Intraday Market Thoughts Archives

Displaying results for week of Jan 06, 2019GBP Jumps, USD's Longest Loss since Jan 2018

The US dollar will close lower for the 4th consecutive week, the longest losing streak since January last year. But the big news of the day is sterling's rally, emerging on the news of a prominent UK Cabinet member demanding Brexit's delay beyond March if next week's vote is rejected. 2 new trades were issued for Premium subscribers on a never-before issued markets.

GBP is the strongest currency of the day, breaking above $1.2850 among suggestions from Conservative rebel Dominic Grieve urging PM May to delay Brexit if her EU withdrawal deal is rejected at next week's Parliament vote. Notably, Despite denying such plans by May's spokesman, sterling remains at its session highs.

The US dollar attempted a comeback on Friday as US December CPI came in mostly within expectations, slipping to 1.9% y/y from 2.2% y/y, thus bolstering the Fed's caser to stay on the sidelines. USD's stabilisation of the last 48 hours is hardly sufficient to convince anyone that the slump is over. Another wave of Fed speakers highlighted risks and challenges to the US economy. On Thursday, Powell repeated that the FOMC can be patient in what now looks like it will be a core part of his message.

One notable independent move was Thursday's drop in the Swiss franc. The selling came after the SNB reported that it lost 15 billion francs last year. It's an unusual central bank in that there are shareholders and it pays a dividend. It holds a massive amount of foreign currency reserves with about 20% allocated to equities. They posted a loss and there was speculation that traders are worried about more pain in the event of a recession. There was also talk of intervention. There were no answers but USD/CHF traced out an outside bullish reversal after hitting the lowest since September.

الذهب والداو والريبل

تعرّف على التحليل الأساسي والفني لكل من مؤشر الذهب والداو والريبل مع خبير الأسواق العالمية أشرف العايدي عبر مدونة أوربكس. الفيديو الكامل

US Dollar Stumbles, Some Stormclouds

Speeches from various Fed members comprised a coordinated message of pausing rate hikes and the US dollar was the clear victim. The New Zealand dollar was the top performer, closely tracked by Gold on Wednesday, while EUR finally regained and closed above 1.1500. News of FITCH warning about a possible downgrade in the AAA rating of the United States has also weighed on USD. [ More on this below ]. Economic data could put the focus back on te slowing economy. The Long Dow Premium issued on Friday has hit its final target of 23930 for 770-pt gain. Now the questions start as to will we go short, what to go short or what to re-enter the long.

ماذا بعد تحقيق الاهداف؟ (فيديو للمشتركين فقط)

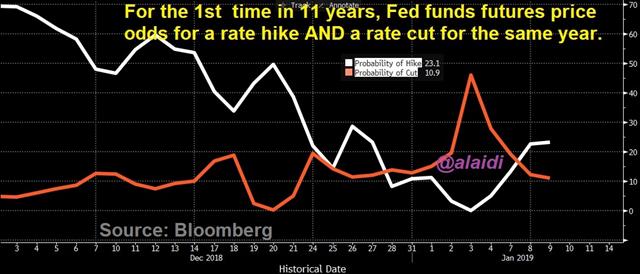

Fed speakers and the FOMC minutes on Wednesday removed any doubt about a shift to the sidelines. Commentary from Evans, Bostic and Rosengren on Wednesday all shifted dovishly with the latter even suggesting the Fed could cut if the outlook deteriorated. The FOMC minutes were much more dovish than Powell indicated in the December press conference in another sign of a shift.

Ultimately, the latest rhetoric strongly suggests the Fed will be on hold in Q1 and probably through Q2 at the minimum. The dollar slumped throughout the day including a 100 pip rally in EUR/USD and USD/JPY falling by 80 pips.

The Bank of Canada left rates on hold but didn't switch to a completely neutral stance. Poloz shifted guidance to say rates will need to rise 'over time', implying there is no rush to hike. It wasn't as dovish as feared and USD/CAD fell for the seventh day. A big part of the fall was due to another 5% rise in oil prices and the weak US dollar. Add to that the accelerating rally in indices.

