December statement. But that's no surprise considering the recent speeches from Powell & Co. Traders will be especially tuned to comments on quantitative tightening i.e. unwinding the balance sheet. A WSJ report on Friday hinted that Powell may keep a large balance sheet than previously signaled and that may have led to the late-week slump in the US dollar.Will the balance sheet become the Fed's new guidance. The Fed can no longer refer solely to semantic tools on changes in Fed Funds rate. The pace of the balance sheet may become a more valuable communications focus.

Overall, however, the risks may be skewed towards a higher dollar or a risk-off trade. The rebound in equity markets in the past three weeks along with some decent economic data has alleviated the risk of a rapid US slowdown. It may only take a minor hawkish hint to send markets spiraling.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC Statement | |||

| Jan 30 19:00 | |||

| FOMC Press Conference | |||

| Jan 30 19:30 | |||

| CPI (q/q) | |||

| 0.5% | 0.4% | 0.4% | Jan 30 0:30 |

الإسترليني يواجه تعديلات وأصوات جديدة

كُن مستعداً لمجموعة جديدة من الأصوات هذا المساء (الثلاثاء حوالي الساعة العاشرة مساءً بتوقيت مكة المكرمة) في البرلمان البريطاني فيما يتعلق بتعديل اتفاقية بريكست الحالية عن خروج بريطانيا من الاتحاد الأوروبي. التحليل الكامل

Amendments on The Brexit Menu

We move one step closer to the Brexit endgame on Tuesday with votes on two critical amendments (details below). The debates shall progress throughout the day before the votes are due at 19:00 London/GMT. Apple earnings follow two hours later. The US announced charges against Huawei in a further ramp of the trade war. Below is the Premium video for subscribers with regards to GBPUSD, indices, EUR, gold and JPY.

UK MPs will get a say on the direction of Brexit on Tuesday in a pair of critical votes. One vote is the Cooper-Boles amendment, which would block a hard Brexit. As we write this, GBP is being lifted by reports that Labour has expressed its willingness to vote for the amendment. May reportedly told Conservatives on the weekend that she won't allow a hard Brexit but she's hoping to defeat the bill because it would curb her negotiating leverage.

The other vote is the Brady amendment which would replace the Irish border backstop with 'alternative arrangements'. May hopes to take the vote to Brussels to secure something she can pass in a meaningful vote that's now scheduled for February 13. On one hand, passing the Brady Amendment would raise hopes that the Backstop will be amended so that it is more suitable to the Democrat Union Party, which will vote on it. The main challenge here is that this will require Theresa May to go to the EU and negotiate again on the Backstop. If the Brady amendment does not pass, then we are stuck at the same position where we were before.

With regards to GBPUSD trading, the pair remains above the 200-DMA for the 3rd straight day, formerly a resistance that took 7 months to break. The base assumption is that there is no breakthrough in the day ahead but such low expectations open the door to a surprise that could lift the pound especially as the risk of a no-deal diminishes and that of delaying Article 50 strengthens.

GBP traders beware this week from other important events such as the revised US Q4 GDP, Federal Reserve decision on Wednesday, US and Canada jobs report on Friday. The resumption of the US-China trade talks on Wednesday will laso be mulled in light of the US criminal charges against Huwawei.

Otherwise, we continue to watch China closely. On Monday, Caterpillar and Nvidia both highlighted slowing growth in China as they cut guidance. The US also announced charges against Huawei and CFO Meng Wanzhou in an escalation that sure to dog relations between the countries while leaving Canada stuck in the middle.

ندوة مساء الأربعاء مع إكس تي بي

لاحظوا أن موعد ندوة الأربعاء يتزامن مع قرار الفدرالي و مذكرة مهمة أخرى: سوف يقوم رئيس الفدرالي باول بخطاب و مؤتمر صحفي نصف ساعة بعد إعلان بيان القرار. و هذا النظام الجديد. سابقا كان خطاب و مؤتمر صحفي ٤ مرات في السنة فقط (مارس، يونيو، سبتمبر و ديسمبر). الآن ستكون في كل لقاء. للتسجيل في الندوة

Careful this week

A busy week lies ahead: Brexit amendment vote on Tuesday, US Q4 revised GDP, Fed decision, US/Canada jobs and resumption of the US-China trade talks later in the week with a host of central banker speeches. USD/CNY drops to key technical support (see more below). The pound starts the week on a lacklustre tone but holds to the bulk of last week's gains on a report that Theresa May told Cabinet she would not take the UK out of the EU without a deal. It helps to continue a run that made the pound the top performer last week. Carney and Draghi speak around 14:00-14:30 GMT/London. 4 out of our 6 open Premium trades are currently in the green, with the 2 losing trades in crypto currencies.

GBP dynamics are all about limiting Theresa May's options. The Brexit amendment vote is due Tuesday, which may limit her ability to leave the EU without a deal. That exposes her other frank where many members of her party believe she can't get a better deal without the threat of a no-deal Brexit.

The 2.5% jump in cable in the past week shows a market less fearful of a no-deal Brexit and if May's comments to cabinet are correct then the only possible outcomes are a deal, delay, election or another referendum. Any of those would be a near-term tailwind for sterling.

One risk is that uncertainty could begin to show up in the data but the risks are two sided. Consumers may retrench but businesses may be stockpiling. The Bank of England may have some insights on Monday when Carney, Broadbent and Ramsden are all set to speak. Carney's latest Brexit-related insights highlighted that the sterling's latest rebound reflected reduced expectations of a no-deal Brexit.

Meanwhile the US dollar came under substantial selling pressure on Friday with no clear catalyst. Even the end to the shutdown brought only minor and temporary relief. A few factors may have weighted. The WSJ reported that the Fed is considering keeping a bigger balance sheet. It's framed as a technical decision but the timing appears dovish. The arrest of Roger Stone was a reminder that Mueller's probe is nearing a conclusion.

The PBOC tweaked rules to add an extra 250 billion yuan in lending. USD/CNY reaches a 6-month low, touching its 200-DMA as the topic of CNY acquires a new role in the upcoming US-China talks. Here's what we said on Friday about the CNY and USD.

The slump in the dollar led to a one-month high in NZD/USD, an 11-day high in EUR/USD and the best levels in gold since June. Gold's best months over the past 15 years have proven to be January and August, with January in the green over the last 5 years & this year is no exception. Goldilocks inflation is especially postv when Fed moves from hawksh to neutral (negtv when moving from dovish to neutral).

| Act | Exp | Prev | GMT |

|---|---|---|---|

| BoE Gov Carney Speaks | |||

| Jan 28 14:30 | |||