In the bigger picture, the S&P 500 climbed for the fourth day but there are some storm clouds. Some final headlines from the US-China meetings suggested sides are far apart on government subsidies to Chinese state companies. The deepening impasse between Trump and Democrats over Wall funding did not help. Economic data could also unwind some of the optimism. The German numbers earlier in the week were extremely weak and talk of a recession in Germany, Italy and France is beginning to percolate.

About that Fitch Warning

Yesterday, Fitch warned of a possible cut to the US AAA rating in the event of a continuation of the shutdown impasse. Ashraf tells me the downgrade will likely materialize when the shutdown morphs into an ugly debt ceiling fight later this quarter. Why ugly? Because today's split in Congress is stark enough...just as stark as it was in summer 2011 -- the year of the Debt Ceiling fight which ultimately led to S&P lowering the US AAA credit rating. We all know what happpened to the markets in August-Sep 2011. Don't forget there is also Brexit that month.Is All Back to Normal ?

So is everything back to normal after Friday's Powell speech? Stocks are on their way to post their 3rd rising week -- something NOT seen in 5 months. So where to from here? Full analysis.

Euro Bucks Bad Data, BOC Next

The euro has shown some impressive resilience in recent weeks but the latest German industrial production raises fresh questions. Meanwhile, German-US 10 year yield spread is at it 8-month highs, raising questions as to when EURUSD will catch up proportionally. More on this below. The Canadian dollar was the top performer Tuesday while the pound lagged. The Bank of Canada decision is due up next. Today's Premium video covers the paramaters of the current long index trade & sheds light on the thinking behind the next fakeout.

The plunge in German industrial production on Tuesday may have served as a wake-up call for policymakers. It fell 1.9% compared to an expected 0.3% rise. The October number was also revised to -0.8% from -0.5% to compound the pain. The industrial sector is critical in the German economy and the sharp slowdown could mean Q4 GDP growth is flat or negative.

The ECB has tried to remain upbeat but rate hikes in 2019 are looking increasingly remote, and with oil prices much lower, there are few cost pressures. The ECB has stubbornly tried to save face but expect more emphasis on downside risks.

Notably impressive was how the euro held its ground despite the poor data. Over the last 4 weeks, the euro outperformed USD, CAD, GBP, NOK, AUD and NZD. It continues to trade above 1.14 and has been carving out higher lows since early November. This is largely a reflection of lower prospects for Fed hikes but that emphasizes that the US dollar has more carry to give up than the euro, even in a downside scenario. Falling oil prices is a more of a net-positive for the Eurozone than the US, which is a marginal exporter.

For now, there's no reason to expect any significant uptrend in the euro and next week's Brexit vote certainly poses risks but, if data continues to disappoint and the euro holds, it could be the start of a bigger turn. Ashraf's long in EURUSD remains +90 pips in the green but he is concerned with the pair's lag behind improving German-US spreads.

Looking ahead, another central bank is also in the process of climbing down from overly-hawkish guidance. The BOC meets Wednesday in what's sure to be a change of tone. Rates aren't in the focus but the statement will have to address lower exports, cheaper oil and slower global growth. At the same time, Poloz is consistently optimistic and he could try to retain a hawkish bias. If so, that would keep the six-day rally in the loonie on track.

الداو جونز والدولار: اتجاه واضح أم فخ جديد؟

هل عاد كل شيء إلى طبيعته بعد خطاب رئيس مجلس الاحتياطي الفيدرالي “باول” يوم الجمعة؟ يمكن أن تدخل مؤشرات سوق الأسهم الأسبوع المرتفع الثالث على التوالي للمرة الأولى في أربعة أشهر. إذن، أين نذهب من هنا؟ التحليل الكامل

Lessons as the Flash Crash Fades

Last week's flash crash in currencies and subsequent recovery offers some valuable lessons about unusual market moves. The Swiss franc was the top performer while the yen lagged on Monday. Today, the US dollar is mostly bid in a day light on data. This morning's release of the US trade balance report has been delayed because of the continued government shutdown. The Dow30 long entered late last week is 650 points in the green and remains in progress.

More to Come

We fear that flash crashes like the one triggered by yen crosses last week will be more-frequent in the future so it's worth keeping in mind the lessons. But what are the lessons? In the the sterling crash of October 2016, the slide was a sign of a complete breakdown, helped by ultra thin liquidity. It came after many days of heavy selling and, importantly, the decline continued even after the crash abated.Aussie Reversal

Last week's episode bears some similarities. AUD/JPY, for instance, had been sold for many days and all they crosses were at least at medium term lows. Yet this time the selling hasn't onlly stopped, but the price has reversed sharply, especially in Aussie crosses. AUD/JPY has nearly completely retraced the losses and other pairs have also rebounded or are close to doing so.The yen crosses could easily track back lower but anyone who sold the drop is currently underwater. So what's the lesson? The main one should be the conditions before the crash and to stay on guard against consistently falling assets that are nearing extreme lows or technical support. Another is be extra vigilant in the quiet trading zone after the US close (17:00-19:00 Eastern, 22:00-Midnight GMT)

As for the direction after a crash, as long as fundamentals are behind the move, the price action shall prevail. In the GBP edition, nothing was changing and Brexit continue to loom. There was no scope for good news. Therefore, beware as we approach next week's Brexit vote in Parliament.

In this edition, the reversal was helped by coordinated action from the Fed, PBOC, White House and BOJ, especially with Powell signalling a pause in rate hikes as did Yellen in early 2016, which helped booost stocks in the 1st half of that year. Such are crucial reasons for the rebound. That said, negative developments could unwind the positivity quickly.

Looking ahead, the November US trader balance report is delayed because of the government shutdown. The report would have been particularly valuable given the ongoing US-China trade talks. We may be able to glean a sense of the US trade balance from data from partners, including Canada which releases its trade report Tuesday.

مقابلتي عن الدولار، الداو جونز و النفط

مقابلتي مع ناصر الطيبي على قناة العربية عن الدولار، مؤشر الداو جونز و دور النفط في أوروبا و الولايات المتحدة. المقابلة الكاملة

Global Housing is Hurting, onto ISM Services

A soft weekend on UK housing on the weekend adds to a growing list of places where home prices are suffering. USD is is lower across the board ahead of key US data with CHF leading and CAD lagging as we turn to Monday's ISM non-manufacturing index (more details below).

Powell's Friday comments reignited risk assets but this episode has likely capped interest rates for the cycle. What's troubling is that even with rates at these historically low levels, there are a handful of places with surprising weakness in housing. This highlights the fact that we should focus on the incremental increase in interest rates since Dec 2015 instead of the aboslute levels.

On the weekend, Nationwide reported that UK house prices fell 2.1% in the past year. They had been forecast to rise 0.5%. More worrisome is that prices are down 1.6% and 0.7% in the past two months alone.

It's far from isolated with home prices suffering in the US, parts of Canada and nearly 10% in Australia. Luxury markets have been under particular pressure with Manhattan, Vancouver, London and Sydney hard hit.

The common theme might be China where apartment prices in parts of the country are down nearly 50%. It begs the question of how much Chinese wealth was support markets elsewhere. It also adds to the worries that China's consumer is tapped out. In the bigger picture, the malaise in the housing market is another reason for central banks to keep rates where they are or lower even if the US and China settle their trade dispute.

On that front, mid-level officials are set to meet this week in Beijing and Trump signaled more progress on the weekend.

Looking to Monday's US session, the highlight is the ISM non-manufacturing index at 1500 GMT. The market is extremely sensitive to economic data at the moment and a miss would raise new questions about the US economy. The consensus is for a small dip to 59.0 from 60.7.